Personal Insurance Health

Health Insurance: Navigating the Complexities for Personalized Coverage

Health insurance is an essential aspect of modern life, offering financial protection and peace of mind. In today's complex healthcare landscape, understanding the intricacies of personal insurance plans is crucial. This comprehensive guide aims to unravel the complexities, empowering individuals to make informed choices and navigate the healthcare system with confidence.

Understanding Personal Health Insurance

Personal health insurance, a cornerstone of healthcare coverage, provides individuals and families with access to medical services and financial support during times of illness or injury. With a myriad of options available, it’s imperative to delve into the specifics to ensure an appropriate and beneficial plan.

Coverage Types and Variations

Health insurance plans vary widely, catering to diverse needs. From comprehensive plans covering a broad spectrum of medical services to specialized policies focusing on specific conditions, the options are extensive. Common types include:

- Major Medical Insurance: These plans offer extensive coverage, often including hospital stays, surgical procedures, and prescription medications.

- Short-Term Health Insurance: Designed for temporary coverage, these plans are ideal for individuals between jobs or those awaiting approval for long-term insurance.

- Catastrophic Health Insurance: With a high deductible, these plans provide coverage for severe illnesses or accidents, offering financial protection for major medical expenses.

- Critical Illness Insurance: Focusing on specific critical illnesses, these policies provide a lump-sum payment upon diagnosis, allowing individuals to focus on treatment without financial strain.

Key Considerations for Personalized Coverage

When selecting a health insurance plan, several factors come into play. These considerations ensure the chosen plan aligns with individual needs and circumstances:

- Premium Costs: Balancing coverage and affordability, premiums vary based on plan type, provider, and individual health status.

- Deductibles and Out-of-Pocket Maximums: Understanding deductibles and out-of-pocket limits is crucial. Higher deductibles often result in lower premiums, while out-of-pocket maximums cap annual expenses.

- Network of Providers: In-network providers offer discounted rates, making it essential to choose a plan with a suitable network of healthcare professionals and facilities.

- Coverage Benefits: Reviewing the specific benefits covered is vital. From routine check-ups to specialized treatments, understanding what's included ensures adequate protection.

Navigating the Healthcare System with Insurance

With a suitable health insurance plan in place, navigating the healthcare system becomes more manageable. However, it’s crucial to understand the process and leverage the benefits effectively.

Utilizing Insurance Benefits

Health insurance plans offer a range of benefits, and maximizing these advantages is key. Some essential aspects include:

- Preventive Care: Many plans cover preventive services like annual check-ups, vaccinations, and screenings without any cost-sharing, encouraging proactive health management.

- Prescription Drug Coverage: Understanding the prescription drug formulary and cost-sharing structures ensures access to necessary medications at affordable rates.

- Specialist Referrals: Navigating the referral process with insurance ensures access to specialized care while adhering to plan guidelines and avoiding additional costs.

- Mental Health and Substance Abuse Services: With mental health becoming a growing concern, insurance plans often cover these services, offering support and treatment options.

Understanding Insurance Claims

Filing insurance claims is a critical aspect of utilizing health insurance benefits. The process involves submitting claims to the insurance provider, which then reviews and processes the request for reimbursement. Key considerations include:

- Claim Forms: Completing and submitting accurate claim forms is essential. This often involves providing personal information, details of the medical service, and supporting documentation.

- Timely Submission: Prompt submission of claims ensures timely reimbursement. Most insurance providers have specific timelines for claim submissions, and adhering to these timelines is crucial.

- Claim Denials: In some cases, claims may be denied. Understanding the reasons for denial and the appeal process is vital to resolving such issues.

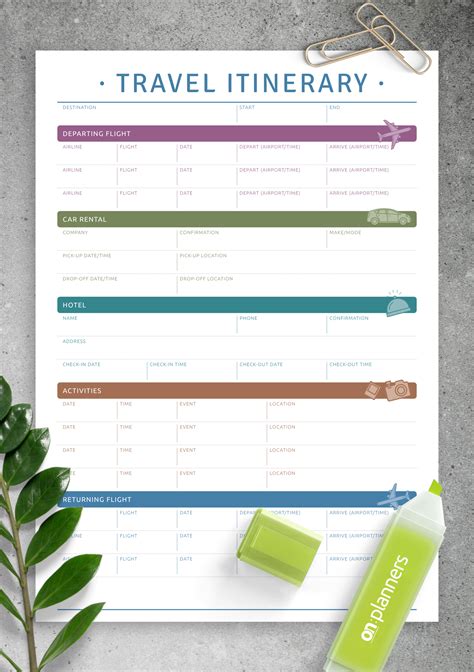

| Metric | Description |

|---|---|

| Deductible | The amount an insured individual must pay out-of-pocket before the insurance provider starts covering costs. |

| Co-pay | A fixed amount paid by the insured for a covered service, often required at the time of service. |

| Co-insurance | The percentage of costs shared between the insured and the insurance provider after the deductible is met. |

Maximizing Health Insurance Benefits

Health insurance offers more than just financial protection; it provides access to a range of services and support. Maximizing these benefits can significantly impact overall health and well-being.

Exploring Additional Benefits

Beyond basic coverage, many health insurance plans offer additional benefits and services. These can include:

- Wellness Programs: Incentivizing healthy lifestyles, wellness programs often provide resources and discounts for fitness activities, nutrition counseling, and more.

- Telehealth Services: With the rise of digital health, many plans now cover virtual consultations, offering convenient access to healthcare professionals.

- Chronic Condition Management: For individuals with chronic conditions, insurance plans may offer specialized programs and support to manage and improve health outcomes.

- Dental and Vision Care: Some plans extend coverage to dental and vision services, ensuring comprehensive healthcare.

Managing Chronic Conditions with Insurance

For individuals managing chronic conditions, health insurance plays a critical role. Insurance plans often offer specific benefits and support, such as:

- Disease Management Programs: Tailored to specific conditions, these programs provide education, resources, and support to manage and improve health outcomes.

- Specialized Treatment Centers: Insurance plans may partner with specialized treatment centers, offering advanced care and support for complex conditions.

- Prescription Discounts: Managing chronic conditions often involves long-term medication use. Insurance plans may offer discounts or coverage for necessary prescriptions.

The Future of Health Insurance

The landscape of health insurance is evolving, driven by advancements in technology, changing healthcare needs, and policy reforms. As we look to the future, several key trends and developments are shaping the industry.

Technology and Digital Health

Digital health technologies are revolutionizing the healthcare industry, and their impact on health insurance is significant. Telehealth services, digital health platforms, and wearable devices are reshaping how individuals access and manage their health, offering new opportunities for insurers.

- Telehealth: With the COVID-19 pandemic accelerating its adoption, telehealth is here to stay. Insurers are now integrating telehealth services into their plans, offering convenient access to healthcare professionals remotely.

- Digital Health Platforms: These platforms provide a centralized hub for managing health, offering resources, tracking vital signs, and facilitating communication with healthcare providers. Insurers are partnering with digital health companies to enhance their offerings.

- Wearable Devices: Wearable technology, from fitness trackers to advanced health monitors, is providing valuable health data. Insurers are exploring ways to integrate this data into their risk assessment and underwriting processes, potentially offering incentives for healthy lifestyles.

Policy Reforms and Industry Innovations

Policy reforms and industry innovations are shaping the future of health insurance. Here are some key developments to watch:

- Value-Based Care: Shifting away from fee-for-service models, value-based care focuses on outcomes and patient satisfaction. Insurers are incentivizing providers to deliver high-quality, cost-effective care, improving patient experiences.

- Accountable Care Organizations (ACOs): ACOs are groups of healthcare providers and insurers working together to coordinate care and improve health outcomes. This collaborative approach is gaining traction, offering potential cost savings and better care coordination.

- Individualized Insurance Plans: With advancements in data analytics, insurers are moving towards more personalized plans. By leveraging health data, insurers can offer tailored coverage and pricing, catering to individual needs.

Conclusion: Empowering Individuals with Knowledge

Health insurance is a complex yet essential component of modern healthcare. By understanding the intricacies of personal insurance plans, individuals can make informed choices, navigate the healthcare system effectively, and maximize their benefits. As the industry evolves, staying informed and adapting to new developments is key to ensuring access to quality healthcare.

This guide aims to provide a comprehensive resource, empowering individuals to take control of their health and financial well-being. With knowledge and awareness, navigating the complexities of health insurance becomes more manageable, leading to better health outcomes and peace of mind.

How do I choose the right health insurance plan for my needs?

+Selecting the right health insurance plan involves careful consideration. Assess your healthcare needs, including any existing conditions, regular medications, and preferred healthcare providers. Compare plans based on coverage, premiums, deductibles, and out-of-pocket costs. Ensure the plan’s network includes your preferred providers and covers the services you require. Consider short-term plans if you’re between jobs or seeking long-term coverage. Research and seek advice from insurance brokers or healthcare professionals to make an informed decision.

What are the key differences between PPO and HMO insurance plans?

+PPO (Preferred Provider Organization) and HMO (Health Maintenance Organization) plans differ in network flexibility and cost-sharing. PPO plans offer more flexibility, allowing you to see out-of-network providers with higher out-of-pocket costs. HMO plans have a restricted network, requiring you to stay within the network for coverage, but typically have lower out-of-pocket expenses. PPOs are ideal for those who value provider choice, while HMOs are more cost-effective for those who prioritize lower premiums and out-of-pocket costs.

How can I reduce my health insurance costs without compromising coverage?

+Reducing health insurance costs involves strategic choices. Consider a high-deductible health plan (HDHP) with a health savings account (HSA) to save on premiums and tax benefits. Evaluate your healthcare needs and select a plan with an appropriate deductible and out-of-pocket maximum. Review the network of providers to ensure your preferred doctors and facilities are included. Shop around and compare plans to find the best value. Remember, balancing cost and coverage is crucial to finding the right plan for your needs.