Nj Insurance Companies

The insurance landscape in New Jersey is diverse and dynamic, playing a crucial role in safeguarding residents and businesses against various risks. This comprehensive overview will delve into the intricacies of the NJ insurance companies, exploring their offerings, regulations, and impact on the state's economy.

Understanding the NJ Insurance Market

New Jersey boasts a thriving insurance industry, characterized by a wide array of providers, ranging from global giants to regional specialists. These companies offer a comprehensive suite of insurance products, catering to the diverse needs of individuals, families, and businesses across the state.

Key Players in the NJ Insurance Arena

The Garden State's insurance sector is dominated by several prominent players, each with a unique market strategy and product portfolio. Here's an insight into some of the major NJ insurance companies:

- State Farm: This renowned insurance provider offers a comprehensive range of products, including auto, home, life, and health insurance. With a strong focus on customer service, State Farm has established itself as a trusted name in the NJ insurance market.

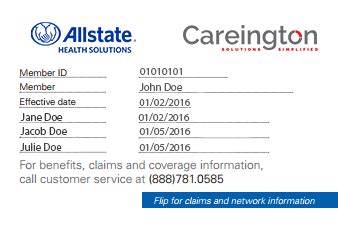

- Allstate: Known for its innovative products and digital offerings, Allstate provides auto, home, renters, and business insurance. The company's commitment to technological advancements has made it a preferred choice for many NJ residents.

- GEICO: GEICO's presence in NJ is significant, offering competitive rates and a wide range of insurance products. From auto and homeowners insurance to life and business coverage, GEICO caters to a diverse customer base.

- Progressive: Progressive Insurance has a strong foothold in NJ, providing auto, home, renters, and boat insurance. The company's focus on customer satisfaction and innovative products has contributed to its success in the state.

- Nationwide: Nationwide's offerings in NJ include auto, home, business, and farm insurance. The company's comprehensive coverage and commitment to customer education have made it a reliable choice for many businesses and individuals.

These companies, along with numerous others, contribute to the robust insurance ecosystem in New Jersey, ensuring residents have access to a wide range of insurance options.

Insurance Regulations in New Jersey

The insurance sector in NJ operates under a comprehensive set of regulations, aimed at protecting consumers and ensuring fair practices. The New Jersey Department of Banking and Insurance (DOBI) is the primary regulatory authority, overseeing the insurance industry's operations and enforcing compliance with state laws and regulations.

Some key regulations governing the NJ insurance market include:

- Rate Regulation: Insurance companies in NJ are required to obtain prior approval from DOBI before implementing any rate changes. This ensures that rates are fair, reasonable, and not excessive.

- Market Conduct Examinations: DOBI conducts periodic examinations of insurance companies to assess their compliance with state laws and regulations. These examinations cover areas such as underwriting, claims handling, and financial stability.

- Consumer Protection: NJ has robust consumer protection laws, including anti-discrimination provisions and requirements for timely claims processing. Insurance companies must adhere to these laws to ensure fair treatment of policyholders.

- Solvency Requirements: Insurance companies operating in NJ must maintain adequate financial reserves to meet their obligations. DOBI closely monitors these reserves to ensure the long-term viability of insurance providers.

Insurance Products and Services in NJ

NJ insurance companies offer a diverse range of products and services to cater to the unique needs of their customers. Here's an overview of some key insurance categories and the providers leading in each area:

Auto Insurance

Auto insurance is a cornerstone of the NJ insurance market, with a wide range of providers offering comprehensive coverage. Some of the leading auto insurance companies in NJ include:

- State Farm: State Farm's auto insurance policies in NJ provide coverage for a range of vehicles, including cars, trucks, and motorcycles. Their policies offer options for collision, comprehensive, liability, and personal injury protection (PIP) coverage.

- GEICO: GEICO's auto insurance policies in NJ are known for their competitive rates and comprehensive coverage. They offer various discounts, including multi-policy discounts, safe driver discounts, and military discounts.

- Progressive: Progressive's auto insurance policies in NJ provide flexible coverage options, including customizable deductibles and a range of add-on coverages. Their policies are designed to cater to the specific needs of NJ drivers.

Homeowners Insurance

Homeowners insurance is essential for protecting one's home and belongings. NJ insurance companies offer a range of policies to suit different needs and budgets. Here are some leading providers in this category:

- Allstate: Allstate's homeowners insurance policies in NJ provide coverage for a range of perils, including fire, theft, and natural disasters. Their policies offer customizable options and discounts for multiple policyholders.

- Nationwide: Nationwide's homeowners insurance policies in NJ offer comprehensive coverage for dwellings, personal property, and liability. They also provide additional coverages for specific risks, such as water backup and identity theft.

- State Farm: State Farm's homeowners insurance policies in NJ provide coverage for a wide range of dwelling types, including single-family homes, condos, and mobile homes. Their policies offer flexible coverage options and discounts for multiple policies.

Life Insurance

Life insurance is a crucial aspect of financial planning, providing peace of mind and financial security for loved ones. NJ insurance companies offer a variety of life insurance products to meet different needs. Here are some notable providers in this space:

- State Farm: State Farm's life insurance policies in NJ offer term life, whole life, and universal life insurance options. Their policies provide flexible coverage amounts and the option to add riders for additional benefits.

- Prudential: Prudential's life insurance policies in NJ provide a range of options, including term life, universal life, and variable universal life insurance. Their policies offer customizable coverage amounts and the ability to add riders for specific needs.

- New York Life: New York Life's presence in NJ is strong, offering a range of life insurance products, including term life, whole life, and variable universal life insurance. Their policies are designed to cater to the unique needs of NJ residents.

The Impact of NJ Insurance Companies on the State's Economy

The insurance industry plays a significant role in the economic landscape of New Jersey. Here's how NJ insurance companies contribute to the state's economy:

Employment and Economic Growth

The insurance sector is a major employer in NJ, providing numerous job opportunities across the state. From insurance agents and underwriters to claims adjusters and customer service representatives, the industry supports a diverse range of careers. According to the NJ Department of Labor and Workforce Development, the insurance industry employs tens of thousands of individuals, contributing significantly to the state's employment rate.

Economic Stability and Risk Management

NJ insurance companies play a vital role in managing risks and providing economic stability to residents and businesses. By offering a range of insurance products, these companies help individuals and businesses mitigate financial losses due to unforeseen events, such as accidents, natural disasters, or health emergencies.

Contribution to State Revenue

The insurance industry contributes substantially to NJ's state revenue through various channels. Insurance companies pay taxes on premiums, investments, and other financial activities. Additionally, the industry's presence in the state generates revenue through licensing fees, regulatory compliance costs, and other administrative expenses.

Community Engagement and Social Responsibility

Many NJ insurance companies actively participate in community initiatives and social responsibility programs. They contribute to local charities, sponsor community events, and support educational programs. By giving back to the community, these companies foster a positive image and enhance their reputation, further contributing to the state's social and economic well-being.

Future Outlook and Innovations in NJ Insurance

The NJ insurance market is poised for continued growth and innovation. As technology advances and consumer preferences evolve, NJ insurance companies are adapting to meet the changing needs of their customers. Here are some trends and developments shaping the future of the industry:

Digital Transformation

Digital transformation is a key focus area for NJ insurance companies. Many providers are investing in technology to enhance the customer experience, streamline processes, and improve operational efficiency. This includes the development of mobile apps, online portals, and digital tools for policy management, claims processing, and customer service.

Data Analytics and Personalized Insurance

The use of data analytics is revolutionizing the insurance industry. NJ insurance companies are leveraging data-driven insights to personalize insurance products and services. By analyzing customer behavior, preferences, and risk factors, providers can offer tailored coverage options and more accurate pricing, enhancing customer satisfaction and loyalty.

Collaborative Partnerships

Collaborative partnerships between insurance companies, technology providers, and other industry stakeholders are becoming increasingly common. These partnerships aim to drive innovation, improve efficiency, and enhance the overall customer experience. For instance, insurance companies may collaborate with fintech startups to develop innovative payment solutions or with tech firms to enhance fraud detection capabilities.

Regulatory Compliance and Ethical Practices

NJ insurance companies are committed to maintaining high standards of regulatory compliance and ethical practices. They actively engage with regulatory bodies to ensure compliance with evolving regulations and best practices. This commitment to ethical behavior and consumer protection enhances the industry's reputation and fosters trust among policyholders.

| Insurance Category | Leading Providers |

|---|---|

| Auto Insurance | State Farm, GEICO, Progressive |

| Homeowners Insurance | Allstate, Nationwide, State Farm |

| Life Insurance | State Farm, Prudential, New York Life |

Frequently Asked Questions

What are the key factors to consider when choosing an insurance company in NJ?

+When selecting an insurance company in NJ, it’s essential to consider factors such as the company’s financial stability, the range of insurance products offered, customer service reputation, claims handling process, and pricing. Additionally, assessing the company’s commitment to ethical practices and regulatory compliance is crucial.

How can I compare insurance rates and coverage in NJ?

+Comparing insurance rates and coverage in NJ can be done through online insurance marketplaces or by directly contacting insurance companies. Online marketplaces provide a convenient way to compare multiple providers’ rates and coverage options. It’s also beneficial to consult with an insurance agent or broker who can guide you through the process and provide personalized recommendations.

What are some common discounts offered by NJ insurance companies?

+NJ insurance companies offer a range of discounts to policyholders. These may include multi-policy discounts (for bundling multiple insurance types with the same provider), safe driver discounts (for maintaining a clean driving record), loyalty discounts (for long-term customers), and discounts for specific occupations or affiliations.

How do I file a claim with an insurance company in NJ?

+Filing a claim with an insurance company in NJ typically involves contacting the company’s claims department, providing details of the incident or loss, and submitting any required documentation. The claims process may vary depending on the type of insurance and the nature of the claim. It’s advisable to review your policy’s terms and conditions and reach out to your insurance provider for specific guidance.

Are there any resources available to help me understand my insurance policy in NJ?

+Yes, there are several resources available to help you understand your insurance policy in NJ. These include your insurance agent or broker, who can provide personalized guidance and clarification. Additionally, many insurance companies offer online resources, such as policy summaries, frequently asked questions (FAQs), and educational materials, to help policyholders understand their coverage.