Motorcycle Insurance Rates

Motorcycle insurance is an essential aspect of responsible riding and ownership. With the freedom and thrill that motorcycles offer, comes a unique set of risks and considerations. Understanding the factors that influence motorcycle insurance rates is crucial for riders seeking adequate coverage at affordable prices. In this comprehensive guide, we delve into the world of motorcycle insurance, exploring the key elements that impact rates, offering practical tips for riders, and providing valuable insights into the process of securing the right coverage.

Understanding the Fundamentals of Motorcycle Insurance

Motorcycle insurance, akin to auto insurance, provides financial protection against potential risks and liabilities associated with riding a motorcycle. This coverage safeguards riders against accidents, theft, and other unforeseen events. However, the specific nature of motorcycles introduces unique challenges and considerations when it comes to insurance.

The cost of motorcycle insurance varies significantly, influenced by a multitude of factors. Understanding these factors is the first step towards making informed decisions and securing the most suitable coverage at the best possible rates.

Key Factors Affecting Motorcycle Insurance Rates

The world of motorcycle insurance is complex, with numerous variables influencing the rates riders face. Here’s a detailed breakdown of the key factors that impact motorcycle insurance costs:

1. Vehicle Type and Usage

The type of motorcycle you ride plays a significant role in determining your insurance rates. Different motorcycle categories, such as cruisers, sports bikes, and touring motorcycles, carry varying levels of risk. Sports bikes, known for their high performance and agility, often attract higher insurance premiums due to their association with higher speeds and potential for accidents.

Furthermore, the intended use of your motorcycle can impact insurance rates. If you primarily use your bike for commuting or long-distance travel, insurers may view this as a lower-risk activity compared to weekend riders who frequently engage in high-speed recreational riding. Insurance companies consider these factors when assessing your premium.

| Motorcycle Type | Average Insurance Cost |

|---|---|

| Sports Bike | $1,200 - $1,800 annually |

| Cruiser | $800 - $1,200 annually |

| Touring Motorcycle | $700 - $1,000 annually |

2. Riding Experience and Age

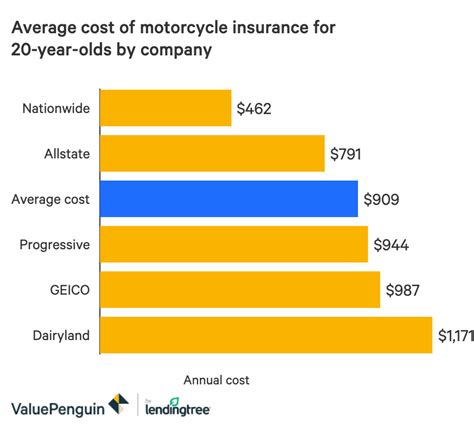

Your riding experience and age are critical factors in determining insurance rates. Generally, younger riders under the age of 25 tend to face higher insurance premiums due to their relative inexperience and the higher risk associated with this demographic. As riders gain more experience and reach an older age bracket, insurance costs often decrease.

Insurance companies use actuarial data to assess the risk associated with different age groups. This data helps them determine the likelihood of accidents and claims, which directly impacts insurance rates. Younger riders may consider taking additional safety courses or obtaining advanced riding certifications to demonstrate their commitment to safe riding and potentially lower their insurance premiums.

3. Location and Mileage

The location where you reside and ride your motorcycle can significantly influence insurance rates. Insurance companies consider regional factors such as crime rates, weather conditions, and traffic congestion when assessing risk. Areas with higher rates of motorcycle theft or accidents may result in increased insurance premiums.

Additionally, the number of miles you ride annually can impact your insurance rates. High-mileage riders, particularly those who commute daily on their motorcycles, may face higher premiums due to the increased exposure to potential risks. Conversely, riders who primarily use their bikes for occasional recreational rides may benefit from lower insurance costs.

4. Insurance Coverage and Deductibles

The type and extent of insurance coverage you choose play a vital role in determining your insurance rates. Comprehensive insurance plans, which offer a wider range of coverage including collision, theft, and liability protection, typically carry higher premiums compared to basic liability-only policies.

Furthermore, the deductible you select can significantly impact your insurance costs. A higher deductible, which is the amount you agree to pay out of pocket before your insurance coverage kicks in, can result in lower insurance premiums. However, it's essential to carefully consider your financial situation and risk tolerance when choosing a deductible to ensure you can afford it in the event of a claim.

5. Riding Record and Claims History

Your riding record and claims history are critical factors in determining insurance rates. Insurance companies carefully review your driving record, including any traffic violations, accidents, and claims made in the past. A clean riding record with no at-fault accidents or traffic violations can lead to lower insurance premiums, as it demonstrates a lower risk profile.

Conversely, a history of accidents, especially those resulting in injuries or significant property damage, can significantly increase insurance rates. Insurance companies use this information to assess the likelihood of future claims and adjust premiums accordingly. Maintaining a safe and responsible riding record is crucial for keeping insurance costs down.

6. Discounts and Bundling

Insurance companies often offer a variety of discounts to incentivize safe riding and attract new customers. These discounts can significantly reduce your insurance premiums. Common discounts include safe rider discounts, multi-policy discounts (bundling motorcycle insurance with other policies like auto or home insurance), and loyalty discounts for long-term customers.

Additionally, some insurance companies offer discounts for riders who complete approved safety courses or have advanced riding certifications. Exploring these discount opportunities can help you save on your insurance costs while also promoting safer riding practices.

Tips for Riders: Securing the Best Motorcycle Insurance Rates

Understanding the factors that influence motorcycle insurance rates is just the first step. Here are some practical tips for riders to navigate the insurance landscape and secure the best coverage at affordable prices:

1. Compare Multiple Insurance Providers

Insurance rates can vary significantly between providers, so it’s essential to shop around and compare quotes from multiple insurers. Online comparison tools and insurance brokerages can be valuable resources for obtaining quotes from various providers. By comparing rates, you can identify the most competitive options and make informed decisions.

2. Understand Your Coverage Needs

Assessing your specific coverage needs is crucial for securing the right insurance policy. Consider factors such as the value of your motorcycle, your riding habits, and the level of financial protection you require. Customizing your coverage to match your needs can help you avoid unnecessary expenses while ensuring adequate protection.

3. Explore Discount Opportunities

Take advantage of any applicable discounts to lower your insurance premiums. Safe rider discounts, multi-policy discounts, and loyalty discounts can significantly reduce your overall insurance costs. Additionally, consider completing approved safety courses or obtaining advanced riding certifications to demonstrate your commitment to safe riding and potentially qualify for additional discounts.

4. Consider Bundling Policies

Bundling your motorcycle insurance with other policies, such as auto or home insurance, can lead to substantial savings. Many insurance providers offer multi-policy discounts when you insure multiple vehicles or assets with them. By bundling your policies, you not only simplify your insurance management but also benefit from cost savings.

5. Maintain a Clean Riding Record

A clean riding record is essential for keeping insurance costs down. Avoid traffic violations and practice safe riding habits to minimize the risk of accidents. By maintaining a responsible and cautious approach to riding, you can demonstrate your low-risk profile to insurance providers, which may result in lower insurance premiums.

6. Choose the Right Deductible

When selecting a deductible, carefully consider your financial situation and risk tolerance. A higher deductible can result in lower insurance premiums, but it’s important to ensure you can afford the deductible in the event of a claim. Choosing a deductible that aligns with your financial capabilities can help you strike a balance between cost savings and financial preparedness.

The Future of Motorcycle Insurance: Technological Advancements and Beyond

The world of motorcycle insurance is evolving, driven by technological advancements and changing rider expectations. Here’s a glimpse into the future of motorcycle insurance and how it may impact riders and the insurance landscape:

1. Telematics and Usage-Based Insurance

Telematics technology, which involves the use of onboard devices or smartphone apps to track driving behavior, is gaining traction in the insurance industry. Usage-based insurance, also known as pay-as-you-ride insurance, uses telematics data to assess individual riding habits and tailor insurance premiums accordingly. This technology has the potential to revolutionize motorcycle insurance by offering riders more personalized and accurate premiums based on their actual riding behavior.

2. Artificial Intelligence and Risk Assessment

Artificial intelligence (AI) is increasingly being leveraged by insurance companies to enhance risk assessment and underwriting processes. AI algorithms can analyze vast amounts of data, including rider profiles, riding habits, and historical claim patterns, to identify potential risks and make more accurate predictions. This advanced risk assessment can lead to more precise insurance pricing and improved coverage options for riders.

3. Digital Transformation and Customer Experience

The digital transformation of the insurance industry is reshaping the customer experience. Online insurance platforms and mobile apps are making it easier for riders to obtain quotes, manage policies, and file claims. Additionally, digital tools enable riders to access real-time information about their insurance coverage, track claims progress, and receive personalized recommendations for optimizing their policies. This digital evolution enhances convenience and transparency for riders.

4. Insurtech Innovations and Collaboration

Insurtech startups and established insurance companies are collaborating to develop innovative solutions that enhance the insurance experience. These collaborations result in new products, services, and distribution channels that cater to the evolving needs of riders. From peer-to-peer insurance models to blockchain-based smart contracts, Insurtech innovations are disrupting traditional insurance models and offering riders more choice and flexibility.

5. Safety Technology and Risk Mitigation

Advancements in motorcycle safety technology, such as advanced braking systems, traction control, and collision avoidance systems, are not only improving rider safety but also impacting insurance rates. Insurance companies are recognizing the risk-reducing benefits of these technologies and may offer discounts or lower premiums for riders who utilize them. As safety technology continues to advance, its impact on insurance rates is expected to become more significant.

Conclusion: Navigating the Motorcycle Insurance Landscape

Motorcycle insurance is a vital aspect of responsible riding, offering financial protection and peace of mind. By understanding the key factors that influence insurance rates and adopting a proactive approach to securing coverage, riders can navigate the insurance landscape with confidence. From exploring discounts and bundling policies to maintaining a clean riding record and embracing technological advancements, riders have the power to shape their insurance experience and secure the best coverage at affordable rates.

As the world of motorcycle insurance evolves, riders can look forward to a future where personalized coverage, enhanced customer experiences, and innovative solutions become the norm. By staying informed and engaged, riders can continue to enjoy the thrill of riding while safeguarding their financial well-being.

What is the average cost of motorcycle insurance per year?

+

The average cost of motorcycle insurance per year can vary widely depending on various factors such as the rider’s age, location, riding experience, and the type of motorcycle. On average, riders can expect to pay between 500 and 1,500 annually for motorcycle insurance. However, it’s important to note that this is just an estimate, and actual premiums can be higher or lower based on individual circumstances.

How can I reduce my motorcycle insurance rates?

+

There are several strategies you can employ to reduce your motorcycle insurance rates. These include comparing quotes from multiple insurers, maintaining a clean riding record, choosing a higher deductible, exploring discount opportunities such as safe rider discounts or multi-policy discounts, and considering usage-based insurance if available. Additionally, regularly reviewing and adjusting your coverage to match your needs can help you optimize your insurance costs.

Does my riding experience affect my insurance rates?

+

Yes, your riding experience is a significant factor in determining your insurance rates. Generally, riders with more experience and a clean riding record are considered lower risk and may enjoy lower insurance premiums. Insurance companies often offer discounts or reduced rates for riders who have completed approved safety courses or obtained advanced riding certifications. Demonstrating your commitment to safe riding can positively impact your insurance costs.