Insurance Cost Per Month

Understanding the intricacies of insurance costs is crucial for anyone seeking to protect their assets, health, or business. The price of insurance is a complex equation influenced by numerous factors, each playing a significant role in determining the final monthly cost. From the type of insurance policy to individual risk factors, the landscape of insurance pricing is diverse and ever-changing. This article aims to provide a comprehensive overview of the elements that contribute to insurance costs, offering a deeper understanding of how these expenses are calculated and the factors that influence them.

The Fundamentals of Insurance Cost Calculation

The calculation of insurance costs is a precise science, incorporating actuarial science principles and statistical analysis to determine the likelihood of an event occurring and its potential impact. This process involves a thorough examination of historical data, trends, and individual circumstances to assess risk and set appropriate premiums. The complexity of this calculation is further heightened by the diverse nature of insurance products, each with its own set of considerations and variables.

Key Factors Influencing Insurance Costs

When assessing the cost of insurance, several key factors come into play. These include the type of insurance policy, the coverage limits and deductibles chosen, the insured’s location, and their personal characteristics and risk factors. Additionally, the insurance company’s claims history and the overall market conditions can significantly impact the cost of insurance.

| Factor | Impact on Insurance Cost |

|---|---|

| Type of Insurance | Different types of insurance, such as auto, home, health, or life insurance, carry varying levels of risk and therefore have different cost structures. |

| Coverage Limits and Deductibles | The amount of coverage an individual chooses, as well as their deductible, can significantly affect the cost of their insurance policy. |

| Location | The insured's location, whether it's their residence, business address, or the place of their vehicle registration, can influence the risk level and, consequently, the cost of insurance. |

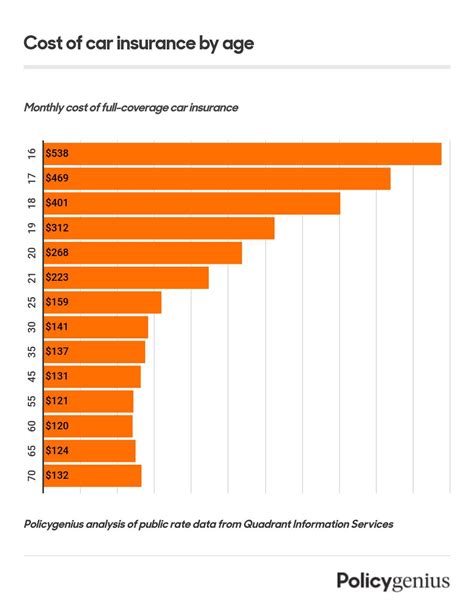

| Personal Characteristics and Risk Factors | An individual's age, gender, health status, driving record, and credit score can all impact their insurance premiums. These factors are used to assess the likelihood of a claim and set appropriate rates. |

| Insurance Company's Claims History | The frequency and severity of claims made by an insurance company's policyholders can affect the company's overall profitability and, subsequently, the premiums it charges. |

| Market Conditions | The insurance market is influenced by various economic factors, regulatory changes, and industry trends, all of which can impact the cost of insurance. |

A Deep Dive into Specific Insurance Types

Each type of insurance presents its own unique considerations and cost structures. Let’s explore some of the most common types of insurance and the factors that affect their costs.

Auto Insurance

Auto insurance is mandatory in most states and is designed to cover the cost of repairs or replacements in the event of an accident, as well as provide liability protection. The cost of auto insurance is influenced by a variety of factors, including:

- Vehicle Type and Usage: The make, model, and age of the vehicle, as well as the distance driven annually, can impact insurance costs. Higher-value vehicles or those that are frequently driven may carry higher premiums.

- Driving Record: A history of accidents or traffic violations can significantly increase insurance premiums. Insurers use driving records to assess the risk of insuring a particular individual.

- Credit Score: Surprisingly, credit scores can play a role in auto insurance costs. Insurers often use credit-based insurance scores as an indicator of an individual's risk level.

- Coverage Limits and Deductibles: Choosing higher coverage limits or lower deductibles can increase the cost of auto insurance. It's important to strike a balance between coverage and affordability.

Home Insurance

Home insurance is essential for protecting your home and belongings against various risks, including fire, theft, and natural disasters. The cost of home insurance can vary significantly based on:

- Location: The location of your home is a critical factor in determining home insurance costs. Areas prone to natural disasters, such as hurricanes or earthquakes, may carry higher premiums.

- Home Value and Contents: The value of your home and the cost of replacing its contents can impact insurance costs. Higher-value homes or those with valuable possessions may require more extensive (and costly) coverage.

- Deductibles and Coverage Limits: Similar to auto insurance, the deductibles and coverage limits chosen for home insurance can affect the overall cost. Balancing coverage and affordability is key.

- Claims History: If you've had a history of making claims, it may impact your home insurance costs. Insurers consider claim frequency and severity when setting premiums.

Health Insurance

Health insurance is a vital component of financial security, providing coverage for medical expenses. The cost of health insurance can be influenced by a range of factors, including:

- Age and Gender: Health insurance costs can vary based on age and gender. Generally, younger individuals pay lower premiums, while older individuals and females may pay more due to higher healthcare utilization.

- Tobacco Use: Tobacco users often face higher health insurance premiums due to the increased health risks associated with smoking.

- Pre-existing Conditions: Individuals with pre-existing medical conditions may face higher premiums or may be unable to secure certain types of coverage.

- Coverage Limits and Deductibles: As with other types of insurance, the coverage limits and deductibles chosen for health insurance can significantly impact the overall cost.

Life Insurance

Life insurance provides financial protection to loved ones in the event of the policyholder’s death. The cost of life insurance is influenced by several factors, including:

- Age: Age is a significant factor in life insurance costs. Generally, younger individuals pay lower premiums, as they are less likely to pass away unexpectedly.

- Health and Lifestyle: An individual's health and lifestyle choices, such as smoking or participating in high-risk activities, can impact their life insurance premiums. Insurers may require medical exams or ask about health history.

- Coverage Amount: The amount of coverage an individual chooses can significantly affect their life insurance premiums. Higher coverage amounts will typically result in higher monthly costs.

Strategies to Lower Insurance Costs

While insurance costs can be influenced by a multitude of factors, there are strategies individuals can employ to potentially reduce their insurance expenses. These strategies can help make insurance more affordable while still providing adequate coverage.

Bundling Insurance Policies

One effective strategy to reduce insurance costs is to bundle multiple insurance policies with the same provider. Many insurance companies offer discounts when customers purchase multiple types of insurance, such as auto and home insurance, from them. By bundling policies, individuals can often save money and streamline their insurance coverage.

Increasing Deductibles

Increasing deductibles can be a cost-saving strategy, particularly for auto and home insurance. While higher deductibles mean individuals will pay more out-of-pocket in the event of a claim, this can lead to lower monthly premiums. It’s important to strike a balance between what you can afford to pay out-of-pocket and the level of protection you need.

Maintaining a Clean Record

For auto insurance, maintaining a clean driving record is crucial to keeping costs down. Avoiding accidents and traffic violations can help individuals qualify for lower premiums. Similarly, for health insurance, maintaining a healthy lifestyle and managing pre-existing conditions can help keep costs manageable.

Shopping Around and Comparing Quotes

Insurance costs can vary significantly between providers. It’s important to shop around and compare quotes from multiple insurance companies to find the best deal. Online insurance marketplaces can be a convenient way to compare prices and coverage options from a variety of providers.

Utilizing Discounts and Special Programs

Many insurance companies offer discounts for a variety of reasons, such as good grades, safe driving, or home safety improvements. It’s worth inquiring about these discounts and taking advantage of any that apply to your situation. Additionally, some insurance companies offer special programs or incentives that can help lower costs, such as usage-based insurance programs for auto insurance.

The Future of Insurance Costs

The insurance industry is continually evolving, and the cost of insurance is no exception. Technological advancements, regulatory changes, and shifting consumer preferences are all factors that can influence the future landscape of insurance costs. As the industry adapts to these changes, it’s likely that we’ll see new pricing models, increased personalization of insurance products, and potentially more affordable options for consumers.

For instance, the rise of telematics and usage-based insurance programs for auto insurance could lead to more personalized pricing based on an individual's actual driving behavior. Similarly, the increasing adoption of digital health records and wearable health tracking devices could provide more accurate data for health insurance underwriting, potentially leading to more tailored and affordable health insurance options.

Additionally, the increasing focus on sustainability and environmental concerns may lead to new insurance products and pricing models that account for these factors. For instance, insurance companies may offer incentives or discounts for eco-friendly practices or provide coverage for new types of risks associated with climate change.

In conclusion, while the future of insurance costs is uncertain, it's clear that the insurance industry is committed to innovation and adaptation. By staying informed about industry trends and advancements, consumers can make more informed decisions about their insurance coverage and potentially benefit from more affordable options in the future.

How often should I review my insurance policies and costs?

+

It’s recommended to review your insurance policies and costs at least once a year. This allows you to stay up-to-date with any changes in your circumstances or the market that could impact your coverage or premiums. Regular reviews can also help you identify opportunities to save money or improve your coverage.

What is a deductible, and how does it impact insurance costs?

+

A deductible is the amount you agree to pay out-of-pocket before your insurance coverage kicks in. Higher deductibles typically result in lower premiums, as you’re assuming more of the financial risk. It’s important to choose a deductible that balances your ability to pay out-of-pocket expenses with the level of protection you need.

Can my insurance costs change over time, even if my circumstances remain the same?

+

Yes, insurance costs can change over time, even if your personal circumstances remain the same. This is because insurance companies regularly review their rates and may adjust them based on factors such as changes in claims frequency or severity, shifts in the market, or regulatory changes. It’s always a good idea to keep an eye on your insurance costs and shop around for better deals.