New Life Insurance

The Ultimate Guide to Understanding and Choosing New Life Insurance Policies

In the realm of financial planning and risk management, life insurance stands as a cornerstone, offering a vital safety net for individuals and families. This comprehensive guide aims to unravel the complexities of life insurance, providing an in-depth analysis of the different types, their benefits, and the key considerations when selecting a policy. With a focus on real-world applications and expert insights, we will navigate the often-confusing world of life insurance, empowering readers to make informed decisions.

The Evolution of Life Insurance: A Historical Perspective

Life insurance, as we know it today, has evolved significantly over centuries. Its roots can be traced back to ancient civilizations, where various forms of insurance-like practices existed to mitigate financial risks. The modern concept of life insurance, however, emerged in the 17th century with the establishment of the Amicable Society in London. This society, founded in 1706, is often regarded as the first life insurance company, offering policies to protect against premature death.

The Amicable Society's model involved members paying an annual subscription, with the proceeds being used to provide a benefit to the family of any member who died. This early form of mutual insurance laid the foundation for the industry we recognize today. Over the years, life insurance evolved to cater to a wider range of needs, from protecting loved ones' financial futures to providing retirement income and estate planning tools.

The late 20th century witnessed a significant shift towards term life insurance, which offered coverage for a specified period, typically 10 to 30 years. This type of policy gained popularity due to its affordability and flexibility, allowing individuals to tailor coverage to their specific needs. Today, the life insurance market offers an array of options, each designed to meet diverse financial goals and circumstances.

Understanding the Types of Life Insurance

The life insurance landscape is diverse, with various types of policies catering to different needs and preferences. Let's delve into the key types and their unique characteristics.

Term Life Insurance

Term life insurance, as mentioned earlier, is a popular choice due to its simplicity and cost-effectiveness. This type of policy provides coverage for a specified term, typically ranging from 10 to 30 years. During this term, the policyholder pays a premium, and in the event of their death, their beneficiaries receive a tax-free lump sum payment. Term life insurance is ideal for individuals seeking coverage for a specific period, such as during their working years or while their children are dependent.

One of the key advantages of term life insurance is its flexibility. Policyholders can choose the term length and the amount of coverage based on their needs. For instance, a young couple might opt for a 20-year term to cover their mortgage and ensure their children's education is funded in the event of an untimely death. As the policyholder ages, they can reassess their needs and either renew the policy or switch to a different type of insurance.

Whole Life Insurance

Whole life insurance, also known as permanent life insurance, offers coverage for the policyholder's entire life, as long as premiums are paid. This type of policy is more comprehensive than term life insurance and typically includes a cash value component, which grows over time and can be accessed by the policyholder through loans or withdrawals.

The cash value component of whole life insurance makes it a versatile tool for estate planning and wealth accumulation. Policyholders can borrow against the cash value or use it to pay premiums, providing a degree of financial flexibility. The policy also offers guaranteed death benefits, ensuring the beneficiaries receive a fixed amount upon the policyholder's death.

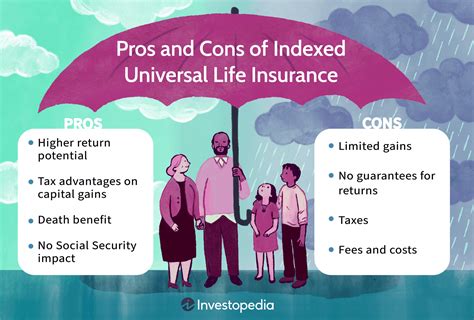

Universal Life Insurance

Universal life insurance is a type of permanent life insurance that offers more flexibility than whole life. It combines a death benefit with a savings element, allowing policyholders to adjust their premiums and death benefit amounts over time. The savings component, known as the cash value, can be used to pay premiums or provide additional death benefits.

One of the key advantages of universal life insurance is its adaptability. Policyholders can increase or decrease their premiums and death benefits based on their changing financial circumstances. This makes it an attractive option for individuals who anticipate their financial needs may evolve over time. Additionally, the cash value component can provide a degree of financial security, especially in retirement.

Variable Life Insurance

Variable life insurance is another type of permanent life insurance that allows policyholders to invest a portion of their premiums in different investment options, such as stocks, bonds, or mutual funds. The death benefit and cash value of the policy are tied to the performance of these investments, offering the potential for higher returns but also carrying more risk.

Variable life insurance is ideal for individuals seeking a life insurance policy that can also function as an investment vehicle. Policyholders can choose from a range of investment options, allowing them to customize their policy based on their risk tolerance and financial goals. However, it's important to note that the value of the policy can fluctuate, and there is a risk of losing money if the investments perform poorly.

Guaranteed Issue Life Insurance

Guaranteed issue life insurance, as the name suggests, is a type of policy that is guaranteed to be issued, regardless of the applicant's health status. This type of insurance is often marketed to individuals who have been denied coverage due to pre-existing conditions or health issues. While it provides a vital safety net for those with health challenges, it typically comes with limitations, such as a lower coverage amount and higher premiums.

Guaranteed issue life insurance is a valuable option for individuals who may have difficulty obtaining traditional life insurance due to health reasons. However, it's important to carefully review the policy's terms and conditions, as there may be exclusions or waiting periods before the full death benefit is payable.

Key Considerations When Choosing a Life Insurance Policy

Selecting the right life insurance policy involves careful consideration of various factors. Here are some key aspects to keep in mind when making your decision.

Your Financial Goals and Needs

The first step in choosing a life insurance policy is to assess your financial goals and needs. Consider the purpose of the policy. Are you looking to protect your family's financial future in the event of your untimely death? Do you need coverage to fund your children's education or pay off your mortgage? Understanding your specific needs will help guide your choice of policy type and coverage amount.

Your Budget and Premium Affordability

Life insurance premiums can vary significantly based on the type of policy, coverage amount, and your personal health and lifestyle factors. It's essential to choose a policy that aligns with your budget and premium affordability. While it's tempting to opt for a higher coverage amount, ensure that you can comfortably afford the premiums over the long term.

Policy Duration and Renewal Options

The duration of your life insurance policy is another crucial consideration. Term life insurance policies typically offer coverage for a specified period, after which you may need to renew or switch to a different policy. Whole life and universal life insurance policies, on the other hand, provide coverage for your entire life, as long as premiums are paid. Consider your long-term needs and whether you prefer a policy with a fixed term or one that offers lifetime coverage.

Flexibility and Adaptability

Life insurance policies vary in their flexibility and adaptability. Some policies, like universal life insurance, allow you to adjust your premiums and death benefits over time, providing a degree of financial flexibility. Others, such as whole life insurance, offer more stability but may be less adaptable to changing circumstances. Assess your needs and preferences to determine the level of flexibility you require in your policy.

Policy Riders and Additional Benefits

Many life insurance policies offer optional riders or additional benefits that can enhance your coverage. These riders can include accelerated death benefits, which allow you to access a portion of your death benefit if you're diagnosed with a terminal illness, or waiver of premium benefits, which waive your premium payments if you become disabled.

Review the available riders and additional benefits to determine if they align with your needs. While these benefits can add value to your policy, they may also increase your premiums, so it's important to carefully weigh the pros and cons.

The Application and Approval Process

Once you've selected the type of life insurance policy that best suits your needs, the next step is the application and approval process. This process can vary depending on the insurer and the type of policy you're applying for.

The Application Process

Most life insurance applications require you to provide personal information, such as your name, date of birth, and contact details. You'll also need to disclose your health history, including any pre-existing conditions or medications you're currently taking. Some applications may also require you to provide information about your lifestyle, such as your smoking status or any hazardous hobbies you participate in.

In addition to the personal information, you'll need to choose the type of policy you want, the coverage amount, and the term or duration of the policy. You'll also be asked to select a beneficiary, who will receive the death benefit upon your passing.

The Approval Process

After submitting your application, the insurer will review your information and assess your eligibility for the policy. This process may involve a medical examination, where a nurse or doctor will collect samples and assess your overall health. The insurer may also request access to your medical records to review your health history in more detail.

Based on the information provided and the results of the medical examination, the insurer will determine whether to approve your application. If approved, you'll receive a policy contract outlining the terms and conditions of your coverage. It's important to carefully review this contract to ensure it aligns with your expectations and the information you provided during the application process.

Common Misconceptions and Myths About Life Insurance

Despite its importance, life insurance is often shrouded in misconceptions and myths. Let's dispel some of these common beliefs to provide a clearer understanding of this vital financial tool.

Life Insurance is Only for the Wealthy

One of the most prevalent myths about life insurance is that it's only for the rich. While it's true that some high-net-worth individuals may require specialized policies, life insurance is accessible and affordable for a wide range of income levels. Term life insurance, in particular, offers coverage for a relatively low premium, making it an excellent option for individuals with limited financial means.

Life Insurance is Too Expensive

Another common misconception is that life insurance is prohibitively expensive. While it's true that some policies, especially those with high coverage amounts or specialized features, can be costly, there are numerous options available at various price points. By carefully assessing your needs and comparing different policies, you can find a life insurance plan that fits your budget.

Life Insurance is Only for the Elderly

Contrary to popular belief, life insurance is not exclusively for senior citizens. In fact, it's often more beneficial to purchase life insurance when you're younger and healthier, as premiums tend to be lower and coverage options more extensive. Additionally, purchasing life insurance early on provides long-term protection and peace of mind, ensuring your loved ones are financially secure regardless of when you pass away.

Life Insurance is a Waste of Money

Some individuals view life insurance as a waste of money, arguing that the premiums could be better spent on other financial goals. While it's true that life insurance may not provide immediate financial gains, it serves a crucial purpose by offering a safety net for your loved ones in the event of your untimely death. The peace of mind that comes with knowing your family's financial future is secure is invaluable, making life insurance a wise investment.

Real-Life Examples and Success Stories

Understanding the theoretical aspects of life insurance is essential, but seeing real-life examples and success stories can provide a more tangible understanding of its impact. Let's explore a few case studies to illustrate the value of life insurance.

Protecting a Family's Financial Future

John, a 35-year-old father of two, purchased a term life insurance policy with a coverage amount of $500,000 when his children were born. Unfortunately, John passed away unexpectedly in a car accident five years later. His life insurance policy provided his family with the financial resources they needed to pay off their mortgage, cover living expenses, and fund his children's education. Without the life insurance payout, John's family would have faced significant financial hardship, but instead, they were able to maintain their standard of living and focus on healing together.

Estate Planning and Wealth Accumulation

Sarah, a successful businesswoman, opted for a whole life insurance policy with a substantial coverage amount and a focus on wealth accumulation. Over the years, the cash value component of her policy grew significantly, providing her with a substantial sum upon her retirement. Sarah used this accumulated wealth to supplement her retirement income, ensuring a comfortable and financially secure retirement. Additionally, the death benefit of her policy provided a substantial inheritance for her children, ensuring their financial security.

Providing Peace of Mind for a Young Couple

Emily and David, a young couple in their early 30s, purchased a term life insurance policy to protect their growing family. With a newborn baby and a mortgage, they wanted to ensure their financial stability in the event of an untimely death. Their life insurance policy provided them with peace of mind, knowing that their loved ones would be financially secure and their dreams for their child's future would be realized, even if the worst were to happen.

The Future of Life Insurance: Emerging Trends and Innovations

The life insurance industry is continually evolving, with new trends and innovations shaping the future of coverage. Let's explore some of the emerging trends and their potential impact on the industry.

Digital Transformation

The digital age has transformed numerous industries, and life insurance is no exception. Many insurers are embracing digital technologies to enhance the customer experience and streamline processes. From online applications and policy management to digital claim submissions, the industry is becoming increasingly tech-savvy.

Digital transformation not only improves efficiency but also opens up new avenues for customer engagement. Insurers are leveraging social media and online platforms to reach a wider audience and provide personalized services. Additionally, the use of artificial intelligence and machine learning is revolutionizing risk assessment and underwriting, allowing for more accurate and efficient policy evaluations.

Personalized Insurance Products

The one-size-fits-all approach to life insurance is becoming a thing of the past. Insurers are increasingly offering personalized insurance products tailored to individual needs and circumstances. This trend is driven by a deeper understanding of customer demographics and preferences, as well as advancements in technology that allow for more nuanced risk assessments.

Personalized insurance products offer a higher degree of customization, allowing individuals to choose coverage options and benefits that align with their specific needs. Whether it's coverage for a specific period, additional benefits such as critical illness coverage, or flexible payment options, insurers are striving to meet the diverse needs of their customers.

Wellness and Lifestyle Programs

Insurers are recognizing the impact of wellness and lifestyle on overall health and are incorporating wellness programs into their offerings. These programs incentivize policyholders to adopt healthier lifestyles by offering discounts or rewards for meeting certain health milestones. For example, some insurers provide reduced premiums for policyholders who maintain a healthy weight, exercise regularly, or quit smoking.

Wellness programs not only benefit policyholders by encouraging healthier lifestyles but also benefit insurers by reducing the risk of premature death or serious illness. This win-win scenario is a testament to the evolving nature of the life insurance industry, which is increasingly focused on preventative measures and long-term customer well-being.

Environmental and Social Impact Considerations

The life insurance industry is also paying increasing attention to environmental and social impact considerations. Some insurers are offering policies that support sustainable and ethical practices, such as those that invest in green technologies or promote environmental initiatives. Additionally, there is a growing trend towards offering insurance products that support social causes, with a portion of the premiums going towards charitable organizations or community development projects.

By incorporating environmental and social impact considerations into their offerings, insurers are not only responding to changing consumer preferences but also contributing to a more sustainable and equitable future. This trend reflects a broader shift towards responsible business practices and a commitment to making a positive impact beyond financial security.

Conclusion: Empowering Financial Security with Life Insurance

Life insurance is more than just a financial product; it's a vital tool for protecting the financial security and well-being of individuals and their loved ones. By understanding the different types of life insurance, assessing your needs and budget, and carefully navigating the application and approval process, you can make informed decisions that provide peace of mind and long-term financial stability.

As the life insurance industry continues to evolve, embracing digital transformation, personalized products, and a focus on wellness and social impact, it offers an ever-expanding array of options to meet diverse needs. Whether you're a young professional starting a family, a business owner planning for retirement, or a senior citizen seeking to leave a legacy, there is a life insurance policy tailored to your circumstances.

Remember, life insurance is an investment in your future and the future of those you love. By taking the time to understand your options and make informed choices, you can ensure that your financial security is protected, no matter what life may bring. So, take the first step