Major Auto Insurance Companies In Usa

In the vast landscape of the United States, the auto insurance industry plays a crucial role in safeguarding millions of drivers and their vehicles. With a diverse range of insurance providers offering various coverage options, understanding the major players in this market is essential for consumers seeking reliable protection. This article aims to delve into the world of auto insurance, shedding light on the key companies that dominate the US market and the unique features they bring to the table.

A Glimpse into the Competitive Auto Insurance Landscape

The US auto insurance market is characterized by a mix of well-established, nationwide insurers and regional providers that cater to specific geographic areas. These companies offer a wide array of coverage plans, from comprehensive policies that cover a broad range of risks to more tailored options designed for specific driver profiles. As we explore the major players, we’ll uncover the unique selling points and services that set each company apart.

Top Players in the US Auto Insurance Market

When it comes to auto insurance, a few names consistently emerge as industry leaders. These companies have built a solid reputation over the years, gaining the trust of millions of American drivers. Let’s take a closer look at some of the major auto insurance providers in the US:

State Farm

State Farm stands as one of the most prominent names in the auto insurance industry, with a rich history spanning over 90 years. Known for its commitment to customer service, the company offers a wide range of insurance products, including auto, home, life, and health insurance. State Farm’s extensive network of local agents provides personalized assistance, making it a preferred choice for many drivers across the nation.

Key Features:

- Offers competitive rates and discounts for safe driving and bundling policies.

- Provides 24⁄7 customer support and claims assistance.

- Known for its driver education programs and community involvement.

Geico

Geico, an acronym for Government Employees Insurance Company, has become a household name in the auto insurance industry. With a focus on digital innovation and direct-to-consumer sales, Geico has captured a significant market share. The company’s online platform and mobile app offer a seamless experience, allowing customers to manage their policies with ease.

Key Features:

- Offers some of the lowest insurance rates in the market.

- Provides a wide range of discounts, including those for military personnel and safe drivers.

- Known for its innovative advertising campaigns and online resources.

Progressive

Progressive has established itself as a forward-thinking auto insurance provider, offering innovative solutions and a customer-centric approach. The company’s Snapshot program, for instance, uses telematics technology to monitor driving behavior, rewarding safe drivers with lower premiums. Progressive also provides a range of additional services, such as roadside assistance and gap coverage.

Key Features:

- Offers the Snapshot program for potential premium discounts.

- Provides comprehensive coverage options and customizable policies.

- Known for its commitment to customer satisfaction and claims handling.

Allstate

Allstate is another prominent player in the US auto insurance market, offering a wide array of coverage options and additional services. The company’s “You’re In Good Hands” slogan reflects its commitment to providing excellent customer service and comprehensive protection. Allstate’s agents are known for their expertise and ability to tailor policies to individual needs.

Key Features:

- Offers a range of discounts, including those for safe driving and loyalty.

- Provides optional coverage add-ons, such as rental car reimbursement and accident forgiveness.

- Known for its innovative advertising campaigns and community initiatives.

USAA

USAA is a unique auto insurance provider, as it exclusively serves active-duty military personnel, veterans, and their families. With a strong focus on customer service and a deep understanding of the military community’s needs, USAA has earned a reputation for excellence. The company offers competitive rates and a range of additional benefits specifically tailored to military life.

Key Features:

- Offers highly competitive rates and extensive discounts for military personnel.

- Provides specialized coverage options, such as deployment travel insurance and rental car coverage.

- Known for its exceptional customer service and commitment to the military community.

Liberty Mutual

Liberty Mutual is a well-established auto insurance provider with a strong presence across the US. The company offers a comprehensive range of insurance products, including auto, home, and life insurance. Liberty Mutual’s focus on innovation and customer experience has helped it become a trusted choice for many drivers.

Key Features:

- Offers a range of discounts, including those for safe driving and bundling policies.

- Provides 24⁄7 claims support and a dedicated mobile app for policy management.

- Known for its commitment to sustainability and community initiatives.

Farmers Insurance

Farmers Insurance is a prominent provider in the auto insurance market, known for its personalized approach and community focus. The company offers a range of insurance products, including auto, home, and business insurance. Farmers Insurance’s local agents are dedicated to providing tailored coverage solutions and excellent customer service.

Key Features:

- Offers competitive rates and discounts for safe driving and loyalty.

- Provides optional coverage add-ons, such as rental car coverage and accident forgiveness.

- Known for its community involvement and support for local initiatives.

Nationwide

Nationwide is a leading auto insurance provider with a nationwide presence. The company offers a comprehensive suite of insurance products, including auto, home, and life insurance. Nationwide’s focus on innovation and customer satisfaction has helped it become a trusted choice for many Americans.

Key Features:

- Offers a range of discounts, including those for safe driving, bundling policies, and loyalty.

- Provides 24⁄7 claims support and a dedicated customer service team.

- Known for its commitment to diversity and inclusion initiatives.

Comparative Analysis: Understanding the Unique Offerings

As we’ve explored the major auto insurance companies in the US, it’s evident that each provider brings its own set of unique features and services. Whether it’s State Farm’s extensive network of local agents, Geico’s focus on digital innovation, or Progressive’s innovative Snapshot program, these companies have carved out distinct niches in the market.

When choosing an auto insurance provider, it’s essential to consider your specific needs and preferences. Factors such as coverage options, discounts, customer service, and technological innovations should all play a role in your decision-making process. By understanding the unique offerings of each company, you can make an informed choice that best aligns with your driving habits and insurance requirements.

Future Trends and Innovations in Auto Insurance

The auto insurance industry is constantly evolving, with new technologies and trends shaping the future of coverage. As we move forward, here are some key trends and innovations to watch out for:

Telematics and Usage-Based Insurance

Telematics technology, which tracks driving behavior and habits, is gaining traction in the auto insurance industry. Usage-based insurance programs, like Progressive’s Snapshot, reward safe drivers with lower premiums. As this technology advances, we can expect more insurers to adopt similar programs, offering drivers more control over their insurance costs.

Digital Transformation and Online Services

The shift towards digital platforms and online services is a prominent trend in the insurance industry. Companies like Geico have already established strong online presences, offering seamless policy management and claims processes. As technology continues to evolve, we can anticipate further enhancements in online customer experiences, making insurance services more accessible and convenient.

Personalized Coverage and Add-Ons

Insurance providers are increasingly recognizing the importance of personalized coverage options. Companies like Allstate and Farmers Insurance offer a range of add-ons and customization options, allowing drivers to tailor their policies to their specific needs. From rental car coverage to accident forgiveness, these additional services provide enhanced protection and peace of mind.

Sustainability and Social Responsibility

With growing awareness of environmental and social issues, insurance companies are beginning to embrace sustainability and social responsibility initiatives. Providers like Liberty Mutual and Nationwide are taking steps to reduce their environmental impact and support community initiatives. This trend is likely to continue, with more insurers incorporating sustainability practices into their operations.

Conclusion

The US auto insurance market is a competitive and dynamic space, with major players constantly innovating to meet the evolving needs of drivers. Whether it’s through technological advancements, personalized coverage options, or a focus on community and sustainability, these companies are dedicated to providing comprehensive protection and exceptional customer experiences. As a consumer, understanding the unique offerings of each provider empowers you to make informed decisions and choose the insurance company that best suits your needs.

How do I choose the right auto insurance company for my needs?

+

When selecting an auto insurance company, consider your specific needs and preferences. Research and compare coverage options, discounts, customer service, and technological innovations offered by different providers. Look for a company that aligns with your driving habits and provides the level of protection you require.

What are some common discounts offered by auto insurance companies?

+

Common discounts offered by auto insurance companies include safe driving discounts, loyalty discounts for long-term customers, bundling discounts for multiple policies, and discounts for specific professions or memberships. These discounts can significantly reduce your insurance premiums, so it’s worth exploring your eligibility.

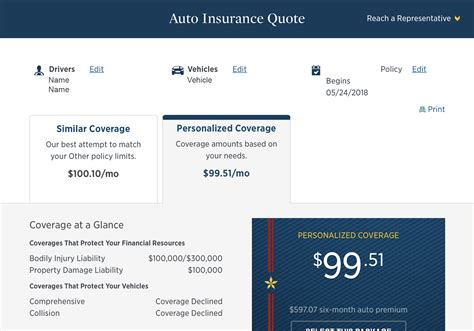

How can I compare insurance quotes from different providers?

+

To compare insurance quotes, you can use online comparison tools or directly visit the websites of major insurance providers. Provide your personal and vehicle information to receive personalized quotes. Compare the coverage options, premiums, and additional benefits offered by each provider to find the best fit for your needs.

What should I consider when filing an auto insurance claim?

+

When filing an auto insurance claim, ensure you have all the necessary documentation, including accident reports, photos, and contact information for any involved parties. Contact your insurance provider promptly and follow their claims process. Be prepared to provide detailed information about the incident and cooperate with the claims adjuster to ensure a smooth resolution.

Are there any emerging trends in auto insurance that I should be aware of?

+

Yes, there are several emerging trends in auto insurance. Telematics and usage-based insurance programs are gaining popularity, offering potential premium discounts based on driving behavior. Additionally, the shift towards digital platforms and personalized coverage options is shaping the future of the industry. Stay informed about these trends to make the most of your insurance experience.