Insurance Quotes Car Cheap

Finding affordable car insurance quotes can be a challenging task, but with the right approach and understanding of the factors that influence insurance rates, you can secure cheap car insurance that provides adequate coverage for your vehicle and driving needs. This comprehensive guide will delve into the intricacies of obtaining cheap car insurance quotes, offering practical advice and insights to help you make informed decisions.

Understanding the Factors that Affect Car Insurance Quotes

To navigate the world of car insurance quotes effectively, it’s essential to grasp the key factors that insurance companies consider when determining your premium. These factors play a significant role in shaping the cost of your insurance policy and can vary based on your location, driving history, and personal circumstances.

Your Driving Record

Your driving history is one of the most influential factors in determining your insurance quote. Insurance companies scrutinize your record for any instances of accidents, traffic violations, or claims made in the past. A clean driving record with no major incidents or claims typically leads to lower insurance rates. Conversely, if you have a history of accidents or traffic violations, you may face higher premiums.

For instance, a driver with a clean record for the past 5 years might receive a premium quote of $800 annually, while a driver with a recent at-fault accident could expect a quote of $1,200, illustrating the impact of driving history on insurance costs.

Vehicle Make and Model

The make and model of your vehicle also play a crucial role in determining your insurance quote. Insurance companies consider factors such as the car’s safety features, repair costs, and its popularity for theft or vandalism. Vehicles with advanced safety technologies and lower repair costs often attract more affordable insurance rates.

| Vehicle | Average Insurance Cost |

|---|---|

| Toyota Corolla | $750 |

| Honda Civic | $820 |

| Ford Mustang | $980 |

Location and Geographical Factors

Your location is a significant determinant of your insurance quote. Insurance rates can vary greatly depending on where you live. Urban areas often have higher insurance costs due to factors like increased traffic, higher accident rates, and a greater risk of theft or vandalism. In contrast, rural areas may offer more affordable insurance rates.

A driver residing in an urban center like New York City might pay an average of $1,500 annually for insurance, while a driver in a rural town could expect a quote closer to $1,000, showcasing the impact of location on insurance costs.

Age and Gender

Your age and gender are also considered by insurance companies when calculating your quote. Generally, younger drivers, especially those under 25, tend to pay higher premiums due to their lack of driving experience and higher risk profile. Similarly, insurance rates can vary based on gender, with some insurers charging different rates for male and female drivers.

Tips to Get Cheap Car Insurance Quotes

Now that we’ve explored the factors influencing car insurance quotes, let’s dive into some practical strategies to help you secure cheap car insurance quotes:

Shop Around and Compare Quotes

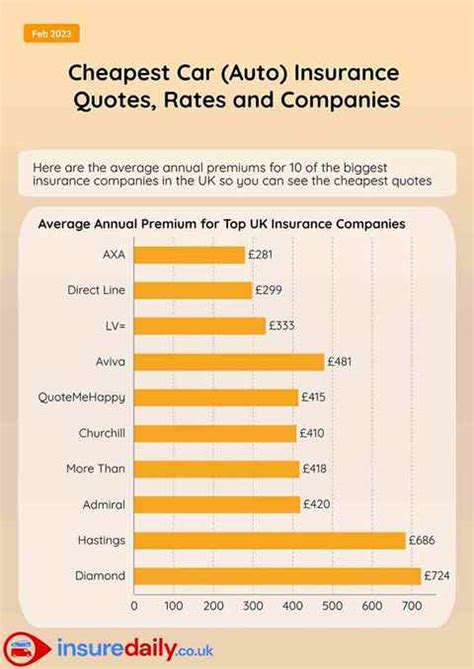

One of the most effective ways to find cheap car insurance is to compare quotes from multiple insurance providers. Each insurer has its own unique formula for calculating premiums, so rates can vary significantly between companies. Use online tools and insurance comparison websites to easily gather multiple quotes and find the best deal.

Bundle Your Policies

If you have multiple insurance needs, such as home, life, or health insurance, consider bundling your policies with the same insurer. Many insurance companies offer discounts when you combine multiple policies, which can lead to significant savings on your car insurance premium.

Choose Higher Deductibles

Opting for a higher deductible can reduce your insurance premium. A deductible is the amount you pay out of pocket before your insurance coverage kicks in. By choosing a higher deductible, you take on more financial responsibility in the event of a claim, which can lead to lower insurance rates.

Maintain a Good Credit Score

Your credit score is often used by insurance companies to assess your financial responsibility. Maintaining a good credit score can lead to lower insurance rates, as it indicates a lower risk profile. If your credit score is less than ideal, consider taking steps to improve it, which can have positive impacts on your insurance costs.

Take Advantage of Discounts

Insurance companies offer a variety of discounts that can significantly reduce your insurance premium. Common discounts include safe driver discounts, good student discounts, loyalty discounts, and discounts for certain professions or affiliations. Always inquire about available discounts and ensure you meet the criteria to qualify.

Understanding Car Insurance Coverage Options

When seeking cheap car insurance quotes, it’s crucial to understand the different coverage options available and how they impact your premium. Different coverage types offer varying levels of protection, and selecting the right coverage ensures you’re adequately protected without paying for unnecessary coverage.

Liability Coverage

Liability coverage is the most basic and required type of car insurance. It covers the costs associated with damages you cause to others’ property or injuries you cause to others in an accident for which you are at fault. Liability coverage is divided into two main categories: bodily injury liability and property damage liability.

Collision and Comprehensive Coverage

Collision coverage pays for the repair or replacement of your vehicle if it’s damaged in an accident, regardless of fault. Comprehensive coverage, on the other hand, covers damages to your vehicle caused by events other than collisions, such as theft, vandalism, natural disasters, or damage caused by animals.

Personal Injury Protection (PIP) and Medical Payments (MedPay)

Personal Injury Protection (PIP) and Medical Payments (MedPay) cover the medical expenses of you and your passengers after an accident, regardless of fault. These coverages ensure that you and your passengers receive necessary medical care without worrying about immediate payment.

Uninsured and Underinsured Motorist Coverage

Uninsured motorist coverage protects you if you’re involved in an accident with a driver who has no insurance. Underinsured motorist coverage provides protection if the at-fault driver’s insurance coverage is insufficient to cover the damages. These coverages are crucial for ensuring you’re not left financially burdened in the event of an accident with an uninsured or underinsured driver.

Future Trends in Car Insurance Quotes

The world of car insurance is constantly evolving, and understanding the future trends can help you make informed decisions when seeking cheap car insurance quotes. Here are some key trends to keep an eye on:

Usage-Based Insurance (UBI)

Usage-Based Insurance (UBI) is a growing trend where insurance companies offer policies based on your actual driving behavior and habits. With UBI, your premium is calculated based on factors like how far and how often you drive, your driving speed, and even your braking habits. This personalized approach to insurance can lead to significant savings for safe and cautious drivers.

Telematics and Connected Car Technology

The integration of telematics and connected car technology is revolutionizing the insurance industry. Telematics devices installed in your vehicle can provide real-time data on your driving behavior, which insurance companies can use to offer more accurate and personalized insurance rates. This technology also enables insurers to offer discounts for safe driving habits and provide real-time assistance in the event of an accident.

Data Analytics and Machine Learning

Insurance companies are increasingly leveraging data analytics and machine learning to improve their underwriting processes and risk assessment. By analyzing vast amounts of data, insurers can identify patterns and trends that help them offer more precise and competitive insurance quotes. This technology also enables insurers to quickly adapt to changing market conditions and offer more tailored insurance products.

Blockchain Technology

The use of blockchain technology is gaining traction in the insurance industry. Blockchain offers a secure and transparent way to store and share data, which can streamline the insurance claims process and reduce fraud. Additionally, blockchain-based smart contracts can automate certain insurance processes, such as claim settlements, leading to faster and more efficient services for policyholders.

How often should I compare car insurance quotes?

+

It’s recommended to compare car insurance quotes at least once a year, especially if your circumstances or driving habits have changed. Regularly shopping around can help you identify the best deals and ensure you’re not overpaying for your insurance.

Can I get car insurance without a license?

+

In most cases, you need a valid driver’s license to obtain car insurance. However, there may be certain situations where you can get insurance without a license, such as if you’re a teenager who’s still learning to drive or if you’re purchasing insurance for a vehicle that’s not driven regularly.

What is the difference between liability and full coverage insurance?

+

Liability insurance covers damages you cause to others, while full coverage insurance (also known as comprehensive coverage) provides broader protection, covering damages to your own vehicle as well as damages to others. Full coverage insurance typically includes collision coverage, comprehensive coverage, and liability coverage.

How do insurance companies determine my insurance premium?

+

Insurance companies use a variety of factors to determine your insurance premium, including your driving history, the make and model of your vehicle, your location, your age and gender, and your credit score. Each insurer has its own formula for calculating premiums, so rates can vary significantly between companies.

Can I get car insurance if I have a poor credit score?

+

Yes, you can still obtain car insurance even with a poor credit score. However, you may face higher insurance premiums, as credit score is often used by insurance companies to assess your financial responsibility. Improving your credit score can lead to lower insurance rates in the future.