Nationwide Insurance Home Insurance

Welcome to this comprehensive guide on Nationwide Insurance's home insurance offerings. As a trusted provider, Nationwide offers a range of tailored coverage options to protect your home and belongings. In this article, we will delve into the various aspects of their home insurance policies, highlighting the benefits, features, and unique advantages they provide to homeowners.

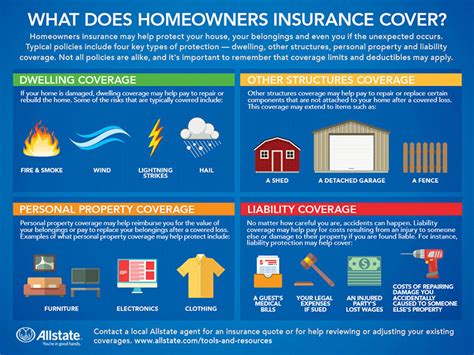

Understanding Nationwide’s Home Insurance Coverage

Nationwide Insurance understands that every home is unique, and so are the risks it may face. Their home insurance policies are designed to offer comprehensive protection against a wide range of perils, ensuring peace of mind for homeowners. Here’s an in-depth look at what Nationwide’s home insurance has to offer.

Coverage Options and Customization

Nationwide’s home insurance policies provide extensive coverage options, allowing homeowners to tailor their insurance plans to their specific needs. Some of the key coverage options include:

- Dwelling Coverage: Protects the physical structure of your home, including the walls, roof, and foundation, against covered perils like fire, wind, and hail damage.

- Personal Property Coverage: Provides coverage for your personal belongings, such as furniture, electronics, and clothing, in case of theft, damage, or loss.

- Liability Coverage: Offers protection in case you are held legally responsible for an injury or property damage that occurs on your property.

- Medical Payments Coverage: Covers medical expenses for injuries sustained by visitors on your property, regardless of liability.

- Additional Living Expenses: Provides financial assistance if you need to relocate temporarily due to a covered loss, covering expenses like hotel stays and meals.

Nationwide also offers specialized coverage options for unique situations, such as:

- Flood Insurance: A separate policy is available to cover flood-related damages, as standard home insurance policies typically exclude flood coverage.

- Earthquake Insurance: Provides coverage for earthquake-related damages, which can be especially beneficial for homeowners in seismically active areas.

- Identity Theft Coverage: Offers assistance and financial protection in case of identity theft, helping you navigate the recovery process.

The Benefits of Nationwide's Home Insurance

Nationwide Insurance's home insurance policies come with a range of benefits that set them apart from other providers. Here are some key advantages:

- Flexible Deductibles: Nationwide offers flexible deductible options, allowing homeowners to choose the amount they are willing to pay out of pocket in case of a claim. This can help reduce premiums for those willing to accept a higher deductible.

- Discounts and Savings: Nationwide provides various discounts to help reduce the cost of home insurance. These include multi-policy discounts (for bundling home and auto insurance), loyalty discounts, and safety discounts for homes equipped with certain safety features.

- 24/7 Claims Service: In the event of a claim, Nationwide's dedicated claims team is available around the clock to assist you. They provide prompt and efficient service, ensuring a smooth and stress-free claims process.

- Disaster Response Team: Nationwide's Disaster Response Team is on standby to assist homeowners in the event of a major catastrophe. They provide immediate support, helping with temporary housing, emergency repairs, and other essential services.

- Valuable Personal Property Coverage: Nationwide's standard home insurance policy includes coverage for valuable items like jewelry, fine art, and collectibles. This coverage is especially beneficial for homeowners with high-value possessions.

Policy Enhancements and Endorsements

To further customize their home insurance policies, Nationwide offers a range of endorsements and policy enhancements. These optional add-ons allow homeowners to expand their coverage and protect against specific risks. Some popular endorsements include:

- Water Backup and Sump Overflow Coverage: Provides coverage for damage caused by water backup through drains or sewers, as well as sump pump overflow or failure.

- Personal Injury Coverage: Offers protection against claims of personal injury, such as libel, slander, or invasion of privacy, providing legal defense and coverage for damages awarded.

- Ordinance or Law Coverage: Covers the cost of complying with updated building codes during repairs or rebuilding after a covered loss. This can be especially important for older homes.

- Identity Recovery Coverage: Assists with the costs associated with recovering your identity after identity theft, including lost wages, child or elder care, and legal fees.

Nationwide's Claims Process and Customer Service

Nationwide Insurance prides itself on its efficient and customer-centric claims process. In the event of a claim, homeowners can expect the following:

- A dedicated claims representative assigned to their case, providing personalized assistance and guidance throughout the claims process.

- Prompt response times, with claims typically processed within 24 to 48 hours after reporting.

- A streamlined digital claims process, allowing homeowners to file claims online or through the Nationwide mobile app.

- Access to Nationwide's network of preferred repair and restoration vendors, ensuring high-quality repairs and timely completion.

- Flexible payment options for out-of-pocket expenses, including the option to use credit or debit cards.

Nationwide's customer service extends beyond claims. Policyholders can expect:

- A dedicated agent or customer service representative to assist with policy inquiries, changes, and renewals.

- 24/7 customer support via phone, email, or live chat, ensuring prompt assistance regardless of the time or day.

- Educational resources and tools to help homeowners understand their coverage and make informed decisions about their insurance needs.

- A user-friendly online portal where policyholders can manage their policies, make payments, and access important documents.

Nationwide's Commitment to Homeowner Education

Nationwide Insurance understands the importance of empowering homeowners with knowledge about their insurance coverage. They provide a wealth of educational resources, including:

- Online articles and guides covering various aspects of home insurance, from understanding different coverage options to preparing for natural disasters.

- Interactive tools and calculators to help homeowners estimate their insurance needs and potential costs.

- Webinars and workshops led by Nationwide experts, offering in-depth insights and advice on topics like home safety, insurance coverage, and disaster preparedness.

- Partnerships with industry organizations and associations to provide homeowners with access to exclusive resources and discounts.

Nationwide's Home Insurance: A Comprehensive Solution

Nationwide Insurance's home insurance policies offer a comprehensive and customizable solution for homeowners. With a range of coverage options, flexible deductibles, and valuable endorsements, Nationwide provides the protection homeowners need to feel secure. Their commitment to customer service, efficient claims processing, and homeowner education sets them apart as a trusted provider in the insurance industry.

If you're a homeowner seeking reliable home insurance, consider Nationwide Insurance. Their expertise, personalized approach, and commitment to customer satisfaction make them a top choice for protecting your home and belongings.

How can I get a quote for Nationwide’s home insurance?

+You can request a quote for Nationwide’s home insurance by visiting their website, calling their customer service hotline, or contacting a local Nationwide agent. Provide details about your home, including its location, size, and any unique features, to receive a personalized quote.

What is the typical response time for Nationwide’s claims process?

+Nationwide aims to provide a prompt response to claims, typically processing them within 24 to 48 hours after reporting. This efficient claims process ensures homeowners receive the support and assistance they need in a timely manner.

Are there any discounts available for Nationwide’s home insurance policies?

+Yes, Nationwide offers various discounts to help reduce the cost of home insurance. These include multi-policy discounts, loyalty discounts, and safety discounts for homes equipped with certain safety features. Check with your Nationwide agent to see which discounts you may be eligible for.