Online Business Insurance

In today's digital age, an increasing number of entrepreneurs are embracing the online realm to establish and grow their businesses. This shift has sparked a rising demand for specialized insurance coverage to safeguard these ventures. Online business insurance is a complex yet crucial aspect of running a successful online enterprise, offering protection against various risks and liabilities unique to the digital landscape. From cyber attacks to delivery mishaps, this type of insurance is designed to shield businesses from potential financial losses and ensure their continued operation.

This comprehensive guide aims to delve into the world of online business insurance, exploring its intricacies, benefits, and the key considerations for entrepreneurs. By the end of this article, readers should have a thorough understanding of why online business insurance is vital and how to choose the right coverage for their specific needs.

Understanding Online Business Insurance

Online business insurance, also known as e-commerce insurance or digital business insurance, is a specialized form of commercial insurance tailored to the unique risks faced by online businesses. These policies provide coverage for a range of potential issues, including data breaches, website crashes, product liability claims, and more.

The rise of e-commerce has created a need for insurance products that protect businesses operating solely or partially online. With the increasing complexity and interconnectedness of the digital world, the potential for risks and liabilities has also grown. Online business insurance aims to address these challenges, offering a safety net for entrepreneurs operating in the digital space.

Key Coverages in Online Business Insurance

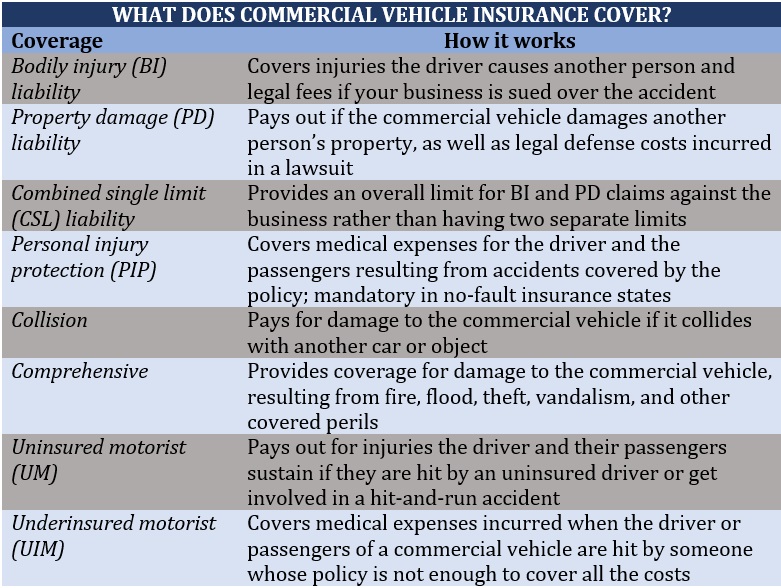

- Cyber Liability Insurance: This coverage is designed to protect businesses from financial losses resulting from cyber attacks, data breaches, or other cyber incidents. It can include costs associated with investigations, legal fees, notification of affected parties, and potential damages.

- E-commerce Package Policies: These policies typically bundle several coverages essential for online businesses. They may include product liability insurance, property insurance for digital assets, business interruption insurance, and more. E-commerce package policies offer a comprehensive solution for businesses that sell goods or services online.

- Professional Liability Insurance: Also known as errors and omissions (E&O) insurance, this coverage is crucial for businesses providing professional services online. It protects against claims of negligence, errors, or omissions that result in financial loss for clients.

- Delivery and Shipping Insurance: Online retailers can benefit from this coverage, which protects against losses incurred during the delivery process. It can cover damaged, lost, or stolen goods during transit, as well as potential liability claims resulting from delivery issues.

- Business Interruption Insurance: This coverage provides financial protection if an online business is forced to shut down temporarily due to a covered event, such as a cyber attack or natural disaster. It can help cover lost income and ongoing expenses until the business can resume operations.

| Coverage Type | Key Benefits |

|---|---|

| Cyber Liability | Protects against financial losses from cyber attacks and data breaches. |

| E-commerce Packages | Provides a comprehensive solution with multiple coverages tailored for online businesses. |

| Professional Liability | Covers claims of negligence or errors for businesses providing professional services online. |

| Delivery and Shipping | Protects against losses during the delivery process, including damaged or lost goods. |

| Business Interruption | Offers financial support during temporary shutdowns, covering lost income and expenses. |

The Importance of Online Business Insurance

Online business insurance is not just a prudent measure; it’s a necessity for any business operating in the digital realm. Here’s why:

Risk Mitigation

The online world presents a host of potential risks, from data breaches to website malfunctions. Online business insurance provides a critical layer of protection, helping businesses mitigate these risks and the associated financial losses.

Peace of Mind

Knowing that your business is protected against potential liabilities and disruptions can provide invaluable peace of mind. It allows entrepreneurs to focus on growing their businesses without constant worry about unforeseen events.

Legal and Regulatory Compliance

Many industries have specific regulations and compliance requirements, especially when it comes to data protection and privacy. Online business insurance can help businesses meet these legal obligations and avoid potential fines or penalties.

Enhanced Reputation and Credibility

Having the right insurance coverage demonstrates a commitment to the business and its customers. It can enhance the reputation of the business and build trust, especially when dealing with sensitive data or high-value transactions.

Choosing the Right Online Business Insurance

Selecting the appropriate online business insurance coverage involves a careful assessment of your specific business needs and potential risks. Here are some key considerations:

Assess Your Business Risks

Every online business is unique, and so are the risks it faces. Start by conducting a thorough risk assessment. Identify the potential hazards your business may encounter, such as cyber attacks, data breaches, product liability issues, or delivery problems. Understanding these risks will guide your insurance decisions.

Tailor Your Coverage

Online business insurance policies can be customized to fit the specific needs of your business. Work with an insurance broker or agent who specializes in e-commerce insurance to design a policy that covers all your critical areas. This may include cyber liability, professional liability, business interruption, and other relevant coverages.

Consider Your Business Model

The nature of your online business will influence the type of insurance you need. For example, an e-commerce retailer selling physical goods will have different requirements than a digital marketing agency or an online service provider. Understand your business model and how it may impact your insurance needs.

Review Policy Limits and Deductibles

When selecting an online business insurance policy, pay close attention to the policy limits and deductibles. Ensure that the limits are sufficient to cover potential losses, and consider whether a higher deductible (which can lower premiums) is a suitable option for your business.

Evaluate the Insurer’s Reputation

Not all insurance providers are created equal. Research the insurer’s reputation, financial stability, and track record in paying claims. You want to ensure that the company you choose will be there to support you if you need to make a claim.

Read the Fine Print

Insurance policies can be complex, with many exclusions and limitations. Take the time to carefully review the policy documents to understand what is and isn’t covered. If you have questions, don’t hesitate to reach out to your insurance broker or agent for clarification.

Case Studies: Real-World Examples of Online Business Insurance

To illustrate the importance and impact of online business insurance, let’s explore a couple of real-world case studies.

Case Study 1: Cyber Attack on an E-commerce Store

An online retailer specializing in luxury goods fell victim to a sophisticated cyber attack. The attack resulted in a data breach, exposing the personal and financial information of thousands of customers. The business faced not only the cost of investigating and containing the breach but also potential lawsuits from affected customers and regulatory fines.

In this case, having comprehensive cyber liability insurance was critical. The policy covered the costs of the investigation, legal fees, and notifications to affected parties. It also provided funds to help the business restore its systems and implement enhanced security measures. Additionally, the policy helped mitigate potential damages from lawsuits and regulatory penalties.

Case Study 2: Product Liability Claim for an Online Service Provider

A software development company provided a customized e-commerce platform to a retail client. Unfortunately, a bug in the platform led to a data breach, resulting in the loss of customer data. The retail client sued the software company for damages, claiming negligence in the development process.

Professional liability insurance, also known as errors and omissions insurance, was instrumental in this scenario. The policy covered the legal fees and potential damages resulting from the lawsuit. It helped the software company defend itself and reach a settlement with the client, avoiding potential bankruptcy.

The Future of Online Business Insurance

As the digital landscape continues to evolve, so too will the world of online business insurance. Here are some trends and predictions for the future:

Increased Focus on Cyber Risk

With cyber attacks becoming more frequent and sophisticated, there will likely be a continued emphasis on cyber risk coverage. This may include expanded cyber liability policies that offer more comprehensive protection against a wider range of cyber threats.

Emerging Risks and Coverages

The online business world is constantly changing, and new risks are emerging. Insurers will need to adapt and develop new coverages to address these risks. This could include protection against issues like ransomware attacks, social engineering scams, and data privacy breaches.

Integration of Technology

Technology will play an increasingly important role in online business insurance. Insurers are likely to leverage advanced analytics, machine learning, and artificial intelligence to better understand and manage risk. This could lead to more accurate pricing and more efficient claims handling.

Collaborative Efforts for Cyber Security

Insurers, technology companies, and businesses may collaborate more closely to enhance cyber security. This could involve the development of new tools and best practices to mitigate cyber risks and protect online businesses.

Regulatory Changes and Compliance

As data protection regulations evolve, online business insurance policies will need to adapt to meet these changing requirements. This could include increased emphasis on privacy protection and compliance measures within insurance policies.

What is the average cost of online business insurance?

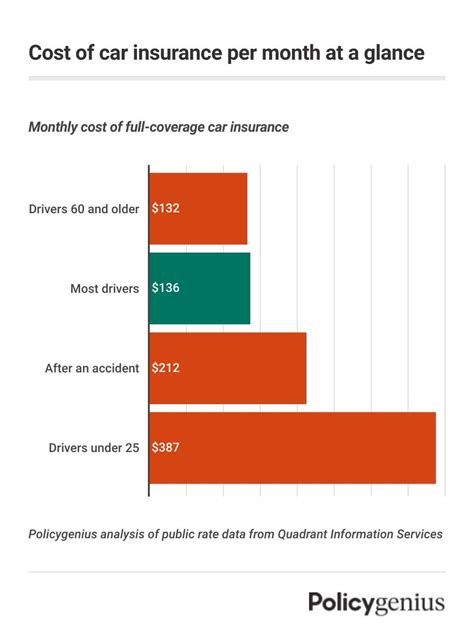

+The cost of online business insurance can vary widely depending on the size and nature of your business, the coverage limits you choose, and your specific risk profile. On average, small businesses can expect to pay anywhere from a few hundred to a few thousand dollars annually for a basic policy. However, more comprehensive coverage or higher limits can significantly increase the cost.

Do I need online business insurance if I have a physical store as well?

+Yes, even if you have a physical store, you still need online business insurance if you conduct any part of your business online. This includes having a website, selling products online, or even just using digital tools and technology for your business operations. Online business insurance covers the unique risks associated with your digital presence.

How can I reduce the cost of my online business insurance premiums?

+There are several ways to potentially reduce your online business insurance premiums. First, consider raising your policy deductibles. This can lower your premiums but will require you to pay more out of pocket if you need to make a claim. You can also explore multi-policy discounts by bundling your online business insurance with other policies like commercial property or liability insurance. Additionally, implementing strong security measures and demonstrating a commitment to cyber security can make you a more attractive risk to insurers, potentially leading to lower premiums.