Life Insurance Explained

Life insurance is an essential financial product that offers peace of mind and security to individuals and their loved ones. In today's fast-paced world, where uncertainties abound, having a robust life insurance policy can provide a safety net during challenging times. This comprehensive guide aims to unravel the complexities of life insurance, exploring its various facets, benefits, and how it can be tailored to meet your unique needs.

Understanding Life Insurance: A Fundamental Overview

Life insurance, at its core, is a contract between an individual (the policyholder) and an insurance company. The policyholder pays a premium, typically on a regular basis, and in return, the insurance provider agrees to pay a sum of money (known as the death benefit) to the designated beneficiaries upon the policyholder’s death.

This financial protection ensures that the policyholder's family or dependents can maintain their standard of living and cover various expenses, including funeral costs, outstanding debts, and ongoing living expenses. Life insurance is a vital tool for estate planning, offering a means to pass on a financial legacy and ensuring the policyholder's loved ones are taken care of, even in their absence.

Types of Life Insurance: Tailoring Coverage to Your Needs

Life insurance policies come in various forms, each designed to cater to different life stages, financial goals, and individual preferences. Understanding the key types of life insurance is crucial in selecting the right coverage for your specific circumstances.

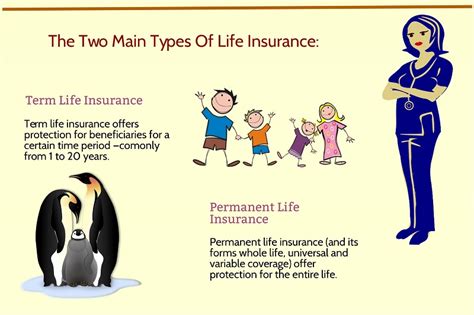

Term Life Insurance

Term life insurance is a straightforward and affordable option, offering coverage for a specified period or “term.” This type of policy provides a death benefit only if the policyholder passes away during the coverage term. Terms can range from 10 to 30 years, and premiums remain fixed throughout the term, making it an attractive choice for those seeking temporary coverage or those on a budget.

Term life insurance is particularly beneficial for young families, as it can cover the cost of raising children, paying off a mortgage, or funding a child's education. As the name suggests, it provides coverage for a specific "term," after which the policyholder may choose to renew it or opt for a different type of coverage.

Permanent Life Insurance

Unlike term life insurance, permanent life insurance offers coverage for the policyholder’s entire life, as long as the premiums are paid. This type of policy includes a cash value component, which grows over time and can be accessed by the policyholder through loans or withdrawals. Permanent life insurance includes whole life, universal life, and variable life insurance policies.

Whole life insurance provides a guaranteed death benefit and cash value growth, with premiums that remain level throughout the policyholder's life. Universal life insurance offers more flexibility, allowing policyholders to adjust premiums and death benefits within certain limits. Variable life insurance, on the other hand, invests a portion of the premiums in stocks, bonds, or mutual funds, providing the potential for higher cash value growth but also carrying more risk.

Key Factors to Consider When Choosing Life Insurance

Selecting the right life insurance policy involves careful consideration of several factors. These factors ensure that the chosen policy aligns with your financial goals, budget, and future plans.

Coverage Amount

Determining the appropriate coverage amount is crucial. It should be sufficient to cover outstanding debts, provide for dependents’ living expenses, and achieve any financial goals you may have. Financial advisors often recommend a coverage amount that is 10 to 15 times your annual income.

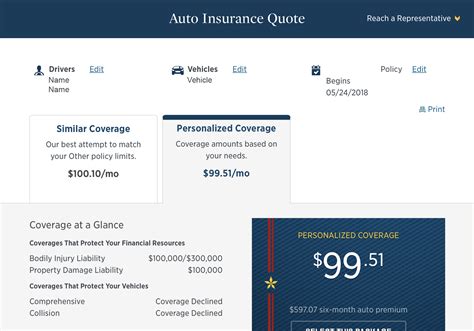

Premiums and Affordability

Premiums are a significant consideration, as they directly impact your budget. Term life insurance generally offers more affordable premiums, while permanent life insurance can be more costly due to its lifelong coverage and cash value accumulation.

Flexibility and Customization

Some life insurance policies offer additional riders or endorsements that can customize your coverage. These riders may include accelerated death benefits for terminal illnesses, waiver of premium in case of disability, or child riders that provide coverage for your children.

| Life Insurance Rider | Description |

|---|---|

| Waiver of Premium | Waives premium payments if the policyholder becomes disabled. |

| Accelerated Death Benefit | Allows for an early payout in case of a terminal illness. |

| Child Rider | Provides coverage for the policyholder's children, often at a low cost. |

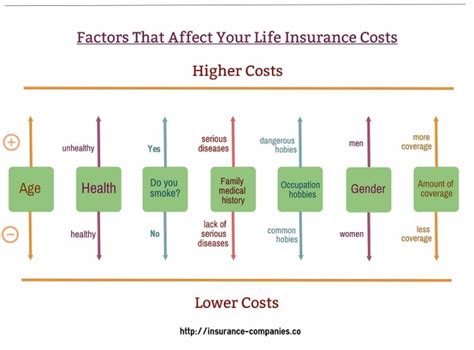

The Impact of Health and Lifestyle

Your health and lifestyle can influence the cost and availability of life insurance. Insurance companies typically require a medical exam and may review your medical history and lifestyle habits (e.g., smoking, extreme sports participation) to assess your risk level. Those with pre-existing health conditions or high-risk lifestyles may face higher premiums or limited coverage options.

The Process of Applying for Life Insurance

Applying for life insurance involves a series of steps, each designed to ensure that the policy is tailored to your needs and that the insurance company can assess the level of risk involved.

Research and Comparison

Start by researching and comparing different life insurance providers and policies. Consider factors like financial stability, customer satisfaction, and the range of coverage options offered. Online comparison tools and financial advisors can be valuable resources during this stage.

Completing an Application

Once you’ve chosen a provider and policy, you’ll need to complete an application. This typically involves providing personal and financial information, as well as details about your health and lifestyle. Be prepared to disclose any pre-existing conditions or medications you’re taking.

Medical Exam and Underwriting

Many life insurance applications require a medical exam, which may include blood tests, urine tests, and a physical assessment. The results of this exam, along with your application and other relevant information, are reviewed by the insurance company’s underwriting team. This team assesses your risk level and determines the terms and conditions of your policy, including the premium amount.

Policy Issuance

If your application is approved, you’ll receive a policy document outlining the terms, conditions, and coverage details. Carefully review this document to ensure it aligns with your expectations and needs. Once you’re satisfied, you can accept the policy and begin making premium payments.

Maximizing the Benefits of Life Insurance

Life insurance isn’t just about providing a death benefit. It can offer several additional advantages and opportunities to enhance your financial well-being.

Tax Benefits

Life insurance policies, particularly permanent life insurance, can provide tax advantages. The cash value growth within the policy is tax-deferred, meaning it grows without being taxed annually. Additionally, death benefits are typically paid out tax-free, offering a significant financial benefit to beneficiaries.

Wealth Accumulation and Retirement Planning

Permanent life insurance policies, with their cash value component, can serve as a long-term savings vehicle. The cash value can be accessed through loans or withdrawals, providing a source of funds for major purchases, education expenses, or even retirement. This feature makes life insurance a versatile tool for wealth accumulation and retirement planning.

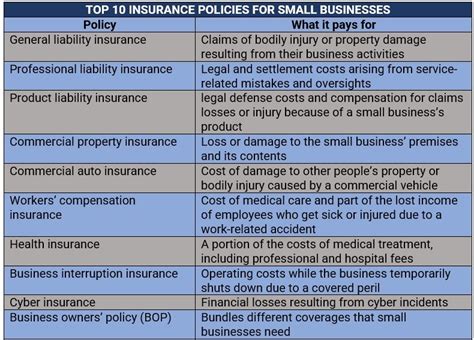

Business Planning and Key Person Insurance

Life insurance is not just for individuals; it can also be a valuable asset for businesses. Key person insurance, for instance, provides coverage for individuals who are critical to a business’s success. In the event of their death, the insurance payout can help cover the financial loss and ensure the business’s continuity.

Common Misconceptions and FAQs about Life Insurance

Life insurance is often surrounded by misconceptions and myths. Addressing these can help individuals make more informed decisions about their coverage.

Is life insurance only for the elderly or those with health issues?

+Life insurance is beneficial for individuals of all ages and health statuses. While it's true that premiums may be lower for younger, healthier individuals, life insurance is a tool for financial planning and security, regardless of age or health.

Can life insurance be used to cover funeral expenses only?

+While funeral expenses are often a primary consideration when purchasing life insurance, the coverage can extend far beyond that. Life insurance can provide a financial cushion for your loved ones, helping them maintain their standard of living and cover various expenses, including outstanding debts and ongoing living costs.

Is life insurance a one-time purchase, or do I need to review and update it regularly?

+Life insurance is not a static product. Your financial situation, family structure, and life goals may change over time, and so should your life insurance policy. Regular reviews, ideally every few years or after significant life events, are essential to ensure your coverage remains adequate and aligned with your needs.

Life insurance is a powerful tool for financial security and peace of mind. By understanding the different types of policies, key considerations, and the application process, individuals can make informed decisions to protect their loved ones and secure their financial future. Remember, life insurance is not a one-size-fits-all solution, and tailoring your coverage to your unique circumstances is essential for optimal protection.