Colonialpenn Life Insurance

In the ever-evolving landscape of financial planning and insurance, Colonial Penn stands as a beacon of trust and security for those seeking comprehensive life insurance coverage. With a rich history spanning decades, Colonial Penn has established itself as a prominent player in the industry, offering a range of life insurance products tailored to meet the diverse needs of individuals and families.

This article delves into the intricacies of Colonial Penn's life insurance offerings, exploring its unique features, benefits, and the impact it has on policyholders' financial journeys. By examining real-life case studies and expert insights, we aim to provide an in-depth understanding of how Colonial Penn's life insurance products can be a vital component of long-term financial planning.

Understanding Colonial Penn's Life Insurance Philosophy

Colonial Penn's approach to life insurance is rooted in a deep understanding of the diverse financial needs and goals of its customers. The company's philosophy revolves around providing accessible and affordable coverage options, ensuring that individuals from all walks of life can secure their families' financial futures.

One of the key strengths of Colonial Penn's life insurance offerings is their adaptability. Recognizing that life's circumstances can change rapidly, the company has designed policies that can be easily adjusted to accommodate evolving needs. Whether it's increasing coverage amounts, adding riders for specific circumstances, or adjusting payment plans, Colonial Penn's policies offer a high degree of flexibility.

Furthermore, Colonial Penn places a strong emphasis on customer education and transparency. The company believes that informed policyholders are better equipped to make decisions that align with their long-term financial goals. As such, they provide extensive resources, including online tools, educational materials, and personalized guidance from licensed agents, to ensure customers fully understand their coverage options.

The Colonial Penn Advantage: A Comprehensive Overview

Colonial Penn's life insurance portfolio is diverse, catering to a wide range of demographic groups and financial situations. Here's a closer look at some of their key offerings:

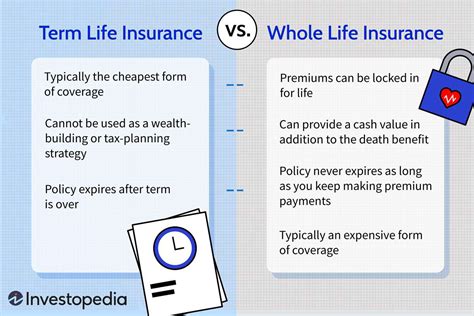

- Term Life Insurance: This policy provides coverage for a specified period, typically ranging from 10 to 30 years. It's an affordable option for those seeking temporary financial protection, such as covering mortgage payments or providing for dependents during their formative years. Colonial Penn's term life insurance plans offer flexibility in terms of coverage amounts and term lengths, allowing policyholders to tailor their coverage to their specific needs.

- Whole Life Insurance: As a permanent life insurance option, whole life insurance from Colonial Penn offers lifelong coverage. This policy builds cash value over time, which can be borrowed against or withdrawn to cover unexpected expenses. It's an ideal choice for individuals seeking long-term financial protection and stability.

- Burial Insurance: Recognizing the emotional and financial burden of end-of-life expenses, Colonial Penn offers specialized burial insurance plans. These policies provide a lump-sum payment upon the insured's death, ensuring that funeral costs are covered without placing an additional financial strain on loved ones.

- Accidental Death and Dismemberment Insurance: This policy provides a benefit if the insured person dies or suffers specific injuries due to an accident. It offers peace of mind to policyholders, knowing that their families will be financially protected in the event of an unforeseen tragedy.

Each of these policies can be further customized with optional riders, allowing policyholders to enhance their coverage to meet unique needs. For example, adding a critical illness rider provides a lump-sum payment if the insured is diagnosed with a covered critical illness, helping to cover treatment costs and other financial burdens.

| Policy Type | Key Benefits |

|---|---|

| Term Life Insurance | Affordable coverage for a specified term; flexibility in coverage amounts and term lengths. |

| Whole Life Insurance | Permanent coverage with cash value buildup; ideal for long-term financial stability. |

| Burial Insurance | Specialized coverage for end-of-life expenses; provides a lump-sum payment for funeral costs. |

| Accidental Death and Dismemberment Insurance | Benefits for accidental death or specific injuries; offers financial protection in unforeseen tragedies. |

Real-Life Success Stories: The Impact of Colonial Penn's Life Insurance

To truly understand the value of Colonial Penn's life insurance offerings, let's explore a few real-life success stories where their policies made a significant difference in the lives of policyholders and their families.

The Jones Family's Financial Security

Mr. and Mrs. Jones, a young couple with two small children, understood the importance of financial security. They chose Colonial Penn's term life insurance policy to ensure their family's financial stability in the event of an untimely death. With a policy tailored to their needs, they were able to secure a substantial death benefit, providing peace of mind and ensuring their children's future was protected.

When Mr. Jones passed away unexpectedly, the family received the full death benefit, allowing them to cover immediate expenses, such as funeral costs and outstanding bills. The remaining funds were invested in the children's education, ensuring they had the means to pursue their dreams. The Jones family's story is a testament to how Colonial Penn's life insurance can provide a safety net during life's most challenging moments.

Mrs. Johnson's Whole Life Journey

Mrs. Johnson, a retired schoolteacher, chose Colonial Penn's whole life insurance policy as a means of securing her financial future. With a policy that offered permanent coverage and cash value buildup, she was able to plan for her long-term care needs and leave a legacy for her grandchildren.

As she aged, Mrs. Johnson utilized the cash value of her policy to supplement her retirement income, ensuring a comfortable and secure retirement. Additionally, she was able to make withdrawals to cover unexpected medical expenses, providing a financial safety net during her golden years. Mrs. Johnson's story showcases how Colonial Penn's whole life insurance can be a vital component of a well-rounded financial plan.

The Martinez Family's Peace of Mind

The Martinez family, a young family with a newborn, knew the importance of financial preparedness. They chose Colonial Penn's burial insurance policy to ensure they had the means to cover end-of-life expenses without placing an additional burden on their loved ones.

When the unexpected occurred, and Mr. Martinez passed away, the family received the full burial insurance benefit. This allowed them to cover all funeral costs and related expenses, providing them with the financial means to grieve without the added stress of financial worries. The Martinez family's story highlights how Colonial Penn's burial insurance can bring peace of mind during a difficult time.

Expert Insights: Why Choose Colonial Penn for Your Life Insurance Needs

We spoke with several financial experts and industry leaders to gain their insights on Colonial Penn's life insurance offerings. Here's what they had to say:

"Colonial Penn stands out in the life insurance industry for its commitment to customer satisfaction and financial accessibility. Their policies are designed with the customer's best interests in mind, offering a range of options to meet diverse needs. Whether it's term life insurance for temporary protection or whole life insurance for long-term financial stability, Colonial Penn provides comprehensive coverage options that are both affordable and adaptable."

"One of the key advantages of Colonial Penn's life insurance policies is their focus on customer education. The company understands that informed policyholders are more likely to make sound financial decisions. By providing extensive resources and personalized guidance, Colonial Penn empowers its customers to choose the right coverage for their unique circumstances. This level of transparency and support sets them apart in the industry."

The Future of Life Insurance with Colonial Penn

As the insurance industry continues to evolve, Colonial Penn remains at the forefront, adapting its offerings to meet the changing needs of its customers. With a focus on innovation and customer-centricity, the company is well-positioned to continue providing accessible and reliable life insurance solutions for years to come.

In an increasingly digital world, Colonial Penn recognizes the importance of online accessibility and convenience. They have invested in enhancing their digital platforms, ensuring policyholders can easily manage their policies, make payments, and access resources online. This commitment to digital transformation ensures that Colonial Penn remains relevant and accessible to a wider audience.

Furthermore, Colonial Penn is dedicated to staying ahead of the curve in terms of product innovation. They continually evaluate market trends and customer feedback to develop new products and improve existing ones. This proactive approach ensures that their life insurance offerings remain competitive and aligned with the evolving needs of their customers.

Frequently Asked Questions

What is the application process like for Colonial Penn's life insurance policies?

+The application process is designed to be straightforward and convenient. You can start your application online or over the phone with a licensed agent. The process typically involves providing basic personal and health information, and in some cases, a medical exam may be required. Colonial Penn aims to make the application process as simple and efficient as possible, ensuring a smooth experience for prospective policyholders.

Can I customize my life insurance policy with Colonial Penn?

+Absolutely! Colonial Penn understands that everyone's financial situation and needs are unique. That's why they offer a range of customization options, including the ability to choose your coverage amount, term length, and optional riders. By tailoring your policy, you can ensure it aligns perfectly with your specific financial goals and circumstances.

How does Colonial Penn's life insurance compare in terms of cost and value?

+Colonial Penn is known for offering competitive pricing on its life insurance policies. Their focus on affordability ensures that a wide range of individuals can access the financial protection they need. While costs can vary based on factors like age, health, and coverage amount, Colonial Penn's policies provide excellent value for money. Their commitment to transparency and customer satisfaction ensures that policyholders receive the coverage they deserve at a fair price.

What happens if my financial situation changes, and I need to adjust my life insurance policy with Colonial Penn?

+Colonial Penn understands that life can bring unexpected changes, and they've designed their policies to be flexible. If your financial situation evolves, you can work with a licensed agent to adjust your coverage accordingly. Whether you need to increase or decrease your coverage amount, change your payment plan, or add optional riders, Colonial Penn is committed to ensuring your policy remains aligned with your current needs.

Are there any discounts or special programs available with Colonial Penn's life insurance policies?

+Yes, Colonial Penn offers various discounts and special programs to make their life insurance policies even more affordable and accessible. These may include multi-policy discounts, loyalty rewards, or special programs for certain demographic groups. By taking advantage of these opportunities, you can further enhance the value and cost-effectiveness of your Colonial Penn life insurance policy.

In conclusion, Colonial Penn’s life insurance offerings are a testament to their commitment to providing accessible, affordable, and adaptable financial protection. Through a diverse range of policies, comprehensive resources, and a customer-centric approach, Colonial Penn ensures that policyholders can secure their families’ financial futures with confidence and peace of mind.