Insurance Company Aetna

Aetna: A Comprehensive Guide to Understanding its Insurance Services

Aetna, a renowned name in the insurance industry, has been a trusted provider of health, life, and various other insurance products for decades. With a rich history and a commitment to innovation, Aetna has grown to become a leading player in the field, offering comprehensive coverage to millions of individuals and businesses across the United States. This guide aims to delve into the world of Aetna, exploring its services, offerings, and impact on the insurance landscape.

The Aetna Journey: A Legacy of Innovation

Aetna's story began in 1853, when it was founded as the Aetna Insurance Company in Hartford, Connecticut. From its early days as a life insurance provider, the company quickly expanded its offerings to include health insurance, becoming a pioneer in the industry. Over the years, Aetna has consistently adapted to the evolving needs of its customers, incorporating technological advancements and a customer-centric approach.

One of Aetna's key strengths lies in its ability to anticipate and address the changing healthcare landscape. With a focus on preventive care and wellness, Aetna has developed innovative programs and tools to empower its members to take control of their health. This commitment to innovation has positioned Aetna as a forward-thinking insurer, offering not just insurance policies, but a holistic approach to healthcare management.

Health Insurance: Comprehensive Coverage for All

Aetna's health insurance offerings are diverse and tailored to meet the unique needs of individuals, families, and businesses. Whether it's providing access to top-tier healthcare providers or offering flexible plan options, Aetna strives to ensure that its members have the coverage they need at a price they can afford.

Individual and Family Plans

For individuals and families, Aetna offers a range of plans, including:

- Aetna Signature Administrators: This plan is ideal for those seeking a personalized approach to healthcare. With a focus on preventive care and personalized health management, Aetna Signature Administrators offers access to a dedicated health team and tailored health plans.

- Aetna Open Access: Providing a wide network of healthcare providers, this plan offers flexibility and choice. Members can visit any in-network doctor or specialist without a referral, ensuring convenience and control over their healthcare decisions.

- Aetna HMO: Health Maintenance Organization (HMO) plans offer comprehensive coverage with a focus on preventive care. Members have access to a primary care physician and a network of specialists, with a range of cost-effective options for managing their healthcare needs.

Group Health Insurance for Businesses

Aetna understands the unique healthcare needs of businesses and their employees. The company offers a range of group health insurance plans, designed to provide comprehensive coverage while also offering cost-saving benefits for employers.

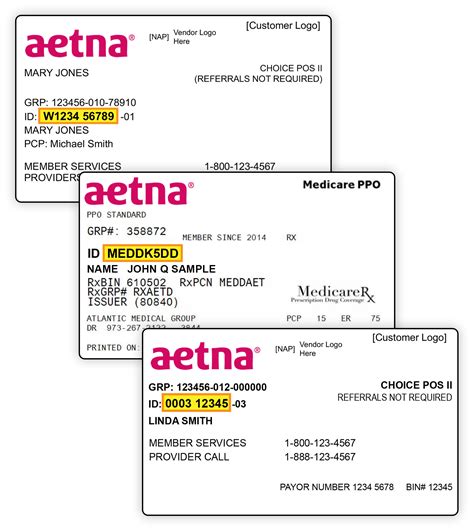

- Aetna Choice POS II: This plan combines the flexibility of a Preferred Provider Organization (PPO) with the cost-effectiveness of a Point of Service (POS) plan. Members can choose from a broad network of providers, with cost-saving incentives for using in-network healthcare services.

- Aetna HealthFund: Aetna's HealthFund plans offer a unique approach, providing employers with a flexible, customized funding option. This plan allows employers to contribute a fixed amount towards their employees' healthcare, while members have the freedom to choose their healthcare providers.

- Aetna CDHP: The Consumer-Directed Health Plan (CDHP) is designed to put individuals in control of their healthcare spending. With a high-deductible health plan, members can save pre-tax dollars in a Health Savings Account (HSA), offering tax advantages and cost-saving benefits.

Life Insurance: Protecting Your Future

Aetna's life insurance offerings provide individuals and families with the financial protection they need to secure their future. With a range of term and permanent life insurance plans, Aetna helps customers plan for life's uncertainties and ensure their loved ones are taken care of.

Term Life Insurance

Term life insurance offers coverage for a specific period, typically 10, 20, or 30 years. Aetna's term life insurance plans provide affordable coverage, with the option to convert to a permanent plan in the future. This flexibility allows individuals to adjust their coverage as their needs evolve.

| Term Length | Coverage Amounts | Renewal Options |

|---|---|---|

| 10, 20, or 30 years | $100,000 to $10 million | Convertible to permanent plans |

Permanent Life Insurance

Permanent life insurance, such as whole life and universal life insurance, provides coverage for the insured's entire life. These plans offer a death benefit, as well as the potential for cash value accumulation. Aetna's permanent life insurance plans offer a range of features and benefits, including flexible premium payments and the option to borrow against the policy's cash value.

| Plan Type | Key Features |

|---|---|

| Whole Life Insurance | Fixed premiums, guaranteed death benefit, and cash value growth |

| Universal Life Insurance | Flexible premiums, potential for higher cash value growth, and the ability to adjust death benefit amounts |

Additional Insurance Services

Beyond health and life insurance, Aetna offers a range of additional insurance products to provide comprehensive protection for its customers.

Dental and Vision Insurance

Aetna's dental and vision insurance plans ensure that members have access to affordable and comprehensive oral and eye care. With a network of preferred providers, members can receive discounts on dental and vision services, ensuring they can maintain their oral and visual health.

Disability Insurance

Aetna's disability insurance plans provide financial protection in the event of an injury or illness that prevents an individual from working. With both short-term and long-term disability plans, Aetna helps individuals protect their income and maintain their standard of living during times of physical or mental disability.

Medigap Insurance

For individuals eligible for Medicare, Aetna offers Medigap insurance plans. These plans supplement Medicare coverage, filling in the gaps and providing additional benefits such as coverage for deductibles, copayments, and foreign travel emergencies.

The Impact of Aetna: Shaping the Insurance Landscape

Aetna's influence extends far beyond its comprehensive insurance offerings. The company's commitment to innovation and customer-centricity has shaped the insurance industry, setting new standards for quality and accessibility. With a focus on preventive care and wellness, Aetna has played a pivotal role in promoting a holistic approach to healthcare.

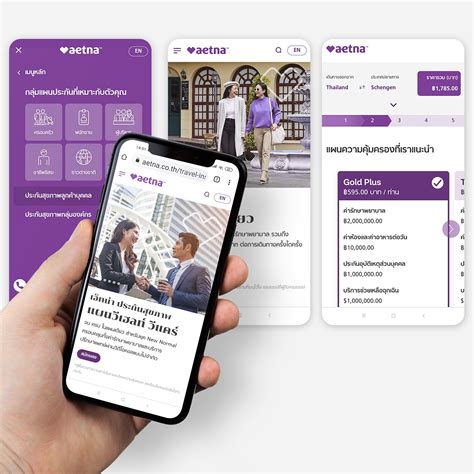

Aetna's technological advancements, such as its online portals and mobile apps, have made managing insurance policies more convenient and accessible. Members can easily view their coverage details, track claims, and access healthcare resources from the comfort of their homes. This digital transformation has not only improved customer experience but has also streamlined administrative processes, benefiting both members and healthcare providers.

Furthermore, Aetna's focus on community engagement and social responsibility has made a positive impact on society. The company's initiatives, such as its health education programs and community outreach efforts, have helped improve health outcomes and access to care for underserved populations. By investing in these initiatives, Aetna demonstrates its commitment to not only providing insurance coverage but also to making a meaningful difference in people's lives.

Frequently Asked Questions

How does Aetna’s health insurance network work, and how can I find in-network providers?

+

Aetna’s health insurance network consists of a vast array of healthcare providers, including doctors, specialists, hospitals, and pharmacies. Members can easily search for in-network providers through the Aetna website or mobile app. By utilizing in-network providers, members can benefit from reduced out-of-pocket costs and enhanced coverage.

What are the key differences between Aetna’s term life and permanent life insurance plans, and how can I choose the right one for me?

+

Term life insurance provides coverage for a specific period, offering affordability and flexibility. Permanent life insurance, on the other hand, offers lifelong coverage with the potential for cash value accumulation. The choice between the two depends on individual needs and financial goals. Term life is ideal for those seeking temporary coverage, while permanent life provides long-term financial protection and potential savings.

How does Aetna ensure the quality of its healthcare providers, and what measures does it take to promote patient safety and satisfaction?

+

Aetna maintains rigorous standards for its network of healthcare providers, regularly evaluating their quality and performance. The company utilizes various measures, including provider credentialing, ongoing quality assessments, and patient feedback, to ensure the highest level of care. Additionally, Aetna offers a range of patient support programs and resources to enhance the overall healthcare experience.

Can I customize my Aetna insurance plan to fit my specific needs, and what options are available for plan customization?

+

Absolutely! Aetna understands that every individual has unique healthcare needs. Many of its insurance plans offer customizable features, allowing members to tailor their coverage. This can include selecting specific providers, adjusting deductibles and copayments, and adding optional riders to address unique health concerns. By offering customizable plans, Aetna ensures that members receive the coverage that best suits their individual circumstances.

What resources and support does Aetna provide to help members navigate their insurance coverage and maximize their benefits?

+

Aetna provides a wealth of resources to help members understand their insurance coverage and make the most of their benefits. This includes online tools and guides, as well as dedicated customer support teams. Members can access their policy details, track claims, and receive personalized recommendations for managing their healthcare costs through Aetna’s user-friendly online platforms and mobile apps. Additionally, Aetna’s customer support teams are available to provide assistance and answer any questions members may have.