Limits Of Liability Insurance

The Comprehensive Guide to Understanding the Limits of Liability Insurance

In the intricate world of insurance, one term that often arises in various contexts is "Limits of Liability". This concept plays a pivotal role in defining the scope and extent of coverage provided by an insurance policy. While it may seem straightforward, the limits of liability can significantly impact your risk management strategies and financial protection. In this in-depth exploration, we will delve into the nuances of liability insurance limits, their implications, and how they can be tailored to meet your specific needs.

Liability insurance is a fundamental component of any risk management portfolio, safeguarding individuals and businesses against financial losses arising from claims made against them. However, the limits of liability within these policies can be a delicate balancing act. Understanding how these limits are determined, the potential consequences of inadequate coverage, and strategies to optimize your insurance plan is crucial for informed decision-making.

Unraveling the Limits of Liability

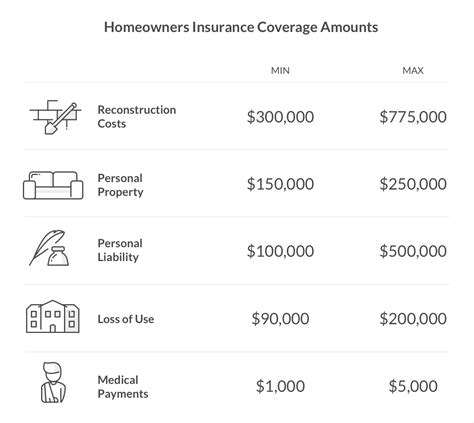

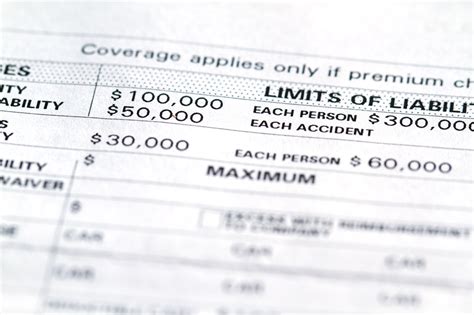

At its core, the limits of liability refer to the maximum amount an insurance company is contractually obligated to pay for covered claims during a specific policy period. This limit is typically defined within the insurance policy's terms and conditions, and it serves as a crucial boundary for the insurer's financial exposure.

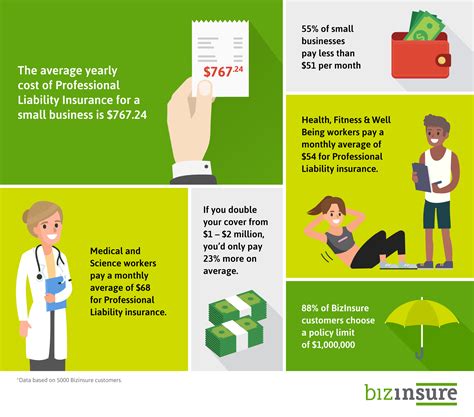

For instance, consider a general liability insurance policy for a small business. The policy might stipulate a limit of liability of $2 million for bodily injury and property damage claims. This means that, in the event of a claim, the insurer will cover expenses and damages up to this specified amount. Any costs exceeding the limit become the responsibility of the insured.

The limits of liability can vary widely across different types of insurance policies and industries. Factors such as the nature of the business, the level of risk involved, and the insurer's own financial capacity all influence the determination of these limits.

Impact and Considerations

The limits of liability have a direct impact on the level of financial protection an insured individual or business receives. If a claim exceeds the policy's limit, the insured party may be held responsible for the remaining amount, which can lead to significant financial strain or even bankruptcy.

For example, imagine a product liability claim against a manufacturer for a defective product that caused severe injuries. If the claim exceeds the manufacturer's policy limit, they might face substantial out-of-pocket expenses. This scenario highlights the critical importance of carefully evaluating and adjusting liability insurance limits to align with potential risks.

Factors Influencing Limits of Liability

Several key factors come into play when determining the limits of liability for an insurance policy. Understanding these factors can empower policyholders to make more informed choices about their coverage.

Industry and Business Characteristics

The nature of an industry and the specific business activities can significantly influence the limits of liability. High-risk industries, such as construction or manufacturing, often require higher limits to account for the increased likelihood and severity of potential claims.

Consider the example of a construction company operating heavy machinery. The potential for accidents and resulting injuries or property damage is higher compared to a low-risk industry like consulting services. Therefore, the construction company's liability insurance limits would need to be set higher to provide adequate protection.

Insurer's Financial Capacity

Insurance companies assess their own financial capacity when determining policy limits. Larger insurers with robust financial reserves may offer higher limits, providing greater peace of mind to policyholders. On the other hand, smaller insurers might have more conservative limits to manage their risk exposure.

Policyholders should carefully consider the financial stability of their insurer to ensure they can rely on the promised coverage in the event of a significant claim.

Historical Claims Data

Insurance companies analyze historical claims data to identify trends and patterns. This data helps them assess the likelihood and severity of future claims, which in turn influences the determination of liability limits.

For instance, if a particular industry has experienced a high number of large-scale claims in recent years, insurers may adjust liability limits upward to accommodate potential future losses. This proactive approach ensures that policyholders are adequately protected.

Risk Management Practices

The insured party's own risk management practices can also impact the limits of liability. Insurers often encourage and reward policyholders who demonstrate a commitment to minimizing risks through proactive measures.

Implementing robust safety protocols, conducting regular maintenance, and maintaining thorough documentation can all signal a reduced risk profile to insurers. As a result, they may offer more favorable liability limits as an incentive for these risk-mitigating practices.

Optimizing Liability Insurance Coverage

Given the critical role of liability insurance in protecting against financial losses, it's essential to ensure that your coverage is optimally tailored to your specific needs.

Conduct a Risk Assessment

Before determining the appropriate limits of liability, conduct a comprehensive risk assessment. Identify the potential hazards and risks associated with your business or personal activities. Consider the severity and frequency of potential claims, as well as any unique factors that could impact your risk profile.

A thorough risk assessment provides a solid foundation for making informed decisions about your liability insurance coverage.

Review Industry Standards

Familiarize yourself with the liability insurance limits commonly adopted within your industry. While every business is unique, understanding the standards can offer valuable insights into the typical coverage levels required.

Industry associations and regulatory bodies often provide guidelines or recommendations for liability insurance limits. These resources can be a useful starting point for your own coverage considerations.

Work with an Insurance Professional

Engaging the expertise of an insurance broker or agent can be invaluable when optimizing your liability insurance coverage. These professionals have extensive knowledge of the insurance market and can provide tailored advice based on your specific circumstances.

An insurance professional can help you navigate the complexities of liability limits, assess your unique risks, and propose suitable coverage options. Their guidance ensures that you're not underinsured, leaving you vulnerable to unexpected financial burdens, or overinsured, resulting in unnecessary expense.

Consider Excess Liability Insurance

For added protection, excess liability insurance, also known as umbrella insurance, can be a prudent choice. This type of insurance provides additional coverage beyond the limits of your primary liability policies.

Excess liability insurance acts as a safety net, offering protection for claims that exceed the limits of your underlying policies. It's particularly beneficial for individuals or businesses with significant assets to protect, as it provides an extra layer of financial security.

Case Study: Tailoring Liability Insurance for a Construction Firm

To illustrate the practical application of optimizing liability insurance limits, let's explore a hypothetical scenario involving a construction firm.

Identifying Risks

Construction activities inherently carry a range of risks, from on-site accidents to property damage and contractual disputes. A comprehensive risk assessment for a construction firm might include the following considerations:

- The frequency and severity of accidents involving heavy machinery.

- The potential for structural failures or design flaws.

- Contractual obligations and the associated risks of non-performance or breaches.

- Environmental impact and the possibility of pollution-related claims.

- Employee safety and the risk of workplace injuries.

Determining Optimal Limits

Based on the identified risks, the construction firm should collaborate with their insurance broker to determine appropriate liability limits. This process might involve the following steps:

- Reviewing historical claims data within the construction industry to understand common claim amounts and frequencies.

- Analyzing the firm's own historical claims data to identify any unique patterns or trends.

- Assessing the financial stability of potential insurers to ensure they can provide the required coverage limits.

- Considering the firm's financial capacity to absorb potential out-of-pocket expenses in the event of a claim exceeding policy limits.

- Implementing robust risk management practices, such as regular equipment inspections and comprehensive safety training, to potentially negotiate more favorable liability limits.

Optimizing Coverage

The construction firm might opt for the following optimized liability insurance coverage:

| Insurance Policy | Limits of Liability |

|---|---|

| General Liability | $5 million |

| Product Liability | $3 million |

| Professional Liability | $2 million |

| Excess Liability (Umbrella) | $10 million |

By carefully tailoring their liability insurance limits, the construction firm ensures that they have adequate protection for the risks they face, providing peace of mind and financial security.

Frequently Asked Questions (FAQ)

What happens if a claim exceeds the policy’s limit of liability?

+

If a claim exceeds the policy’s limit of liability, the insured party becomes responsible for the remaining amount. This can lead to significant out-of-pocket expenses and potentially impact their financial stability. It’s crucial to carefully assess your risk profile and choose liability limits that provide adequate protection.

How often should I review and adjust my liability insurance limits?

+

It’s recommended to review your liability insurance limits annually or whenever significant changes occur in your business or personal circumstances. This could include expansion into new markets, changes in regulatory requirements, or modifications to your risk management practices. Regular reviews ensure that your coverage remains aligned with your evolving needs.

Can I purchase liability insurance with unlimited limits of liability?

+

While some insurance policies offer very high limits, truly unlimited liability coverage is rare. Insurers need to manage their own financial exposure, and setting unlimited limits would be impractical. However, excess liability insurance (umbrella insurance) can provide additional coverage beyond the limits of your primary policies, offering a robust level of protection.

How does my insurer determine the limits of liability for my policy?

+

Insurers determine liability limits based on a combination of factors, including your industry’s risk profile, your business’s historical claims data, and your insurer’s financial capacity. They also consider your risk management practices and any unique circumstances that might impact your risk exposure. Working with an insurance professional can help you understand and negotiate favorable liability limits.