Normal Health Insurance Premiums

Health insurance is a vital aspect of modern life, providing individuals and families with financial protection and access to essential healthcare services. Understanding the costs and factors influencing health insurance premiums is crucial for making informed decisions about coverage. In this comprehensive guide, we will delve into the world of normal health insurance premiums, exploring the various elements that contribute to their determination and offering valuable insights to help you navigate the complex landscape of healthcare finances.

Unraveling the Mystery of Health Insurance Premiums

Health insurance premiums are the regular payments made by policyholders to their insurance providers in exchange for comprehensive healthcare coverage. These premiums vary widely based on several factors, each playing a significant role in shaping the overall cost of health insurance.

Key Factors Influencing Health Insurance Premiums

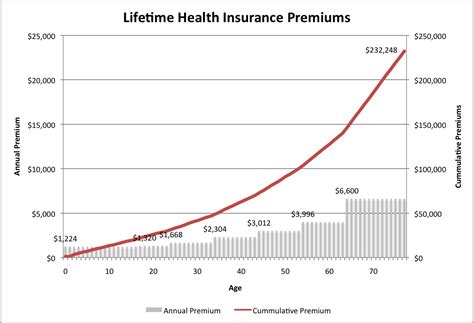

- Age: One of the primary determinants of health insurance premiums is the age of the policyholder. Generally, younger individuals pay lower premiums due to their relatively lower risk of developing serious health conditions. As people age, the risk of chronic illnesses and medical complications increases, leading to higher premiums.

- Gender: Historically, health insurance premiums have been influenced by gender, with women often facing higher premiums than men. This disparity is primarily attributed to the higher healthcare costs associated with reproductive health services and pregnancy-related care. However, with the implementation of the Affordable Care Act (ACA) in the United States, gender-based discrimination in premium pricing has been largely eliminated.

- Tobacco Use: Smoking and tobacco use are significant risk factors for various health issues, including respiratory diseases, cardiovascular problems, and certain types of cancer. Insurance providers often charge higher premiums to individuals who use tobacco, as these habits can lead to increased healthcare needs and costs.

- Medical History: Pre-existing medical conditions and previous health issues can impact health insurance premiums. Policyholders with a history of chronic illnesses, serious injuries, or costly medical treatments may face higher premiums. Insurance companies carefully assess medical histories to evaluate the potential risk associated with insuring an individual.

- Location: The cost of healthcare services and the availability of medical facilities can vary significantly from one region to another. As a result, health insurance premiums are often higher in areas with a higher concentration of healthcare providers and more expensive medical procedures.

- Plan Type and Coverage: The type of health insurance plan and the level of coverage chosen by the policyholder also influence premiums. Plans with more comprehensive benefits and lower out-of-pocket expenses typically come with higher premiums. On the other hand, plans with limited coverage and higher deductibles may offer more affordable premiums.

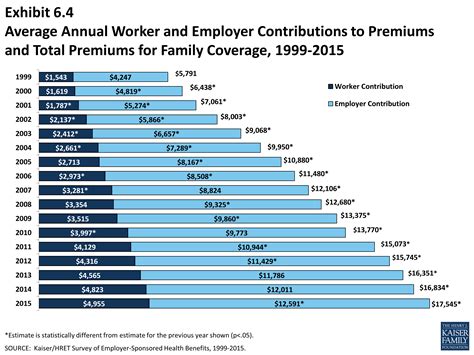

- Family Size: When insuring a family, the number of individuals covered under the policy impacts the overall premium. Family plans typically involve a base premium for the primary policyholder and additional premiums for each dependent covered. Larger families may face higher overall premiums due to the increased likelihood of healthcare needs.

| Factor | Impact on Premiums |

|---|---|

| Age | Premiums increase with age due to higher health risks. |

| Gender | Historically, women faced higher premiums, but the ACA has reduced gender-based discrimination. |

| Tobacco Use | Tobacco users pay higher premiums due to increased health risks. |

| Medical History | Pre-existing conditions and health issues can lead to higher premiums. |

| Location | Healthcare costs and provider availability influence premium variations. |

| Plan Type and Coverage | Comprehensive plans with lower out-of-pocket costs have higher premiums. |

| Family Size | Larger families may face higher premiums due to increased healthcare needs. |

Understanding Premium Variations: A Real-World Perspective

To illustrate the impact of various factors on health insurance premiums, let’s explore a hypothetical case study. Meet Sarah, a 35-year-old non-smoker with a clean medical history living in a metropolitan area. She is considering health insurance plans for herself and her family, which includes her spouse and two children.

Scenario 1: Individual Plan

Sarah starts by exploring individual health insurance plans. Given her age, gender, and non-smoking status, she qualifies for relatively affordable premiums. The plan she chooses offers a comprehensive range of benefits, including low deductibles and out-of-pocket expenses. As a result, her monthly premium is approximately $450, providing her with peace of mind and access to quality healthcare.

Scenario 2: Family Plan

Now, let’s consider Sarah’s decision to insure her entire family. She opts for a family plan that covers herself, her spouse, and their two children. Due to the increased number of individuals and the potential for higher healthcare needs, the family plan premium is higher than her individual plan. The monthly premium for this family coverage is approximately $1,200, ensuring comprehensive healthcare for the entire household.

Scenario 3: Impact of Pre-existing Conditions

Suppose Sarah’s spouse, John, has a history of diabetes and requires regular medical care and medications. This pre-existing condition significantly influences their health insurance premiums. When John applies for coverage under a family plan, the insurance provider considers his medical history and assigns a higher premium. As a result, their family plan premium increases to $1,500 per month, reflecting the increased risk associated with John’s condition.

Scenario 4: Smoking and Premium Penalties

Imagine that Sarah’s brother, David, is a smoker and is also seeking health insurance coverage. Due to the increased health risks associated with tobacco use, David faces higher premiums. His individual health insurance plan, which includes coverage for smoking-related illnesses, comes with a monthly premium of $600, significantly higher than Sarah’s non-smoker premium.

Scenario 5: Regional Variations

Let’s consider a different scenario where Sarah and her family relocate to a rural area with limited access to healthcare facilities. In this case, the cost of healthcare services and the availability of medical providers may impact their health insurance premiums. The family plan premium in this rural area could be slightly lower, around $1,150 per month, due to the reduced healthcare costs and competition among providers.

Maximizing Value: Strategies for Managing Health Insurance Costs

While health insurance premiums are influenced by various factors beyond our control, there are strategies individuals can employ to manage and optimize their healthcare costs effectively.

1. Compare Plans and Shop Around

When selecting a health insurance plan, it’s crucial to compare multiple options. Different providers offer various plans with different benefits, deductibles, and premiums. Take the time to research and analyze the options available in your area, considering factors such as coverage, network of providers, and out-of-pocket expenses. Shopping around can help you find a plan that aligns with your needs and offers the best value for your money.

2. Evaluate Your Health and Lifestyle

Assessing your current health and lifestyle can help you choose a plan that suits your specific needs. If you lead a healthy lifestyle with minimal health concerns, you may opt for a plan with higher deductibles and lower premiums. On the other hand, if you have pre-existing conditions or anticipate higher healthcare needs, a plan with lower deductibles and more comprehensive coverage might be a better fit.

3. Utilize Preventive Care Services

Many health insurance plans offer preventive care services at little to no cost. Taking advantage of these services, such as annual check-ups, vaccinations, and screenings, can help identify potential health issues early on. Preventive care not only promotes overall well-being but can also reduce the likelihood of developing more serious and costly health conditions in the future.

4. Manage Chronic Conditions Effectively

If you have a chronic condition, effective management can help control healthcare costs. Work closely with your healthcare providers to develop a comprehensive treatment plan. Adhere to recommended medications, attend regular follow-up appointments, and actively participate in your healthcare decisions. By staying on top of your condition, you can potentially reduce the frequency and severity of costly medical emergencies.

5. Consider Health Savings Accounts (HSAs)

Health Savings Accounts are tax-advantaged accounts that allow individuals to set aside pre-tax dollars for qualified medical expenses. HSAs are often paired with high-deductible health insurance plans. By contributing to an HSA, you can save money for future medical needs while enjoying the tax benefits. HSAs provide flexibility and control over your healthcare finances, allowing you to manage costs more efficiently.

The Future of Health Insurance Premiums

The landscape of health insurance premiums is constantly evolving, influenced by advancements in medical technology, changes in healthcare regulations, and shifts in societal needs. As healthcare costs continue to rise, insurance providers are exploring innovative strategies to contain expenses and improve the overall efficiency of the healthcare system.

Potential Future Developments

- Value-Based Care Models: There is a growing trend towards value-based care, where healthcare providers are incentivized to deliver high-quality, cost-effective care. This approach aims to improve patient outcomes while reducing unnecessary healthcare expenditures. Value-based care models have the potential to lower overall healthcare costs, positively impacting health insurance premiums.

- Telehealth Integration: The widespread adoption of telehealth services during the COVID-19 pandemic has highlighted the benefits of remote healthcare. Telehealth offers convenient access to medical advice and consultations, reducing the need for in-person visits. As telehealth becomes more integrated into healthcare systems, it could lead to lower premiums by minimizing the cost of traditional office visits.

- Data-Driven Pricing: With advancements in healthcare data analytics, insurance providers are increasingly leveraging data-driven insights to price premiums more accurately. By analyzing vast amounts of medical information, insurance companies can better predict healthcare needs and risks, leading to more precise and fair premium pricing.

- Increased Focus on Wellness and Prevention: As awareness of the importance of preventive care grows, insurance providers may offer incentives and discounts for policyholders who actively engage in wellness programs and maintain healthy lifestyles. Encouraging preventive measures can help reduce the incidence of costly illnesses and lower overall healthcare costs, potentially resulting in more affordable premiums.

Conclusion

Understanding the factors that influence health insurance premiums is crucial for making informed decisions about your healthcare coverage. While individual circumstances play a significant role in determining premiums, being proactive and strategic in your approach to health insurance can help you navigate the complexities of the healthcare system. By comparing plans, evaluating your needs, and adopting healthy lifestyle habits, you can optimize your health insurance costs and ensure access to quality healthcare.

As the healthcare landscape continues to evolve, staying informed about emerging trends and innovations can empower you to make the most of your health insurance benefits. By embracing value-based care, integrating telehealth services, and prioritizing preventive care, you can contribute to a more efficient and cost-effective healthcare system, ultimately leading to more affordable and accessible healthcare for all.

What is the average cost of health insurance premiums in the United States?

+The average cost of health insurance premiums varies significantly based on individual factors and plan types. As of recent data, the average monthly premium for individual plans is around 450, while family plans can range from 1,200 to $1,500 per month. It’s important to note that these averages can fluctuate based on regional variations, provider networks, and the specific benefits offered by each plan.

How do pre-existing conditions impact health insurance premiums?

+Pre-existing conditions, such as diabetes or heart disease, can significantly influence health insurance premiums. Insurance providers carefully assess medical histories to evaluate the potential risk associated with insuring an individual. Policyholders with pre-existing conditions may face higher premiums due to the increased likelihood of costly medical treatments and ongoing healthcare needs.

Can I negotiate health insurance premiums with my provider?

+Negotiating health insurance premiums directly with your provider is generally not possible due to standardized pricing structures. However, you can explore alternative plans or seek out discounts and incentives offered by insurance companies. Some providers offer loyalty discounts, wellness program incentives, or discounts for bundling multiple insurance policies.

Are there any government programs that can help reduce health insurance premiums?

+Yes, several government programs are designed to assist individuals and families in accessing affordable health insurance. For example, the Affordable Care Act (ACA) offers tax credits and subsidies to eligible individuals and families to help offset the cost of health insurance premiums. Additionally, Medicaid and Children’s Health Insurance Program (CHIP) provide coverage for low-income individuals and families.

How can I reduce my health insurance premiums as a young adult?

+As a young adult, you generally benefit from lower health insurance premiums due to your age and relatively lower health risks. However, you can further reduce your premiums by opting for plans with higher deductibles and out-of-pocket expenses. Additionally, maintaining a healthy lifestyle, practicing preventive care, and avoiding risky behaviors like smoking can help keep your premiums low.