Insurance Company Quotes

In today's complex world, where unforeseen events can have significant financial implications, insurance has become an indispensable tool for individuals and businesses alike. The process of obtaining insurance coverage often begins with requesting quotes from various insurance companies. These quotes provide an estimate of the cost and coverage details, enabling individuals to make informed decisions about their insurance needs. This article delves into the intricate world of insurance company quotes, exploring the factors that influence them, the steps involved in obtaining accurate quotes, and the strategies to ensure you receive the best value for your insurance coverage.

Understanding the Fundamentals of Insurance Company Quotes

Insurance company quotes are tailored estimates that provide prospective policyholders with an overview of the costs and coverage options available for their specific needs. These quotes are essential in helping individuals understand the financial commitment and the extent of protection offered by different insurance policies. The quote process is intricate, as it considers various factors unique to each individual’s situation.

Key Components of an Insurance Quote

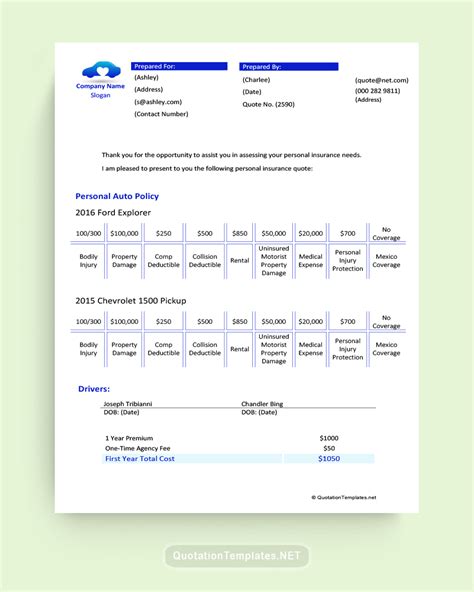

An insurance quote typically includes the following crucial elements:

- Premium: This is the amount the policyholder pays to the insurance company for the coverage. It is often calculated based on factors such as the type of coverage, the amount of coverage needed, and the risk profile of the insured.

- Coverage Limits: The quote will specify the maximum amount the insurance company will pay out in the event of a claim. These limits vary based on the policy and the specific coverage selected.

- Deductibles: Deductibles are the amount the policyholder must pay out of pocket before the insurance coverage kicks in. Higher deductibles often result in lower premiums, as the insured assumes more financial responsibility.

- Policy Term: This refers to the duration of the insurance coverage. It can range from short-term policies lasting a few months to long-term policies that provide coverage for several years.

- Exclusions: Insurance quotes will also outline situations or events that are not covered by the policy. Understanding these exclusions is crucial to ensure you have adequate protection for your specific needs.

Factors Influencing Insurance Quotes

Several factors play a role in determining the quote you receive from insurance companies. These factors can vary based on the type of insurance you’re seeking, but some common influences include:

- Risk Profile: Insurance companies assess the risk associated with insuring an individual or entity. Factors such as age, health status, driving record (for auto insurance), and the value of assets being insured can all impact the perceived risk.

- Location: The geographic location of the insured can significantly affect insurance quotes. Areas prone to natural disasters, high crime rates, or dense populations may result in higher premiums.

- Claims History: A history of frequent or costly claims can influence future insurance quotes. Insurance companies consider this data when assessing the risk of insuring an individual or business.

- Coverage Type and Amount: The type of insurance (e.g., auto, home, health) and the level of coverage required will directly impact the quote. Higher coverage limits typically result in higher premiums.

- Deductible Selection: As mentioned earlier, choosing a higher deductible can lead to lower premiums. Insurance companies offer various deductible options, allowing policyholders to customize their coverage based on their financial preferences.

The Process of Obtaining Insurance Company Quotes

Obtaining insurance quotes has become more accessible and efficient in recent years, thanks to online platforms and digital tools. However, the process can still be complex, and understanding the steps involved can help you navigate it more effectively.

Gathering Information

Before requesting quotes, it’s essential to have a clear understanding of your insurance needs. Consider the following:

- What type of insurance do you require (e.g., auto, home, life, health)?

- What specific coverage limits do you need? (e.g., liability coverage for auto insurance, dwelling coverage for home insurance)

- Are there any unique circumstances or risks associated with your situation that might impact the quote (e.g., a high-risk occupation, a history of severe weather events in your area)?

- Do you have any existing policies that you’d like to replace or supplement with a new quote?

Comparing Quotes

Once you’ve gathered the necessary information, it’s time to request quotes from multiple insurance companies. You can do this through various channels, including:

- Online Platforms: Many insurance companies and brokers offer online quote tools on their websites. These tools allow you to input your information and receive quotes from multiple providers in one place.

- Insurance Brokers: Working with an insurance broker can be beneficial, as they have access to quotes from multiple companies and can provide personalized advice based on your needs.

- Direct Contact: You can also reach out to individual insurance companies directly to request quotes. This approach may be more time-consuming but can provide valuable insights into the specific offerings of each company.

Evaluating the Quotes

When you receive quotes from various insurance companies, it’s crucial to evaluate them carefully. Consider the following aspects:

- Premium: Compare the premiums offered by different companies. While a lower premium might be tempting, ensure you understand the coverage limits and any exclusions that come with it.

- Coverage Details: Pay close attention to the coverage limits and any specific exclusions. Ensure the policy aligns with your unique needs and provides adequate protection.

- Reputation and Financial Stability: Research the reputation and financial stability of the insurance companies offering quotes. You want to ensure they are reputable and financially sound to provide reliable coverage when you need it most.

- Customer Service and Claims Process: Consider the quality of customer service and the ease of the claims process. Reading reviews and seeking recommendations can provide valuable insights into these aspects.

Strategies for Securing the Best Insurance Quotes

Obtaining accurate and competitive insurance quotes requires a strategic approach. Here are some strategies to help you secure the best deals:

Bundle Your Policies

If you require multiple types of insurance, such as auto and home insurance, consider bundling your policies with the same insurance company. Many companies offer discounts when you bundle multiple policies, as it reduces administrative costs and simplifies your insurance management.

Raise Your Deductibles

As mentioned earlier, choosing a higher deductible can result in lower premiums. However, ensure that the increased deductible aligns with your financial capabilities. If you’re unable to afford the deductible in the event of a claim, the savings from a lower premium may not be worth the risk.

Improve Your Risk Profile

Insurance companies assess your risk profile when determining quotes. Taking steps to improve your risk profile can lead to more favorable quotes. For example, if you’re seeking auto insurance, maintaining a clean driving record and taking defensive driving courses can reduce your perceived risk.

Shop Around and Negotiate

Don’t settle for the first quote you receive. Shopping around and comparing quotes from multiple companies is essential to finding the best deal. Additionally, don’t be afraid to negotiate. Many insurance companies are open to discussing your quote and may offer better rates if they believe you’re a valuable customer.

Explore Discounts

Insurance companies often offer a variety of discounts to attract customers. These discounts can include:

- Multi-Policy Discounts: As mentioned, bundling multiple policies with the same company can lead to significant savings.

- Loyalty Discounts: Staying with the same insurance company for an extended period may result in loyalty discounts.

- Safety Discounts: Installing safety features in your home or vehicle, such as security systems or advanced driver-assistance systems, can lead to reduced premiums.

- Occupational or Association Discounts: Certain occupations or professional associations may be eligible for discounts through group insurance programs.

The Future of Insurance Company Quotes

The insurance industry is continually evolving, and the process of obtaining quotes is no exception. With advancements in technology and data analytics, insurance companies are increasingly able to offer more accurate and personalized quotes. Here are some trends and future implications to consider:

Data-Driven Quotes

Insurance companies are leveraging vast amounts of data to improve the accuracy of their quotes. By analyzing historical claims data, demographic information, and even real-time data (such as weather patterns or traffic conditions), insurers can more precisely assess risk and offer tailored quotes.

Telematics and Usage-Based Insurance

In the auto insurance industry, telematics and usage-based insurance are gaining traction. These technologies allow insurance companies to monitor driving behavior in real time, offering discounts to safe drivers and adjusting premiums based on actual usage. This approach provides a more accurate assessment of risk and can lead to significant savings for responsible drivers.

Artificial Intelligence and Machine Learning

AI and machine learning are transforming the insurance industry, including the quote process. These technologies enable insurers to process vast amounts of data quickly and accurately, leading to faster and more precise quotes. Additionally, AI-powered chatbots and virtual assistants are enhancing the customer experience by providing instant quotes and personalized recommendations.

Blockchain Technology

Blockchain technology has the potential to revolutionize the insurance industry by improving transparency, security, and efficiency. In the context of insurance quotes, blockchain can enhance data sharing and verification, reducing the time and effort required to obtain accurate quotes. Additionally, smart contracts built on blockchain can automate certain insurance processes, further streamlining the quote and claims processes.

Conclusion

Obtaining insurance company quotes is a critical step in ensuring you have adequate and affordable coverage for your unique needs. By understanding the factors that influence quotes, following a strategic approach to comparison shopping, and leveraging emerging technologies and trends, you can secure the best insurance deals available. Remember, insurance is a long-term investment in your financial security, and taking the time to find the right coverage at the right price is a wise decision.

How often should I review my insurance policies and quotes?

+It’s recommended to review your insurance policies and quotes annually or whenever there are significant life changes, such as marriage, the birth of a child, purchasing a new home, or changing jobs. These events can impact your insurance needs and the quotes you receive.

Can I negotiate my insurance quote if I find a better deal elsewhere?

+Absolutely! Insurance companies often appreciate loyal customers and may be willing to match or beat a competitor’s quote to retain your business. Don’t hesitate to discuss your options with your insurance provider.

Are there any resources to help me understand the complex terms and jargon used in insurance quotes?

+Yes, many insurance companies and industry associations provide educational resources and glossaries to help consumers understand insurance terminology. Additionally, insurance brokers can provide valuable insights and explanations tailored to your specific situation.