Medical Insurance Companies

The healthcare industry is undergoing a significant transformation, and at the heart of this evolution are medical insurance companies. These entities play a pivotal role in shaping the healthcare landscape, influencing access to medical services, and determining the overall patient experience. In this comprehensive guide, we delve into the intricate world of medical insurance companies, exploring their impact, challenges, and future prospects.

The Evolution of Medical Insurance Companies

Medical insurance, often regarded as a cornerstone of modern healthcare systems, has evolved significantly over the years. From its early roots as a means to protect against catastrophic health events, medical insurance has transformed into a complex industry with far-reaching implications.

The story of medical insurance companies is one of adaptation and innovation. In the late 19th century, mutual aid societies and fraternal organizations laid the foundation for what we now recognize as health insurance. These early forms of insurance were often limited to specific communities or professions, offering a sense of security in the face of unforeseen medical emergencies.

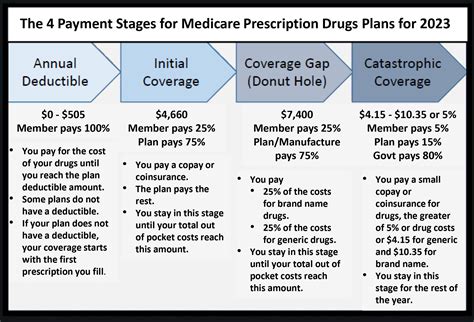

Fast forward to the 20th century, and the landscape of medical insurance underwent a paradigm shift. The introduction of employer-sponsored health plans in the 1920s marked a significant milestone, making health insurance more accessible to a broader segment of the population. This model, coupled with the establishment of government-backed healthcare programs like Medicare and Medicaid, revolutionized the industry, setting the stage for the modern medical insurance ecosystem.

Today, medical insurance companies operate in a highly regulated environment, with intricate policies and procedures governing their operations. They are key stakeholders in the healthcare system, influencing everything from the cost of medical procedures to the availability of specialized treatments.

Understanding the Role of Medical Insurance Companies

Medical insurance companies serve as intermediaries between patients and healthcare providers, navigating the complex web of medical services and financial obligations. Their primary function is to provide financial protection against the high costs associated with medical care, ensuring that individuals have access to essential healthcare services without facing undue financial burden.

Key Functions and Responsibilities

At its core, a medical insurance company assumes the following critical roles:

- Risk Assessment and Underwriting: Insurers meticulously evaluate the health status and risk factors of potential policyholders to determine the level of coverage and associated premiums.

- Premium Collection: They collect premiums from policyholders, generating the financial resources necessary to cover healthcare expenses.

- Claims Processing: When policyholders require medical treatment, insurers process claims, verifying the validity of expenses and authorizing payments to healthcare providers.

- Network Management: Many insurance companies maintain networks of preferred providers, offering discounted rates to policyholders who utilize these in-network services.

- Benefit Administration: Insurers outline and manage the benefits included in insurance plans, specifying coverage limits, copays, and deductibles.

The Impact on Healthcare Access

The influence of medical insurance companies extends beyond financial protection. Their decisions and policies can significantly impact healthcare access and outcomes. For instance, insurance plans with restrictive networks or limited coverage may deter patients from seeking necessary medical care, leading to potential delays in diagnosis and treatment.

On the other hand, innovative insurance models, such as value-based insurance design (VBID), aim to enhance patient access and outcomes by reducing cost barriers for essential services. VBID plans, for example, may waive copays for preventive care or offer incentives for patients to seek timely treatment.

| Traditional Insurance Plan | VBID Plan |

|---|---|

| 20% Copay for Office Visits | Waived Copay for Preventive Care |

| High Deductible for Specialty Care | Reduced Deductible for Chronic Condition Management |

| No Incentives for Timely Treatment | Financial Rewards for Meeting Treatment Goals |

Navigating the Complexities of Medical Insurance

While medical insurance companies provide a vital service, their operations are not without challenges. The industry faces a myriad of complexities, ranging from regulatory compliance to technological disruptions.

Regulatory Landscape

Medical insurance companies operate within a highly regulated environment, with stringent laws and guidelines governing their practices. Compliance with regulations like the Affordable Care Act (ACA) in the United States is crucial to avoid legal repercussions and maintain trust with policyholders.

Technological Advancements

The digital age has brought about significant technological advancements, and the insurance industry is no exception. Insurers are increasingly leveraging technology to streamline processes, enhance customer engagement, and improve operational efficiency.

For instance, the adoption of electronic health records (EHR) and telemedicine platforms has revolutionized the way insurers interact with healthcare providers and policyholders. These technologies facilitate real-time data sharing, improve claim processing, and enhance the overall customer experience.

Consumer Expectations

In today’s digital world, consumers expect seamless and personalized experiences across all industries, including insurance. Medical insurance companies must adapt to meet these evolving expectations, offering user-friendly platforms for policy management, claims submission, and access to healthcare resources.

Additionally, the rise of consumer-driven health plans (CDHPs) has shifted the focus towards empowering individuals to make informed healthcare choices. CDHPs often include high-deductible health plans coupled with health savings accounts (HSAs), giving policyholders more control over their healthcare spending.

Future Prospects and Innovations

The future of medical insurance companies is poised for significant transformations, driven by technological advancements, changing consumer preferences, and evolving healthcare models.

Telehealth and Virtual Care

The COVID-19 pandemic accelerated the adoption of telehealth and virtual care services, and this trend is expected to continue. Medical insurance companies are increasingly incorporating coverage for virtual consultations and remote monitoring, recognizing the cost-effectiveness and accessibility benefits of these services.

Artificial Intelligence and Data Analytics

Artificial intelligence (AI) and data analytics are revolutionizing the insurance industry. Insurers are leveraging these technologies to enhance risk assessment, streamline claims processing, and personalize insurance offerings. AI-powered chatbots, for instance, can provide instant policy information and assist with claims inquiries.

Collaborative Healthcare Models

The future of medical insurance may involve more collaborative relationships between insurers, healthcare providers, and patients. Integrated care models, where insurers work closely with healthcare systems to improve patient outcomes, could become more prevalent. This approach could lead to better coordination of care and more efficient use of healthcare resources.

Wellness and Prevention Focus

A growing emphasis on wellness and prevention is reshaping the insurance landscape. Insurers are incentivizing policyholders to adopt healthy lifestyles and engage in preventive care through rewards programs and reduced premiums. This shift towards proactive healthcare management is expected to reduce long-term healthcare costs and improve overall population health.

Conclusion

Medical insurance companies are at the forefront of a dynamic and ever-evolving healthcare ecosystem. Their role in shaping access to medical services and influencing patient outcomes is undeniable. As we navigate the complexities of the modern healthcare landscape, it is crucial to understand the impact and potential of these entities.

By embracing technological advancements, adapting to changing consumer preferences, and fostering collaborative relationships, medical insurance companies can continue to drive positive change in the healthcare industry. The future of medical insurance is bright, with innovations that promise to enhance patient experiences, improve healthcare outcomes, and make quality healthcare more accessible to all.

How do medical insurance companies determine premiums?

+Premiums are determined through a complex process known as risk assessment and underwriting. Insurers evaluate factors such as age, health status, and pre-existing conditions to assess the risk associated with covering an individual. Based on this assessment, they set premiums accordingly, with higher-risk individuals typically facing higher premiums.

What is the difference between in-network and out-of-network providers?

+In-network providers are healthcare professionals and facilities that have a contractual agreement with your insurance company. Using in-network providers often results in lower out-of-pocket costs, as insurance plans typically negotiate discounted rates with these providers. Out-of-network providers, on the other hand, have no such agreement, and using their services may result in higher costs, as the insurance company may not cover the full amount.

How can I choose the right medical insurance plan for my needs?

+Choosing the right medical insurance plan involves careful consideration of your healthcare needs and financial situation. Factors to consider include the cost of premiums and out-of-pocket expenses, the breadth of coverage (including network providers and specialized services), and any unique benefits or incentives offered by the plan. It’s also important to understand the plan’s limitations and exclusions to ensure it aligns with your healthcare priorities.