Nationwide Insurance Make A Payment

In today's fast-paced world, convenience and efficiency are highly valued, especially when it comes to financial transactions. This holds true for policyholders of Nationwide Insurance, one of the leading insurance providers in the United States. With its commitment to customer satisfaction and innovative services, Nationwide offers a seamless and secure online payment system, ensuring policyholders can manage their payments with ease.

Making a payment with Nationwide Insurance is not only straightforward but also provides a range of options to suit different preferences and needs. Whether you prefer the convenience of online payments, the simplicity of automatic payments, or the traditional method of mailing a check, Nationwide ensures a smooth and reliable payment process. This article will delve into the various payment methods, offering a comprehensive guide to help you choose the most suitable option for your financial management.

Online Payment: The Digital Convenience

In the digital age, online payment options have become increasingly popular, and Nationwide Insurance recognizes the importance of providing a secure and user-friendly online platform. With just a few clicks, policyholders can access their accounts, view billing information, and make payments anytime, anywhere.

The Nationwide Payment Portal is designed with simplicity and security in mind. Here's a step-by-step guide to making an online payment:

-

Access the Nationwide Payment Portal: Visit the official Nationwide website and locate the "Make a Payment" section. You can also bookmark this page for quick access in the future.

-

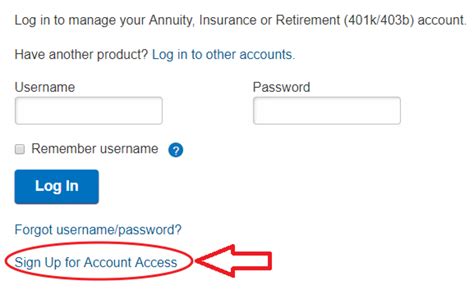

Log In to Your Account: Enter your policy number and the corresponding password or PIN. If you're a new user, you'll need to create an account by providing your policy details and setting up a secure login.

-

Select Your Payment Method: Nationwide offers various payment options, including credit/debit cards and bank transfers. Choose the method that best suits your preferences and financial situation.

-

Enter Payment Details: Depending on your chosen method, you'll need to provide relevant information such as your card number, expiration date, CVV, or your bank account details. Ensure all information is accurate to avoid any delays or additional charges.

-

Review and Confirm Payment: Before finalizing the transaction, carefully review the payment details, including the amount, payment method, and any applicable fees. Once you're satisfied, confirm the payment to complete the process.

-

Receive Payment Confirmation: After successfully making the payment, you'll receive an immediate confirmation on the website. Additionally, Nationwide will send an email confirmation to your registered email address, providing a detailed breakdown of the transaction.

The online payment method offers several advantages, including instant payment processing, the ability to view and manage your payment history, and the convenience of making payments from the comfort of your home or office. Furthermore, Nationwide ensures the highest level of security, employing encryption technologies to safeguard your personal and financial information.

Benefits of Online Payment

-

Convenience and Flexibility: Make payments at your convenience, whether during a lunch break or late at night. You can also access your account from any device with an internet connection, eliminating the need to visit a physical location.

-

Real-Time Payment Processing: Online payments are processed instantly, ensuring your payment is promptly received and applied to your policy. This helps maintain uninterrupted coverage and avoids any potential lapses in insurance.

-

Enhanced Security: Nationwide employs robust security measures, including encryption and secure sockets layer (SSL) technology, to protect your sensitive information. Your personal and financial data remain safe throughout the payment process.

-

Detailed Payment History: The Nationwide Payment Portal allows you to view and track your payment history, providing a transparent record of all transactions. This feature is particularly useful for budgeting and financial planning.

While the online payment method offers numerous benefits, some policyholders may prefer alternative options. Let's explore the other payment methods provided by Nationwide Insurance.

Automatic Payments: Simplifying Your Financial Routine

For those who value simplicity and want to streamline their financial routine, automatic payments are an excellent choice. With this method, Nationwide will automatically deduct your insurance premium from your chosen account on a specified date, ensuring timely payments without the need for manual intervention.

Setting up automatic payments is straightforward and can be done through the Nationwide Payment Portal. Here's a simple guide:

-

Log In to Your Nationwide Account: Access your account through the Nationwide website or mobile app. If you haven't set up an account yet, follow the registration process using your policy details.

-

Navigate to Payment Settings: Locate the "Payment Settings" or "Automatic Payments" section within your account. This option is typically found under the "My Profile" or "Account Management" tab.

-

Choose Your Payment Method: Select the account from which you want the payments to be deducted. You can choose between your bank account or a credit/debit card.

-

Set the Payment Frequency: Determine how often you want the payments to be deducted. Common options include monthly, quarterly, or annual payments.

-

Select the Payment Date: Choose the specific date on which you want the payments to be processed. Ensure you have sufficient funds in your account to cover the premiums on this date.

-

Review and Confirm: Carefully review the payment details, including the amount, payment method, and frequency. Once you're satisfied, confirm the setup to activate automatic payments.

Automatic payments offer several advantages, including peace of mind knowing your payments are always on time, reduced risk of late fees or policy lapses, and the convenience of not having to remember due dates. Additionally, this method is ideal for policyholders who prefer a hands-off approach to financial management.

Advantages of Automatic Payments

-

Timely and Consistent Payments: Automatic payments ensure your premiums are paid on time, every time. This consistency helps maintain uninterrupted coverage and avoids any potential disruptions to your insurance benefits.

-

Reduced Risk of Late Fees: By setting up automatic payments, you eliminate the risk of forgetting a payment or facing unexpected late fees. This method provides a reliable and predictable payment schedule.

-

Convenience and Peace of Mind: With automatic payments, you can focus on other aspects of your financial life without worrying about insurance premiums. This feature is particularly beneficial for busy individuals or those who prefer a streamlined financial routine.

While automatic payments are a popular choice, some policyholders may prefer the traditional method of mailing a check. Let's explore this option and the steps involved.

Mailing a Check: The Traditional Approach

Although online and automatic payments are convenient options, some policyholders may prefer the familiarity and security of mailing a check. Nationwide Insurance understands this preference and provides a straightforward process for making payments via mail.

Here's a step-by-step guide to mailing a check to Nationwide Insurance:

-

Prepare the Check: Obtain a personal check from your bank account. Ensure the check is filled out correctly, including your policy number, the payment amount, and your signature.

-

Address the Envelope: Clearly write the address of the Nationwide Insurance payment processing center on the envelope. You can find the specific address on your billing statement or by contacting Nationwide's customer service.

-

Include a Payment Coupon: If you received a billing statement or payment coupon with your policy documents, include it with your check. This helps Nationwide accurately process your payment.

-

Mail the Payment: Send the envelope containing your check and any necessary documents to the Nationwide payment processing center. Use a reliable postal service to ensure timely delivery.

-

Track the Payment: Once you've mailed the payment, consider tracking the envelope to ensure it reaches Nationwide. This provides peace of mind and helps you monitor the payment process.

While mailing a check may take longer than online or automatic payments, it offers a sense of security and control for those who prefer traditional methods. Additionally, this option is suitable for policyholders who do not have access to online banking or prefer to keep a physical record of their payments.

Advantages of Mailing a Check

-

Physical Record: Mailing a check provides a tangible record of your payment, which can be beneficial for personal financial tracking and tax purposes.

-

Security and Control: Some policyholders feel more secure with the traditional method of mailing a check. This option allows for a sense of control over the payment process, especially for those who prefer a more hands-on approach.

-

Suitable for Limited Access: If you have limited access to online banking or prefer not to provide sensitive financial information online, mailing a check is a reliable alternative.

Now that we've explored the various payment methods offered by Nationwide Insurance, let's delve into some frequently asked questions to provide further clarity and guidance.

Can I Make Partial Payments with Nationwide Insurance?

+Yes, Nationwide Insurance allows policyholders to make partial payments. This flexibility can be especially useful for those facing temporary financial constraints. However, it's important to note that partial payments may incur additional fees or affect your coverage. It's recommended to discuss your specific situation with a Nationwide representative to understand the implications.

Are There Any Fees Associated with Online Payments?

+Nationwide Insurance does not charge any additional fees for online payments. However, depending on your chosen payment method, your bank or credit card provider may apply certain fees or charges. It's advisable to check with your financial institution for any potential fees associated with online transactions.

How Long Does It Take for My Payment to Be Processed Online?

+Online payments with Nationwide Insurance are processed instantly. Once you confirm the payment, you'll receive immediate confirmation on the website, and the funds will be deducted from your account. This real-time processing ensures timely payments and helps maintain uninterrupted coverage.

Can I Make Payments Using a Credit Card with Nationwide Insurance?

+Absolutely! Nationwide Insurance accepts credit card payments for insurance premiums. You can use major credit cards, including Visa, MasterCard, American Express, and Discover. This provides flexibility and convenience for policyholders who prefer to use credit cards for their payments.

Is It Safe to Provide My Bank Account Information for Automatic Payments?

+Nationwide Insurance prioritizes the security of your personal and financial information. When setting up automatic payments, you'll be guided through a secure process that employs encryption technologies to protect your data. Additionally, Nationwide's systems are regularly audited to ensure compliance with industry security standards.

In conclusion, Nationwide Insurance offers a range of payment methods to cater to different preferences and needs. Whether you choose the convenience of online payments, the simplicity of automatic payments, or the traditional approach of mailing a check, Nationwide ensures a secure and reliable payment process. By understanding the advantages and features of each method, you can make an informed decision that aligns with your financial management style and preferences.

Remember, staying on top of your insurance payments is crucial for maintaining uninterrupted coverage and peace of mind. With Nationwide Insurance’s commitment to customer satisfaction and innovative services, managing your policy payments has never been easier.