Insurance For International Travel

Traveling abroad is an exciting prospect, offering new experiences, cultures, and adventures. However, it's essential to prepare for the unexpected, and one crucial aspect of international travel preparation is securing appropriate insurance coverage. Travel insurance for international trips provides a safety net, ensuring you can navigate potential hurdles and emergencies with peace of mind. This article delves into the world of insurance for international travel, offering an in-depth analysis of its importance, types, coverage, and more.

The Significance of Insurance for International Travel

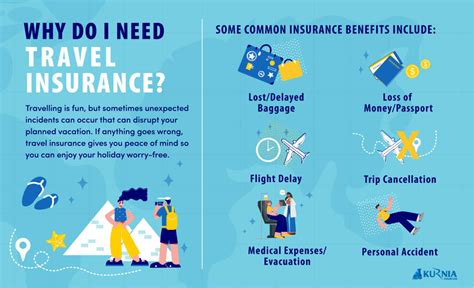

International travel insurance is a vital component of any overseas trip, offering protection and assistance in various scenarios. From medical emergencies to trip cancellations, luggage loss, and even legal assistance, it provides a comprehensive safety net. The benefits of travel insurance extend beyond peace of mind, ensuring travelers can focus on enjoying their adventures without constant worry.

Consider the story of Sarah, an avid traveler who embarked on a solo trip to Europe. During her journey, she suffered a sudden illness, requiring immediate medical attention. Thankfully, her travel insurance covered the cost of her treatment, allowing her to recover without financial strain. This real-life example highlights the critical role insurance plays in ensuring travelers can navigate unexpected situations with confidence.

Understanding the Risks

International travel comes with its own set of risks and challenges. Medical emergencies can occur unexpectedly, and the cost of treatment abroad can be significantly higher than at home. Additionally, trip cancellations due to unforeseen circumstances, such as severe weather or family emergencies, can result in substantial financial losses. Travel insurance provides a financial safety net, covering these expenses and more.

Another critical aspect of international travel insurance is its ability to provide emergency assistance. This includes help with finding local medical facilities, translation services, and even evacuation in severe cases. Travel insurance companies often have dedicated assistance teams available 24/7, ensuring travelers have access to support whenever and wherever they need it.

Types of International Travel Insurance

International travel insurance policies come in various forms, each tailored to meet specific needs. Understanding the different types of coverage is essential to choose the right policy for your trip.

Single-Trip Insurance

As the name suggests, single-trip insurance is designed for one specific journey. It covers the duration of the trip, typically lasting a few days to several weeks. This type of insurance is ideal for short-term travelers or those who only travel occasionally.

For instance, imagine a student planning a month-long study trip to South America. Single-trip insurance would provide coverage for the entire duration of their stay, offering protection against medical emergencies, trip cancellations, and luggage loss.

Annual Multi-Trip Insurance

Annual multi-trip insurance, as the name implies, offers coverage for multiple trips within a year. It’s ideal for frequent travelers who embark on several journeys annually. This type of insurance provides continuous coverage, eliminating the need to purchase a new policy for each trip.

Consider the case of a business professional who travels frequently for work. Annual multi-trip insurance would ensure they're covered for all their business trips, providing peace of mind and simplifying the insurance process.

Specialized Travel Insurance

Some travelers may require specialized insurance, particularly those engaging in high-risk activities or visiting remote destinations. Specialized travel insurance policies cater to these unique needs, offering enhanced coverage for activities like extreme sports, adventure tours, or even cruises.

For example, an adventure seeker planning a trek in the Himalayas may opt for specialized travel insurance that covers search and rescue operations, which is a crucial aspect of coverage in such remote and challenging environments.

Key Coverage Aspects

International travel insurance policies offer a range of coverage options. Understanding these aspects is crucial to ensure you have the right protection for your trip.

Medical Expenses

Medical coverage is often the most critical aspect of travel insurance. It covers the cost of medical treatment, hospitalization, and even emergency dental care. Some policies also include coverage for pre-existing medical conditions, which is essential for travelers with ongoing health issues.

For instance, a traveler with a history of asthma may require specialized medical coverage to ensure their condition is managed effectively during their trip. This coverage could include access to specific medications or specialized medical equipment.

Trip Cancellation and Interruption

Trip cancellation and interruption coverage protects travelers from financial losses due to unforeseen circumstances. This coverage reimburses the cost of non-refundable trip expenses if the trip is canceled or interrupted due to reasons like severe weather, natural disasters, or personal emergencies.

Imagine a couple planning their dream honeymoon to the Caribbean. If a sudden family emergency arises, forcing them to cancel their trip, trip cancellation coverage would reimburse their non-refundable expenses, ensuring they don't incur significant financial losses.

Luggage and Personal Belongings

Travel insurance policies often include coverage for luggage and personal belongings. This covers the cost of replacing lost, stolen, or damaged items during the trip. However, it’s essential to note that there are often limits to this coverage, and high-value items may require additional protection.

For instance, a traveler carrying expensive electronics like a laptop or camera may need to declare these items separately to ensure they're adequately covered.

Emergency Evacuation and Repatriation

Emergency evacuation and repatriation coverage is a critical aspect of international travel insurance. It covers the cost of medical evacuation in severe cases and repatriation of the traveler’s remains in the event of their death.

Consider a traveler who suffers a severe injury while hiking in a remote area. Emergency evacuation coverage would ensure they receive the necessary medical attention and are safely transported to a suitable medical facility.

Choosing the Right Policy

Selecting the right travel insurance policy involves careful consideration of various factors. Here are some key aspects to keep in mind:

Destination and Activities

The destination and activities planned for your trip play a significant role in policy selection. Certain destinations may have higher medical costs or present unique risks, while specific activities may require specialized coverage.

For example, a traveler planning a skiing trip in the Alps would benefit from a policy that covers winter sports injuries, which is often an optional add-on to standard travel insurance.

Pre-Existing Medical Conditions

If you have a pre-existing medical condition, it’s crucial to choose a policy that provides coverage for these conditions. Some policies may exclude certain pre-existing conditions, so it’s essential to read the fine print and choose a provider that caters to your specific needs.

A traveler with a history of heart disease, for instance, would need to ensure their policy covers any potential cardiac emergencies during their trip.

Trip Duration and Frequency

The duration and frequency of your trips also impact policy selection. If you travel frequently or for extended periods, an annual multi-trip policy may be more cost-effective. For shorter, one-off trips, a single-trip policy is often the best option.

Comparison Shopping

It’s always beneficial to compare different insurance providers and policies. Each provider offers unique benefits and coverage limits, so it’s essential to review and understand these aspects before making a decision.

Online comparison tools can be a valuable resource, allowing you to quickly assess various policies and their features. However, it's crucial to read the policy documents thoroughly to understand the fine print and any exclusions.

Real-Life Scenarios and Coverage

Understanding how travel insurance works in real-life scenarios can provide valuable insights into its importance and coverage.

Medical Emergency Abroad

Imagine a traveler who suffers a severe allergic reaction while on a beach vacation. Their travel insurance policy covers the cost of immediate medical treatment, including emergency transportation to a nearby hospital. The policy also includes coverage for any follow-up care needed once they return home.

Trip Cancellation Due to Weather

A family plans a summer vacation to a tropical destination. However, due to unexpected severe weather conditions, their flights are canceled, and they’re unable to travel. Their travel insurance policy covers the cost of their non-refundable trip expenses, providing financial relief during this unexpected turn of events.

Lost Luggage

A business traveler arrives at their destination only to discover their luggage is missing. Their travel insurance policy covers the cost of purchasing essential items like clothing and toiletries until their luggage is located or replaced.

Travel Insurance Tips and Best Practices

Here are some valuable tips and best practices to ensure you make the most of your travel insurance coverage:

- Read the policy document thoroughly to understand the coverage, exclusions, and any specific requirements.

- Keep a copy of your insurance policy and emergency contact numbers with you during your trip.

- Inform your insurance provider immediately if you need to make a claim, and provide all the necessary documentation.

- Understand the process for making a claim, including any time limits and required steps.

- Consider purchasing additional coverage for high-value items or specialized activities.

The Future of Travel Insurance

As travel continues to evolve, so does the world of travel insurance. Here’s a glimpse into the future of this industry:

Digitalization and Instant Coverage

With the rise of digital technologies, travel insurance providers are embracing digitalization. This includes the ability to purchase insurance policies instantly online, with real-time coverage activation. This trend offers travelers more convenience and flexibility, especially for last-minute trips.

Personalized Coverage

The future of travel insurance lies in personalized coverage tailored to individual needs. Travelers will have the ability to customize their policies, choosing specific coverages and limits based on their unique trip requirements.

Enhanced Assistance Services

Travel insurance companies are continuously improving their assistance services. This includes expanding language support, providing more comprehensive medical advice, and offering additional concierge services to enhance the traveler’s experience.

Integration with Travel Platforms

Travel insurance providers are partnering with online travel platforms and agencies to offer seamless insurance coverage as part of the booking process. This integration ensures travelers have access to insurance options when planning their trips, making it a more integrated and convenient process.

Conclusion

Insurance for international travel is an essential aspect of any overseas journey. It provides peace of mind, financial protection, and assistance in times of need. By understanding the different types of coverage, choosing the right policy, and following best practices, travelers can ensure they’re well-prepared for any eventuality.

As the travel industry continues to evolve, so too will travel insurance. With digitalization, personalized coverage, and enhanced assistance services, the future of travel insurance promises to be even more comprehensive and traveler-centric.

Remember, travel insurance is not just a necessity; it's an investment in your peace of mind and safety. So, whether you're embarking on a solo adventure or a family vacation, ensure you're protected with the right insurance coverage.

What should I do if I need to make a claim while abroad?

+If you need to make a claim while abroad, it’s essential to contact your insurance provider immediately. Most providers have 24⁄7 emergency assistance lines. Provide them with all the necessary details, including any relevant documentation, and follow their instructions for the claim process.

Are there any exclusions in travel insurance policies?

+Yes, travel insurance policies typically have exclusions. These may include pre-existing medical conditions, dangerous activities like skydiving without additional coverage, or specific destinations with high-risk advisories. It’s crucial to read the policy document to understand any exclusions.

Can I extend my travel insurance coverage if my trip duration changes?

+Yes, if your trip duration changes, you can often extend your travel insurance coverage. Contact your insurance provider to discuss your options and any additional costs involved. It’s important to ensure your coverage remains valid for the entire duration of your trip.

What happens if I lose my insurance documents while traveling?

+If you lose your insurance documents while traveling, you can usually request a replacement copy from your insurance provider. Keep their emergency contact details with you, and reach out to them immediately to request a new document. Ensure you have a digital copy of your policy for easy access.