Insurance Medical

The world of insurance and medical care is a complex landscape that impacts millions of people worldwide. Understanding the intricacies of this system is crucial for individuals seeking to navigate their health and financial well-being. This article aims to delve into the fascinating realm of insurance medical, exploring its importance, the processes involved, and its evolving role in modern healthcare.

The Significance of Insurance Medical

In today’s healthcare ecosystem, insurance medical serves as a vital bridge between patients and healthcare providers. It ensures that individuals have access to the medical services they need without facing crippling financial burdens. By providing coverage for various medical expenses, insurance medical plays a critical role in promoting public health and ensuring equitable access to quality healthcare.

For many, insurance medical is not just a financial safety net but a gateway to preventative care, specialized treatments, and long-term management of chronic conditions. It empowers individuals to take charge of their health, make informed decisions, and seek timely medical attention without the fear of unaffordable costs.

The Insurance Medical Process: A Deep Dive

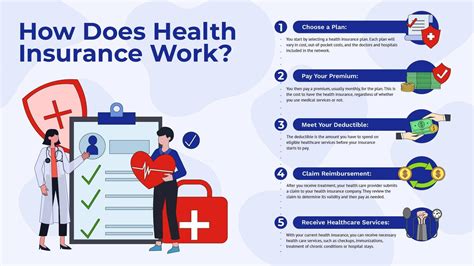

The journey of insurance medical begins with the selection of an appropriate health insurance plan. This process involves understanding one’s healthcare needs, evaluating different policy options, and making an informed decision. Key considerations include the coverage scope, premium costs, deductibles, and the network of healthcare providers associated with the plan.

Policy Enrollment and Activation

Once an individual selects a plan, the enrollment process starts. This involves filling out extensive forms, providing personal and medical information, and sometimes undergoing a medical examination. The insurance provider then evaluates the application, and upon approval, issues a policy with specific terms and conditions.

Activation of the policy is a critical step, often requiring the insured individual to complete certain actions, such as paying the first premium or providing additional documentation. It's important to note that delays in activation can impact coverage, so prompt action is advisable.

Utilizing Insurance Benefits

With an active policy, individuals can begin utilizing their insurance benefits. This typically involves selecting a primary care physician (PCP) within the insurance network, who acts as a gateway to other specialized services. The PCP is responsible for managing the individual’s healthcare needs, referring them to specialists when necessary, and ensuring a coordinated care approach.

When seeking medical services, individuals must remember to carry their insurance card and provide their insurance information to healthcare providers. This ensures that the services received are billed correctly and that the insurance company processes the claims efficiently.

The Claims Process

When a healthcare provider delivers a service, they submit a claim to the insurance company. This claim details the services rendered, the associated costs, and the patient’s insurance information. The insurance company then evaluates the claim, ensuring it complies with the policy terms and conditions. If approved, the insurance company reimburses the provider for the covered services.

Individuals should note that they may be responsible for paying a portion of the claim, known as the deductible, copayment, or coinsurance. These amounts are outlined in the policy and can vary based on the service received and the individual's plan.

Appealing Insurance Decisions

In some cases, insurance companies may deny claims or coverage for specific services. When this happens, individuals have the right to appeal these decisions. The appeals process involves providing additional information or documentation to support the claim and demonstrating why the service should be covered under the policy.

It's important to understand the appeals process outlined in the insurance policy and to act promptly if a claim is denied. Timely action can increase the chances of a successful appeal and ensure individuals receive the coverage they are entitled to.

The Future of Insurance Medical

The landscape of insurance medical is evolving rapidly, driven by advancements in technology, changing healthcare needs, and shifting industry dynamics. Here’s a glimpse into the future of this critical industry.

Digital Transformation

The insurance industry is embracing digital technology to streamline processes and enhance customer experiences. From online enrollment and policy management to digital claims submission and processing, technology is transforming the way insurance medical operates.

Digital platforms are also enabling more efficient and personalized interactions between insurers, healthcare providers, and policyholders. This shift towards digital is expected to continue, offering greater convenience, transparency, and efficiency in insurance medical processes.

Expanded Coverage and Access

As the healthcare landscape evolves, so do the needs of individuals. Insurance medical providers are increasingly recognizing the importance of expanding coverage to include a broader range of services, including preventative care, mental health services, and alternative therapies.

Additionally, efforts are underway to improve access to healthcare, particularly in underserved areas. This includes initiatives to encourage the adoption of telemedicine and remote healthcare services, making quality medical care more accessible to individuals regardless of their geographic location.

Data-Driven Insights

The vast amounts of data generated in the healthcare industry are being leveraged to gain valuable insights and inform decision-making. Insurance medical providers are utilizing data analytics to better understand healthcare trends, identify cost-saving opportunities, and improve the overall efficiency of the healthcare system.

By analyzing data, insurers can identify areas where interventions can lead to better health outcomes and more cost-effective care. This data-driven approach is expected to play an increasingly significant role in shaping the future of insurance medical.

Consumer-Centric Models

The focus on consumer-centric models is growing in the insurance medical industry. This shift involves designing policies and services that better cater to the unique needs and preferences of individuals. It includes offering a wider range of plan options, providing more transparent pricing, and improving communication and education about insurance benefits.

By putting the consumer at the center, insurance medical providers aim to enhance customer satisfaction, improve health outcomes, and foster a more trusting relationship between insurers and policyholders.

Collaborative Care Approaches

The future of insurance medical is likely to see increased collaboration between insurers, healthcare providers, and other stakeholders. This collaborative approach aims to improve the coordination of care, reduce redundant services, and ensure a more holistic approach to patient treatment.

Through coordinated efforts, insurers and healthcare providers can work together to identify and address gaps in care, manage chronic conditions more effectively, and promote overall wellness. This collaborative care model has the potential to enhance the quality of healthcare while also controlling costs.

Addressing Social Determinants of Health

The insurance medical industry is also recognizing the impact of social determinants of health—the economic and social conditions that influence individual and community health status. Insurers are beginning to explore ways to address these determinants, such as improving access to healthy foods, promoting physical activity, and addressing housing and transportation needs.

By recognizing and addressing these broader factors, insurance medical providers can play a more comprehensive role in supporting the overall health and well-being of their policyholders.

Conclusion: A Complex Yet Essential System

Insurance medical is a complex system, involving numerous stakeholders and intricate processes. Yet, it remains an essential component of modern healthcare, ensuring that individuals can access the medical services they need without facing financial ruin.

As we've explored, the insurance medical landscape is evolving, driven by technological advancements, changing healthcare needs, and a growing focus on consumer-centric models. These changes promise a future where insurance medical is more accessible, efficient, and tailored to the unique needs of individuals.

By understanding the significance and intricacies of insurance medical, individuals can make more informed decisions about their healthcare and financial well-being. This knowledge empowers them to navigate the system effectively, ensuring they receive the care they need while managing their financial responsibilities.

What are some common types of health insurance plans available?

+Common types of health insurance plans include Preferred Provider Organizations (PPOs), Health Maintenance Organizations (HMOs), Exclusive Provider Organizations (EPOs), and Point of Service (POS) plans. Each plan type has its own network of providers, coverage options, and cost structures.

How can I choose the right health insurance plan for my needs?

+Choosing the right health insurance plan involves assessing your healthcare needs, understanding the coverage options and costs of different plans, and considering factors such as network providers, prescription drug coverage, and out-of-pocket expenses. It’s also beneficial to read reviews and compare plans to make an informed decision.

What should I do if my insurance claim is denied?

+If your insurance claim is denied, it’s important to understand the reason for the denial and your rights under your insurance policy. You may need to provide additional information or documentation to support your claim. It’s also beneficial to seek guidance from insurance experts or legal professionals who can help you navigate the appeals process.