Insurance In New Jersey

In the Garden State, insurance plays a pivotal role in safeguarding the diverse population and vibrant economy of New Jersey. From the bustling streets of Newark to the serene beaches of the Jersey Shore, understanding the intricacies of insurance is essential for residents and businesses alike. In this comprehensive guide, we will delve into the world of insurance in New Jersey, exploring the unique challenges and opportunities that shape this industry.

Navigating the Insurance Landscape in New Jersey

New Jersey is known for its diverse range of insurance needs, reflecting the state’s varied demographics and industries. From the bustling urban centers to the rural communities, the insurance landscape is as diverse as the state itself. Here’s an in-depth look at the key aspects of insurance in New Jersey:

Auto Insurance: A Necessity for Every Driver

In New Jersey, having auto insurance is not just a legal requirement; it’s a necessity for every driver. With its busy roads and dense population, the state demands comprehensive coverage to protect against accidents and unforeseen events. The New Jersey Motor Vehicle Commission (MVC) mandates that all drivers carry a minimum amount of liability insurance, but many residents opt for additional coverage to ensure they’re fully protected.

One unique aspect of auto insurance in New Jersey is the No-Fault Insurance system, also known as Personal Injury Protection (PIP). This system provides medical coverage for injured drivers and passengers, regardless of fault in an accident. PIP coverage is mandatory in New Jersey and can cover a wide range of medical expenses, making it a crucial component of any auto insurance policy.

For those seeking affordable auto insurance, New Jersey offers a Basic Policy, which provides the minimum coverage required by law. However, it's important to note that this basic policy may not provide sufficient protection for many drivers. To tailor coverage to individual needs, residents often opt for comprehensive policies that include collision, comprehensive, and additional liability coverage.

| Auto Insurance Coverage | Description |

|---|---|

| Liability Coverage | Covers damages to others in an accident. |

| Personal Injury Protection (PIP) | Provides medical coverage for injuries sustained in an accident. |

| Collision Coverage | Covers damage to your vehicle in an accident. |

| Comprehensive Coverage | Protects against non-collision incidents like theft or natural disasters. |

Home Insurance: Protecting Your Castle

New Jersey is home to a wide range of residential properties, from coastal mansions to suburban homes and urban apartments. Home insurance is crucial for protecting these dwellings and their contents against various risks. The state’s diverse climate, with its hurricanes, nor’easters, and occasional tornadoes, makes comprehensive coverage essential.

The cost of home insurance in New Jersey can vary significantly based on factors such as location, property value, and the level of coverage desired. Coastal areas, for instance, often face higher premiums due to the increased risk of storms and flooding. To ensure adequate protection, homeowners should carefully assess their coverage needs and consider additional endorsements for specific risks, such as flood insurance.

| Home Insurance Coverage | Description |

|---|---|

| Dwelling Coverage | Protects the structure of your home. |

| Personal Property Coverage | Covers belongings inside your home. |

| Liability Coverage | Provides protection if someone is injured on your property. |

| Additional Living Expenses | Covers costs if your home is uninhabitable due to a covered loss. |

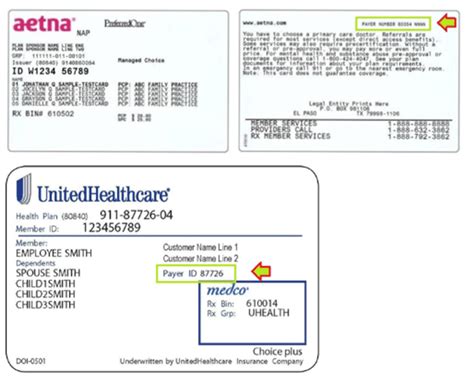

Health Insurance: A Priority for Every Resident

New Jersey has taken significant steps to ensure its residents have access to health insurance. The state’s health insurance market offers a range of plans, including those available through the Affordable Care Act (ACA) marketplace. These plans provide essential health coverage, ensuring residents have access to necessary medical services.

For those seeking coverage outside the ACA marketplace, New Jersey offers a robust private insurance market. Residents can choose from a variety of plans, including PPOs, HMOs, and EPOs, to find the coverage that best suits their needs. Additionally, the state provides programs like Medicaid and the Children's Health Insurance Program (CHIP) to ensure that low-income residents have access to essential healthcare.

New Jersey has also implemented initiatives to improve healthcare accessibility and affordability. For instance, the state has expanded its Medicaid program to cover more low-income residents, and it has implemented measures to control healthcare costs, ensuring that insurance remains accessible for all.

Life Insurance: Securing Your Legacy

Life insurance is a crucial aspect of financial planning in New Jersey, providing peace of mind for residents and their families. The state’s diverse population, with its varying needs and circumstances, makes life insurance an essential tool for estate planning and financial security.

New Jersey offers a wide range of life insurance options, including term life, whole life, and universal life policies. Term life insurance provides coverage for a specified period, often offering the most affordable option for younger individuals or those with temporary needs. Whole life and universal life policies, on the other hand, provide permanent coverage and often include a cash value component, making them suitable for long-term financial planning and wealth accumulation.

| Life Insurance Types | Description |

|---|---|

| Term Life Insurance | Provides coverage for a specific term, often renewable. |

| Whole Life Insurance | Provides permanent coverage with cash value accumulation. |

| Universal Life Insurance | Offers flexible premiums and coverage amounts, with a cash value component. |

Business Insurance: Supporting Economic Growth

New Jersey’s thriving economy relies on a robust business insurance sector. From small startups to large corporations, every business in the state needs adequate insurance coverage to protect against various risks. This includes liability insurance to safeguard against lawsuits, property insurance to protect physical assets, and workers’ compensation insurance to cover employee injuries.

For small businesses, finding affordable insurance coverage can be a challenge. However, New Jersey offers resources and programs to support these enterprises. The state's Small Business Development Centers provide guidance on insurance needs and can help connect businesses with affordable coverage options. Additionally, the New Jersey Business Action Center offers resources and support to ensure businesses have the insurance coverage they need to thrive.

| Business Insurance Coverage | Description |

|---|---|

| Liability Insurance | Protects against lawsuits and legal claims. |

| Property Insurance | Covers physical assets and buildings. |

| Workers' Compensation Insurance | Provides coverage for employee injuries. |

| Professional Liability Insurance | Covers errors and omissions for professionals. |

Conclusion: Insurance in New Jersey

Insurance in New Jersey is a multifaceted industry, catering to the diverse needs of its residents and businesses. From auto insurance and health coverage to life and business insurance, New Jerseyans have access to a wide range of policies to protect their assets, health, and livelihoods. Understanding the unique challenges and opportunities of the Garden State’s insurance landscape is crucial for making informed decisions and ensuring adequate protection.

As New Jersey continues to thrive and evolve, its insurance industry will adapt to meet the changing needs of its population. Whether it's navigating the complexities of auto insurance, securing affordable health coverage, or protecting businesses against risks, the state's residents and enterprises can rely on a robust insurance market to provide the protection they need.

FAQ

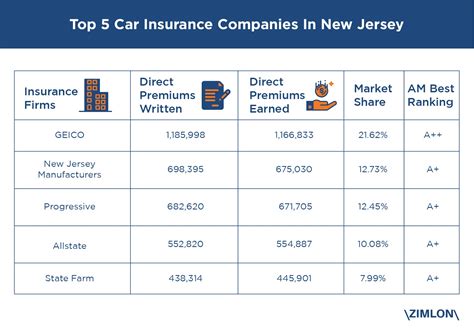

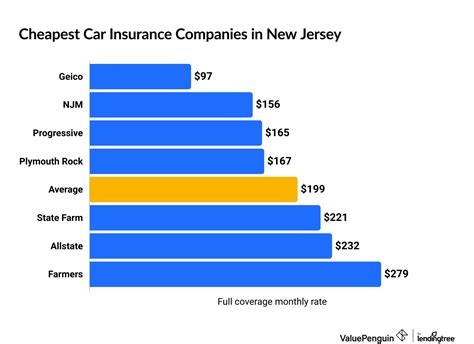

What is the average cost of auto insurance in New Jersey?

+The average cost of auto insurance in New Jersey varies based on factors such as the driver’s age, driving record, and location. However, the state’s average premium is generally higher compared to the national average due to factors like dense traffic and high accident rates. On average, drivers in New Jersey can expect to pay around 1,500 to 2,000 per year for auto insurance.

How can I find affordable health insurance in New Jersey?

+To find affordable health insurance in New Jersey, you can start by exploring the options available through the Affordable Care Act (ACA) marketplace. These plans offer subsidies for low- and middle-income individuals, making coverage more affordable. Additionally, you can compare private insurance plans and consider high-deductible health plans (HDHPs) paired with a Health Savings Account (HSA) for tax-advantaged savings.

What are the requirements for home insurance in New Jersey?

+New Jersey does not mandate home insurance, but it is highly recommended to protect your property and belongings. The specific requirements for home insurance coverage can vary based on factors like the location of your home and the lender’s requirements if you have a mortgage. Generally, you’ll need coverage for the replacement cost of your home and its contents, as well as liability protection.

Are there any discounts available for life insurance in New Jersey?

+Yes, there are several discounts available for life insurance in New Jersey. These can include discounts for non-smokers, bundling life insurance with other policies (such as auto or home insurance), and group rates through employers or professional organizations. Additionally, some insurers offer discounts for purchasing life insurance at a younger age or for maintaining a healthy lifestyle.