Insurance Companies Auto

The world of auto insurance is a complex landscape that plays a crucial role in the lives of countless individuals and businesses worldwide. With millions of vehicles on the road, the need for comprehensive and reliable auto insurance coverage is paramount. This article aims to delve deep into the intricacies of the auto insurance industry, shedding light on its workings, trends, and future prospects.

Understanding Auto Insurance: A Comprehensive Overview

Auto insurance, a staple of the insurance sector, serves as a financial safeguard for vehicle owners and drivers. It provides coverage for a range of potential risks and liabilities associated with operating a motor vehicle. From collisions and accidents to theft and natural disasters, auto insurance policies offer peace of mind and financial protection.

The auto insurance industry is vast and diverse, catering to the unique needs of different demographics and vehicle types. Whether it's a personal car, a commercial fleet, or even exotic and classic cars, there's an insurance policy tailored to fit. The industry's adaptability and innovation are key to its success, ensuring that drivers can find coverage that suits their specific circumstances.

Key Components of Auto Insurance Policies

Auto insurance policies are meticulously crafted to address a multitude of scenarios. Here's a breakdown of some of the key components that form the backbone of these policies:

- Liability Coverage: This aspect of auto insurance covers the policyholder's legal responsibility for bodily injury or property damage to others resulting from an accident.

- Collision Coverage: A vital component, collision coverage pays for damage to the insured vehicle caused by a collision, regardless of fault.

- Comprehensive Coverage: This coverage protects against damages caused by events other than collisions, such as theft, vandalism, natural disasters, or hitting an animal.

- Medical Payments Coverage: Also known as Personal Injury Protection (PIP), this coverage pays for medical expenses incurred by the policyholder and passengers in an accident, regardless of fault.

- Uninsured/Underinsured Motorist Coverage: This protection safeguards the policyholder in the event of an accident with a driver who either has no insurance or insufficient coverage to pay for the damages caused.

Each of these components plays a vital role in ensuring that policyholders are adequately protected. Insurance companies offer a range of coverage options, allowing drivers to customize their policies to fit their specific needs and budget.

The Evolution of Auto Insurance: A Historical Perspective

The auto insurance industry has undergone a remarkable transformation since its inception. What began as a simple concept to mitigate the risks associated with early automobiles has evolved into a sophisticated and highly regulated sector.

In the early 20th century, auto insurance was a novelty, with a handful of companies pioneering the concept. As the automobile industry boomed, so did the demand for insurance coverage. The industry responded by developing more comprehensive policies and introducing innovative features to meet the evolving needs of drivers.

Key Milestones in the Evolution of Auto Insurance

| Year | Milestone |

|---|---|

| 1925 | The first no-fault auto insurance policy was introduced, offering a new approach to settling accident claims. |

| 1956 | The introduction of the first comprehensive auto insurance policy marked a significant expansion of coverage options. |

| 1984 | Uninsured motorist coverage became mandatory in several states, ensuring protection for policyholders against uninsured drivers. |

| 2000s | The rise of digital technology revolutionized the industry, with online insurance quotes and policy management becoming commonplace. |

| Present | The industry continues to evolve, with a focus on personalized coverage, telematics, and usage-based insurance. |

The evolution of auto insurance is a testament to the industry's adaptability and commitment to meeting the changing needs of its customers. As vehicles and driving patterns evolve, so too does the insurance coverage required to protect drivers and their assets.

The Impact of Technological Advancements

The digital age has brought about a revolution in the auto insurance industry, transforming the way policies are sold, managed, and utilized. Technological advancements have paved the way for a more efficient, personalized, and data-driven insurance experience.

Digital Innovation in Auto Insurance

Here's a glimpse into some of the ways technology is shaping the future of auto insurance:

- Online Quoting and Policy Management: Insurance companies now offer online platforms for customers to obtain quotes, compare policies, and manage their coverage. This convenience has streamlined the insurance process, making it more accessible and efficient.

- Telematics and Usage-Based Insurance: Telematics technology allows insurance providers to track driving behavior and offer personalized premiums based on actual usage. This innovative approach rewards safe driving and provides a more accurate assessment of risk.

- Artificial Intelligence and Machine Learning: AI and machine learning algorithms are being employed to analyze vast amounts of data, enabling insurance companies to make more accurate predictions and offer tailored coverage options.

- Mobile Apps and Digital Assistance: Insurance companies are developing mobile apps and digital assistance tools to enhance the customer experience. These platforms offer real-time policy updates, claims management, and even virtual accident assistance.

The integration of technology into the auto insurance industry has not only improved efficiency but has also empowered customers with greater control over their coverage. As technology continues to advance, the industry is poised to become even more innovative and customer-centric.

The Future of Auto Insurance: Trends and Predictions

As we look ahead, the auto insurance industry is set to undergo further transformation, driven by emerging trends and technological advancements. Here's a glimpse into the future of auto insurance:

Key Trends Shaping the Future

- Connected Cars and Autonomous Vehicles: With the rise of connected cars and autonomous vehicles, the insurance industry will need to adapt its coverage to address the unique risks and liabilities associated with these advanced technologies.

- Personalized Insurance: The trend towards personalized insurance is set to continue, with insurance companies offering tailored policies based on individual driving behavior, preferences, and vehicle usage patterns.

- Digital Transformation: The digital revolution in the insurance industry is here to stay. Insurance companies will continue to invest in digital platforms, artificial intelligence, and data analytics to enhance the customer experience and streamline operations.

- Sustainability and Green Initiatives: As the world embraces sustainability, the insurance industry is likely to see an increase in green initiatives and coverage for environmentally friendly vehicles and technologies.

The future of auto insurance is promising, with a focus on innovation, sustainability, and customer-centric approaches. As the industry continues to evolve, it will play a pivotal role in shaping the future of mobility and providing essential protection for drivers and their vehicles.

Conclusion

In conclusion, the auto insurance industry is a complex and vital component of our modern world. From its humble beginnings to its current state of innovation and technological integration, it has come a long way. As we navigate the future, the industry’s ability to adapt and innovate will be key to its continued success and relevance.

Whether you're a seasoned driver or a newcomer to the roads, understanding the intricacies of auto insurance is essential. With the right coverage, you can drive with confidence, knowing that you're protected against the unexpected. As the industry continues to evolve, stay informed and choose the coverage that best suits your needs.

What are the key factors that influence auto insurance rates?

+Auto insurance rates are influenced by a variety of factors, including the driver’s age, gender, driving record, and the type of vehicle insured. Additionally, the location and the coverage options chosen can significantly impact the premium.

How do insurance companies determine fault in an accident?

+Insurance companies use a comprehensive process to determine fault, which includes gathering evidence, witness statements, and police reports. They also consider the applicable traffic laws and regulations to make an informed decision.

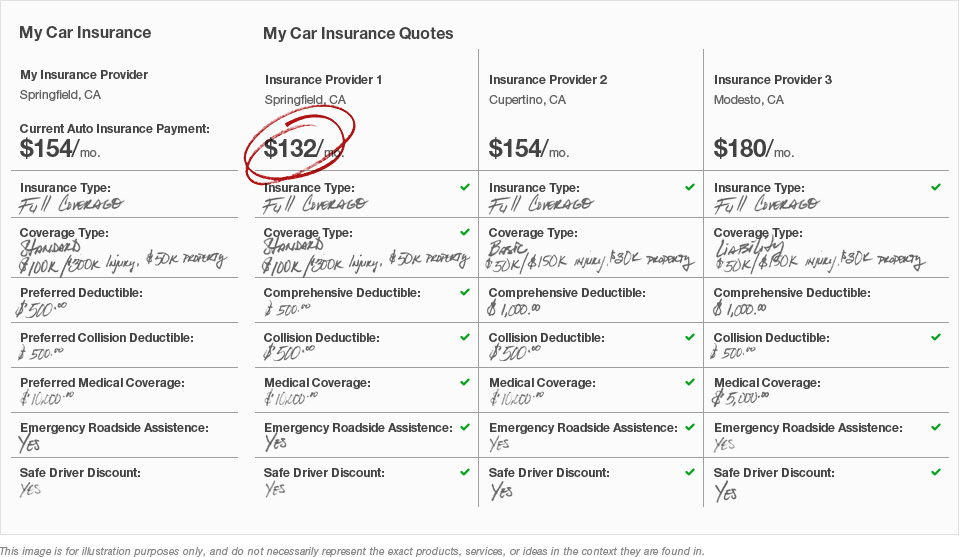

What are some tips for choosing the right auto insurance policy?

+When selecting an auto insurance policy, it’s important to consider your specific needs and budget. Compare quotes from multiple providers, understand the coverage options, and don’t hesitate to ask questions to ensure you’re getting the best value for your money.