Insurance Companies For Cars

When it comes to safeguarding your vehicle, choosing the right insurance company is paramount. The market is flooded with numerous options, each promising comprehensive coverage and competitive rates. This article aims to provide an in-depth analysis of the top insurance providers in the automotive sector, helping you make an informed decision to protect your investment.

Understanding the Importance of Car Insurance

Car insurance is not just a legal requirement in most regions; it’s an essential financial safeguard. It provides coverage for a range of incidents, from minor fender-benders to catastrophic accidents. The right policy can protect you from substantial financial losses and offer peace of mind while on the road.

The market for car insurance is highly competitive, with numerous providers vying for your business. This competition is beneficial for consumers, as it drives innovation and cost-effectiveness. However, with so many options, selecting the best insurance company can be a daunting task. This is where a comprehensive analysis comes into play, helping you navigate the complex world of automotive insurance.

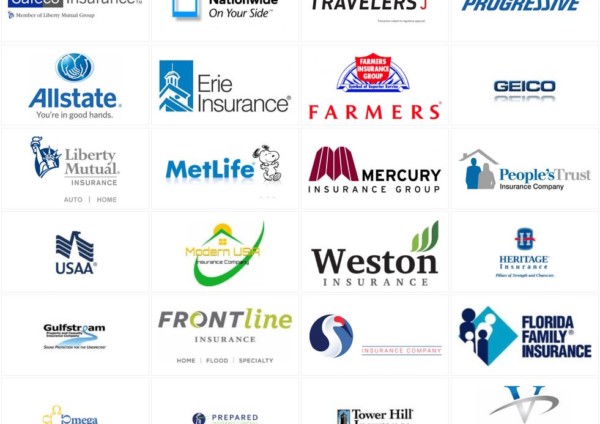

Top Insurance Companies for Cars: A Comprehensive Analysis

This section delves into the leading insurance providers in the automotive sector, offering an in-depth analysis of their coverage, customer service, and financial stability.

State Farm: A Trusted Leader

State Farm has solidified its position as one of the leading insurance providers in the United States. With a rich history spanning over a century, State Farm has built a reputation for reliable coverage and exceptional customer service. Their comprehensive auto insurance policies offer a wide range of coverage options, including liability, collision, and comprehensive coverage, as well as additional features like rental car reimbursement and glass repair.

State Farm's customer-centric approach is evident in their network of local agents who provide personalized service. They offer a seamless digital experience, allowing policyholders to manage their insurance needs online or via their mobile app. Furthermore, State Farm is known for its competitive pricing, making it an attractive option for many car owners.

| Coverage Type | State Farm |

|---|---|

| Liability | Offers various limits to choose from, providing coverage for bodily injury and property damage caused by the policyholder. |

| Collision | Covers damage to the insured vehicle in the event of a collision, regardless of fault. |

| Comprehensive | Provides protection against non-collision incidents, including theft, vandalism, and natural disasters. |

| Additional Features | Rental car reimbursement, glass repair, and accident forgiveness are some of the additional benefits offered. |

Geico: A Digital Insurance Giant

Geico, or Government Employees Insurance Company, has revolutionized the insurance industry with its focus on digital innovation. Known for its catchy advertising campaigns, Geico has become a household name, offering auto insurance policies that are both affordable and comprehensive.

Geico's strength lies in its digital capabilities. Policyholders can manage their insurance needs entirely online or via the Geico mobile app. The company offers a wide range of coverage options, including liability, collision, comprehensive, and additional features like roadside assistance and mechanical breakdown insurance. Geico's pricing is highly competitive, making it an attractive option for cost-conscious consumers.

| Coverage Type | Geico |

|---|---|

| Liability | Provides multiple coverage limits for bodily injury and property damage, ensuring adequate protection. |

| Collision | Covers vehicle damage caused by collisions, regardless of fault. |

| Comprehensive | Offers protection against non-collision incidents, such as theft, vandalism, and natural disasters. |

| Additional Features | Includes roadside assistance, mechanical breakdown insurance, and accident forgiveness. |

Progressive: Customizable Coverage

Progressive Insurance is renowned for its commitment to providing customizable insurance solutions. They offer a wide array of coverage options, allowing policyholders to tailor their policies to their specific needs and budget.

Progressive's Name Your Price tool is a unique feature that lets customers choose their desired premium amount and coverage level. This flexibility is a significant advantage, especially for car owners with specific insurance requirements. Progressive also offers a range of discounts, making their policies even more affordable.

| Coverage Type | Progressive |

|---|---|

| Liability | Provides coverage for bodily injury and property damage caused by the policyholder, with various coverage limits available. |

| Collision | Covers vehicle damage caused by collisions, offering options for deductible amounts. |

| Comprehensive | Protects against non-collision incidents, including theft, vandalism, and natural disasters. |

| Additional Features | Includes rental car reimbursement, roadside assistance, and gap insurance. |

Allstate: Reliable Protection

Allstate Insurance is a trusted name in the automotive insurance sector, known for its reliable coverage and customer satisfaction. They offer a comprehensive range of insurance products, including auto, home, and life insurance, providing a one-stop shop for all your insurance needs.

Allstate's Drivewise program is a unique offering that rewards safe driving habits. Policyholders can install a device in their vehicle that tracks driving behavior, and safe driving habits can lead to discounts on their insurance premiums. Allstate also offers a wide range of coverage options, ensuring that policyholders can find the right level of protection for their vehicles.

| Coverage Type | Allstate |

|---|---|

| Liability | Provides coverage for bodily injury and property damage, with various coverage limits available. |

| Collision | Covers vehicle damage caused by collisions, offering options for deductible amounts. |

| Comprehensive | Protects against non-collision incidents, such as theft, vandalism, and natural disasters. |

| Additional Features | Includes rental car reimbursement, roadside assistance, and accident forgiveness. |

USAA: Exclusive for Military Members and Their Families

USAA Insurance is an exclusive provider catering specifically to military members, veterans, and their families. With a focus on providing exceptional service to this unique demographic, USAA has earned a reputation for its commitment to its members.

USAA's military-centric approach is evident in its comprehensive insurance offerings. They provide auto insurance policies tailored to the unique needs of military personnel, including coverage for deployment and temporary storage of vehicles. USAA also offers a range of additional benefits, such as roadside assistance and rental car coverage, specifically designed for military families.

| Coverage Type | USAA |

|---|---|

| Liability | Provides coverage for bodily injury and property damage, with various coverage limits available. |

| Collision | Covers vehicle damage caused by collisions, offering options for deductible amounts. |

| Comprehensive | Protects against non-collision incidents, including theft, vandalism, and natural disasters. |

| Additional Features | Includes deployment coverage, temporary storage coverage, and military-specific discounts. |

Factors to Consider When Choosing an Insurance Company

When selecting an insurance company for your car, it’s crucial to consider several factors to ensure you choose the best provider for your needs. Here are some key considerations:

- Coverage Options: Ensure the insurance company offers a range of coverage options, including liability, collision, comprehensive, and additional features like rental car reimbursement and roadside assistance.

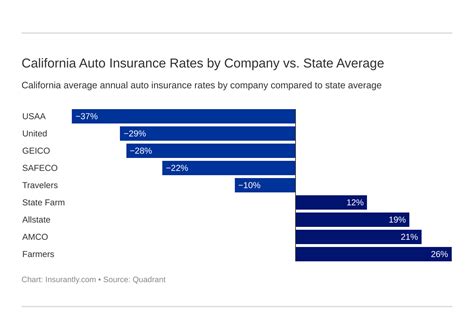

- Pricing: Compare insurance quotes from different providers to find the most competitive rates. Remember, the cheapest option may not always provide the best value.

- Customer Service: Look for an insurance company with a strong reputation for customer service. This includes prompt claim handling, a helpful and knowledgeable customer support team, and a user-friendly digital experience.

- Financial Stability: Check the financial health of the insurance company to ensure they can fulfill their obligations. A company's financial strength rating can provide insight into their stability.

- Discounts: Many insurance companies offer discounts for various reasons, such as safe driving records, loyalty, or policy bundling. Explore the discounts available to see if you can save on your insurance premiums.

- Digital Capabilities: In today's digital age, consider the insurance company's online and mobile app offerings. A user-friendly digital experience can make managing your insurance policy more convenient.

- Reviews and Ratings: Read customer reviews and ratings to get an understanding of the insurance company's reputation and the experiences of its policyholders.

Frequently Asked Questions

What are the key factors to consider when choosing car insurance?

+

When selecting car insurance, consider factors such as coverage options, pricing, customer service, financial stability, discounts, digital capabilities, and reviews from existing customers.

How do I find the best insurance rates for my car?

+

To find the best insurance rates, compare quotes from multiple providers, consider bundling policies, explore discounts, and maintain a good driving record.

What additional features should I look for in an auto insurance policy?

+

Look for additional features like rental car reimbursement, roadside assistance, accident forgiveness, and gap insurance to enhance your coverage.

How can I save money on my car insurance premiums?

+

You can save money by shopping around for quotes, maintaining a good driving record, exploring discounts, and considering higher deductibles.

What is the difference between liability, collision, and comprehensive coverage?

+

Liability coverage protects you against claims for bodily injury or property damage caused to others. Collision coverage pays for repairs to your vehicle after an accident, while comprehensive coverage provides protection for non-collision incidents like theft or natural disasters.