State Farm Home Insurance Phone Number

For individuals seeking reliable insurance coverage for their homes, State Farm stands out as a prominent player in the industry. In this comprehensive guide, we delve into the specifics of State Farm's home insurance offerings, providing you with detailed insights to help make informed decisions. Our aim is to equip you with the knowledge to navigate the complexities of home insurance, ensuring you find the right coverage tailored to your unique needs.

Understanding State Farm’s Home Insurance Coverage

State Farm offers a comprehensive range of home insurance policies designed to cater to various homeowner needs. Their coverage options are structured to provide protection against a wide array of potential risks, including natural disasters, theft, and accidental damage. This flexibility allows homeowners to customize their insurance plans to match the specific characteristics of their property and personal circumstances.

Key Features of State Farm’s Home Insurance Policies

State Farm’s home insurance policies offer a multitude of benefits and features that set them apart in the market. One notable advantage is the option to bundle home and auto insurance policies, resulting in potential cost savings for policyholders. Additionally, State Farm provides an extensive network of local agents who offer personalized guidance and support throughout the insurance process.

In terms of coverage, State Farm's policies include:

- Dwelling Coverage: This aspect of the policy provides protection for the physical structure of the home, including the walls, roof, and permanent fixtures. It covers damages caused by perils such as fire, lightning, windstorms, and vandalism.

- Personal Property Coverage: State Farm's policies ensure that the contents of your home, such as furniture, electronics, and clothing, are covered against theft, damage, or loss. This coverage extends to personal items even when they are away from your home.

- Liability Coverage: In the event that someone is injured on your property or you are found legally responsible for causing property damage or bodily injury to others, State Farm's liability coverage provides financial protection. This coverage helps cover legal expenses and any compensation that may be awarded.

- Additional Living Expenses: Should your home become uninhabitable due to a covered loss, this coverage helps with the additional costs of temporary housing and living expenses until you can return to your home.

Furthermore, State Farm's home insurance policies come with various optional endorsements and riders that can be added to the base policy to enhance coverage. These include:

- Water Backup Coverage: Provides protection against water damage caused by the backup or overflow of sewers or drains.

- Identity Restoration Coverage: Assists policyholders in the event of identity theft, covering costs related to legal fees, lost wages, and other expenses incurred during the restoration process.

- Personal Article Floater: Allows for higher coverage limits for valuable items such as jewelry, artwork, or collectibles, which may exceed the standard personal property coverage limits.

State Farm’s Claims Process and Customer Service

State Farm prides itself on its efficient and customer-centric claims process. Policyholders can file claims online, over the phone, or through their local agent. The company offers a dedicated claims hotline, ensuring prompt assistance and guidance throughout the claims process. State Farm’s claims adjusters are known for their expertise and commitment to fair and timely settlements.

In addition to its robust claims process, State Farm provides a wealth of resources and tools to help homeowners manage their policies. This includes an online account management system, mobile apps for convenient access to policy information, and educational materials to enhance homeowners' understanding of their insurance coverage.

State Farm’s Financial Strength and Reputation

State Farm is recognized as one of the leading insurance providers in the United States, boasting a strong financial position and an exceptional reputation for customer satisfaction. The company has consistently maintained high financial ratings from independent rating agencies, reflecting its stability and ability to meet its policy obligations.

State Farm's commitment to its customers is evident in its long-standing track record of providing reliable coverage and exceptional service. The company has received numerous accolades for its customer service, including top rankings in J.D. Power's Home Insurance Studies and recognition from prominent industry organizations for its innovative products and services.

How to Contact State Farm for Home Insurance Inquiries

For individuals interested in learning more about State Farm’s home insurance offerings or for existing policyholders seeking assistance, there are several convenient ways to get in touch with the company.

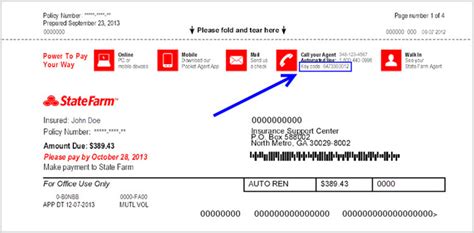

Phone Number

State Farm provides a dedicated phone number for home insurance inquiries and customer support. The number is 1-800-STATE-FARM (1-800-782-8332). This hotline is available 24⁄7, ensuring that customers can reach a representative whenever they need assistance.

Online Resources and Tools

State Farm’s official website, https://www.statefarm.com, is a valuable resource for customers. It offers an array of online tools, including a home insurance quote calculator, policy management features, and a comprehensive knowledge base with articles and guides on various insurance topics.

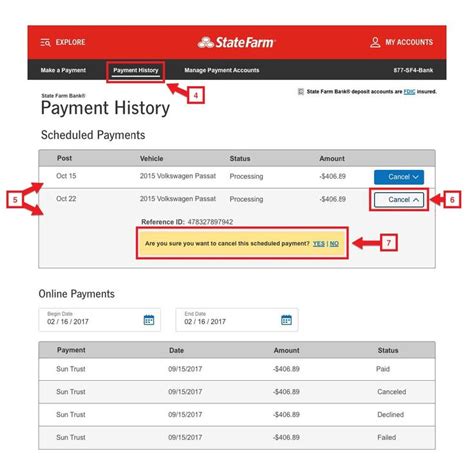

Policyholders can also access their accounts online, view policy details, make payments, and manage their coverage preferences through the State Farm website or mobile app.

Local Agent Network

State Farm’s network of local agents is a key differentiator in the insurance industry. These agents are licensed professionals who are well-versed in the company’s products and services. They provide personalized advice and assistance, helping customers navigate the complexities of home insurance and find the best coverage options for their specific needs.

To find a local State Farm agent, customers can use the "Find an Agent" feature on the company's website. This tool allows users to search for agents based on their location or by entering their ZIP code.

Social Media and Customer Support Channels

State Farm maintains an active presence on various social media platforms, including Facebook, Twitter, and Instagram. These channels are not only used for marketing purposes but also as a means of engaging with customers and providing timely responses to inquiries.

Additionally, State Farm offers live chat support on its website, enabling customers to connect with customer service representatives in real-time. This feature is particularly useful for quick questions or for those who prefer online communication.

Conclusion

State Farm’s home insurance offerings provide a comprehensive and flexible solution for homeowners seeking reliable protection for their properties. With its extensive coverage options, personalized approach, and strong financial standing, State Farm stands out as a trusted partner in the insurance industry. By offering a range of contact methods, including a dedicated phone number, online resources, and a network of local agents, State Farm ensures that customers can easily access the information and support they need.

Frequently Asked Questions

How much does State Farm’s home insurance cost?

+

The cost of State Farm’s home insurance policies can vary depending on factors such as the location of the property, the value of the home, and the coverage limits selected. To get an accurate quote, it’s recommended to contact State Farm directly or use their online quote tool, which considers specific details about your home and personal circumstances.

What are the eligibility requirements for State Farm’s home insurance policies?

+

State Farm’s home insurance policies are generally available to homeowners who own their primary residence or a second home. Eligibility may vary based on factors such as the age and condition of the property, as well as the homeowner’s credit history. It’s advisable to consult with a State Farm agent to determine specific eligibility criteria.

Can I customize my State Farm home insurance policy to meet my specific needs?

+

Absolutely! State Farm offers a wide range of customization options to tailor their home insurance policies to individual needs. Policyholders can choose coverage limits, add optional endorsements, and select additional coverage options to ensure their policy provides the right level of protection for their unique circumstances.

How does State Farm handle claims and what is the typical claims process timeline?

+

State Farm has a well-established claims process designed to provide efficient and timely assistance to policyholders. Once a claim is filed, a dedicated claims adjuster is assigned to evaluate the claim and determine the extent of coverage. The timeline for claim resolution can vary depending on the complexity of the claim and the availability of necessary documentation. State Farm aims to provide prompt and fair settlements to its customers.

Are there any discounts available for State Farm home insurance policies?

+

Yes, State Farm offers a variety of discounts to help policyholders save on their home insurance premiums. These discounts may include bundle discounts for combining home and auto insurance policies, safety discounts for homes equipped with security systems, and loyalty discounts for long-term customers. It’s advisable to discuss available discounts with a State Farm agent to ensure you’re taking advantage of all applicable savings.