Minimum Auto Insurance Coverage

When it comes to driving a vehicle, having auto insurance is not just a good idea but a legal requirement in most parts of the world. Auto insurance provides financial protection in case of accidents, theft, or other unforeseen events. While comprehensive coverage is ideal, many drivers opt for the minimum auto insurance coverage to meet legal obligations and keep costs manageable. In this article, we will delve into the world of minimum auto insurance coverage, exploring its intricacies, benefits, and considerations.

Understanding Minimum Auto Insurance Coverage

Minimum auto insurance coverage refers to the lowest level of insurance coverage that drivers are mandated to carry by law. The specific requirements for minimum coverage vary from one jurisdiction to another, and understanding these requirements is crucial for any vehicle owner. This section aims to provide a comprehensive overview of minimum auto insurance coverage, its components, and how it differs across regions.

Liability Coverage

Liability coverage is a fundamental component of minimum auto insurance. It protects the policyholder from financial liability in the event that they are found at fault for an accident that causes injuries or property damage to others. Liability coverage typically includes two main components: bodily injury liability and property damage liability.

- Bodily Injury Liability: This coverage pays for medical expenses, rehabilitation costs, and other damages incurred by individuals injured in an accident caused by the policyholder. It helps cover the costs associated with treating injuries, lost wages, and even long-term disability.

- Property Damage Liability: In the event that the policyholder’s vehicle damages another person’s property, this coverage steps in to cover the repair or replacement costs. This can include damage to other vehicles, buildings, fences, or any other property involved in the accident.

Regional Variations in Minimum Coverage

The minimum auto insurance coverage requirements can vary significantly depending on the jurisdiction in which the vehicle is registered. These variations are influenced by a range of factors, including local laws, traffic patterns, and historical accident data.

| Jurisdiction | Minimum Coverage Requirements |

|---|---|

| State A | Bodily Injury Liability: 50,000 per person, 100,000 per accident Property Damage Liability: 25,000</td> </tr> <tr> <td>State B</td> <td>Bodily Injury Liability: 25,000 per person, 50,000 per accident<br>Property Damage Liability: 10,000 |

| Province C | Bodily Injury Liability: 100,000 per person, 300,000 per accident Property Damage Liability: $50,000 |

It's important for drivers to be aware of the specific requirements in their region to ensure they meet the legal obligations. Failure to carry the minimum coverage can result in legal consequences, including fines, license suspension, or even vehicle impoundment.

Benefits and Considerations of Minimum Coverage

Opting for minimum auto insurance coverage offers several benefits, but it also comes with certain considerations that drivers should be aware of. This section explores the advantages and potential drawbacks of choosing the minimum coverage option.

Cost Savings

One of the primary advantages of minimum auto insurance coverage is its affordability. By selecting the lowest legally required coverage, drivers can significantly reduce their insurance premiums. This is especially beneficial for those on a tight budget or those who drive infrequently.

However, it's essential to strike a balance between cost savings and adequate protection. While minimum coverage might be more affordable, it may not provide sufficient financial protection in the event of a severe accident or extensive property damage.

Legal Compliance

Minimum auto insurance coverage ensures that drivers remain compliant with local laws and regulations. By carrying the required coverage, drivers avoid legal penalties and potential financial consequences that can arise from driving without insurance.

Legal compliance also provides peace of mind, knowing that the driver is protected from financial liability in the event of an accident. It demonstrates responsibility and a commitment to safety on the roads.

Limitations and Risks

While minimum auto insurance coverage offers legal compliance and cost savings, it’s crucial to acknowledge its limitations and potential risks. The coverage limits set by the minimum requirements might not be sufficient to cover all expenses incurred in an accident.

- Medical Expenses: In an accident resulting in severe injuries, the medical expenses alone could far exceed the bodily injury liability limits of the minimum coverage. This leaves the policyholder responsible for any additional costs.

- Property Damage: Similarly, if an accident results in extensive property damage, such as a totalled vehicle or significant structural damage to a building, the property damage liability limits might be inadequate.

- Legal Fees: In the event of a lawsuit resulting from an accident, the policyholder's legal fees and potential settlements or judgments could exceed the coverage limits, leaving them financially vulnerable.

It's important for drivers to carefully assess their risk tolerance and financial capabilities when choosing minimum coverage. While it might be a cost-effective option, it may not provide the level of protection desired in certain situations.

Expanding Your Coverage

While minimum auto insurance coverage meets the legal requirements, it might not provide the comprehensive protection that many drivers seek. This section explores the various additional coverage options available to enhance protection and peace of mind.

Collision Coverage

Collision coverage is an optional add-on to minimum auto insurance. It provides protection for the policyholder’s vehicle in the event of an accident, regardless of fault. This coverage pays for repairs or the replacement cost of the vehicle if it’s deemed a total loss.

Collision coverage is particularly beneficial for drivers who own newer or more expensive vehicles, as it offers financial protection against accidents that might result in costly repairs.

Comprehensive Coverage

Comprehensive coverage, another optional addition to the minimum insurance plan, offers protection against non-accident-related incidents. This includes damage caused by natural disasters, theft, vandalism, or even damage caused by animals.

Comprehensive coverage provides a broader range of protection and can be especially valuable for drivers living in areas prone to natural disasters or those who park their vehicles in unsecured locations.

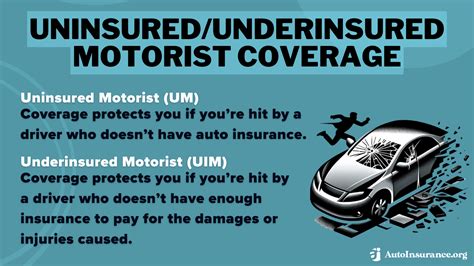

Uninsured/Underinsured Motorist Coverage

Uninsured/underinsured motorist coverage is designed to protect policyholders in situations where they are involved in an accident with a driver who has little or no insurance coverage. This coverage pays for the policyholder’s injuries and damages caused by an uninsured or underinsured driver.

While it's an optional add-on, uninsured/underinsured motorist coverage can provide peace of mind, especially in regions where a significant portion of drivers carry inadequate insurance.

Medical Payments Coverage

Medical payments coverage, also known as MedPay, is an optional coverage that pays for medical expenses incurred by the policyholder and their passengers in the event of an accident, regardless of fault. It provides a quick and straightforward way to cover medical bills without having to wait for liability determinations.

MedPay coverage can be particularly beneficial for drivers who frequently carry passengers, as it ensures that their medical expenses are covered promptly.

Future Implications and Industry Trends

The auto insurance industry is constantly evolving, and minimum coverage requirements are no exception. This section explores the potential future implications and industry trends related to minimum auto insurance coverage.

Increasing Coverage Requirements

As traffic patterns, accident rates, and vehicle values change, there is a possibility that minimum coverage requirements will be adjusted to reflect these shifts. Regulatory bodies may decide to increase the liability limits or introduce new coverage mandates to better protect drivers and the public.

Staying informed about any changes in minimum coverage requirements is essential for drivers to ensure they maintain adequate protection.

Technological Advances and Telematics

The integration of technology into the auto insurance industry, particularly through telematics devices, is transforming the way insurance is priced and offered. Telematics devices collect data on driving behavior, such as speed, acceleration, and braking patterns, which can be used to assess risk and offer personalized insurance rates.

In the future, telematics-based insurance policies might become more prevalent, offering drivers the opportunity to customize their coverage based on their individual driving habits. This could lead to more dynamic and accurate pricing structures.

Alternative Risk Transfer Mechanisms

The insurance industry is exploring alternative risk transfer mechanisms, such as parametric insurance and captive insurance, to better manage risks and offer more tailored coverage options. These mechanisms involve the use of predefined triggers and parameters to determine payouts, providing a more efficient and predictable claims process.

While these alternatives are primarily aimed at businesses and large-scale risks, they could potentially influence the way auto insurance is structured and offered in the future, providing more innovative and flexible coverage options.

Conclusion

Minimum auto insurance coverage serves as a crucial legal and financial safeguard for drivers, offering protection against liability in the event of accidents. While it provides a cost-effective solution, drivers should carefully consider their individual needs and risk tolerance when selecting their coverage limits. Expanding coverage beyond the minimum can offer added peace of mind and protection against a broader range of incidents.

As the auto insurance industry continues to evolve, staying informed about coverage requirements, technological advancements, and alternative risk transfer mechanisms will be essential for drivers to make informed decisions about their insurance coverage.

What happens if I drive without the minimum auto insurance coverage?

+Driving without the minimum auto insurance coverage is illegal and can result in severe penalties. Depending on the jurisdiction, consequences may include fines, license suspension, vehicle impoundment, and even criminal charges. It’s crucial to always carry at least the minimum required coverage to avoid legal troubles and financial liabilities.

How do I know if my current auto insurance meets the minimum requirements?

+To ensure your auto insurance meets the minimum requirements, review your policy documents or contact your insurance provider. They can provide you with the specific coverage limits and details of your policy. Additionally, you can refer to your state or provincial regulations to understand the mandatory coverage limits in your region.

Can I customize my minimum auto insurance coverage to fit my specific needs?

+While minimum auto insurance coverage is mandated by law, you can often customize certain aspects of your policy to better fit your needs. For example, you might be able to increase your liability limits, add optional coverages like collision or comprehensive, or choose a higher deductible to reduce your premiums. Consult with your insurance provider to explore these customization options.