Nj Insurance Quotes

Obtaining accurate and affordable insurance quotes is crucial for residents of New Jersey, as it ensures financial protection and peace of mind. With a diverse range of insurance options available, understanding the specific needs and requirements of individuals and businesses in the Garden State is essential. This comprehensive guide aims to provide valuable insights into the world of insurance quotes in New Jersey, covering various aspects from policy types to cost-saving strategies.

Understanding Insurance Needs in New Jersey

New Jersey, known for its vibrant communities and diverse landscapes, presents unique insurance considerations. Whether you’re a resident of Jersey City, seeking auto insurance for your commute across the Hudson River, or a business owner in Hoboken, requiring comprehensive commercial coverage, the state’s insurance landscape is varied and complex. Understanding the specific needs and regulations in New Jersey is the first step towards securing the right insurance protection.

Auto Insurance: Navigating New Jersey’s Roads

For vehicle owners in New Jersey, auto insurance is a legal requirement and a vital component of financial security. The state’s minimum liability coverage requirements include bodily injury coverage of 15,000 per person and 30,000 per accident, as well as property damage coverage of $5,000. However, many experts recommend purchasing higher limits to ensure adequate protection in the event of an accident.

New Jersey is known for its busy highways and urban areas, which can increase the risk of accidents. As such, comprehensive and collision coverage are essential considerations for residents. Additionally, the state’s unique laws, such as the Verifying Insurance Credentials Law (VIC), which requires electronic verification of insurance coverage for vehicle registration, add an extra layer of complexity to auto insurance.

When seeking auto insurance quotes in New Jersey, factors such as the make and model of your vehicle, your driving history, and your credit score can significantly impact the premium. For instance, drivers with a clean record and a safe vehicle may qualify for lower rates, while those with multiple violations or accident claims may face higher costs.

| Auto Insurance Coverage | New Jersey Requirements |

|---|---|

| Bodily Injury Liability | $15,000 per person / $30,000 per accident |

| Property Damage Liability | $5,000 |

| Uninsured Motorist Coverage | Included (same limits as liability coverage) |

| Personal Injury Protection (PIP) | Mandatory ($15,000 minimum) |

Homeowners Insurance: Protecting Your Property

New Jersey’s diverse landscapes, from coastal regions to suburban neighborhoods, present unique challenges when it comes to homeowners insurance. Residents must contend with potential risks such as coastal storms, floods, and even earthquakes. As such, comprehensive coverage is essential to protect against these hazards.

When obtaining homeowners insurance quotes in New Jersey, factors such as the location, size, and age of your home, as well as any additional structures or high-value possessions, will influence the premium. For instance, homes in high-risk areas for natural disasters may require specialized coverage, which can increase the cost.

New Jersey also has specific laws regarding homeowners insurance, such as the New Jersey Fair Automobile and Property Insurance Plan, which ensures that all eligible residents can obtain property insurance, even if they are considered high-risk. This plan, often referred to as the “Fair Plan,” provides a safety net for those who may struggle to find coverage in the standard market.

| Homeowners Insurance Coverage | Considerations |

|---|---|

| Dwelling Coverage | Protects the structure of your home |

| Personal Property Coverage | Covers possessions inside your home |

| Liability Coverage | Protects against lawsuits and medical claims |

| Additional Living Expenses | Covers temporary living costs if your home is uninhabitable |

| Flood Insurance | Required for homes in high-risk flood zones |

Securing the Best Insurance Quotes in New Jersey

Navigating the insurance landscape in New Jersey can be challenging, but with the right approach and guidance, you can secure the best quotes for your needs. Here are some strategies to help you obtain accurate and affordable insurance quotes in the Garden State.

Comparing Multiple Quotes

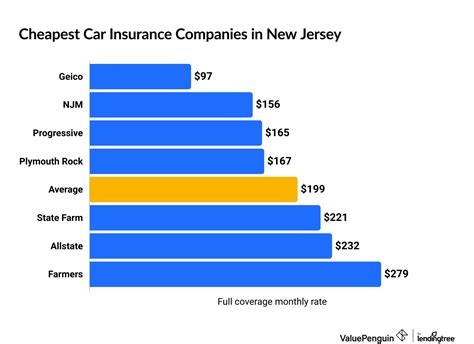

One of the most effective ways to secure a competitive insurance quote is by comparing multiple offers. In New Jersey, there are numerous insurance providers, each with their own rates and policy options. By obtaining quotes from several insurers, you can identify the most cost-effective coverage that suits your specific needs.

Online comparison tools can be particularly useful for this task. These platforms allow you to enter your details once and receive multiple quotes, saving you time and effort. However, it’s essential to ensure that the quotes you receive are accurate and tailored to your situation. Provide as much detail as possible about your needs and circumstances to ensure you get precise quotes.

Understanding Discounts and Savings

Insurance providers in New Jersey often offer a variety of discounts to attract and retain customers. These discounts can significantly reduce your insurance premiums, making coverage more affordable. Some common discounts include:

- Multi-Policy Discounts: Insuring multiple aspects of your life, such as your home and auto, with the same provider can result in substantial savings.

- Safe Driver Discounts: Drivers with a clean record, free of accidents and violations, may qualify for lower auto insurance rates.

- Home Safety Discounts: Homeowners who install security systems, smoke detectors, or other safety features may be eligible for reduced premiums.

- Loyalty Discounts: Staying with the same insurer for an extended period can lead to loyalty discounts, rewarding your long-term commitment.

It's important to ask your insurance agent about all the potential discounts you may qualify for. Each insurer may have unique offers, so thorough research can uncover significant savings.

Bundling Your Insurance Policies

Bundling, or combining multiple insurance policies with the same provider, is a strategic way to save on insurance costs. By consolidating your auto, home, renters, or other types of insurance, you can often negotiate better rates and take advantage of multi-policy discounts.

For instance, if you’re a homeowner in New Jersey, bundling your homeowners insurance with your auto insurance policy can result in substantial savings. Many insurers offer a bundling discount that provides a reduced rate for each policy when you combine them. This strategy not only saves you money but also simplifies your insurance management, as you only have one provider to deal with.

Seeking Professional Guidance

Navigating the complex world of insurance can be daunting, especially when you’re trying to find the best quotes in New Jersey. That’s why seeking professional guidance from an insurance agent or broker can be invaluable. These experts can provide personalized advice based on your specific needs and circumstances.

An insurance agent or broker can help you understand the nuances of different policies, guide you through the quote process, and ensure you’re getting the best value for your money. They can also provide insights into the latest trends and changes in the New Jersey insurance market, helping you stay informed and make the right decisions.

What is the average cost of auto insurance in New Jersey?

+The average cost of auto insurance in New Jersey can vary significantly based on individual factors such as driving history, vehicle type, and location. According to recent data, the average premium for minimum liability coverage is approximately $1,500 per year. However, comprehensive policies with higher limits can cost upwards of $3,000 annually.

Are there any unique insurance requirements in New Jersey?

+Yes, New Jersey has several unique insurance requirements. For instance, the state requires Personal Injury Protection (PIP) coverage as part of auto insurance policies. Additionally, New Jersey is one of the few states that mandate electronic verification of insurance credentials through the Verifying Insurance Credentials Law (VIC) for vehicle registration.

How can I reduce my homeowners insurance costs in New Jersey?

+There are several strategies to reduce homeowners insurance costs in New Jersey. These include increasing your deductible, bundling your policies, installing security systems or smoke detectors, and maintaining a good credit score. Additionally, regularly reviewing and updating your policy to reflect your current needs can help prevent over-insurance and save money.

What should I look for when comparing insurance quotes in New Jersey?

+When comparing insurance quotes in New Jersey, it's crucial to ensure that the quotes are tailored to your specific needs and circumstances. Look for policies that provide adequate coverage for your risks, whether it's auto accidents, home damage, or liability concerns. Compare the coverage limits, deductibles, and any additional benefits or exclusions. Also, consider the reputation and financial stability of the insurance provider.

In conclusion, obtaining the best insurance quotes in New Jersey requires a strategic approach that considers your specific needs, the unique requirements of the state, and cost-saving strategies. By understanding your insurance needs, comparing multiple quotes, and leveraging discounts and bundling options, you can secure affordable and comprehensive coverage. Remember, professional guidance can also be invaluable in navigating the complex world of insurance.