Low Price Homeowners Insurance

Securing your home with affordable homeowners insurance is a smart financial move, especially in today's economy. With the right coverage, you can protect your most valuable asset without breaking the bank. In this article, we will delve into the world of low-price homeowners insurance, exploring the key factors that influence premiums, strategies to reduce costs, and tips to ensure you get the best value for your money.

Understanding the Fundamentals of Homeowners Insurance

Homeowners insurance is a crucial financial safeguard, providing coverage for your home, personal belongings, and liability. It offers peace of mind, ensuring you’re protected against unforeseen events like natural disasters, theft, or accidents. Understanding the basics is essential to make informed decisions and find the right coverage at the right price.

Here's a breakdown of the key components of homeowners insurance:

- Dwelling Coverage: This covers the physical structure of your home, including repairs or rebuilding costs in case of damage.

- Personal Property Coverage: It safeguards your belongings against theft, damage, or loss, ensuring you're reimbursed for their value.

- Liability Coverage: A vital aspect, it protects you from lawsuits if someone is injured on your property or if your actions cause damage to others.

- Additional Living Expenses: In case of a disaster rendering your home uninhabitable, this coverage helps cover temporary living expenses.

- Medical Payments: This coverage provides for medical expenses if someone is injured on your property, regardless of fault.

Each of these components can be customized based on your specific needs and budget. By understanding these fundamentals, you can tailor your homeowners insurance policy to suit your requirements without overspending.

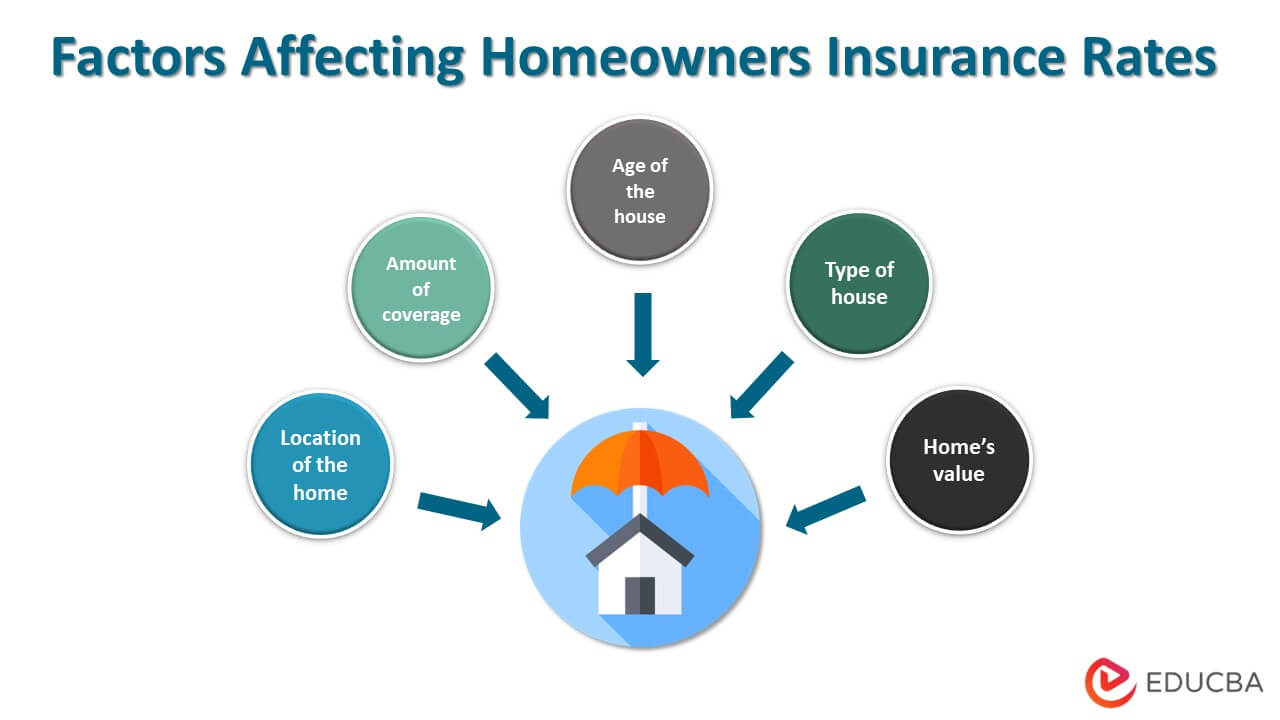

Factors Influencing Homeowners Insurance Premiums

The cost of homeowners insurance varies significantly based on a multitude of factors. Understanding these influences can help you make informed decisions to secure the best coverage at the lowest price.

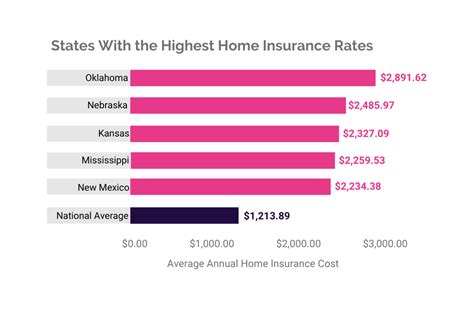

Location and Risk Factors

Your geographical location plays a significant role in determining your insurance premium. Areas prone to natural disasters like hurricanes, earthquakes, or floods generally have higher insurance costs. Additionally, crime rates and the prevalence of local hazards like wildfires or severe weather events can impact premiums.

For instance, a coastal home in a hurricane-prone region will likely have higher insurance costs compared to an inland home. Similarly, homes in high-crime areas or those near wildfire-prone forests may face increased insurance premiums.

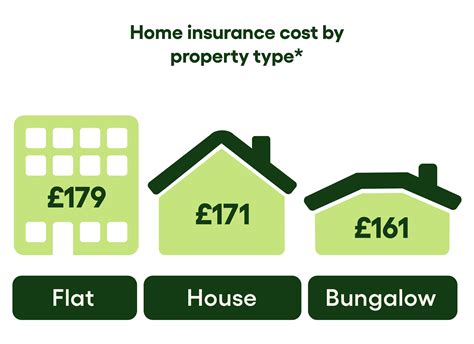

Home Value and Replacement Cost

The value of your home and its replacement cost are crucial factors in determining insurance premiums. Generally, higher-value homes with more expensive building materials and finishes will have higher insurance costs. This is because the insurance company needs to cover the cost of rebuilding or repairing the home to its original condition.

Policy Coverage and Deductibles

The level of coverage you choose and the associated deductibles also impact your insurance premium. Higher coverage limits and lower deductibles typically result in higher premiums. Conversely, opting for lower coverage limits and higher deductibles can reduce your monthly payments but may leave you exposed to higher out-of-pocket expenses in the event of a claim.

Home’s Age and Condition

The age and condition of your home can affect insurance costs. Older homes may have outdated wiring, plumbing, or roofing, which can increase the risk of damage and subsequent insurance claims. Regular maintenance and updates can help mitigate these risks and potentially lower insurance premiums.

Credit Score and Claims History

Your credit score and claims history are often considered by insurance providers. A higher credit score can lead to lower insurance premiums, as it is seen as an indicator of financial responsibility. Additionally, a history of frequent or large claims can result in higher premiums or even policy cancellations.

Strategies to Reduce Homeowners Insurance Costs

While insurance premiums are influenced by various factors, there are strategies you can employ to reduce costs and secure low-price homeowners insurance.

Shop Around and Compare Quotes

One of the most effective ways to find low-price homeowners insurance is to compare quotes from multiple providers. Insurance rates can vary significantly between companies, so getting quotes from at least three insurers is recommended. Online quote comparison tools can make this process quicker and easier.

Bundle Policies for Discounts

Bundling your homeowners insurance with other policies, such as auto insurance, can often lead to significant discounts. Insurance providers typically offer multi-policy discounts to encourage customers to use their services for multiple needs. This strategy can result in substantial savings on your insurance premiums.

Increase Your Deductible

Opting for a higher deductible can reduce your insurance premiums. A deductible is the amount you agree to pay out-of-pocket before your insurance coverage kicks in. By choosing a higher deductible, you take on more financial responsibility, which can lead to lower insurance costs. However, it’s important to ensure you can afford the higher deductible in the event of a claim.

Make Your Home More Secure

Installing security systems, fire alarms, and sprinkler systems can reduce the risk of theft and fire damage, leading to lower insurance premiums. Additionally, ensuring your home has modern safety features like smoke detectors, carbon monoxide detectors, and fire-resistant materials can make it more resilient and potentially reduce insurance costs.

Review and Adjust Coverage Annually

Regularly reviewing your insurance coverage and making necessary adjustments can help you stay protected while keeping costs down. As your life and circumstances change, so might your insurance needs. For instance, if you’ve made significant home improvements or acquired valuable new possessions, you may need to increase your coverage limits. Conversely, if your home’s value has decreased, you may be able to reduce your coverage and save on premiums.

Finding the Right Balance: Value vs. Cost

When seeking low-price homeowners insurance, it’s crucial to strike a balance between value and cost. While reducing insurance premiums is important, ensuring you have adequate coverage is paramount. Here are some considerations to help you find the right balance:

Assess Your Risk Profile

Understanding your risk profile is essential in determining the appropriate level of insurance coverage. Consider factors like your home’s location, its age and condition, and any specific vulnerabilities it may have. For instance, if you live in an area prone to natural disasters, you may need to prioritize comprehensive coverage over cost savings.

Consider Actual Cash Value vs. Replacement Cost

When choosing homeowners insurance, you’ll typically have the option to select between actual cash value (ACV) and replacement cost coverage. ACV covers the cost of replacing your belongings minus depreciation, while replacement cost covers the full cost of replacing your belongings without deducting for depreciation. While ACV coverage is generally cheaper, it may not fully cover the cost of replacing your belongings, especially if they’re older or have significantly depreciated.

Tailor Your Coverage to Your Needs

Not all homeowners insurance policies are created equal. Different providers offer various coverage options and add-ons. Tailor your policy to your specific needs and circumstances. For instance, if you have high-value items like jewelry or artwork, you may need to purchase additional coverage or endorsements to ensure they’re adequately protected.

Understand Policy Exclusions

Before purchasing a homeowners insurance policy, carefully review the exclusions. Insurance policies often exclude coverage for certain types of damage or losses. For example, many standard policies don’t cover flood damage, so if you live in a flood-prone area, you may need to purchase separate flood insurance. Understanding these exclusions can help you make informed decisions and avoid unexpected gaps in coverage.

The Future of Homeowners Insurance: Trends and Innovations

The homeowners insurance industry is evolving, driven by technological advancements and changing consumer needs. Here are some trends and innovations shaping the future of homeowners insurance:

Digitalization and Automation

The insurance industry is increasingly embracing digital technologies to streamline processes and enhance customer experiences. Online quote comparison tools, digital claim filing, and policy management platforms are becoming more prevalent, making it easier and faster for consumers to obtain insurance and manage their policies.

Telematics and Usage-Based Insurance

Usage-based insurance, also known as telematics, is gaining traction in the homeowners insurance sector. This approach uses sensors and technology to monitor and assess a home’s risk profile in real-time. By collecting data on factors like occupancy patterns, energy usage, and even weather conditions, insurers can offer more tailored and potentially lower-cost insurance policies.

Artificial Intelligence and Machine Learning

Artificial intelligence (AI) and machine learning (ML) are revolutionizing the insurance industry. These technologies are being used to analyze vast amounts of data, identify patterns, and make more accurate predictions about risk. This can lead to more precise pricing and coverage options, benefiting both insurers and policyholders.

Sustainability and Green Initiatives

With growing environmental concerns, the insurance industry is increasingly focusing on sustainability and green initiatives. Some insurers are offering discounts or incentives for policyholders who adopt energy-efficient measures or implement sustainable practices in their homes. This trend not only benefits the environment but can also lead to reduced insurance costs for policyholders.

Expert Insights and Tips

Here are some expert insights and tips to help you navigate the world of low-price homeowners insurance:

💡 Tip 1: Review Your Policy Regularly

Insurance needs can change over time. Regularly review your policy to ensure it aligns with your current circumstances and coverage needs. This simple step can help you avoid paying for unnecessary coverage or missing out on crucial protections.

💡 Tip 2: Maintain a Good Credit Score

Your credit score is a significant factor in determining your insurance premiums. Maintaining a good credit score can lead to lower insurance costs. If you have a less-than-perfect credit score, consider taking steps to improve it, such as paying bills on time and reducing your overall debt.

💡 Tip 3: Consider Increasing Your Deductible

While it's important to have a deductible you can afford, increasing your deductible can lead to significant savings on your insurance premiums. Just ensure you have sufficient savings to cover the increased deductible in the event of a claim.

💡 Tip 4: Shop Around for the Best Deal

Don't settle for the first insurance quote you receive. Shop around and compare quotes from multiple insurers. Online comparison tools can make this process quicker and easier, helping you find the best deal for your specific needs.

💡 Tip 5: Bundle Policies for Discounts

Bundling your homeowners insurance with other policies, such as auto insurance, can lead to substantial discounts. This strategy not only saves you money but also simplifies your insurance management, as you'll have just one provider to deal with.

Conclusion: Securing Affordable Protection for Your Home

Securing low-price homeowners insurance is about finding the right balance between coverage and cost. By understanding the factors that influence premiums, implementing cost-saving strategies, and staying informed about industry trends, you can protect your home without straining your budget. Remember, your home is one of your most valuable assets, so ensuring it’s adequately protected is essential.

Whether you're a first-time homeowner or looking to review your existing insurance coverage, taking the time to explore your options and make informed decisions can lead to significant savings and peace of mind. With the right approach and a bit of research, you can find the perfect balance of value and cost in your homeowners insurance.

How often should I review my homeowners insurance policy?

+It’s recommended to review your policy annually or whenever your circumstances change significantly. This ensures your coverage remains up-to-date and adequately protects your assets.

Can I save money on homeowners insurance by choosing a higher deductible?

+Yes, choosing a higher deductible can lead to lower insurance premiums. However, ensure you have sufficient savings to cover the increased deductible in the event of a claim.

What factors can increase my homeowners insurance premiums?

+Several factors can influence premiums, including your location, the age and condition of your home, your credit score, and your claims history. Additionally, choosing higher coverage limits and lower deductibles can result in higher premiums.

Are there any discounts available for homeowners insurance?

+Yes, many insurers offer discounts for bundling policies, installing security systems, or adopting energy-efficient measures. It’s worth exploring these options to potentially save on your insurance premiums.