Insurance Quotes In Florida

When it comes to insurance, Florida residents have unique considerations due to the state's geographical location and its susceptibility to natural disasters. Obtaining insurance quotes in Florida can be a complex process, but understanding the factors that influence these quotes is essential for making informed decisions about coverage.

In this comprehensive guide, we delve into the world of insurance quotes in Florida, exploring the various factors that impact premiums, the coverage options available, and strategies to secure the best rates. By the end of this article, you'll have a deeper understanding of the insurance landscape in the Sunshine State and be equipped with the knowledge to navigate it effectively.

Factors Influencing Insurance Quotes in Florida

Numerous variables come into play when insurance providers calculate quotes for Floridians. These factors can significantly impact the cost of insurance, and understanding them is crucial for tailoring your coverage and managing expenses.

Location and Weather Risks

Florida’s diverse regions, from coastal areas to inland cities, face different natural disaster risks. Insurers carefully assess these risks when determining quotes. For instance, residents of hurricane-prone coastal areas often pay higher premiums due to the increased likelihood of storm-related claims.

According to a recent study by the Florida Office of Insurance Regulation, homeowners in high-risk hurricane zones can expect to pay premiums that are 20% to 50% higher than those in low-risk areas. This disparity underscores the importance of location in insurance quote calculations.

| Location Type | Average Premium Increase |

|---|---|

| Coastal Regions | 25% - 40% |

| Inland Cities | 10% - 20% |

| Flood-Prone Areas | Up to 35% |

Furthermore, the state's vulnerability to hurricanes, floods, and other weather events makes comprehensive coverage essential. As such, residents should carefully evaluate their insurance needs and consider adding endorsements or additional coverage to protect against specific risks.

Claim History and Credit Score

Your insurance claim history and credit score are two critical factors that insurance providers scrutinize when determining quotes. A history of frequent claims, even for minor incidents, can signal higher risk to insurers and result in increased premiums.

Similarly, a poor credit score can lead to higher rates. Insurers often use credit-based insurance scores, which are derived from credit history, to assess an individual's risk level. A low score may indicate a higher likelihood of filing claims, which can impact the quote you receive.

For example, a Consumer Federation of America study revealed that individuals with poor credit scores often pay 70% more for auto insurance than those with excellent credit. This stark difference emphasizes the impact of credit scores on insurance costs.

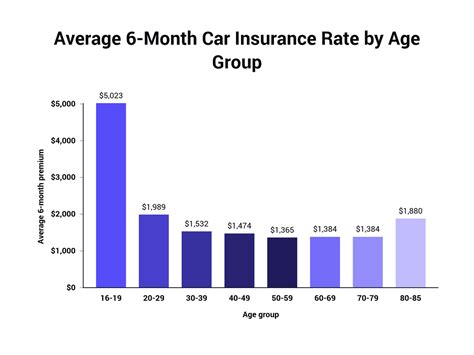

Age, Gender, and Marital Status

Personal demographics, including age, gender, and marital status, also play a role in insurance quotes. Statistically, younger drivers and individuals under 25 often pay higher premiums due to their perceived higher risk of accidents. Gender-based pricing is less common now, but certain insurers may still consider gender when assessing risk.

Marital status can also influence quotes. Studies have shown that married individuals often benefit from lower insurance rates, as they are statistically less likely to be involved in accidents. This trend highlights the complex interplay of personal demographics in insurance quote calculations.

Types of Insurance and Coverage Options in Florida

Florida residents have a range of insurance options available to protect themselves and their assets. Understanding the different types of insurance and the coverage they offer is essential for making informed decisions about your policy.

Homeowners Insurance

Homeowners insurance is a critical consideration for Floridians, given the state’s susceptibility to hurricanes and other natural disasters. This type of insurance provides coverage for damage to your home and its contents, as well as liability protection if someone is injured on your property.

When shopping for homeowners insurance in Florida, it's important to consider the specific risks you face. For instance, if you live in a hurricane-prone area, you may need to add windstorm coverage or purchase a separate policy from the Florida Hurricane Catastrophe Fund to ensure comprehensive protection.

Additionally, Floridians should be aware of the state's unique sinkhole coverage requirements. Due to the state's geology, sinkholes are a real concern, and insurance providers are required to offer this coverage as an add-on to standard homeowners policies. It's essential to understand your options and the specific protections you need.

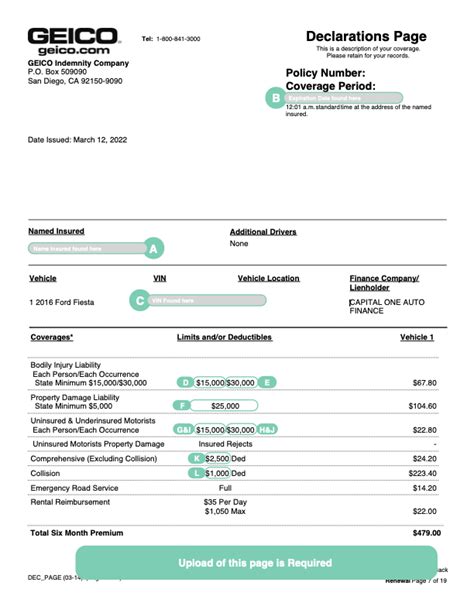

Auto Insurance

Auto insurance is mandatory in Florida, and the state requires all drivers to carry a minimum level of coverage. However, this minimum coverage may not be sufficient to protect you financially in the event of an accident. It’s crucial to carefully review your policy and consider additional coverage options to ensure you’re adequately protected.

For instance, Florida's unique no-fault insurance system requires drivers to carry personal injury protection (PIP) coverage. This coverage pays for medical expenses and lost wages following an accident, regardless of fault. However, the state's recent reforms have limited the benefits available through PIP, so it's essential to understand your coverage and consider additional options.

Beyond the minimum requirements, Floridians should consider adding comprehensive and collision coverage to their auto insurance policies. These coverages protect against damage from non-accident events, such as theft, vandalism, or natural disasters, ensuring that your vehicle is fully protected.

Health Insurance

Health insurance is a vital consideration for all individuals, and Florida residents have access to a range of options through the federal Affordable Care Act (ACA) marketplace. The state also offers Medicaid and other health insurance programs to eligible residents.

When selecting a health insurance plan, it's important to consider your healthcare needs and preferences. Factors such as your usual healthcare providers, prescription medications, and anticipated medical procedures can all influence the plan that's right for you. Additionally, Florida residents should be aware of the state's unique healthcare landscape, including the availability of telemedicine and the impact of the COVID-19 pandemic on healthcare services.

Strategies for Securing the Best Insurance Quotes in Florida

Navigating the insurance landscape in Florida can be challenging, but there are strategies you can employ to secure the best quotes and coverage for your needs.

Shop Around and Compare Quotes

One of the most effective ways to find the best insurance quotes is to shop around and compare rates from multiple providers. Florida’s insurance market is highly competitive, and insurers offer a range of coverage options and pricing structures. By comparing quotes, you can identify the policies that offer the best value for your specific needs.

When comparing quotes, pay close attention to the coverage limits, deductibles, and any additional endorsements or riders. These factors can significantly impact the value of your policy and your out-of-pocket expenses in the event of a claim. It's essential to understand the fine print and choose a policy that aligns with your financial and coverage goals.

Bundle Your Policies

Many insurance providers offer discounts when you bundle multiple policies, such as combining your auto and homeowners insurance. Bundling can result in significant savings, as insurers often reward loyalty and the convenience of managing multiple policies under one account.

For example, a study by the Insurance Information Institute found that bundling homeowners and auto insurance policies can save you up to 25% on your premiums. This strategy can be particularly beneficial for Floridians, who often require multiple types of insurance coverage to protect their assets and meet state requirements.

Consider High Deductibles and Additional Coverage

Choosing a policy with a higher deductible can reduce your monthly premiums, as you’re assuming more financial responsibility in the event of a claim. However, it’s essential to carefully consider your financial situation and ensure you can afford the deductible if needed.

Additionally, reviewing your coverage limits and considering additional endorsements or riders can ensure you have the protection you need. For instance, if you live in a high-risk area for hurricanes, adding windstorm coverage or purchasing flood insurance can provide peace of mind and comprehensive protection.

Maintain a Good Credit Score and Driving Record

As mentioned earlier, your credit score and driving record play a significant role in insurance quote calculations. Maintaining a good credit score and a clean driving record can help you secure lower premiums and better coverage options.

If you have a less-than-perfect credit score or a history of claims, it's essential to take steps to improve your situation. This may involve paying down debt, negotiating with creditors, or taking advantage of credit repair services. Similarly, practicing safe driving habits and avoiding accidents can help keep your insurance premiums in check.

Conclusion

Obtaining insurance quotes in Florida requires a thorough understanding of the unique risks and considerations in the state. From the impact of location and weather risks to the importance of credit scores and driving records, there are numerous factors that influence the cost of insurance.

By familiarizing yourself with the different types of insurance available, shopping around for the best quotes, and employing strategic approaches like bundling policies and maintaining a good credit score, you can secure the coverage you need at a price that fits your budget. Remember, insurance is a critical component of financial planning, and the right coverage can provide peace of mind and protection for you and your loved ones.

What is the average cost of homeowners insurance in Florida?

+The average cost of homeowners insurance in Florida varies based on location, coverage limits, and other factors. According to the Insurance Information Institute, the average annual premium in Florida is around 2,000, but this can range from 1,500 to $3,000 or more depending on your specific circumstances.

Are there any discounts available for auto insurance in Florida?

+Yes, several discounts are available for auto insurance in Florida. These may include discounts for safe driving, bundling with homeowners insurance, paying your premium in full, maintaining a good credit score, and more. It’s worth shopping around and discussing your options with insurers to maximize your savings.

How can I find affordable health insurance in Florida?

+Florida residents can access affordable health insurance through the federal Affordable Care Act (ACA) marketplace. You can also explore Medicaid and other state-specific programs for low-income individuals and families. Additionally, comparing quotes from different insurers and considering different plan options can help you find the most cost-effective coverage that meets your needs.