Kinds Of Insurance

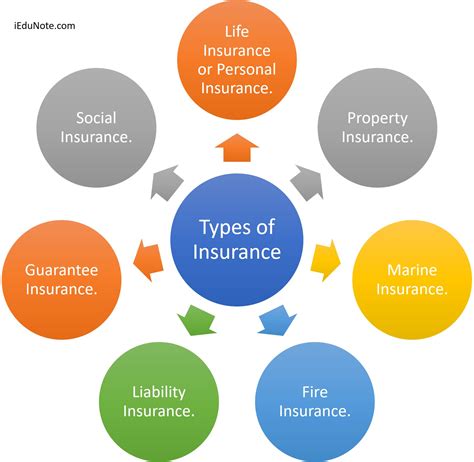

Insurance is an essential aspect of modern life, providing financial protection and peace of mind to individuals, businesses, and organizations across the globe. With a myriad of insurance policies available, it can be overwhelming to navigate the complex world of risk management. From safeguarding your health to protecting your assets, insurance plays a crucial role in mitigating potential losses and ensuring stability. This article aims to explore the diverse landscape of insurance types, shedding light on the various policies that cater to different needs and risks.

Health Insurance: Securing Your Well-Being

Health insurance stands as one of the most vital forms of coverage, ensuring access to quality healthcare services without the burden of exorbitant costs. With rising medical expenses, this type of insurance is crucial for individuals and families alike. Here’s a glimpse into the world of health insurance:

Comprehensive Coverage

Comprehensive health insurance plans offer extensive coverage, including hospitalization, surgical procedures, prescription medications, and routine check-ups. These plans provide financial protection against unexpected medical emergencies and help manage the costs associated with ongoing health conditions.

Specialized Health Plans

Beyond comprehensive coverage, specialized health insurance plans cater to specific needs. For instance, dental insurance plans focus on oral health, covering dental procedures and routine check-ups. Similarly, vision insurance plans provide coverage for eye examinations, prescription lenses, and contact lenses.

| Health Insurance Type | Coverage Highlights |

|---|---|

| Comprehensive Health Insurance | Hospitalization, surgeries, medications, and routine care |

| Dental Insurance | Dental procedures, oral surgery, and routine dental care |

| Vision Insurance | Eye exams, prescription lenses, and contact lenses |

Life Insurance: Protecting Your Legacy

Life insurance is a cornerstone of financial planning, providing a safety net for your loved ones in the event of your untimely demise. This type of insurance ensures that your family’s financial stability remains intact, even in the face of tragedy. Let’s delve into the world of life insurance:

Term Life Insurance

Term life insurance offers coverage for a specific period, typically ranging from 10 to 30 years. This policy provides a death benefit to your beneficiaries if you pass away during the term. It is an affordable option for those seeking temporary coverage to protect their family during their working years.

Permanent Life Insurance

Permanent life insurance, including whole life and universal life insurance, offers lifelong coverage. These policies not only provide a death benefit but also accumulate cash value over time, which can be borrowed against or withdrawn during your lifetime.

| Life Insurance Type | Key Features |

|---|---|

| Term Life Insurance | Affordable, temporary coverage with a fixed death benefit |

| Whole Life Insurance | Lifetime coverage with cash value accumulation |

| Universal Life Insurance | Flexible premiums and coverage amounts, with cash value accumulation |

Property and Casualty Insurance: Safeguarding Your Assets

Property and casualty insurance is designed to protect your assets and belongings from a range of risks, including natural disasters, theft, and accidents. This category of insurance is essential for homeowners, renters, and businesses alike. Here’s an overview:

Homeowners Insurance

Homeowners insurance provides coverage for your home and its contents, offering protection against damage caused by fire, storms, vandalism, and other perils. It also includes liability coverage, safeguarding you against legal claims resulting from accidents on your property.

Renters Insurance

Renters insurance is tailored for individuals who rent their living space. This policy covers your personal belongings and provides liability protection, ensuring you’re not left financially vulnerable in the event of a loss or accident.

Business Insurance

Business insurance is a broad category that encompasses various policies to protect commercial entities. From general liability insurance, which covers third-party claims, to property insurance for physical assets, and professional liability insurance for specific professions, business insurance is crucial for mitigating financial risks.

| Property and Casualty Insurance Type | Coverage Highlights |

|---|---|

| Homeowners Insurance | Protection for your home and belongings, with liability coverage |

| Renters Insurance | Coverage for personal belongings and liability protection for renters |

| Business Insurance | General liability, property, and professional liability coverage for businesses |

Auto Insurance: Protecting Your Mobility

Auto insurance is mandatory in many regions and provides crucial coverage for vehicle owners. It protects against financial losses resulting from accidents, theft, or damage to your vehicle. Here’s a breakdown of auto insurance:

Liability Coverage

Liability insurance covers damages you may cause to others’ property or injuries you may inflict on others in an accident. This coverage is essential to protect your finances in the event of a lawsuit.

Comprehensive and Collision Coverage

Comprehensive coverage protects your vehicle against non-collision incidents, such as theft, vandalism, or natural disasters. Collision coverage, on the other hand, covers damages to your vehicle resulting from collisions with other vehicles or objects.

Personal Injury Protection (PIP)

Personal Injury Protection, or PIP, covers medical expenses and lost wages for you and your passengers in the event of an accident, regardless of fault. This coverage provides added financial protection for medical bills and lost income.

| Auto Insurance Coverage | Key Benefits |

|---|---|

| Liability Coverage | Protects against legal claims and financial losses due to accidents |

| Comprehensive Coverage | Covers non-collision incidents, such as theft and natural disasters |

| Collision Coverage | Provides coverage for damages to your vehicle in accidents |

| Personal Injury Protection (PIP) | Covers medical expenses and lost wages for you and your passengers |

Travel Insurance: Adventure with Peace of Mind

Travel insurance is an essential companion for those embarking on journeys near or far. It provides coverage for a range of travel-related risks, ensuring your adventures remain memorable for the right reasons.

Medical and Emergency Assistance

Travel insurance policies often include coverage for unexpected medical emergencies while abroad. This can include emergency medical evacuation, hospitalization, and even prescription medications. It provides peace of mind, ensuring you receive the necessary care, regardless of your location.

Trip Cancellation and Interruption

Travel insurance can reimburse you for non-refundable trip expenses if your travel plans are disrupted due to unforeseen circumstances, such as illness, natural disasters, or other covered events. This coverage ensures you don’t lose out financially when unexpected events arise.

Baggage and Personal Effects

Travel insurance policies often include coverage for lost, stolen, or damaged baggage and personal items. This can provide financial relief and ensure you’re not left stranded without essentials during your trip.

| Travel Insurance Coverage | Key Benefits |

|---|---|

| Medical and Emergency Assistance | Covers unexpected medical emergencies and provides assistance during travel |

| Trip Cancellation and Interruption | Reimburses non-refundable trip expenses due to covered events |

| Baggage and Personal Effects | Provides coverage for lost, stolen, or damaged baggage and personal items |

Conclusion: Navigating the Insurance Landscape

The world of insurance is vast and complex, offering tailored solutions for a myriad of risks. From health and life insurance to property, casualty, auto, and travel insurance, each type serves a unique purpose in protecting individuals, families, and businesses. Understanding the various insurance options is crucial for making informed decisions and ensuring your financial stability and well-being.

As you navigate the insurance landscape, remember that each policy is a tool to manage risk and protect what matters most. By choosing the right insurance coverage, you can rest assured that you're prepared for life's unexpected twists and turns.

What is the difference between term and permanent life insurance?

+

Term life insurance offers temporary coverage for a specified period, typically 10 to 30 years. It provides a death benefit to beneficiaries if the insured passes away during the term. Permanent life insurance, on the other hand, offers lifelong coverage and includes a cash value component that accumulates over time. This cash value can be borrowed against or withdrawn during the insured’s lifetime.

How does renters insurance differ from homeowners insurance?

+

Renters insurance is tailored for individuals who rent their living space. It covers personal belongings and provides liability protection, similar to homeowners insurance. However, renters insurance does not cover the physical structure of the dwelling, as it is the landlord’s responsibility to insure the building. Homeowners insurance, on the other hand, covers the dwelling and its contents, as well as providing liability protection for the homeowner.

What is comprehensive coverage in auto insurance, and why is it important?

+

Comprehensive coverage in auto insurance provides protection for non-collision incidents, such as theft, vandalism, natural disasters, and other perils. It is important because it covers damages to your vehicle that are not caused by collisions. For instance, if your car is stolen or damaged by a fallen tree during a storm, comprehensive coverage would reimburse you for the repairs or the value of the vehicle.