National Insurance Texas

Texas, the second-most populous state in the United States, boasts a thriving economy and a unique cultural landscape. Amidst its diverse industries and vibrant communities, understanding the intricacies of National Insurance becomes crucial for residents and businesses alike. This article delves into the world of National Insurance in Texas, offering a comprehensive guide to its history, implications, and future prospects.

A Historical Perspective on National Insurance in Texas

The story of National Insurance in Texas traces back to the early 20th century, when the state’s rapid industrialization and urbanization sparked a need for robust social welfare programs. In 1935, as part of President Franklin D. Roosevelt’s New Deal, the Social Security Act was enacted, marking a significant milestone in the evolution of National Insurance.

Texas, recognizing the importance of social security, actively participated in the federal program, ensuring that its residents had access to vital benefits. Over the years, the state's commitment to National Insurance grew, leading to the establishment of various local initiatives and programs tailored to meet the unique needs of its diverse population.

One notable development was the creation of the Texas Workforce Commission (TWC) in 1936. The TWC played a pivotal role in administering unemployment insurance, job training programs, and workforce development initiatives, contributing significantly to the state's economic stability and growth.

The Impact of National Insurance on Texas’ Economy

National Insurance has had a profound impact on Texas’ economy, fostering stability and growth. The state’s robust social security net, encompassing retirement benefits, unemployment insurance, and healthcare programs, has played a crucial role in maintaining a healthy workforce and supporting economic prosperity.

One of the key ways National Insurance has influenced Texas' economy is through its unemployment insurance programs. During economic downturns, these programs provide essential financial support to workers, helping them meet their basic needs and maintain their purchasing power. This, in turn, stimulates local economies and supports small businesses, which form the backbone of Texas' diverse industry sectors.

Moreover, National Insurance has been instrumental in attracting and retaining talent in Texas. The state's commitment to providing comprehensive social security benefits, including access to quality healthcare and retirement savings programs, makes it an attractive destination for skilled workers and professionals. This talent pool is vital for the growth and innovation of Texas' thriving tech, healthcare, and energy sectors.

Texas’ Unique Approach to National Insurance

While Texas adheres to federal guidelines for National Insurance, the state has also implemented unique programs and initiatives to address its specific needs. One such initiative is the Texas Public School Employees Retirement System (TRS), which provides retirement benefits to public school employees, ensuring their financial security post-retirement.

Additionally, Texas has been at the forefront of workforce development initiatives, recognizing the importance of skilled labor in driving economic growth. Programs like the Skills Development Fund, administered by the TWC, provide grants to employers for employee training, helping to upskill the workforce and adapt to the changing demands of the job market.

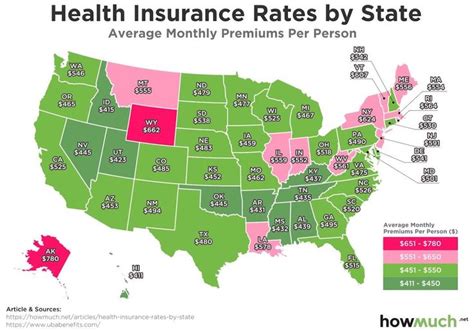

Furthermore, Texas has made significant strides in healthcare insurance, particularly in the context of the Affordable Care Act (ACA). The state's Health Insurance Marketplace, established under the ACA, offers affordable health insurance options to residents, ensuring access to quality healthcare services.

Future Prospects and Challenges

Looking ahead, National Insurance in Texas faces both opportunities and challenges. With an aging population and rising healthcare costs, the state will need to carefully navigate the evolving landscape of social security.

One of the key challenges is funding sustainability. As the demand for social security benefits increases, ensuring the long-term financial viability of these programs becomes crucial. Texas will need to strike a balance between providing adequate benefits and maintaining fiscal responsibility.

However, the state's history of innovation and adaptability bodes well for the future. Texas has consistently demonstrated its ability to adapt to changing economic and social landscapes, and this resilience will be vital in addressing the challenges posed by an evolving National Insurance landscape.

The Role of Technology

In an era defined by digital transformation, technology will play a pivotal role in shaping the future of National Insurance in Texas. From streamlining administrative processes to enhancing the delivery of benefits, technology has the potential to revolutionize the way social security programs are managed and accessed.

For instance, the adoption of blockchain technology could enhance the security and transparency of benefit distribution, while artificial intelligence and machine learning algorithms could improve the efficiency of claim processing and fraud detection.

Collaboration and Innovation

Moving forward, Texas can benefit from fostering cross-sector collaboration and innovation in the realm of National Insurance. By bringing together stakeholders from the public, private, and non-profit sectors, the state can develop innovative solutions to address emerging challenges and ensure the long-term viability of its social security programs.

| Social Security Program | Key Metrics |

|---|---|

| Retirement Benefits | Over 2.5 million beneficiaries as of 2022 |

| Unemployment Insurance | Approximately 200,000 claims per week during peak periods |

| Healthcare Insurance | Over 3 million Texans enrolled in the Health Insurance Marketplace |

How does Texas compare to other states in terms of National Insurance contributions and benefits?

+

Texas generally follows federal guidelines for National Insurance contributions and benefits. However, the state’s unique initiatives, such as the Texas Public School Employees Retirement System and the Skills Development Fund, offer additional support tailored to the needs of its residents and workforce.

What role does the Texas Workforce Commission play in National Insurance?

+

The Texas Workforce Commission (TWC) is a vital administrator of National Insurance programs in the state. It oversees unemployment insurance, job training programs, and workforce development initiatives, contributing to the state’s economic stability and growth.

How is Texas preparing for the future of National Insurance with an aging population and rising healthcare costs?

+

Texas is approaching these challenges through a combination of funding sustainability measures and technological innovations. The state is exploring ways to enhance the efficiency and security of benefit distribution while also fostering cross-sector collaboration to develop innovative solutions for the future.