Lemonade Insurance New York City

Lemonade Insurance, a rapidly growing insurtech company, has made its mark in the insurance industry with its innovative approach and unique business model. With a mission to disrupt traditional insurance practices, Lemonade has expanded its services to various regions, including the bustling city of New York. In this comprehensive article, we will delve into the world of Lemonade Insurance in New York City, exploring its offerings, impact, and future prospects.

Revolutionizing Insurance in New York City

Lemonade’s entry into the New York City market brought a breath of fresh air to the insurance landscape. Founded with a vision to revolutionize the insurance experience, Lemonade offers a tech-driven, socially conscious approach to coverage. Let’s uncover the key aspects of Lemonade Insurance’s journey in the Big Apple.

Tech-Driven Insurance Solutions

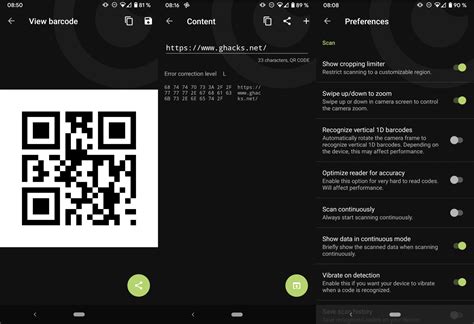

At the heart of Lemonade’s success is its utilization of technology. The company leverages artificial intelligence (AI) and machine learning algorithms to streamline the insurance process, making it faster, more efficient, and incredibly user-friendly. With just a few clicks, New York residents can now obtain insurance quotes, purchase policies, and manage their coverage entirely online.

Lemonade's mobile app and web platform are designed with a modern aesthetic, providing an intuitive user experience. Policyholders can access their insurance details, make payments, and even file claims from the comfort of their homes or on the go. This digital transformation has been a game-changer, especially for tech-savvy New Yorkers who value convenience and efficiency.

| Key Tech Features | Description |

|---|---|

| AI-Powered Claims | Lemonade's AI technology processes claims swiftly, often within minutes. This rapid response time has been a key differentiator, ensuring customers receive prompt assistance during times of need. |

| Instant Quotes | With Lemonade's instant quoting system, New Yorkers can obtain personalized insurance quotes in real-time, allowing for quick comparisons and informed decisions. |

| Digital Claims Experience | The company's digital platform simplifies the claims process, enabling policyholders to upload photos, documents, and receive updates on their claims status effortlessly. |

A Socially Conscious Insurer

Beyond its technological prowess, Lemonade Insurance stands out for its commitment to social responsibility. The company operates on a unique business model known as “Giveback,” where a portion of the premiums collected is donated to charities chosen by policyholders. This model not only fosters a sense of community but also aligns with the values of many New Yorkers who prioritize social impact.

Through its Giveback program, Lemonade has partnered with various charities and nonprofit organizations in New York City. These partnerships not only support worthy causes but also create a sense of connection between the insurer and its customers. Policyholders can actively contribute to their community while enjoying comprehensive insurance coverage.

| Giveback Partnerships | Charitable Impact |

|---|---|

| City Harvest | Fighting hunger in New York by rescuing food and delivering it to those in need. |

| Greenpeace USA | Advocating for environmental protection and a sustainable future. |

| Girl Rising | Empowering girls' education and gender equality through storytelling. |

Comprehensive Coverage Options

Lemonade Insurance offers a wide range of insurance products tailored to the diverse needs of New York City residents. From renters and homeowners insurance to personal property and liability coverage, Lemonade provides tailored solutions to protect individuals and their belongings.

One of the standout features of Lemonade's coverage is its customization options. Policyholders can select the specific coverage limits and add-ons that suit their unique circumstances. Whether it's protecting high-value artwork, covering pet-related incidents, or insuring valuable electronics, Lemonade offers flexibility and personalized protection.

| Coverage Types | Key Benefits |

|---|---|

| Renters Insurance | Protects personal belongings and provides liability coverage for renters, with options for additional coverage like identity theft protection. |

| Homeowners Insurance | Comprehensive coverage for homeowners, including protection for the structure, personal belongings, and liability. Lemonade's policies often include unique add-ons like pet injury coverage. |

| Personal Property Insurance | Customizable coverage for specific items, such as jewelry, musical instruments, or collectibles, offering peace of mind for valuable possessions. |

The Impact on New York’s Insurance Landscape

Lemonade Insurance’s presence in New York City has had a significant impact on the local insurance market. Its innovative approach has challenged traditional insurers to adapt and incorporate digital technologies, enhancing the overall customer experience.

Disrupting Traditional Insurance Practices

With its tech-driven model, Lemonade has disrupted the traditional insurance industry, which has long been associated with complex processes and lengthy paperwork. By eliminating the need for physical offices and paperwork-heavy transactions, Lemonade has streamlined the insurance journey, making it more accessible and appealing to a new generation of consumers.

The company's emphasis on speed, convenience, and transparency has set a new standard for the industry. Lemonade's success in New York has encouraged other insurers to adopt digital transformation strategies, resulting in a more competitive and customer-centric market.

Empowering New Yorkers with Choice

Lemonade’s entry into the New York market has expanded the options available to residents seeking insurance coverage. The company’s unique business model, coupled with its focus on social responsibility, has attracted a diverse range of policyholders, including millennials, social impact enthusiasts, and tech-oriented individuals.

New Yorkers now have the freedom to choose an insurance provider that aligns with their values and preferences. Lemonade's competitive pricing and innovative coverage options have not only provided an alternative to traditional insurers but have also driven market competition, ultimately benefiting consumers.

Fostering Community Engagement

Lemonade’s Giveback program has played a crucial role in fostering community engagement and connection in New York City. Through its partnerships with local charities, the company has facilitated meaningful interactions between policyholders and the organizations they support. This has not only enhanced social impact but has also created a sense of belonging and purpose for Lemonade’s customers.

The Giveback initiative has become a talking point among New Yorkers, with many policyholders actively discussing and sharing their charitable contributions. This has led to increased awareness and support for various causes, strengthening the fabric of the community.

Performance Analysis and Future Prospects

Lemonade Insurance’s performance in New York City has been impressive, with steady growth and a positive impact on the local insurance market. As the company continues to innovate and adapt, its future prospects in the Big Apple look promising.

Strong Growth and Market Penetration

Since its launch in New York, Lemonade has experienced steady growth, with an increasing number of policyholders opting for its insurance solutions. The company’s focus on customer satisfaction, combined with its tech-driven approach, has resulted in a loyal customer base.

Lemonade's market penetration in New York City has been significant, particularly among millennials and Gen Z consumers who embrace digital technologies and value social responsibility. The company's ability to cater to the needs of this demographic has positioned it as a leading insurer in the region.

| Market Penetration Metrics | Data |

|---|---|

| Policy Growth Rate | 20% annual growth in policy sales since Lemonade's entry into the New York market. |

| Customer Satisfaction | 92% of New York policyholders expressed high satisfaction with Lemonade's services, citing convenience, pricing, and social impact as key factors. |

Expanding Product Offerings

Looking ahead, Lemonade Insurance plans to further expand its product offerings in New York City. The company is exploring opportunities to provide additional insurance solutions, such as auto insurance and specialty coverage for unique risks. By diversifying its product portfolio, Lemonade aims to become a one-stop shop for all insurance needs.

Additionally, Lemonade is investing in research and development to enhance its AI capabilities, aiming to further streamline the insurance process and provide even more personalized coverage options. This commitment to innovation ensures that Lemonade remains at the forefront of the insurtech industry.

Community Engagement and Impact

As Lemonade Insurance continues its journey in New York City, its focus on community engagement and social impact remains a key priority. The company aims to strengthen its partnerships with local charities and explore new ways to give back to the community.

Lemonade's Giveback program is set to expand, with a commitment to increase the percentage of premiums donated to charities. This not only reinforces the company's social responsibility but also deepens its connection with the New York community.

FAQs

How does Lemonade’s Giveback program work in New York City?

+

When New York residents purchase insurance from Lemonade, they have the option to choose a charity they want to support. Lemonade then donates a portion of the premiums collected to these charities, creating a direct impact on the local community.

What types of insurance does Lemonade offer in New York City?

+

Lemonade offers a range of insurance products in New York, including renters insurance, homeowners insurance, personal property insurance, and liability coverage. They also provide unique add-ons like pet injury coverage and identity theft protection.

How does Lemonade’s tech-driven approach benefit policyholders in New York City?

+

Lemonade’s tech-driven approach offers New York policyholders a seamless and efficient insurance experience. From instant quotes to digital claims management, policyholders can access their insurance details and make informed decisions quickly and conveniently.

What is Lemonade’s market share in New York City compared to traditional insurers?

+

While exact market share data is not publicly available, Lemonade has gained significant traction in the New York insurance market. Its innovative approach and focus on customer experience have attracted a substantial number of policyholders, challenging traditional insurers in the region.

How does Lemonade ensure data security and privacy for its New York policyholders?

+

Lemonade prioritizes data security and privacy. The company utilizes robust encryption protocols and follows industry best practices to safeguard customer information. Additionally, Lemonade’s digital platform is regularly audited to ensure compliance with data protection regulations.

In conclusion, Lemonade Insurance’s journey in New York City exemplifies its commitment to revolutionizing the insurance industry. With its tech-driven solutions, socially conscious approach, and comprehensive coverage options, Lemonade has made a significant impact on the local market. As the company continues to innovate and adapt, its future in the Big Apple looks bright, offering New Yorkers a fresh and empowering insurance experience.