Insurance Small Business Owners

Running a small business is a challenging yet rewarding endeavor, and one of the crucial aspects that often gets overlooked is insurance. Insurance for small businesses is not just a legal requirement but a strategic tool to protect your business, manage risks, and ensure long-term sustainability. This comprehensive guide will delve into the world of insurance for small business owners, offering insights, tips, and a deep understanding of this essential aspect of entrepreneurship.

Understanding the Importance of Insurance

Insurance is a vital component of any business, regardless of its size. It provides a safety net against unforeseen events and potential liabilities, which can range from natural disasters to legal disputes. For small business owners, insurance offers a way to mitigate risks and protect the business from financial ruin. It’s an investment in the future, ensuring that the business can withstand unexpected challenges and continue to thrive.

Risk Management and Mitigation

Every business faces risks, and small businesses are no exception. These risks can come from various sources, such as property damage, lawsuits, employee injuries, or even cyber attacks. Insurance policies are designed to address these risks, offering financial protection and peace of mind. By understanding the potential risks and ensuring adequate coverage, small business owners can focus on their core operations without constant worry.

For instance, a general liability insurance policy can safeguard a business against claims of bodily injury or property damage that may occur on the business premises. This could include a customer slipping and falling or a delivery truck causing an accident. Without such insurance, the business owner might be personally liable for these incidents, leading to significant financial strain.

Legal and Regulatory Compliance

Insurance is often a legal requirement for businesses. Depending on the industry and location, small businesses may need specific types of insurance to comply with local, state, or federal laws. Failure to have the right insurance coverage can lead to legal penalties and even the shutdown of the business.

Consider the case of workers' compensation insurance, which is mandatory in most states for businesses with employees. This insurance provides coverage for employees who suffer work-related injuries or illnesses. Without it, the business could face severe legal consequences and be held responsible for the employee's medical bills and potential loss of income.

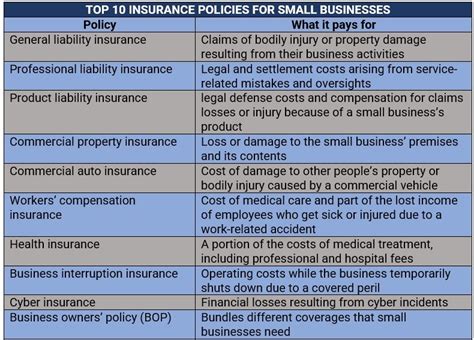

Types of Insurance for Small Businesses

The insurance landscape for small businesses is vast and varied. Different types of insurance cater to specific needs and risks. Here’s a closer look at some of the most common and essential insurance policies for small businesses.

General Liability Insurance

As mentioned earlier, general liability insurance is a cornerstone of small business insurance. It protects the business against a wide range of claims, including bodily injury, property damage, personal and advertising injury, and medical payments. This type of insurance is particularly crucial for businesses that interact with the public or have a physical presence, such as retail stores or restaurants.

| Coverage Type | Description |

|---|---|

| Bodily Injury | Covers claims of physical injury to customers or visitors on your premises. |

| Property Damage | Protects against claims of damage to others' property caused by your business. |

| Personal and Advertising Injury | Covers claims of libel, slander, or copyright infringement related to your business's advertising. |

| Medical Payments | Provides coverage for medical expenses of injured parties, regardless of fault. |

Professional Liability Insurance (Errors and Omissions)

Professional liability insurance, also known as errors and omissions (E&O) insurance, is designed for businesses that provide professional services. It protects the business against claims of negligence, errors, or omissions that result in financial loss for the client. This type of insurance is crucial for industries like consulting, accounting, legal services, and web development, where the work is largely knowledge-based and the risk of client dissatisfaction is high.

Workers’ Compensation Insurance

Workers’ compensation insurance is a legal requirement in most states for businesses with employees. It provides coverage for employees who suffer work-related injuries or illnesses, covering their medical expenses and a portion of their lost wages. This insurance not only protects the business from potential lawsuits but also ensures that injured employees receive the care and support they need.

Commercial Property Insurance

Commercial property insurance protects the physical assets of a business, including buildings, inventory, equipment, and furnishings. It provides coverage against a variety of risks, such as fire, theft, vandalism, and natural disasters. For small businesses with a physical presence, this insurance is crucial to ensure that the business can recover and continue operations in the event of a disaster.

Business Interruption Insurance

Business interruption insurance is designed to cover the loss of income and additional expenses a business may incur if it needs to suspend operations due to a covered peril, such as a fire or a natural disaster. This insurance can provide a lifeline for small businesses, helping them stay afloat financially while they work to get their operations back up and running.

Cyber Liability Insurance

With the increasing reliance on technology and the growing threat of cyber attacks, cyber liability insurance has become a critical component of small business insurance. This policy provides coverage for losses resulting from cyber incidents, such as data breaches, hacking, or ransomware attacks. It can help small businesses manage the financial impact of these incidents, including the cost of investigating and resolving the breach, as well as potential legal liabilities.

How to Choose the Right Insurance

Choosing the right insurance for your small business involves a careful assessment of your unique risks and needs. Here are some steps to guide you through the process.

Conduct a Risk Assessment

Start by conducting a thorough risk assessment of your business. Identify the potential hazards and liabilities that your business may face. Consider factors such as the nature of your business, the industry you operate in, your location, the size of your business, and the number of employees you have. This assessment will help you understand the types of insurance you need and the level of coverage required.

Understand Your Industry’s Specific Risks

Different industries have unique risks. For example, a construction business faces different hazards than a software development company. Understand the specific risks associated with your industry and ensure that your insurance coverage addresses these risks adequately. Industry-specific insurance policies are often available to provide comprehensive coverage tailored to your business’s needs.

Work with an Insurance Professional

Consider seeking advice from an insurance broker or agent who specializes in small business insurance. They can provide valuable insights and guidance based on their experience working with businesses similar to yours. An insurance professional can help you navigate the complex world of insurance, ensuring that you get the right coverage at a competitive price.

Compare Quotes and Policies

Shop around and compare quotes and policies from different insurance providers. While cost is an important factor, it’s not the only consideration. Look at the coverage limits, deductibles, exclusions, and any additional benefits or services provided by the insurer. Ensure that the policy language is clear and that you understand exactly what is and isn’t covered.

Consider Bundling Policies

Bundling multiple insurance policies with the same insurer can often result in cost savings. Many insurance companies offer discounts when you purchase multiple policies from them. This can be an effective way to reduce your insurance costs while still ensuring comprehensive coverage.

The Role of Insurance in Business Growth and Success

Insurance is not just about risk mitigation and compliance. It plays a crucial role in the growth and success of small businesses. Here’s how insurance can contribute to the long-term prosperity of your business.

Attracting Investors and Partners

Having adequate insurance coverage can be a key factor in attracting investors and partners. Investors want to see that your business is well-protected and has taken steps to manage its risks. A robust insurance portfolio can signal to potential investors and partners that your business is responsible, well-prepared, and committed to long-term success.

Building Customer Trust

Customers value businesses that take their responsibilities seriously, including risk management. By demonstrating that you have appropriate insurance coverage, you can build trust with your customers. This trust can lead to increased customer loyalty, positive word-of-mouth, and a stronger brand reputation.

Managing Business Continuity

Insurance is a critical component of business continuity planning. It ensures that your business can recover from unexpected events and continue operations. By having the right insurance coverage, you can minimize downtime, maintain financial stability, and keep your business running smoothly even in the face of adversity.

The Future of Insurance for Small Businesses

The insurance landscape for small businesses is evolving rapidly, driven by technological advancements, changing consumer expectations, and emerging risks. Here’s a glimpse into the future of insurance for small business owners.

Digitalization and Automation

The insurance industry is embracing digitalization and automation to enhance efficiency and improve the customer experience. Online platforms and mobile apps are making it easier for small business owners to compare policies, purchase insurance, and manage their coverage. Automated processes can also reduce the time and effort required to handle claims, making the insurance process more streamlined and efficient.

Parametric Insurance

Parametric insurance is an innovative approach to risk management that uses predefined parameters, such as weather data or satellite imagery, to trigger payouts. This type of insurance can provide faster and more efficient coverage for small businesses, particularly in the face of natural disasters or other catastrophic events. By removing the need for extensive claims processing, parametric insurance can ensure that small businesses receive the financial support they need quickly and efficiently.

Data-Driven Risk Assessment

With the increasing availability of data and advanced analytics, insurance companies are better equipped to assess risks accurately. By leveraging data-driven insights, insurers can offer more tailored and cost-effective policies to small businesses. This shift towards data-driven risk assessment can lead to more precise pricing, improved risk management, and enhanced coverage options for small business owners.

Collaborative Risk Management

The future of insurance for small businesses may involve more collaborative approaches to risk management. This could include insurance providers working closely with small businesses to identify and mitigate risks, as well as providing resources and support to enhance overall risk management practices. By fostering a culture of collaboration, insurers can help small businesses not only recover from losses but also prevent them in the first place.

How much does small business insurance typically cost?

+

The cost of small business insurance can vary widely depending on several factors, including the type of business, its location, the level of coverage required, and the insurer. On average, small businesses can expect to pay between 500 and 1,000 per year for general liability insurance. However, the cost can be significantly higher or lower based on the specific needs and risks of the business.

Are there any tax benefits associated with small business insurance?

+

Yes, small business insurance premiums are generally tax-deductible. This means that the cost of insurance can be claimed as a business expense, reducing the business’s taxable income. Consulting with a tax professional can help small business owners understand the specific tax benefits and deductions available to them.

What happens if I don’t have the required insurance for my small business?

+

Failing to have the required insurance for your small business can lead to severe consequences. Depending on the specific insurance and jurisdiction, you may face legal penalties, fines, or even the shutdown of your business. Additionally, without the necessary insurance coverage, you may be personally liable for any losses or damages that occur, putting your personal assets at risk.