Insurance Full Coverage

Full coverage insurance is a comprehensive term that refers to an insurance policy that offers extensive protection for vehicles, covering a wide range of potential risks and damages. It is designed to provide policyholders with peace of mind, ensuring that they are financially safeguarded in the event of accidents, natural disasters, or other unforeseen circumstances that may lead to vehicle damage or loss. In this article, we will delve into the intricacies of full coverage insurance, exploring its components, benefits, and considerations to help you make informed decisions when it comes to protecting your vehicles.

Understanding Full Coverage Insurance

Full coverage insurance is a broad term encompassing various types of insurance coverage tailored to protect vehicles from a multitude of risks. It typically combines collision coverage and comprehensive coverage, which together provide an all-encompassing layer of protection. Let’s break down these key components:

Collision Coverage

Collision coverage is a fundamental aspect of full coverage insurance. It steps in to cover the costs associated with repairing or replacing your vehicle when it is involved in a collision, regardless of who is at fault. This coverage is especially beneficial in scenarios where the other driver is uninsured or underinsured, as it ensures you are not left bearing the financial burden of repairs or replacements.

Additionally, collision coverage often extends to situations where your vehicle collides with an object, such as a tree, a fence, or even an animal. In these cases, the insurance provider will typically assess the extent of the damage and provide coverage based on the policy's terms and conditions.

Comprehensive Coverage

Comprehensive coverage is another crucial component of full coverage insurance. It safeguards your vehicle against damages caused by events beyond your control, such as natural disasters, vandalism, theft, or animal collisions. This type of coverage ensures that you are protected even when accidents occur outside of typical driving scenarios.

For instance, if your vehicle is damaged during a hailstorm or a flood, comprehensive coverage will step in to help cover the costs of repairs or, in some cases, provide compensation for the total loss of the vehicle. It also extends to situations where your vehicle is vandalized or stolen, offering financial assistance to help you replace or repair the damaged parts.

Moreover, comprehensive coverage often includes protection against damages caused by falling objects, such as tree branches, or even damages resulting from certain types of glass breakage. It is a vital component of full coverage insurance, providing an extra layer of security against unforeseen events.

| Coverage Type | Key Benefits |

|---|---|

| Collision Coverage | Covers repairs or replacements for vehicle damage due to collisions, including accidents with objects. |

| Comprehensive Coverage | Protects against damages caused by natural disasters, vandalism, theft, and collisions with animals. |

Benefits of Full Coverage Insurance

Full coverage insurance provides a myriad of benefits that can significantly impact your financial well-being and peace of mind. Here are some key advantages to consider:

Financial Protection

The primary benefit of full coverage insurance is the financial protection it offers. In the event of an accident or damage to your vehicle, the insurance coverage steps in to cover the costs, ensuring that you are not left with a substantial financial burden. This is especially crucial when accidents occur with uninsured or underinsured drivers, as full coverage insurance can help bridge the gap in liability coverage.

Additionally, comprehensive coverage provides financial security against damages caused by natural disasters or acts of vandalism, which can be particularly costly to repair or replace. With full coverage insurance, you can rest assured that you will have the necessary funds to restore your vehicle to its pre-damage condition.

Peace of Mind

Having full coverage insurance provides policyholders with a sense of security and peace of mind. Knowing that your vehicle is protected against a wide range of risks allows you to focus on your daily activities without constant worry about potential accidents or damages. It eliminates the stress and anxiety associated with unexpected vehicle repairs or replacements, enabling you to drive with confidence.

Total Loss Protection

In the unfortunate event that your vehicle is declared a total loss due to extensive damage, full coverage insurance steps in to provide compensation. This means that if the cost of repairing your vehicle exceeds a certain threshold, typically the vehicle’s actual cash value, the insurance provider will cover the full amount, allowing you to purchase a replacement vehicle without incurring significant financial loss.

Rental Car Coverage

Many full coverage insurance policies include rental car coverage, which is especially beneficial when your vehicle is undergoing repairs. This coverage ensures that you have access to a rental car while your insured vehicle is being fixed, minimizing disruptions to your daily routine and providing a convenient solution for transportation needs.

| Benefit | Description |

|---|---|

| Financial Protection | Full coverage insurance covers repair or replacement costs, ensuring you're not left with a substantial financial burden. |

| Peace of Mind | Policyholders can drive with confidence, knowing their vehicle is protected against a wide range of risks. |

| Total Loss Protection | In case of a total loss, full coverage insurance provides compensation to help purchase a replacement vehicle. |

| Rental Car Coverage | Many policies offer rental car coverage during repairs, ensuring uninterrupted transportation. |

Considerations and Customization

While full coverage insurance offers extensive protection, it is essential to consider your specific needs and circumstances when selecting a policy. Here are some factors to keep in mind:

Policy Deductibles

Insurance deductibles are the amount you must pay out of pocket before your insurance coverage kicks in. With full coverage insurance, you typically have the option to choose your deductible amount. Higher deductibles can lead to lower insurance premiums, but it’s crucial to select a deductible that aligns with your financial capabilities.

Personalized Coverage

Full coverage insurance policies can be customized to suit your unique needs. You can opt for additional coverage options, such as gap insurance, which covers the difference between your vehicle’s value and the amount owed on your loan in the event of a total loss. Additionally, you can choose specific coverage limits and add-ons based on your vehicle’s value and your personal preferences.

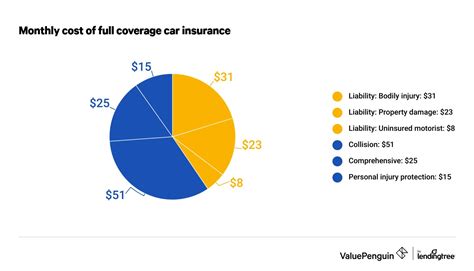

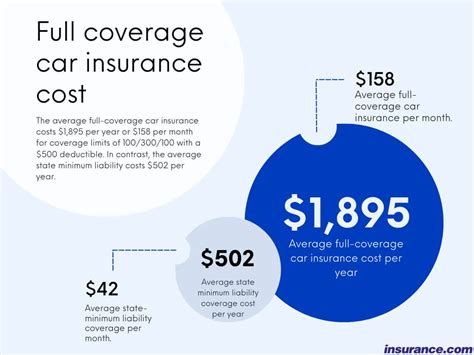

Cost Considerations

Full coverage insurance tends to be more expensive than basic liability coverage due to the extensive protection it provides. It is essential to compare quotes from different insurance providers and assess the cost-effectiveness of the coverage. Consider your vehicle’s value, your driving history, and your financial situation when evaluating the cost of full coverage insurance.

Vehicle Age and Value

The age and value of your vehicle play a significant role in determining the need for full coverage insurance. If your vehicle is older and has a lower market value, it may not be cost-effective to invest in full coverage. In such cases, you might consider opting for liability coverage or exploring other insurance options that provide adequate protection without excessive costs.

| Consideration | Details |

|---|---|

| Policy Deductibles | Choose a deductible that aligns with your financial capabilities to strike a balance between cost and coverage. |

| Personalized Coverage | Customize your policy with additional coverage options like gap insurance to meet your specific needs. |

| Cost Considerations | Compare quotes and assess the cost-effectiveness of full coverage insurance based on your vehicle's value and driving history. |

| Vehicle Age and Value | Consider the age and value of your vehicle when determining the necessity and affordability of full coverage insurance. |

Conclusion: Making an Informed Choice

Full coverage insurance is a comprehensive solution for vehicle protection, offering a wide range of benefits and peace of mind. By understanding the components of full coverage, its benefits, and the considerations involved, you can make an informed decision about the type of insurance that best suits your needs and circumstances.

Remember, while full coverage insurance provides extensive protection, it is essential to review your policy's terms and conditions, understand the coverage limits, and assess the cost-effectiveness based on your individual situation. With the right insurance coverage, you can drive with confidence, knowing that your vehicle is protected against a multitude of risks.

What is the difference between full coverage and liability-only insurance?

+Full coverage insurance includes collision and comprehensive coverage, providing protection against a wide range of risks. Liability-only insurance, on the other hand, covers only the damage you cause to others’ property or injuries you cause to others. It does not cover your own vehicle’s damage.

Is full coverage insurance worth the cost?

+The value of full coverage insurance depends on your individual circumstances. If you have a newer or more expensive vehicle, full coverage can provide significant financial protection. However, for older vehicles with lower market value, it may be more cost-effective to opt for liability coverage.

Can I customize my full coverage insurance policy?

+Yes, full coverage insurance policies can be customized to meet your specific needs. You can choose different coverage limits, add-ons like gap insurance, and even select personalized options to ensure your policy aligns with your preferences and circumstances.