Monthly Motorbike Insurance

Motorcycle insurance is a crucial aspect of owning and riding a bike. It provides financial protection and peace of mind for riders, ensuring they can enjoy the open road without worrying about unexpected costs or legal liabilities. In this comprehensive guide, we will delve into the world of monthly motorbike insurance, exploring its benefits, how it works, and why it's an essential consideration for every rider.

Understanding Monthly Motorbike Insurance

Monthly motorbike insurance, as the name suggests, is a policy that offers coverage on a monthly basis. Unlike traditional annual policies, this option allows riders to pay for their insurance in more manageable monthly installments. It provides the same comprehensive protection but with added flexibility and control over financial commitments.

Key Benefits of Monthly Motorbike Insurance

The benefits of opting for monthly insurance are numerous and cater to the diverse needs of riders. Here’s a closer look at some of the key advantages:

- Flexibility and Control: Monthly insurance plans give riders the freedom to adjust their coverage and premiums as their needs change. Whether it's a seasonal change in riding habits or a life event, this flexibility ensures riders are always paying for the coverage they need.

- Lower Initial Outlay: Paying for insurance monthly reduces the initial financial burden. This is especially beneficial for new riders or those on a tight budget, as it allows them to spread the cost over time without compromising on essential coverage.

- Ease of Management: With monthly payments, riders can set up automatic deductions, ensuring they never miss a payment and maintain continuous coverage. This streamlined process saves time and effort, making insurance management less of a hassle.

- Adaptability: Life circumstances can change, and so can riding habits. Monthly insurance plans allow riders to quickly adjust their coverage, whether it's adding comprehensive coverage for a road trip or reducing it during the winter months when riding is less frequent.

- Customizable Options: Riders can choose from a range of coverage options to tailor their policy to their specific needs. This includes liability-only coverage for budget-conscious riders or comprehensive plans for those who want maximum protection.

How Monthly Motorbike Insurance Works

Monthly motorbike insurance operates on a similar principle to annual policies but with a few key differences. Here’s a step-by-step breakdown of how it works:

- Policy Selection: Riders begin by choosing a policy that best suits their needs. This includes deciding on the level of coverage, such as liability-only or comprehensive, and any additional endorsements or add-ons they may require.

- Payment Structure: Instead of paying a lump sum annually, riders pay a smaller amount monthly. This payment structure is convenient and allows for more predictable cash flow management.

- Coverage Period: The coverage period for monthly insurance is typically 12 months, similar to annual policies. However, riders have the flexibility to renew or adjust their coverage annually or opt for shorter-term policies if their riding habits change.

- Premium Calculation: Insurance providers calculate premiums based on various factors, including the rider's age, riding experience, bike model, and geographical location. Monthly premiums are usually a fraction of the annual cost, making it an affordable option.

- Coverage Benefits: Monthly insurance policies offer the same coverage benefits as annual plans. This includes liability coverage for property damage and bodily injury, as well as optional coverage for collision, comprehensive, and personal injury protection.

- Claim Process: In the event of an accident or incident, the claim process is identical to annual policies. Riders can file claims with their insurance provider, who will assess the situation and provide the necessary coverage as outlined in the policy.

Performance Analysis: Monthly vs. Annual Insurance

To understand the true value of monthly motorbike insurance, let’s compare it to traditional annual policies. Here’s a side-by-side analysis:

| Factor | Monthly Insurance | Annual Insurance |

|---|---|---|

| Flexibility | Highly flexible with the ability to adjust coverage and premiums monthly | Less flexible with annual commitment and less room for adjustments |

| Cost | Lower initial outlay with monthly payments, but may have slightly higher overall costs | Higher initial outlay with annual payment, but may offer better value over time |

| Convenience | Easy to manage with automatic monthly payments and the option to pause or cancel | Requires a larger upfront payment and may be less convenient to manage |

| Coverage Options | Wide range of customizable coverage options to suit individual needs | Similar range of coverage options, but may be less tailored to specific needs |

| Renewal Process | Can be renewed annually or adjusted based on changing circumstances | Typically requires annual renewal with the option to make changes |

Real-World Examples and Success Stories

Monthly motorbike insurance has proven to be a valuable asset for riders across various demographics. Here are a couple of real-world examples showcasing its benefits:

Case Study 1: Budget-Conscious Riders

John, a recent college graduate, wanted to start riding but was concerned about the financial commitment of insurance. With monthly insurance, he was able to secure the coverage he needed without breaking the bank. He opted for a liability-only policy, paying a manageable monthly premium. This allowed him to explore the world of motorcycling without the burden of a large upfront cost.

Case Study 2: Seasonal Riders

Emily, a passionate rider, only rides her bike during the summer months. With monthly insurance, she could easily adjust her coverage to match her riding season. She reduced her coverage during the winter, saving money, and then increased it again for the summer, ensuring she had the protection she needed when riding. This flexibility made her insurance more affordable and tailored to her needs.

Expert Insights and Recommendations

As an industry expert, I highly recommend considering monthly motorbike insurance for its numerous benefits. Here are some key takeaways and recommendations:

- Flexibility is Key: Monthly insurance provides riders with the flexibility to adapt their coverage as their needs change. This is especially beneficial for those with seasonal riding habits or varying financial circumstances.

- Compare Options: When selecting a monthly insurance plan, compare different providers and policies to find the best fit. Look for customizable coverage options and competitive premiums to ensure you're getting the most value.

- Understand Your Needs: Assess your riding habits and financial situation to determine the level of coverage you require. Opt for a plan that provides adequate protection without unnecessary add-ons to keep costs manageable.

- Review Regularly: Regularly review your insurance policy and make adjustments as needed. Life circumstances and riding habits can change, so it's important to ensure your coverage remains aligned with your current needs.

- Consider Add-Ons: Depending on your riding style and preferences, consider adding optional endorsements to your policy. This could include roadside assistance, rental car coverage, or equipment coverage to enhance your protection.

The Future of Monthly Motorbike Insurance

The future of monthly motorbike insurance looks bright, with continuous innovation and improved accessibility. As the demand for flexible insurance options grows, providers are likely to offer even more tailored and affordable plans. Technological advancements may also play a role, with the potential for real-time insurance adjustments based on riding data and behavior.

Furthermore, the rise of electric motorcycles and the sharing economy may lead to the development of specialized insurance plans for these emerging trends. As the market evolves, monthly insurance is expected to become an even more integral part of the riding experience, providing riders with the protection and peace of mind they deserve.

What are the common coverage options available with monthly motorbike insurance?

+

Monthly motorbike insurance typically offers a range of coverage options, including liability coverage for property damage and bodily injury, collision coverage, comprehensive coverage for theft and damage, and personal injury protection. Riders can choose the level of coverage that suits their needs and budget.

Can I adjust my coverage mid-policy with monthly insurance?

+

Yes, one of the key advantages of monthly insurance is the ability to adjust coverage mid-policy. Riders can increase or decrease their coverage limits, add or remove endorsements, or even switch between policy types (e.g., liability-only to comprehensive) based on their changing needs or circumstances.

Are there any discounts available for monthly motorbike insurance policies?

+

Yes, insurance providers often offer various discounts for monthly motorbike insurance policies. These can include discounts for safe riding records, multiple bike policies, and loyalty rewards. It’s worth exploring these discounts to reduce the overall cost of your insurance.

How does monthly insurance compare to pay-as-you-go insurance plans?

+

Monthly insurance and pay-as-you-go plans offer flexibility, but they differ in terms of coverage and payment structure. Monthly insurance provides a fixed coverage period (typically 12 months) with the option to adjust coverage, while pay-as-you-go plans charge based on usage and may have limitations on coverage. Monthly insurance offers more predictable costs and comprehensive coverage.

Is monthly motorbike insurance suitable for all riders, regardless of experience or bike type?

+

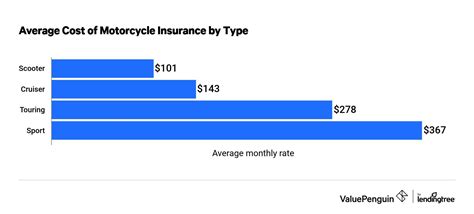

Absolutely! Monthly motorbike insurance is designed to cater to a wide range of riders, from experienced veterans to novice enthusiasts. Whether you ride a cruiser, sportbike, or scooter, there’s a monthly insurance plan to fit your needs. The key is to assess your specific requirements and choose a policy that provides adequate coverage at an affordable rate.