State Farm Mutual Insurance Claims

In the realm of insurance, understanding the claims process is crucial for policyholders. This in-depth exploration delves into the intricacies of State Farm Mutual Insurance claims, shedding light on the steps, strategies, and key considerations for a seamless and efficient claims experience.

Navigating the State Farm Claims Journey

State Farm Mutual Insurance, a leading provider in the industry, offers a comprehensive claims process designed to assist policyholders in navigating the complexities of insurance claims. From understanding the initial reporting to the final settlement, this section provides an overview of the entire journey.

Step 1: Reporting the Claim

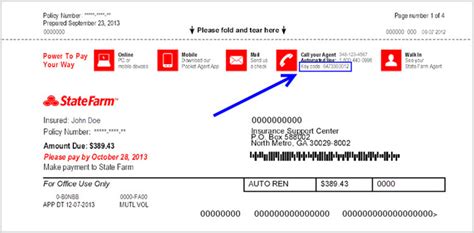

The first step in the State Farm claims process is reporting the incident. Policyholders are encouraged to promptly report any losses or damages to their local State Farm agent or the 24-hour claims hotline. The timely reporting ensures that the claims process can commence without delay, allowing State Farm to begin investigating and assessing the claim.

During the reporting process, policyholders should be prepared to provide detailed information about the incident, including the date, time, location, and any relevant parties involved. Accurate and comprehensive information is crucial for a smooth claims experience, as it enables State Farm to accurately assess the claim and determine the appropriate coverage.

Step 2: Claims Investigation

Once the claim is reported, State Farm initiates a thorough investigation to gather the necessary information and evidence. This stage involves a comprehensive review of the policyholder’s coverage, the circumstances of the incident, and any relevant documents or reports. The claims adjuster assigned to the case plays a vital role in guiding the policyholder through this process, ensuring that all necessary steps are taken to support the claim.

During the investigation, policyholders may be requested to provide additional documentation, such as photographs, police reports, or repair estimates. It is essential to cooperate fully with the claims adjuster and provide all the required information promptly to avoid potential delays in the claims process.

Step 3: Assessment and Coverage Determination

After the investigation, State Farm proceeds to assess the claim and determine the applicable coverage. This stage involves a careful review of the policyholder’s insurance policy, including the specific terms, conditions, and exclusions. The claims adjuster evaluates the claim based on the policy provisions and the evidence gathered during the investigation.

Policyholders should understand that the coverage determination may involve complex legal and technical considerations. State Farm's experienced claims adjusters are well-equipped to navigate these complexities and provide a fair and accurate assessment of the claim. If there are any questions or concerns about the coverage determination, policyholders are encouraged to discuss them openly with their assigned claims adjuster.

Step 4: Resolution and Settlement

Once the coverage determination is made, State Farm works towards resolving the claim and reaching a settlement. This stage involves negotiations between the policyholder and State Farm to agree on the final amount and terms of the settlement. The claims adjuster strives to find a mutually beneficial resolution that aligns with the policyholder’s interests and the terms of the insurance policy.

Policyholders should actively participate in the settlement discussions, providing input and feedback on the proposed resolution. Open communication and collaboration are key to ensuring a satisfactory outcome. State Farm aims to provide timely and fair settlements, understanding the importance of financial stability and peace of mind for policyholders.

Maximizing Your State Farm Claims Experience

To enhance your State Farm claims experience, it is essential to be well-prepared and informed. This section offers practical tips and strategies to navigate the claims process effectively.

Understand Your Policy Coverage

A thorough understanding of your State Farm insurance policy is crucial. Take the time to review your policy documents, including the coverage limits, deductibles, and any specific exclusions. By familiarizing yourself with the policy terms, you can better advocate for your rights and ensure that your claim is handled fairly.

Gather Relevant Documentation

When reporting a claim, it is beneficial to have all the necessary documentation readily available. This includes photographs of the damage, repair estimates, police reports, and any other relevant evidence. By providing comprehensive documentation, you assist the claims adjuster in assessing your claim accurately and expediting the claims process.

Communicate Effectively with Your Claims Adjuster

Open and honest communication with your assigned claims adjuster is vital. Be proactive in providing updates, answering questions, and seeking clarification when needed. Building a strong relationship with your claims adjuster can lead to a more collaborative and efficient claims experience. Feel free to ask questions and voice any concerns you may have throughout the process.

Explore Additional Resources

State Farm offers a range of resources to support policyholders throughout the claims journey. From online claim status updates to educational materials and claim assistance tools, these resources can provide valuable insights and guidance. Take advantage of these resources to stay informed and empowered during the claims process.

The Future of State Farm Claims: Embracing Innovation

State Farm is committed to staying at the forefront of the insurance industry, leveraging technology and innovation to enhance the claims experience. This section explores the future of State Farm claims, highlighting the company’s dedication to continuous improvement and customer satisfaction.

Digital Claims Processing

State Farm is investing in digital transformation to streamline the claims process. The introduction of online claim portals and mobile apps allows policyholders to report claims, upload documentation, and track the progress of their claims conveniently. By embracing digital claims processing, State Farm aims to provide a faster, more efficient, and user-friendly experience for policyholders.

Artificial Intelligence and Machine Learning

State Farm is exploring the potential of artificial intelligence (AI) and machine learning (ML) to enhance claims handling. These technologies can automate repetitive tasks, analyze large datasets, and identify patterns to improve accuracy and efficiency. By leveraging AI and ML, State Farm aims to reduce processing times, minimize errors, and provide more personalized claim experiences.

Collaborative Claims Management

State Farm recognizes the importance of collaboration in the claims process. The company is working towards establishing stronger partnerships with repair facilities, medical providers, and other industry stakeholders. By fostering collaborative relationships, State Farm aims to streamline the claims journey, ensuring a seamless experience for policyholders and improving overall customer satisfaction.

Continuous Training and Development

State Farm places a strong emphasis on continuous training and development for its claims professionals. By investing in the skills and knowledge of its workforce, State Farm ensures that its claims adjusters are equipped with the latest industry insights and best practices. This commitment to ongoing education enables State Farm to deliver exceptional service and adapt to the evolving needs of its policyholders.

Conclusion: Empowering Policyholders through Knowledge

Understanding the State Farm claims process empowers policyholders to navigate the complexities of insurance claims with confidence. By following the outlined steps, maximizing their claims experience, and embracing the innovations in claims handling, policyholders can rest assured that their interests are well-protected. State Farm’s commitment to customer satisfaction and continuous improvement ensures a bright future for the claims journey, providing policyholders with the support and guidance they need.

How long does the State Farm claims process typically take?

+The duration of the State Farm claims process can vary depending on the complexity of the claim and the availability of necessary documentation. In most cases, simple claims can be resolved within a few days to a week. More complex claims may take several weeks or even months, especially if additional investigations or negotiations are required.

Can I choose my own repair facility or medical provider when filing a claim with State Farm?

+Yes, State Farm allows policyholders to choose their preferred repair facilities or medical providers. However, it is important to ensure that the chosen providers are within the network of State Farm’s approved vendors. This ensures that the costs are covered by your insurance policy and helps streamline the claims process.

What happens if I disagree with State Farm’s coverage determination or settlement offer?

+If you have concerns or disagree with State Farm’s coverage determination or settlement offer, it is essential to communicate your perspective to your claims adjuster. State Farm aims to resolve disputes through open dialogue and negotiation. In some cases, mediation or arbitration may be necessary to reach a mutually agreeable solution.