Insurance Price Check

Welcome to this comprehensive guide on the world of insurance price comparisons. In today's market, understanding the intricacies of insurance costs is crucial for making informed decisions. With a vast array of insurance providers offering different policies, it's essential to delve into the factors that influence premiums and explore strategies to find the best value. This article aims to equip you with the knowledge and tools to navigate the insurance landscape confidently.

Unraveling Insurance Premiums: A Deep Dive

The cost of insurance, often referred to as the premium, is a multifaceted concept influenced by numerous variables. Let’s explore the key factors that play a role in determining insurance prices.

Risk Assessment: The Foundation of Insurance Premiums

At its core, insurance is a tool to manage risk. Insurance companies meticulously assess the risks associated with insuring an individual or entity. This risk assessment is a critical determinant of the premium. For instance, when considering car insurance, factors like driving history, age, and the type of vehicle all contribute to the perceived risk, thus impacting the premium.

Similarly, in health insurance, age, pre-existing conditions, and lifestyle choices are crucial in risk evaluation. Younger individuals with no health complications may enjoy lower premiums compared to older adults with medical histories. This risk-based pricing ensures that insurance companies can accurately predict and manage the potential costs associated with providing coverage.

The Role of Coverage and Policy Features

The scope of coverage and the features included in an insurance policy are major contributors to its cost. Comprehensive plans that offer a wide range of benefits will naturally command higher premiums. For instance, a basic health insurance plan might cover essential medical services, while a more premium plan could include dental, vision, and prescription drug coverage, as well as additional benefits like mental health services.

The same principle applies to property insurance. A standard home insurance policy might cover the structure and personal belongings, while a more comprehensive plan could include coverage for natural disasters, liability protection, and even additional living expenses in case of a disaster.

Geographic Location and Its Impact

Your geographic location is another significant factor in insurance pricing. Insurance companies consider the unique risks associated with different regions. For example, areas prone to natural disasters like hurricanes or earthquakes may have higher insurance premiums for property insurance. Similarly, regions with a high crime rate might see increased car insurance costs due to the higher likelihood of accidents or theft.

Personal Factors: Age, Gender, and Lifestyle

Personal characteristics also play a role in insurance pricing. Age is a common factor, with younger individuals often paying higher premiums due to their perceived higher risk of engaging in risky behaviors or making claims. Gender can also be a consideration, particularly in certain types of insurance like auto insurance, where historical data may show different risk profiles for males and females.

Lifestyle choices can further influence premiums. For instance, smokers may pay higher life insurance premiums due to the increased health risks associated with smoking. Similarly, individuals who participate in high-risk hobbies or sports may see elevated premiums for health or life insurance.

Strategies for Finding the Best Insurance Deals

Now that we’ve explored the factors influencing insurance prices, let’s delve into strategies to find the best deals and ensure you’re getting the most value for your money.

Comparing Quotes: The Power of Shopping Around

One of the most effective ways to find competitive insurance rates is to compare quotes from multiple providers. Insurance companies set their own premiums, so shopping around can reveal significant differences in cost for similar coverage. Online insurance marketplaces or comparison websites can be invaluable tools for this process, allowing you to quickly and easily gather quotes from a variety of insurers.

Understanding Discounts and Savings Opportunities

Insurance companies often offer discounts and incentives to attract customers and reward loyalty. These can significantly reduce your premium. Common discounts include multi-policy discounts (bundling home and auto insurance, for example), loyalty discounts for long-term customers, and discounts for safe driving or a clean health record.

Some insurance companies also offer usage-based insurance programs, where your premium is adjusted based on your actual usage and behavior. This can be particularly beneficial for drivers, as safe driving habits can lead to lower premiums.

Bundling Policies for Cost Efficiency

Bundling multiple insurance policies with the same provider can often lead to significant savings. Insurance companies frequently offer multi-policy discounts, recognizing the convenience and loyalty of customers who choose to consolidate their insurance needs with one company. By bundling your home, auto, and potentially life insurance policies, you can often secure a discounted rate for each.

Utilizing Technology for Cost Management

In today’s digital age, technology offers powerful tools for managing insurance costs. Mobile apps and online platforms provided by insurance companies can give you real-time insights into your policy, track your usage or claims history, and even provide tips for reducing premiums. These tools can help you make informed decisions about your coverage and identify areas where you might be overinsured or able to save.

Seeking Professional Advice: The Role of Insurance Brokers

Insurance brokers are professionals who can be invaluable resources in your quest for the best insurance deals. They work with multiple insurance companies and can provide personalized advice based on your specific needs and circumstances. Brokers can help you understand the intricacies of different policies, identify potential savings, and ensure you’re getting the coverage that best suits your requirements.

Navigating the Fine Print: Understanding Policy Terms

While comparing prices and seeking the best deals is essential, it’s equally important to understand the terms and conditions of your insurance policy. The fine print can reveal critical details about your coverage, exclusions, and the process for making claims.

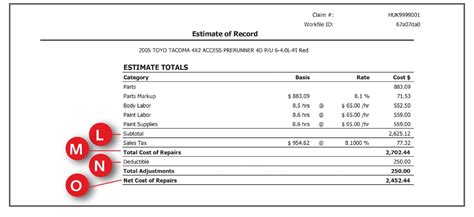

Coverage Limits and Deductibles

Coverage limits define the maximum amount your insurance company will pay for a covered loss. It’s crucial to understand these limits to ensure you have adequate coverage. For instance, in health insurance, the coverage limit might be the maximum amount the insurer will pay for a specific illness or injury, beyond which you’ll be responsible for the costs.

Deductibles are another key consideration. A deductible is the amount you pay out of pocket before your insurance coverage kicks in. Higher deductibles often result in lower premiums, so it's a trade-off between immediate savings and potential out-of-pocket expenses if you need to make a claim.

Exclusions and Limitations

Insurance policies typically have exclusions and limitations that define what is not covered. Understanding these is crucial to avoid surprises if you need to make a claim. For example, a home insurance policy might exclude damage caused by floods, requiring separate flood insurance for such scenarios.

Claims Process and Timeframes

Familiarize yourself with the claims process and the timeframes involved. This ensures you know what to expect and can take appropriate action if a claim needs to be made. Some insurance companies offer fast-track claims processes or 24⁄7 support, which can be beneficial in urgent situations.

The Future of Insurance Pricing: Trends and Innovations

The insurance industry is continually evolving, and several trends and innovations are shaping the future of insurance pricing.

The Rise of Telematics and Usage-Based Insurance

Telematics, the technology of measuring vehicle usage and driver behavior, is revolutionizing auto insurance. Usage-based insurance programs, also known as pay-as-you-drive or pay-how-you-drive, use telematics to track driving habits and offer premiums based on actual usage. This shift towards data-driven pricing is expected to continue, offering benefits to both insurers and policyholders.

Artificial Intelligence and Machine Learning

Artificial intelligence (AI) and machine learning are increasingly being used by insurance companies to analyze vast amounts of data and make more accurate predictions about risk. This technology can identify patterns and trends that traditional methods might miss, leading to more precise pricing and improved risk management.

Blockchain Technology and Smart Contracts

Blockchain technology, known for its use in cryptocurrencies, is also finding applications in insurance. Smart contracts, self-executing contracts with the terms directly written into code, can automate various insurance processes, including claims management and policy administration. This technology has the potential to reduce administrative costs and enhance efficiency, which could lead to more competitive pricing.

The Sharing Economy and On-Demand Insurance

The rise of the sharing economy, driven by platforms like Airbnb and Uber, has created new insurance needs. On-demand insurance, which provides coverage for specific activities or periods, is gaining traction. This allows individuals to insure themselves only when they need it, offering flexibility and potentially lower costs.

Conclusion: Empowering Informed Insurance Decisions

Understanding the factors that influence insurance prices and adopting strategies to find the best deals are essential steps towards making informed insurance choices. By comparing quotes, understanding discounts and savings opportunities, and utilizing technology and professional advice, you can navigate the insurance landscape confidently. Additionally, staying informed about emerging trends and innovations in the insurance industry can provide insights into potential future cost savings and improved coverage.

How often should I review my insurance policies for potential cost savings?

+It’s recommended to review your insurance policies annually or whenever your personal circumstances change significantly. This ensures that your coverage remains adequate and that you’re not overpaying for unnecessary features.

What are some common mistakes to avoid when comparing insurance quotes?

+Avoid focusing solely on price without considering the coverage and reputation of the insurance provider. Additionally, be cautious of policies with very low premiums, as they may have significant exclusions or limitations.

Can I negotiate insurance premiums with providers?

+While insurance premiums are generally non-negotiable, you can often find better rates by comparing multiple providers and leveraging discounts. However, it’s worth inquiring about potential discounts or promotions that could reduce your premium.

How can I ensure I’m getting the most out of my insurance coverage?

+Regularly review your coverage to ensure it aligns with your current needs and circumstances. Stay informed about changes in your industry or personal life that could impact your risk profile and adjust your coverage accordingly. Additionally, take advantage of any discounts or savings opportunities offered by your insurer.