Mercury Insurance Group

Mercury Insurance Group: A Comprehensive Review of Its Services and Impact on the Insurance Industry

Mercury Insurance Group, often referred to as Mercury Insurance, is a prominent player in the insurance landscape, offering a diverse range of coverage options to customers across the United States. With a rich history spanning several decades, the company has established itself as a trusted provider of auto, home, business, and other specialty insurance products. In this in-depth review, we will delve into the various aspects of Mercury Insurance's operations, exploring its unique features, growth strategies, and the impact it has had on the insurance industry.

Headquartered in the heart of Los Angeles, California, Mercury Insurance has built a solid reputation for its innovative approaches to insurance, customer-centric services, and a strong commitment to delivering value. The company's journey, marked by strategic acquisitions and a focus on technological advancements, has positioned it as a leading force in the highly competitive insurance market. This article aims to provide an insightful analysis of Mercury Insurance's offerings, its performance, and its contributions to shaping the insurance sector.

A Legacy of Innovation: Mercury Insurance’s Journey

Mercury Insurance Group was founded in 1962 by George Joseph, a visionary entrepreneur who aimed to disrupt the traditional insurance model. Joseph’s initial focus was on providing affordable and comprehensive auto insurance to California residents, a mission that laid the foundation for the company’s future success. Over the years, Mercury Insurance expanded its reach, branching out into various insurance segments and establishing a strong presence across the United States.

One of the key milestones in Mercury Insurance's journey was its acquisition of Allstate Insurance's Western Region Personal Auto Book of Business in 2007. This strategic move not only expanded the company's customer base but also enhanced its market position, allowing it to offer more diverse insurance products and services. The acquisition demonstrated Mercury Insurance's ability to recognize and capitalize on growth opportunities, a trait that has become integral to its long-term success.

A Diverse Range of Insurance Products

Mercury Insurance has carved a niche for itself by offering a comprehensive suite of insurance products tailored to meet the diverse needs of its customers. Here’s an overview of the key insurance segments the company operates in:

Auto Insurance

Mercury Insurance’s core strength lies in its auto insurance offerings. The company provides a wide range of coverage options, including liability, collision, comprehensive, and personal injury protection (PIP) insurance. With a focus on affordability and customer satisfaction, Mercury Insurance has earned a reputation for its competitive pricing and personalized service. The company’s auto insurance policies are designed to cater to a diverse customer base, including high-risk drivers and those seeking specialized coverage for classic or antique vehicles.

Homeowners Insurance

Expanding beyond auto insurance, Mercury Insurance has made significant strides in the homeowners insurance market. The company offers coverage for a variety of dwelling types, including single-family homes, condominiums, and rental properties. Mercury Insurance’s homeowners policies provide protection against a range of perils, including fire, theft, and natural disasters. Additionally, the company offers optional endorsements to customize coverage based on individual needs, such as personal liability, medical payments, and water backup coverage.

Business Insurance

Recognizing the unique insurance needs of small and medium-sized businesses, Mercury Insurance has developed a comprehensive business insurance portfolio. The company offers a range of commercial insurance products, including general liability, property, workers’ compensation, and commercial auto insurance. Mercury Insurance’s business insurance policies are tailored to provide protection against a wide array of risks, ensuring that businesses can operate with confidence and peace of mind.

Other Specialty Insurance

Mercury Insurance’s commitment to meeting the diverse needs of its customers extends beyond the traditional insurance segments. The company offers a range of specialty insurance products, including:

- Motorcycle Insurance: Coverage options for bike enthusiasts, providing protection against accidents and theft.

- RV Insurance: Tailored policies for recreational vehicle owners, covering everything from travel trailers to motorhomes.

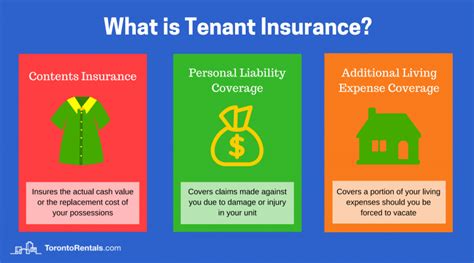

- Renter's Insurance: Essential coverage for renters, protecting their personal belongings and providing liability protection.

- Landlord Insurance: Specialized policies for landlords, offering protection for their rental properties and associated liabilities.

- Life Insurance: Term and whole life insurance options to help individuals and families plan for their financial future.

Technological Advancements: Mercury Insurance’s Digital Transformation

In an era where digital innovation is transforming the insurance landscape, Mercury Insurance has embraced technology to enhance its customer experience and operational efficiency. The company has invested significantly in developing a robust digital infrastructure, leveraging data analytics and artificial intelligence to streamline its processes and improve customer interactions.

Digital Onboarding and Policy Management

Mercury Insurance has prioritized a seamless digital onboarding process, allowing customers to apply for insurance policies and manage their accounts online. The company’s user-friendly website and mobile app enable customers to access their policy information, make payments, and file claims with ease. This digital transformation has not only improved customer convenience but also reduced administrative burdens, enabling Mercury Insurance to offer faster and more efficient services.

Data-Driven Underwriting and Claims Handling

By leveraging advanced data analytics and machine learning algorithms, Mercury Insurance has revolutionized its underwriting process. The company utilizes predictive modeling and risk assessment tools to make informed decisions, ensuring that its insurance products are priced competitively while maintaining financial stability. This data-driven approach has also enhanced the company’s claims handling capabilities, enabling it to process and settle claims more efficiently, thereby improving customer satisfaction.

Telematics and Usage-Based Insurance

Mercury Insurance has embraced telematics technology, offering usage-based insurance (UBI) programs to its auto insurance customers. By installing small devices in vehicles or utilizing smartphone apps, the company can monitor driving behavior and offer personalized insurance rates based on actual usage. This innovative approach has not only incentivized safer driving habits but also provided customers with more control over their insurance costs.

Industry Recognition and Awards

Mercury Insurance’s commitment to innovation, customer satisfaction, and industry leadership has been recognized through various awards and accolades. The company has consistently ranked highly in customer satisfaction surveys, earning accolades such as the J.D. Power Award for Auto Claims Satisfaction and the Auto Insurance Study Award for its exceptional claims handling processes.

Additionally, Mercury Insurance has been recognized for its financial strength and stability. Rating agencies such as A.M. Best and Standard & Poor's have assigned strong ratings to the company, reflecting its solid financial foundation and ability to meet its policyholder obligations. This recognition not only reinforces Mercury Insurance's credibility but also instills confidence among its customers and business partners.

Mercury Insurance’s Impact on the Insurance Industry

Mercury Insurance’s journey and success have had a significant impact on the insurance industry, influencing market trends and shaping the way insurance services are delivered. Here’s how the company has contributed to the evolution of the insurance sector:

Promoting Innovation and Technological Adoption

Mercury Insurance’s embrace of technology and innovation has served as a catalyst for change within the insurance industry. The company’s successful implementation of digital transformation initiatives has inspired other insurers to invest in technological advancements, leading to improved customer experiences and operational efficiencies across the board. By setting a benchmark for digital innovation, Mercury Insurance has encouraged the industry to adopt new technologies and stay ahead of the curve.

Enhancing Customer-Centric Approaches

Mercury Insurance’s focus on customer satisfaction and personalized service has elevated the importance of customer-centric approaches within the insurance industry. The company’s commitment to understanding and meeting the diverse needs of its customers has inspired other insurers to prioritize customer experience and tailor their offerings accordingly. This shift towards customer-centricity has led to more flexible insurance products, improved communication, and enhanced overall customer satisfaction.

Expanding Insurance Accessibility

Mercury Insurance’s mission to provide affordable and accessible insurance coverage has expanded insurance options for individuals and businesses across the United States. By offering a diverse range of insurance products at competitive rates, the company has made insurance more accessible to a broader demographic. This has not only benefited customers but has also contributed to the overall growth and stability of the insurance market, fostering a more inclusive and robust insurance ecosystem.

Conclusion: Mercury Insurance’s Legacy Continues

Mercury Insurance Group’s journey from a small auto insurance provider to a leading force in the insurance industry is a testament to its founder’s vision and the company’s unwavering commitment to innovation and customer satisfaction. With a diverse range of insurance products, a strong focus on technological advancements, and a dedication to industry leadership, Mercury Insurance has left an indelible mark on the insurance landscape.

As the company continues to evolve and adapt to the dynamic insurance market, its impact on the industry is likely to grow. By staying true to its core values and embracing new opportunities, Mercury Insurance is well-positioned to continue delivering exceptional insurance services and shaping the future of the insurance sector.

How does Mercury Insurance compare to other insurance providers in terms of pricing?

+Mercury Insurance offers competitive pricing for its insurance products, often providing lower rates compared to its peers. The company’s focus on affordability and personalized rates, especially in the auto insurance segment, has made it a popular choice for customers seeking cost-effective coverage.

What sets Mercury Insurance apart from its competitors in the insurance market?

+Mercury Insurance’s commitment to innovation and customer satisfaction sets it apart. The company’s embrace of technology, data-driven approaches, and a diverse range of insurance products has allowed it to cater to a wide range of customer needs. Additionally, Mercury Insurance’s strong financial standing and industry recognition add to its competitive advantage.

Does Mercury Insurance offer any loyalty or referral programs for its customers?

+Yes, Mercury Insurance values its long-term customers and offers loyalty programs to reward their loyalty. The company’s “Mercury Promise” program provides discounts and incentives to customers who renew their policies and maintain a good driving record. Additionally, Mercury Insurance offers referral bonuses for customers who refer new business to the company.

How has Mercury Insurance’s digital transformation impacted its customer service and claims handling processes?

+Mercury Insurance’s digital transformation has revolutionized its customer service and claims handling processes. The company’s online and mobile platforms provide customers with 24⁄7 access to their policy information, allowing for faster and more convenient policy management. Additionally, the use of advanced data analytics has streamlined claims handling, resulting in quicker claim settlements and improved customer satisfaction.

What is Mercury Insurance’s approach to environmental sustainability and social responsibility?

+Mercury Insurance is committed to environmental sustainability and social responsibility. The company has implemented various initiatives to reduce its carbon footprint, such as paperless billing and the use of renewable energy sources. Additionally, Mercury Insurance supports local communities through charitable donations and volunteer programs, demonstrating its commitment to making a positive impact beyond its business operations.