Marketplace Insurance Arkansas

Arkansas, a state nestled in the heart of the United States, boasts a diverse landscape ranging from the lush Ozark Mountains to the vast Mississippi River Delta. Amidst this picturesque backdrop, the insurance landscape, particularly within the Marketplace, plays a pivotal role in safeguarding the well-being of its residents. This comprehensive guide delves into the intricacies of Marketplace Insurance Arkansas, shedding light on its significance, functionality, and the impact it has on the lives of Arkansans.

Understanding Marketplace Insurance in Arkansas

The Health Insurance Marketplace, commonly referred to as Marketplace, is a platform designed to facilitate the procurement of health insurance coverage. It serves as a centralized hub, offering a range of insurance plans from various providers, thereby empowering individuals and families to make informed choices regarding their healthcare coverage. In Arkansas, the Marketplace assumes a critical role, catering to the diverse healthcare needs of its residents and ensuring accessibility to quality insurance options.

The inception of the Marketplace in Arkansas can be traced back to the implementation of the Affordable Care Act (ACA), which revolutionized the healthcare industry by introducing a more inclusive and affordable approach to insurance coverage. Since its establishment, the Marketplace has evolved, adapting to the dynamic nature of healthcare demands and the evolving insurance landscape.

Eligibility and Enrollment

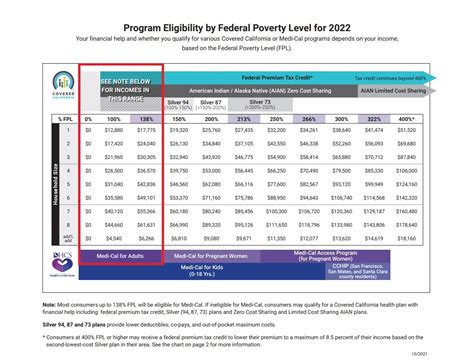

Understanding the eligibility criteria for Marketplace insurance is paramount for Arkansans seeking coverage. The Marketplace is open to individuals and families who meet specific requirements, primarily related to income and residency. Generally, individuals with an annual household income falling between 100% and 400% of the Federal Poverty Level (FPL) are eligible for premium tax credits, reducing the cost of insurance plans. However, it's crucial to note that eligibility criteria can vary based on factors such as age, family size, and specific healthcare needs.

The enrollment process for Marketplace insurance is straightforward and can be completed online, over the phone, or in-person with the assistance of trained navigators. Open Enrollment Period, typically spanning a few months each year, is the designated time for individuals to select and enroll in insurance plans. Outside of this period, special enrollment periods may be available for qualifying life events, such as marriage, birth of a child, or loss of other health coverage.

| Eligibility Factor | Details |

|---|---|

| Income | Household income between 100% and 400% of FPL qualifies for premium tax credits. |

| Residency | Arkansas residents are eligible for Marketplace insurance plans. |

| Life Events | Qualifying life events trigger special enrollment periods outside the Open Enrollment Period. |

Insurance Plan Options

The Marketplace in Arkansas offers a diverse range of insurance plans, catering to the unique needs of its residents. These plans can be categorized into Metal Plans (e.g., Bronze, Silver, Gold, and Platinum) and Catastrophic Plans. Metal Plans are named for their metal designations and vary in terms of premiums and out-of-pocket costs, with Bronze plans typically having lower premiums and higher out-of-pocket costs, while Platinum plans offer the opposite.

Catastrophic Plans, on the other hand, are designed for individuals under 30 or those with a hardship exemption, providing a more affordable option with lower premiums and higher deductibles. It's essential for Arkansans to carefully evaluate their healthcare needs and financial capabilities to choose the plan that best suits their circumstances.

| Plan Type | Details |

|---|---|

| Metal Plans | Varied options with different premium and out-of-pocket cost structures. |

| Catastrophic Plans | Affordable option for individuals under 30 or with hardship exemptions. |

The Impact of Marketplace Insurance in Arkansas

The introduction and growth of Marketplace insurance in Arkansas have had a profound impact on the state's healthcare landscape, influencing accessibility, affordability, and the overall well-being of its residents.

Increased Access to Healthcare

One of the most significant impacts of Marketplace insurance in Arkansas is the increased accessibility to healthcare services. The Marketplace has provided a platform for individuals and families, particularly those with low to moderate incomes, to obtain affordable health insurance coverage. This has resulted in a reduction in the number of uninsured individuals, ensuring more Arkansans can access necessary medical care without financial barriers.

Furthermore, the Marketplace has played a pivotal role in promoting preventative healthcare measures. With insurance coverage, individuals are more likely to seek regular check-ups, screenings, and vaccinations, leading to early detection and management of potential health issues. This proactive approach not only improves overall health outcomes but also reduces the burden on the healthcare system in the long run.

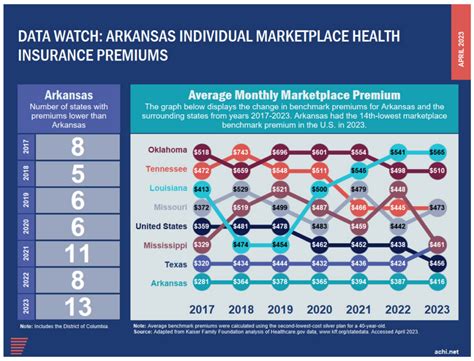

Affordability and Financial Protection

The affordability aspect of Marketplace insurance is a key driver of its success in Arkansas. Premium tax credits and cost-sharing reductions have made insurance plans more financially feasible for many residents. These subsidies have enabled individuals and families to choose plans that align with their healthcare needs without straining their budgets.

Additionally, Marketplace insurance provides essential financial protection. With comprehensive coverage, Arkansans can manage unexpected medical expenses, reducing the risk of financial hardship due to healthcare costs. This financial security fosters peace of mind and allows individuals to focus on their well-being without the constant worry of unaffordable medical bills.

Enhanced Healthcare Outcomes

The overall impact of Marketplace insurance on healthcare outcomes in Arkansas is positive and far-reaching. With increased accessibility and affordability, more Arkansans are able to receive timely and appropriate medical care. This leads to better management of chronic conditions, improved treatment outcomes for acute illnesses, and a general improvement in the overall health status of the state's population.

Furthermore, the Marketplace has facilitated a shift towards a more holistic approach to healthcare. Insurance plans often include coverage for mental health services, substance abuse treatment, and preventive care, addressing the multifaceted nature of health and well-being. This comprehensive coverage ensures that Arkansans receive the care they need to thrive physically, mentally, and emotionally.

The Future of Marketplace Insurance in Arkansas

Looking ahead, the future of Marketplace insurance in Arkansas is poised for continued growth and evolution. As the healthcare landscape continues to change, the Marketplace will adapt to meet the evolving needs of Arkansans.

Expanding Coverage Options

One of the anticipated developments is the expansion of coverage options. Insurance providers are likely to introduce new plans and enhance existing ones to cater to the diverse needs of the population. This could include the introduction of more specialized plans, such as those focused on specific health conditions or tailored to meet the unique requirements of different age groups.

Furthermore, efforts to improve the overall affordability of insurance plans are expected. This may involve collaborations between insurance providers, healthcare institutions, and policymakers to identify strategies that reduce costs without compromising the quality of care. By finding innovative ways to streamline healthcare delivery and administrative processes, the cost of insurance coverage can be further mitigated.

Digital Innovation and Accessibility

The digital transformation of the healthcare industry is also set to influence the future of Marketplace insurance in Arkansas. With the increasing adoption of digital health solutions, the Marketplace is likely to embrace digital innovations to enhance the enrollment and management of insurance plans. This could include the development of user-friendly mobile applications and online platforms, making the process of selecting and managing insurance plans more accessible and convenient for Arkansans.

Additionally, the integration of digital technologies can facilitate more efficient claims processing and provide real-time updates on insurance coverage and benefits. This level of transparency and accessibility can empower individuals to make more informed decisions about their healthcare and better manage their insurance plans.

Community Engagement and Education

Community engagement and education will continue to play a vital role in the success of Marketplace insurance in Arkansas. Outreach programs and educational initiatives will be crucial in ensuring that all Arkansans, regardless of their background or circumstances, understand the importance of insurance coverage and how to access it.

By fostering a culture of health literacy and financial awareness, individuals can make more informed choices about their healthcare and manage their insurance plans effectively. This community-centric approach will not only improve the uptake of Marketplace insurance but also ensure that Arkansans receive the maximum benefits from their chosen plans.

Frequently Asked Questions (FAQ)

What is the Federal Poverty Level (FPL) and how is it calculated for Marketplace insurance eligibility in Arkansas?

+The Federal Poverty Level (FPL) is a benchmark used to determine eligibility for various programs, including Marketplace insurance. It is calculated based on the size of the household and the state's cost of living. For Marketplace insurance in Arkansas, the FPL is adjusted annually, and it serves as a guideline to determine whether an individual or family qualifies for premium tax credits.

<div class="faq-item">

<div class="faq-question">

<h3>Are there any special enrollment periods in Arkansas outside of the regular Open Enrollment Period for Marketplace insurance?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>Yes, there are special enrollment periods in Arkansas for <em>Marketplace</em> insurance. These periods are triggered by qualifying life events, such as marriage, birth or adoption of a child, loss of other health coverage, or changes in income. During these special enrollment periods, individuals can enroll in or change their insurance plans outside of the regular Open Enrollment Period.</p>

</div>

</div>

<div class="faq-item">

<div class="faq-question">

<h3>How can Arkansans find out more about the specific insurance plans available on the Marketplace and their coverage details?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>Arkansans can explore the various insurance plans available on the <em>Marketplace</em> by visiting the official <em>Marketplace</em> website or by seeking assistance from trained navigators. These resources provide detailed information about plan options, including coverage details, premiums, and out-of-pocket costs. Navigators can also offer personalized guidance based on an individual's specific healthcare needs and financial circumstances.</p>

</div>

</div>

<div class="faq-item">

<div class="faq-question">

<h3>What support is available for Arkansans who need assistance with Marketplace insurance enrollment or have questions about their coverage?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>Assistance for Arkansans seeking help with <em>Marketplace</em> insurance enrollment or coverage questions is readily available. Trained navigators are on hand to provide guidance and support throughout the enrollment process. Additionally, the <em>Marketplace</em> website offers comprehensive resources, including FAQs, tutorials, and contact information for further assistance. Local community health centers and insurance brokers can also offer valuable support and expertise.</p>

</div>

</div>

<div class="faq-item">

<div class="faq-question">

<h3>How can Arkansans stay informed about changes and updates to Marketplace insurance plans and eligibility criteria?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>Staying informed about changes and updates to <em>Marketplace</em> insurance plans and eligibility criteria is crucial for Arkansans. The best way to stay updated is by regularly visiting the official <em>Marketplace</em> website, which provides the latest information and announcements. Additionally, subscribing to email updates or following relevant social media accounts can ensure that individuals receive timely notifications about any changes that may impact their insurance coverage.</p>

</div>

</div>

</div>

In conclusion, Marketplace insurance in Arkansas has emerged as a vital component of the state’s healthcare landscape, offering accessibility, affordability, and financial protection to its residents. As the Marketplace continues to evolve, it will play an increasingly pivotal role in shaping the health and well-being of Arkansans, ensuring that quality healthcare is within reach for all.