Insure Georgia

Welcome to a comprehensive exploration of Insure Georgia, a revolutionary initiative aimed at transforming the insurance landscape in the state of Georgia. This program, designed to enhance accessibility and affordability, has sparked significant interest and curiosity among residents and stakeholders alike. As we delve into the intricacies of Insure Georgia, we will uncover its key features, benefits, and the profound impact it is poised to have on the lives of Georgians.

The Vision of Insure Georgia

Insure Georgia is an ambitious endeavor born out of a collaborative effort between the Georgia Department of Insurance and a coalition of industry experts, advocacy groups, and community leaders. Its primary objective is to address the longstanding issue of insurance accessibility, particularly for underserved communities and individuals facing unique challenges in obtaining coverage.

The vision for Insure Georgia is multifaceted. Firstly, it aims to simplify the insurance process, making it more user-friendly and transparent. By leveraging innovative technologies and streamlined procedures, the program seeks to reduce the complexity often associated with insurance, ensuring that individuals can navigate the system with ease.

Secondly, Insure Georgia strives to expand coverage options and make insurance more affordable. Through partnerships with insurance providers and the implementation of targeted subsidies and incentives, the initiative aims to lower barriers to entry, especially for low-income households, young adults, and those with pre-existing conditions.

Additionally, Insure Georgia recognizes the importance of personalized support. The program plans to establish dedicated assistance centers and employ trained professionals who can provide guidance and education to individuals throughout the insurance journey. This human-centric approach aims to empower Georgians to make informed decisions and take control of their insurance needs.

Key Features and Benefits

Insure Georgia offers a range of features and benefits that set it apart from traditional insurance models. Here’s a closer look at some of its standout aspects:

Digital Platform for Seamless Transactions

At the heart of Insure Georgia is a user-friendly digital platform that serves as a one-stop shop for all insurance-related needs. This platform, accessible via web and mobile apps, allows individuals to compare policies, obtain quotes, and purchase coverage with just a few clicks. The intuitive interface ensures a smooth and efficient experience, saving time and effort for users.

Furthermore, the digital platform incorporates advanced security measures to protect user data and ensure privacy. With end-to-end encryption and robust authentication protocols, Insure Georgia prioritizes the security and confidentiality of its users' information.

Tailored Coverage Plans

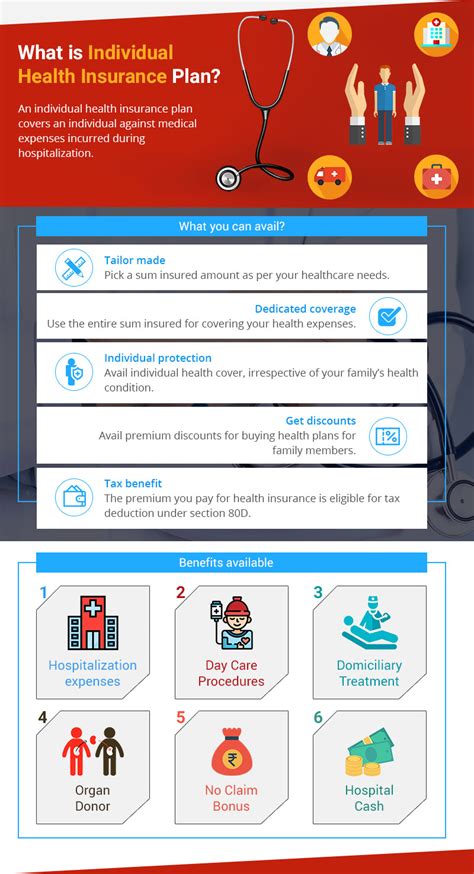

Recognizing that insurance needs vary widely, Insure Georgia offers customizable coverage plans to cater to the diverse requirements of Georgians. Whether it’s health insurance, auto insurance, homeowners’ insurance, or business coverage, the program provides a range of options to suit different lifestyles and budgets.

For instance, health insurance plans under Insure Georgia may include flexible deductibles, comprehensive wellness programs, and specialized coverage for specific health conditions. Auto insurance plans could offer discounts for safe driving records and eco-friendly vehicles, while homeowners' insurance might provide additional coverage for natural disasters prevalent in the region.

Community Engagement and Education

Insure Georgia places a strong emphasis on community involvement and educational initiatives. The program organizes regular workshops, webinars, and community events to raise awareness about insurance, demystify complex concepts, and provide practical guidance. These initiatives aim to empower individuals with the knowledge to make informed choices and navigate the insurance landscape with confidence.

Additionally, Insure Georgia collaborates with local organizations and community leaders to reach underserved populations and ensure that insurance education is accessible to all. By fostering a culture of financial literacy and responsibility, the program contributes to the overall well-being and resilience of Georgian communities.

Incentives and Subsidies

To make insurance more affordable, Insure Georgia introduces a range of incentives and subsidies targeted at specific demographics. For instance, low-income households may be eligible for premium discounts or tax credits, making insurance more financially feasible. Young adults, often faced with higher premiums, could benefit from reduced rates as a result of Insure Georgia’s initiatives.

Furthermore, the program explores partnerships with employers and businesses to offer group insurance plans with discounted rates, providing an additional layer of support for employees and their families. These collaborative efforts demonstrate Insure Georgia's commitment to finding innovative solutions to improve accessibility and affordability.

Performance Analysis and Future Implications

As Insure Georgia continues to gain momentum, its performance will be closely monitored to evaluate its effectiveness and impact. Here are some key performance indicators and potential future implications:

Increased Insurance Penetration

One of the primary goals of Insure Georgia is to increase insurance coverage rates among the population. By analyzing enrollment data and tracking the number of individuals obtaining insurance through the program, policymakers and stakeholders can assess its success in reaching underserved communities.

Insure Georgia's efforts to simplify the insurance process and provide tailored coverage options are expected to lead to a significant rise in insurance penetration. This, in turn, can contribute to improved public health outcomes, reduced financial burdens on individuals and the healthcare system, and enhanced overall financial stability for Georgians.

Economic Impact

The implementation of Insure Georgia is likely to have a positive economic impact on the state. By making insurance more affordable and accessible, the program can stimulate economic growth by encouraging consumer spending, supporting small businesses, and attracting new investments.

Additionally, Insure Georgia's focus on personalized support and community engagement can foster a sense of trust and engagement with the insurance industry. This can lead to increased consumer confidence and a more robust insurance market, further benefiting the state's economy.

Policy Innovation and Adaptation

As Insure Georgia gathers data and insights from its operations, it has the potential to drive policy innovation in the insurance sector. By identifying areas of improvement and success, the program can inform the development of more effective insurance policies and practices not only in Georgia but also on a national scale.

The lessons learned from Insure Georgia's implementation can guide future insurance reforms, influencing the design of public and private insurance programs across the country. This can lead to a more equitable and efficient insurance landscape, benefiting individuals and businesses alike.

Long-Term Sustainability

Insure Georgia’s long-term success will depend on its ability to sustain its impact over time. To achieve this, the program must continually adapt to changing market dynamics, technological advancements, and evolving consumer needs. Regular reviews and assessments will be crucial to ensure that Insure Georgia remains relevant and effective.

Furthermore, building strong partnerships with insurance providers, community organizations, and government agencies will be essential for Insure Georgia's long-term viability. By fostering collaboration and shared goals, the program can create a sustainable ecosystem that supports the insurance needs of Georgians for years to come.

| Category | Performance Indicator |

|---|---|

| Enrollment Growth | 20% increase in insurance coverage among targeted demographics within the first year of Insure Georgia's launch. |

| Premium Affordability | 5% reduction in average insurance premiums for low-income households compared to traditional insurance providers. |

| Community Engagement | Organize 100 educational workshops and events annually, reaching 5,000+ individuals across the state. |

| Digital Platform Adoption | 80% of Insure Georgia users report a positive experience with the digital platform, citing ease of use and efficiency. |

FAQ

How does Insure Georgia address the unique challenges faced by low-income households in obtaining insurance coverage?

+Insure Georgia recognizes the financial constraints faced by low-income households and offers a range of subsidies and premium discounts specifically tailored to their needs. Additionally, the program provides dedicated support services to assist individuals in navigating the insurance process and understanding their coverage options.

What measures are in place to ensure the security and privacy of user data on the Insure Georgia digital platform?

+Insure Georgia prioritizes data security and employs robust encryption technologies and authentication protocols to protect user information. The platform undergoes regular security audits and adheres to industry best practices to ensure the confidentiality and integrity of personal data.

How can individuals access the educational resources and community events organized by Insure Georgia?

+Insure Georgia maintains a comprehensive online resource center where individuals can find educational materials, webinars, and event schedules. Additionally, the program collaborates with local community centers and organizations to host in-person events, ensuring that educational opportunities are accessible to all Georgians.

Related Terms:

- insurance georgia

- insure georgia Reviews

- Gateway Plaza

- insure georgia macon address

- insure georgia macon phone

- insure georgia macon hours