Normal Car Insurance Cost

Understanding the average cost of car insurance is crucial for any vehicle owner, as it helps in budgeting and financial planning. The term "normal" when referring to car insurance costs can be somewhat relative, as it largely depends on various factors specific to the policyholder and their circumstances. These factors influence the premium rates, which can vary significantly from one individual to another. Therefore, providing an exact figure for the "normal" car insurance cost can be challenging. However, we can delve into the key determinants of insurance rates and explore some averages to offer a clearer picture.

Factors Influencing Car Insurance Costs

The cost of car insurance is influenced by a multitude of factors, including but not limited to:

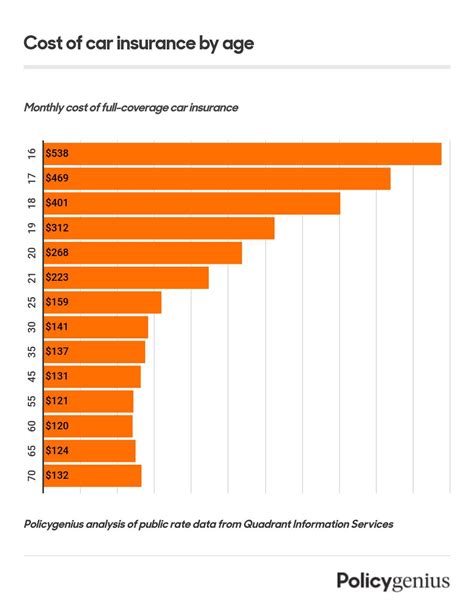

- Driver’s Age and Experience: Younger drivers, particularly those under 25, often face higher premiums due to their perceived higher risk. As drivers gain experience and age, insurance costs generally decrease.

- Vehicle Type and Usage: The make, model, and year of your vehicle play a significant role. Sports cars and luxury vehicles tend to have higher insurance rates due to their cost and potential for higher repair expenses. Additionally, how you use your car (commuting, leisure, business) can impact your premium.

- Location: Insurance rates vary based on geographic location. Factors like crime rates, traffic density, and weather conditions can affect the cost of insurance. Urban areas often have higher rates than rural ones.

- Driving Record: A clean driving record with no accidents or violations can lead to lower insurance premiums. Conversely, a history of accidents or traffic violations may result in higher costs.

- Coverage and Deductibles: The type and extent of coverage you choose will impact your premium. Comprehensive and collision coverage, for instance, can increase costs, while higher deductibles may reduce them.

- Personal Factors: Insurance providers consider personal details like your credit score and marital status. A higher credit score and being married can sometimes lead to lower insurance rates.

Average Car Insurance Costs

According to recent industry data, the average cost of car insurance in the United States for a policy covering liability, comprehensive, and collision is approximately 1,674 per year</strong>, or about <strong>139.50 per month. However, it’s essential to remember that this is just an average, and your personal insurance cost could be significantly higher or lower depending on the factors mentioned earlier.

| Coverage Type | Average Annual Cost |

|---|---|

| Liability Only | $500 - $1,500 |

| Full Coverage (Liability, Collision, Comprehensive) | $1,000 - $2,500 |

| High-Risk Policies | $3,000 - $10,000 |

State-Wise Variations

Car insurance costs can vary significantly by state due to differences in laws, regulations, and the cost of living. For instance, the average annual premium in Michigan is around 3,000</strong>, while in states like Ohio and Pennsylvania, it's closer to <strong>1,000. Here’s a table showcasing the average annual premiums for various states:

| State | Average Annual Premium |

|---|---|

| Michigan | $3,000 |

| Ohio | $1,000 |

| Pennsylvania | $1,200 |

| California | $1,500 |

| Texas | $1,100 |

Strategies to Lower Car Insurance Costs

While you can’t control all the factors that influence insurance rates, there are some strategies you can employ to potentially lower your car insurance costs:

- Shop Around: Obtain quotes from multiple insurance providers to compare rates and find the best deal.

- Increase Deductibles: Choosing a higher deductible can lead to lower premiums, but ensure you can afford the deductible in case of an accident.

- Maintain a Clean Driving Record: Avoid traffic violations and accidents to keep your insurance rates as low as possible.

- Consider Usage-Based Insurance: Some providers offer policies that track your driving habits and reward safe driving with lower rates.

- Bundle Policies: Insuring multiple vehicles or combining car insurance with other policies (like home insurance) can often result in discounts.

- Take Advantage of Discounts: Many insurers offer discounts for various reasons, such as good student discounts, safe driver discounts, or discounts for taking defensive driving courses.

The Bottom Line

Determining the “normal” cost of car insurance is a complex task due to the multitude of factors at play. While averages can provide a general idea, your personal insurance cost will be unique to your circumstances. By understanding the factors that influence insurance rates and employing strategies to lower costs, you can make more informed decisions about your car insurance coverage.

What is the average car insurance cost for young drivers?

+Young drivers often face higher insurance premiums due to their perceived higher risk. The average annual cost for a young driver (under 25) can range from 1,500 to 5,000, depending on various factors like the driver’s record, vehicle type, and location.

How do credit scores impact car insurance rates?

+Credit scores can significantly affect car insurance rates. Generally, a higher credit score is associated with lower insurance premiums, as it’s seen as an indicator of financial responsibility. Some states, however, have banned the use of credit scores in insurance pricing.

Are there any ways to get cheaper car insurance for high-risk drivers?

+High-risk drivers, such as those with multiple accidents or violations, often face higher insurance costs. However, they can still explore options like high-risk insurance providers, usage-based insurance, or taking steps to improve their driving record to potentially lower their premiums over time.