Low Cost Insurance

In today's world, financial security and peace of mind are essential, and insurance plays a pivotal role in safeguarding our assets and well-being. However, the cost of insurance coverage can often be a significant concern, especially for those on a tight budget. The quest for low-cost insurance has become a common challenge, prompting many to explore innovative solutions and make informed decisions to secure adequate protection without breaking the bank. This article delves into the strategies, insights, and practical approaches to obtaining affordable insurance coverage, offering a comprehensive guide for anyone seeking to balance their financial obligations with necessary insurance policies.

Navigating the Landscape of Low-Cost Insurance

The insurance market is diverse, offering a range of options tailored to meet various needs. For those seeking affordable coverage, understanding the landscape and leveraging the right strategies can make a significant difference. Here, we explore the key aspects and expert tips to navigate the world of low-cost insurance.

Comparing Quotes: The Power of Competition

One of the most effective ways to secure low-cost insurance is by leveraging the power of competition. Obtaining multiple quotes from different insurance providers allows you to compare prices and coverage options. Online comparison tools and websites can streamline this process, making it easier to find the best deals. Remember, quotes can vary significantly between providers, so it’s crucial to shop around and negotiate for the best rates.

For instance, consider the case of John, a young professional seeking affordable car insurance. By using an online comparison platform, he was able to secure a quote that was 20% lower than his current provider, saving him a significant amount annually. This example underscores the importance of comparing quotes and highlights the potential savings that can be achieved.

Understanding Coverage Options and Personalized Needs

While keeping costs low is a priority, it’s equally important to ensure that the insurance coverage meets your specific needs. Different policies offer varying levels of protection, and understanding these nuances is crucial. For instance, health insurance policies may differ in terms of deductibles, co-pays, and covered services. By assessing your personal circumstances and future needs, you can make informed choices and avoid unnecessary expenses.

Let's take the example of Sarah, a freelance writer with a variable income. She chose a health insurance plan with a higher deductible but lower monthly premiums, aligning with her budget and the likelihood of fewer healthcare expenses. This strategy allowed her to maintain affordable coverage while still having access to essential medical services.

| Coverage Type | Average Cost |

|---|---|

| Auto Insurance | $1000 - $2000 annually |

| Health Insurance | $5000 - $10,000 annually |

| Homeowners Insurance | $500 - $1500 annually |

Bundling Policies for Cost-Effectiveness

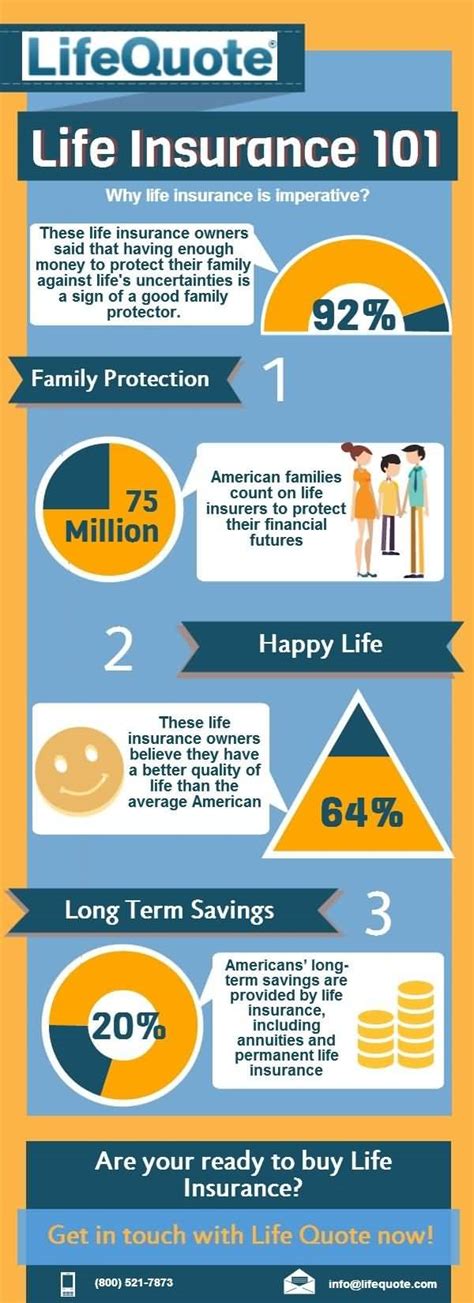

Many insurance providers offer discounts when you bundle multiple policies with them. For instance, purchasing both home and auto insurance from the same company can result in significant savings. This strategy is particularly beneficial for those who own multiple assets or have various insurance needs. By bundling, you not only simplify your insurance management but also enjoy the cost advantages that come with loyalty.

Imagine a family that owns a home and multiple vehicles. By bundling their home, auto, and even life insurance policies with a single provider, they can negotiate better rates and potentially save thousands of dollars annually. This approach ensures comprehensive coverage while keeping costs manageable.

Leveraging Discounts and Rewards Programs

Insurance providers often offer discounts and rewards as incentives to attract and retain customers. These can include discounts for safe driving records, loyalty rewards for long-term customers, or even discounts for certain professions or affiliations. By researching and understanding the available discounts, you can take advantage of these opportunities to reduce your insurance costs.

For example, many insurance companies offer discounts to customers who install security systems in their homes or vehicles. By investing in such systems, not only do you enhance your safety but also qualify for potential insurance discounts, making it a win-win situation.

Expert Strategies for Affordable Insurance

Securing low-cost insurance is not just about finding the cheapest policy; it’s about making informed decisions that balance coverage and cost. Here, we delve into expert strategies and industry insights to help you navigate the insurance landscape effectively.

The Role of Deductibles and Premiums

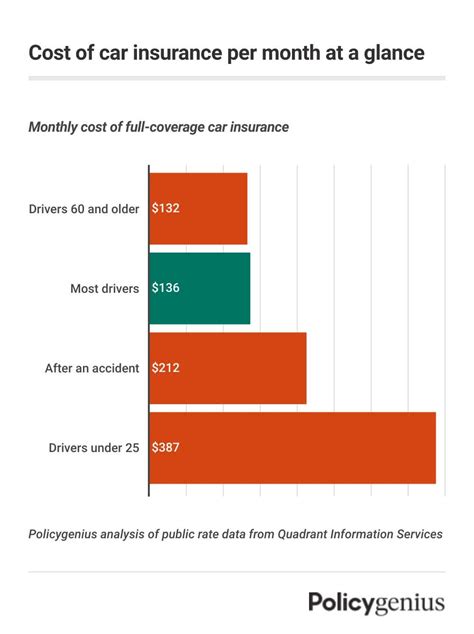

Understanding the relationship between deductibles and premiums is crucial when seeking affordable insurance. In general, policies with higher deductibles often have lower premiums, and vice versa. This trade-off allows you to tailor your insurance coverage to your specific needs and budget. For instance, if you’re a safe driver with a clean record, opting for a higher deductible and lower premium can be a strategic choice.

However, it's essential to consider the potential out-of-pocket expenses that come with higher deductibles. Weighing the risks and benefits of this approach is key to making an informed decision. Consult with insurance experts or agents to understand how deductibles and premiums align with your financial goals and risk tolerance.

Exploring Alternative Insurance Options

The traditional insurance market isn’t the only option available. Exploring alternative insurance providers and models can open up new avenues for cost-effective coverage. For instance, peer-to-peer insurance models, where a group of individuals shares the risk and cost of insurance, can offer unique and affordable solutions.

Additionally, consider exploring insurance providers that specialize in certain niches or demographics. These providers may offer tailored policies and pricing structures that better align with your needs and budget. By researching and comparing these alternatives, you can discover innovative ways to secure the coverage you need without compromising on cost.

The Impact of Credit Score on Insurance Costs

Did you know that your credit score can influence the cost of your insurance premiums? Many insurance providers use credit-based insurance scores to assess the risk associated with insuring a particular individual or property. A higher credit score can lead to lower premiums, as it indicates a lower risk of potential claims. Therefore, maintaining a good credit score can be a strategic way to reduce your insurance costs.

Take the case of Mark, who improved his credit score by paying off debts and managing his credit responsibly. As a result, when he renewed his insurance policies, he qualified for lower premiums, saving him a substantial amount annually. This example highlights the indirect but significant impact of credit score on insurance costs.

Real-World Success Stories: Navigating Low-Cost Insurance

Real-life experiences and success stories can provide valuable insights and inspiration when it comes to securing low-cost insurance. Here, we share a few anecdotes and strategies employed by individuals who have successfully navigated the insurance landscape on a budget.

The Power of Negotiation and Relationship Building

Building a relationship with your insurance agent or provider can be a powerful strategy for securing affordable insurance. Many agents have the flexibility to offer discounts or negotiate better rates, especially for loyal customers. By establishing a rapport and regularly communicating your needs, you can potentially unlock cost-saving opportunities.

For instance, consider the story of Emily, a small business owner. By fostering a strong relationship with her insurance agent, she was able to negotiate a customized policy that met her specific business needs at a competitive rate. This personalized approach allowed her to secure the coverage she required without paying for unnecessary extras.

Leveraging Technology for Cost-Effective Solutions

The rise of technology and digital platforms has revolutionized the insurance industry, offering new avenues for cost-effective coverage. Online insurance providers and comparison websites have made it easier than ever to compare quotes, understand policies, and secure the best deals. Additionally, many insurance companies now offer apps and digital tools that simplify policy management and provide real-time updates, enhancing the overall experience and potentially reducing costs.

One such example is the use of telematics devices in auto insurance. These devices track driving behavior and can provide data to insurance companies, allowing them to offer personalized rates based on safe driving habits. By adopting these technologies, drivers can not only improve their driving skills but also potentially reduce their insurance costs.

The Role of Education and Awareness

Education and awareness play a crucial role in securing low-cost insurance. Understanding the insurance market, your rights as a consumer, and the various options available empowers you to make informed decisions. By staying informed about industry trends, changes in regulations, and new products, you can identify opportunities to save on insurance costs.

Consider attending insurance workshops, reading industry publications, or engaging with online communities focused on insurance. These resources can provide valuable insights, tips, and strategies to help you navigate the insurance landscape effectively and secure the best deals.

Future Trends: The Evolution of Low-Cost Insurance

The insurance industry is constantly evolving, and new trends and technologies are shaping the future of low-cost insurance. Here, we explore some of the emerging trends and their potential impact on the availability and affordability of insurance coverage.

The Rise of Insurtech and Digital Transformation

The integration of technology and insurance, known as Insurtech, is revolutionizing the industry. Digital platforms, AI, and data analytics are enhancing the efficiency and accessibility of insurance services. From streamlined online applications to personalized risk assessments, Insurtech is making insurance more affordable and accessible to a wider audience.

For instance, the use of AI in underwriting processes allows insurance companies to quickly assess risk and offer tailored policies at competitive rates. Additionally, the rise of digital insurance providers offers new, cost-effective options for consumers, disrupting the traditional insurance market and driving down prices.

Predictive Analytics and Risk Assessment

Advanced data analytics and predictive modeling are transforming the way insurance companies assess risk. By analyzing vast amounts of data, insurance providers can identify patterns and trends, allowing them to offer more accurate and personalized policies. This approach not only improves the accuracy of risk assessment but also has the potential to reduce costs for consumers.

For example, in the health insurance sector, predictive analytics can identify individuals at risk of developing certain conditions and offer tailored prevention programs. This proactive approach not only improves health outcomes but also reduces the likelihood of costly claims, benefiting both the insured and the insurance provider.

The Impact of Regulatory Changes

Regulatory changes and reforms can have a significant impact on the insurance industry, affecting the availability and cost of coverage. For instance, reforms aimed at increasing competition or standardizing insurance practices can drive down prices and improve consumer protection. On the other hand, regulatory hurdles or changes in tax policies can increase costs for insurance providers, which may be passed on to consumers.

Staying informed about regulatory changes and their potential impact is crucial for consumers. Understanding how these changes affect the insurance landscape can help you anticipate and navigate potential shifts in coverage and costs.

Conclusion: Securing Your Future with Low-Cost Insurance

The quest for low-cost insurance is a journey that requires careful consideration, research, and strategic decision-making. By understanding the insurance landscape, leveraging expert strategies, and staying informed about emerging trends, you can secure the coverage you need without compromising your financial goals.

Remember, insurance is a vital tool for financial security and risk management. By adopting a proactive approach and exploring innovative solutions, you can navigate the insurance market with confidence, ensuring that you and your assets are protected at a price that fits your budget. Stay informed, compare quotes, and embrace the evolving world of insurance to secure your future with low-cost coverage.

How often should I review my insurance policies to ensure I’m getting the best rates?

+It’s recommended to review your insurance policies annually or whenever your circumstances change significantly. This ensures that your coverage remains up-to-date and that you’re not paying for unnecessary extras.

Can I negotiate with my insurance provider to get better rates?

+Absolutely! Many insurance providers are open to negotiation, especially if you’ve been a loyal customer. Don’t be afraid to discuss your needs and inquire about potential discounts or customized policies.

Are there any potential drawbacks to choosing policies with higher deductibles and lower premiums?

+While higher deductibles can lead to lower premiums, it’s important to consider your financial situation and the potential out-of-pocket expenses. If you’re unable to cover the higher deductible in the event of a claim, it may not be the best option. Assess your risk tolerance and financial stability before making a decision.

How can I stay informed about changes in the insurance industry and potential cost-saving opportunities?

+Staying informed is key. Subscribe to insurance newsletters, follow industry publications, and engage with online communities focused on insurance. These resources can provide valuable insights and keep you updated on the latest trends and cost-saving strategies.