Liability Only Car Insurance

In the complex world of insurance, there's a type of coverage that's often misunderstood yet plays a crucial role in financial protection: liability-only car insurance. This coverage is a more budget-friendly option that provides essential protection for vehicle owners while driving on the road. As we delve into this topic, we'll uncover the nuances of liability-only insurance, its benefits, and when it's the right choice for your vehicle.

Understanding Liability-Only Car Insurance

Liability-only car insurance is a specific type of coverage that provides financial protection for the policyholder in the event they cause an accident that results in bodily injury or property damage to others. In essence, it covers the costs associated with the policyholder’s liability for the accident. This type of insurance is distinct from comprehensive or collision coverage, which protect the policyholder’s vehicle in various scenarios, including accidents, theft, and natural disasters.

Liability-only insurance is often a more affordable option, as it doesn't provide coverage for the policyholder's vehicle. It's a good choice for individuals who drive older vehicles or those who have vehicles that are already paid off and would be more cost-effective to replace in the event of an accident.

Key Components of Liability-Only Coverage

Liability-only car insurance typically includes two main types of coverage:

- Bodily Injury Liability: This coverage pays for medical expenses, lost wages, and other costs incurred by individuals injured in an accident that the policyholder caused.

- Property Damage Liability: This aspect of the policy covers the cost of repairing or replacing property damaged in an accident, such as the other driver’s vehicle, fences, buildings, or other structures.

Additionally, some liability-only policies may include coverage for legal defense costs if the policyholder is sued as a result of an accident.

| Coverage Type | Description |

|---|---|

| Bodily Injury Liability | Covers medical expenses and other costs for injured parties. |

| Property Damage Liability | Pays for repairs or replacements of damaged property. |

| Legal Defense Costs | Provides coverage for legal fees if the policyholder is sued. |

When is Liability-Only Insurance the Right Choice?

Liability-only car insurance is an excellent option for certain scenarios. Here are some situations where this type of coverage might be the most suitable choice:

- Older Vehicles: If you drive an older vehicle that has limited monetary value, liability-only insurance can provide the necessary protection without the need for additional coverage for your vehicle.

- Budget Constraints: For individuals on a tight budget, liability-only insurance offers a more affordable alternative to comprehensive coverage, ensuring you have the essential protection required by law.

- Paid-Off Vehicles: If your vehicle is fully paid off and you have the financial means to replace it if needed, liability-only insurance can be a cost-effective option.

- Minimal Driving: If you drive infrequently or for short distances, liability-only insurance might suffice, as the risk of accidents is relatively lower.

Considerations and Potential Drawbacks

While liability-only insurance offers significant cost savings, it’s important to carefully consider your unique circumstances. Here are some factors to keep in mind:

- Vehicle Value: If your vehicle is relatively new or has a high resale value, comprehensive coverage might be a better option to protect your investment.

- Accident Risk: Individuals who drive frequently or in high-risk areas might benefit from additional coverage to protect against accidents and other unforeseen events.

- Personal Circumstances: Your personal financial situation and ability to cover potential out-of-pocket expenses in the event of an accident should also be considered.

Comparing Liability-Only with Other Coverage Types

When deciding on the right type of car insurance, it’s essential to understand how liability-only coverage differs from other common insurance types.

Liability-Only vs. Comprehensive Coverage

Comprehensive car insurance provides the broadest range of coverage, including liability protection, collision coverage, and coverage for various other events, such as theft, vandalism, and natural disasters. While comprehensive coverage offers more protection, it also comes at a higher cost. Liability-only insurance, on the other hand, provides a more affordable option for those who primarily need protection for their liability in accidents.

| Coverage Type | Liability-Only | Comprehensive |

|---|---|---|

| Liability Protection | ✔️ | ✔️ |

| Collision Coverage | ❌ | ✔️ |

| Other Perils Coverage | ❌ | ✔️ |

| Cost | Lower | Higher |

Liability-Only vs. Collision Coverage

Collision coverage specifically protects the policyholder’s vehicle in the event of an accident, regardless of fault. It covers the costs to repair or replace the insured vehicle after a collision. While liability-only insurance doesn’t provide this type of coverage, it’s important to note that collision coverage is typically more expensive than liability-only.

| Coverage Type | Liability-Only | Collision |

|---|---|---|

| Liability Protection | ✔️ | ✔️ |

| Vehicle Protection | ❌ | ✔️ |

| Cost | Lower | Higher |

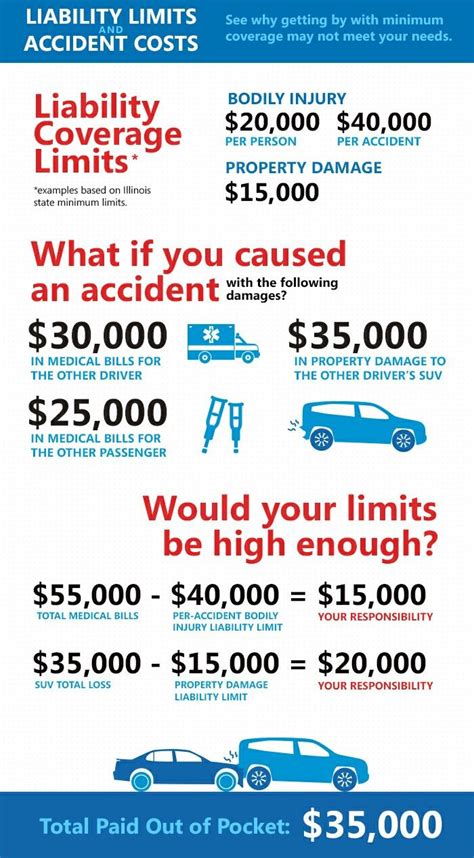

Choosing the Right Liability Coverage Limits

When selecting liability-only car insurance, one of the most important decisions is determining the appropriate coverage limits. These limits dictate the maximum amount your insurance company will pay for bodily injury and property damage claims arising from an accident you cause.

Understanding Coverage Limits

Liability coverage limits are typically expressed as three numbers, such as 50/100/50. These numbers represent:

- Bodily Injury Liability Per Person: The maximum amount the insurance company will pay for bodily injury claims per person injured in an accident.

- Bodily Injury Liability Per Accident: The maximum amount the insurance company will pay for all bodily injury claims resulting from a single accident, regardless of the number of injured individuals.

- Property Damage Liability: The maximum amount the insurance company will pay for property damage claims arising from a single accident.

For example, a liability coverage limit of 50/100/50 means the insurance company will pay up to $50,000 for bodily injury claims per person, up to $100,000 for bodily injury claims per accident, and up to $50,000 for property damage claims per accident.

| Coverage Limit | Description |

|---|---|

| 50/100/50 | $50,000 per person for bodily injury, $100,000 per accident for bodily injury, and $50,000 per accident for property damage. |

| 100/300/100 | $100,000 per person for bodily injury, $300,000 per accident for bodily injury, and $100,000 per accident for property damage. |

| 250/500/250 | $250,000 per person for bodily injury, $500,000 per accident for bodily injury, and $250,000 per accident for property damage. |

Factors to Consider for Coverage Limits

When choosing liability coverage limits, consider the following factors:

- Financial Protection: Higher limits provide greater financial protection in the event of a serious accident. They ensure you’re covered for significant medical expenses and property damage claims.

- Legal Requirements: Different states have varying minimum liability coverage requirements. Ensure you meet these requirements to stay compliant with the law.

- Personal Assets: If you have significant personal assets, higher liability limits can help protect these assets in the event of a lawsuit arising from an accident.

- Risk Assessment: Consider your driving habits and the risks associated with your daily commute. If you frequently drive in high-risk areas, higher limits might be advisable.

Additional Considerations for Liability-Only Insurance

While liability-only insurance offers a cost-effective solution for many drivers, there are some additional considerations to keep in mind when selecting this type of coverage.

Uninsured/Underinsured Motorist Coverage

Uninsured/underinsured motorist coverage is an optional coverage that can be added to your liability-only policy. This coverage provides protection in the event you’re involved in an accident with a driver who either has no insurance or has insufficient insurance to cover the costs of the accident. It’s an important consideration, as it can protect you from significant out-of-pocket expenses in these scenarios.

Medical Payments Coverage

Medical payments coverage, often referred to as “MedPay,” is another optional coverage that can be added to your liability-only policy. This coverage provides reimbursement for medical expenses incurred by you or your passengers in the event of an accident, regardless of fault. It can be a valuable addition to your policy, as it ensures prompt payment for medical bills without the need for a lengthy claims process.

Personal Injury Protection (PIP)

Personal Injury Protection, or PIP, is another type of coverage that can be added to your liability-only policy. PIP provides coverage for medical expenses, lost wages, and other related costs for you and your passengers, regardless of fault. While PIP is not available in all states, it can be a beneficial addition to your policy, especially if you live in a no-fault state.

Frequently Asked Questions

Can I customize my liability-only insurance policy?

+

Yes, you can customize your liability-only insurance policy to fit your specific needs. This includes choosing the coverage limits that best suit your financial situation and risk tolerance. Additionally, you can add optional coverages like uninsured/underinsured motorist coverage, medical payments coverage, and personal injury protection (PIP) to enhance your protection.

What happens if I cause an accident with liability-only insurance?

+

If you cause an accident with liability-only insurance, your policy will cover the costs of bodily injury and property damage claims made against you up to your chosen coverage limits. It’s important to note that liability-only insurance does not cover damage to your own vehicle, so you’ll need to cover those costs out of pocket or through other means.

Is liability-only insurance legally required?

+

Yes, liability-only insurance is legally required in most states. However, the minimum coverage limits vary by state, so it’s important to check your state’s requirements to ensure you’re meeting the necessary standards. Failure to carry the required insurance can result in fines, license suspension, and other legal consequences.