Insurance Ppo Definition

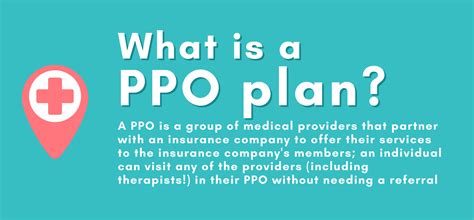

The insurance landscape is vast and complex, with various types of policies and plans designed to cater to different needs and preferences. Among these, Preferred Provider Organizations (PPOs) have become a popular choice for many individuals and families seeking comprehensive healthcare coverage. Understanding what a PPO is and how it works is essential to making informed decisions about your insurance coverage.

Understanding Preferred Provider Organizations (PPOs)

A Preferred Provider Organization, or PPO, is a type of health insurance plan that offers policyholders a wide range of healthcare options and flexibility. It is a network of healthcare providers, including doctors, specialists, hospitals, and other medical facilities, that have negotiated discounted rates with the insurance company. PPO plans aim to provide cost-effective and convenient healthcare services while still allowing policyholders to have a degree of choice in their healthcare decisions.

One of the key features of a PPO plan is the ability to visit any healthcare provider, whether in-network or out-of-network. Unlike some other insurance plans, PPOs do not require you to choose a primary care physician or obtain referrals to see specialists. This freedom of choice is particularly beneficial for individuals with specific healthcare needs or those who prefer to continue seeing their trusted providers.

The Advantages of PPO Plans

PPO insurance plans offer several advantages that make them appealing to a wide range of individuals and families:

- Flexibility in Provider Choice: As mentioned, PPOs allow you to visit any healthcare provider, whether they are part of the insurance network or not. This flexibility is especially beneficial for those who have established relationships with specific doctors or specialists.

- No Referrals Required: With a PPO plan, you can directly access specialists without the need for a referral from a primary care physician. This streamlines the healthcare process and provides quicker access to specialized care.

- Lower Out-of-Pocket Costs: While PPOs offer the freedom to choose out-of-network providers, it is generally more cost-effective to utilize in-network providers. In-network healthcare services often come with lower co-pays and deductibles, making healthcare more affordable.

- Nationwide Coverage: Many PPO plans provide coverage across the United States, ensuring that you have access to healthcare services regardless of where you are. This is particularly advantageous for individuals who travel frequently or live in areas with limited healthcare options.

- Comprehensive Benefits: PPO plans typically offer a wide range of benefits, including coverage for hospital stays, surgeries, prescription drugs, preventive care, and specialty services. Some plans may also include additional benefits such as dental and vision coverage.

The specific benefits and coverage details of a PPO plan can vary depending on the insurance provider and the chosen plan. It is important to carefully review the plan's summary of benefits to understand the exact coverage and any potential limitations or exclusions.

How PPO Plans Work

When you enroll in a PPO plan, you will receive an insurance card that lists your policy details, including your member ID and the insurance company’s contact information. This card serves as proof of insurance and is required when seeking healthcare services.

Here's a step-by-step guide on how PPO plans typically operate:

- Choosing a Provider: You have the freedom to select any healthcare provider, whether they are in-network or out-of-network. You can search for in-network providers through the insurance company's website or by contacting their customer service.

- Making an Appointment: Contact the chosen provider to schedule an appointment. At this stage, you may be asked to provide your insurance information, including your member ID, to verify coverage.

- Visiting the Provider: When you arrive for your appointment, present your insurance card to the provider's office staff. They will verify your coverage and may collect any necessary co-pays or deductibles.

- Receiving Healthcare Services: The provider will deliver the necessary healthcare services, such as consultations, diagnostic tests, treatments, or procedures. You may be responsible for paying any applicable co-pays or deductibles at the time of service.

- Claims and Reimbursement: After your visit, the provider's office will submit a claim to your insurance company. The claim includes details about the services provided and the associated costs. The insurance company will then process the claim and reimburse the provider based on the negotiated rates.

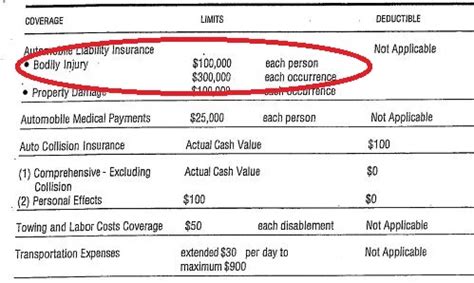

- Out-of-Pocket Costs: Depending on your plan's specific coverage and benefits, you may be responsible for paying a portion of the healthcare costs out of pocket. This can include co-pays, deductibles, and any services or treatments that are not covered by your insurance plan.

- Explanation of Benefits (EOB): Following the claim submission, you will receive an Explanation of Benefits (EOB) from your insurance company. The EOB provides details about the services rendered, the amounts paid by the insurance company, and any remaining balance that you may owe.

It is important to note that the exact process and out-of-pocket costs can vary depending on the insurance company and your specific plan. Some PPO plans may have different co-pay structures or require pre-authorization for certain procedures. Always refer to your plan's summary of benefits and contact your insurance provider for any clarification.

Comparing PPOs to Other Insurance Plans

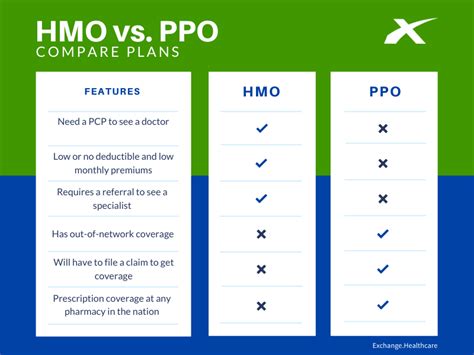

When considering insurance options, it is beneficial to understand how PPO plans compare to other common types of health insurance plans:

| Plan Type | Provider Choice | Referrals | Out-of-Pocket Costs |

|---|---|---|---|

| PPO | Flexibility to choose any provider, in-network or out-of-network | No referrals needed | Lower costs with in-network providers, but out-of-network options available |

| Health Maintenance Organization (HMO) | Limited to in-network providers | Usually required for specialists | Lower costs with in-network providers, but out-of-network coverage may be limited or expensive |

| Exclusive Provider Organization (EPO) | Limited to in-network providers | No referrals needed | Lower costs with in-network providers, but no coverage for out-of-network services |

| Point-of-Service (POS) Plan | Flexibility to choose in-network or out-of-network providers | Referrals usually required for out-of-network providers | Lower costs with in-network providers, but out-of-network options available with potential higher costs |

While PPO plans offer flexibility and nationwide coverage, it is essential to consider your specific healthcare needs and preferences when choosing an insurance plan. Other plan types may be more suitable for individuals who prefer a more structured healthcare network or have limited access to certain providers.

Conclusion: Making an Informed Decision

Understanding the definition and benefits of a PPO plan is the first step towards making an informed decision about your insurance coverage. PPO plans offer a balance between flexibility and cost-effectiveness, providing policyholders with the freedom to choose their healthcare providers while still benefiting from discounted rates through the insurance network.

When evaluating PPO plans, consider your personal healthcare needs, the availability of preferred providers, and the overall cost structure. Review the plan's summary of benefits, understand the potential out-of-pocket costs, and assess whether the plan aligns with your short-term and long-term healthcare goals.

Remember, insurance is a complex subject, and it is always beneficial to consult with insurance professionals or brokers who can provide personalized advice based on your unique circumstances. By doing so, you can ensure that you choose the insurance plan that best meets your needs and provides the coverage and peace of mind you deserve.

Can I switch from a PPO plan to another type of insurance plan if it better suits my needs?

+Yes, you have the option to switch insurance plans during the open enrollment period or if you experience a qualifying life event, such as marriage, divorce, birth of a child, or job change. It is important to review the specific rules and timelines for switching plans in your region.

Are there any age restrictions for enrolling in a PPO plan?

+No, PPO plans are typically available to individuals of all ages. However, the cost of the plan and the specific benefits may vary based on factors such as age, pre-existing conditions, and other demographic factors.

What happens if I need to see a specialist, but they are not in my PPO network?

+In such cases, you have the option to see the out-of-network specialist. However, the costs may be higher, and you may need to pay a larger portion out of pocket. It is advisable to check with your insurance provider and understand the specific costs and coverage for out-of-network services.