Insurance Policy

The insurance industry is an integral part of modern life, providing financial protection and security to individuals and businesses alike. An insurance policy is a legal contract between an insurance provider and a policyholder, outlining the terms and conditions of coverage. This document plays a crucial role in ensuring peace of mind and stability for policyholders, covering a wide range of potential risks and uncertainties. With a diverse array of policies available, from life insurance to property and casualty coverage, understanding the nuances of insurance policies is essential for making informed decisions and securing adequate protection.

Understanding Insurance Policies: A Comprehensive Guide

Insurance policies serve as the cornerstone of risk management, offering a safety net against unforeseen events. By transferring the financial burden of potential losses to insurance companies, policyholders gain access to a vital tool for safeguarding their assets, livelihoods, and even their very lives. In this comprehensive guide, we will delve into the intricate world of insurance policies, exploring their various types, key components, and the benefits they provide.

Types of Insurance Policies

The insurance landscape is diverse, offering a plethora of policy types to cater to the unique needs of individuals and businesses. Here’s an overview of some of the most common insurance policies:

- Life Insurance: Life insurance policies provide financial security to the policyholder's beneficiaries in the event of their death. These policies can offer a range of benefits, from immediate financial support to long-term estate planning.

- Health Insurance: Health insurance covers the cost of medical treatments, hospitalizations, and other healthcare-related expenses. With rising healthcare costs, health insurance has become an essential component of financial planning.

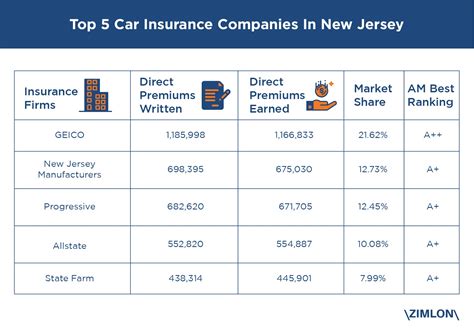

- Property Insurance: Property insurance, including home and auto insurance, protects policyholders against damages or losses to their properties due to various perils such as fire, theft, or natural disasters.

- Liability Insurance: Liability insurance safeguards individuals and businesses from financial losses arising from accidents, injuries, or property damage caused to others. It is particularly crucial for businesses to mitigate the risks associated with their operations.

- Business Insurance: Businesses face a multitude of risks, from property damage to liability claims. Business insurance policies offer tailored coverage to protect against these risks, ensuring the continuity and stability of operations.

- Travel Insurance: Travel insurance provides coverage for unexpected events during trips, such as trip cancellations, medical emergencies, or lost luggage. It offers peace of mind for travelers, ensuring they can focus on their adventures without financial worries.

Key Components of an Insurance Policy

Insurance policies are complex documents, containing various clauses and provisions that define the rights and responsibilities of both the insurer and the policyholder. Here are some key components to understand:

- Policy Period: The policy period refers to the duration for which the insurance coverage is effective. It typically runs for a specific number of years, after which the policyholder can renew the coverage.

- Coverage Limits: Coverage limits define the maximum amount the insurance company will pay out in the event of a claim. These limits are set based on the policyholder's needs and the type of coverage chosen.

- Premiums: Premiums are the regular payments made by the policyholder to the insurance company in exchange for coverage. The amount of the premium is influenced by factors such as the type of policy, the level of coverage, and the policyholder's risk profile.

- Deductibles and Co-payments: Deductibles and co-payments are out-of-pocket expenses that the policyholder must pay before the insurance coverage kicks in. Deductibles are typically applied to each claim, while co-payments are a fixed amount paid by the policyholder for certain services.

- Exclusions: Exclusions are specific events or circumstances that are not covered by the insurance policy. It is crucial to review the exclusions section of the policy to understand what risks are not protected against.

- Claims Process: The claims process outlines the steps the policyholder must take to file a claim and receive compensation. It is essential to understand this process to ensure a smooth and timely resolution of claims.

Benefits of Insurance Policies

Insurance policies offer a myriad of benefits that extend beyond financial protection. Here are some key advantages:

- Peace of Mind: One of the primary benefits of insurance policies is the peace of mind they provide. Policyholders can rest assured knowing they are financially protected against unforeseen events, allowing them to focus on their daily lives and pursuits.

- Risk Management: Insurance policies enable effective risk management by transferring the financial burden of potential losses to the insurance company. This allows individuals and businesses to plan and operate with a greater sense of stability and security.

- Financial Security: In the event of a covered loss, insurance policies provide financial support to policyholders. This support can be crucial in times of hardship, helping individuals and businesses recover and rebuild.

- Estate Planning: Life insurance policies, in particular, play a vital role in estate planning. They can provide a substantial sum to beneficiaries, ensuring financial security for loved ones and helping to fulfill the policyholder's legacy.

- Business Continuity: For businesses, insurance policies are essential for maintaining continuity and stability. By protecting against various risks, insurance ensures that businesses can withstand unforeseen events and continue their operations.

The Future of Insurance Policies

The insurance industry is evolving rapidly, driven by advancements in technology and changing consumer needs. Here’s a glimpse into the future of insurance policies:

- Digital Transformation: The insurance industry is embracing digital technologies, offering online platforms for policy management, claims processing, and even the purchase of insurance policies. This digital transformation enhances convenience and efficiency for both insurers and policyholders.

- Personalized Coverage: With the advent of data analytics and artificial intelligence, insurance companies are able to offer more personalized coverage options. By analyzing individual risk profiles, insurers can tailor policies to the unique needs of policyholders.

- Insurtech Innovations: Insurtech startups are disrupting the traditional insurance model, introducing innovative solutions such as usage-based insurance, peer-to-peer insurance, and parametric insurance. These new models offer greater flexibility and affordability for policyholders.

- Increased Use of Telematics: Telematics, the use of technology to track and monitor behavior, is gaining traction in the insurance industry. In particular, usage-based auto insurance policies utilize telematics to assess driving behavior, offering discounts to safe drivers.

- Enhanced Customer Experience: Insurance companies are prioritizing customer experience, implementing omnichannel strategies and leveraging customer relationship management (CRM) systems to provide personalized and efficient service.

Conclusion

Insurance policies are a vital component of modern life, offering financial protection and peace of mind to individuals and businesses. By understanding the various types of policies, their key components, and the benefits they provide, policyholders can make informed decisions to secure the coverage they need. As the insurance industry continues to evolve, embracing digital transformation and innovative solutions, the future of insurance policies looks promising, offering greater convenience, personalization, and affordability.

What is the difference between term life insurance and whole life insurance?

+Term life insurance provides coverage for a specific period, typically 10 to 30 years, while whole life insurance offers lifelong coverage. Term life insurance is generally more affordable but provides coverage only for the specified term. Whole life insurance, on the other hand, builds cash value over time and can be used as an investment vehicle.

How do I choose the right health insurance plan for my needs?

+When selecting a health insurance plan, consider factors such as your healthcare needs, the cost of premiums and deductibles, the network of providers, and any additional benefits or perks offered by the plan. It’s crucial to carefully review the policy’s coverage limits and exclusions to ensure it aligns with your requirements.

Can I customize my insurance policy to suit my specific needs?

+Yes, many insurance companies offer customizable policies that allow you to tailor coverage to your unique needs. You can choose the level of coverage, add optional riders, and select specific deductibles and coverage limits to create a policy that provides the right protection for your situation.