Pet Insurance Compared

Unveiling the Landscape of Pet Insurance: A Comprehensive Comparison Guide

Welcome, fellow pet owners and animal enthusiasts! In today's fast-paced world, ensuring the well-being of our furry companions is more crucial than ever. With veterinary care costs on the rise, many pet parents are turning to pet insurance as a safeguard for their beloved animals. But with so many options available, how do you choose the right coverage? In this in-depth guide, we'll delve into the world of pet insurance, exploring various providers, plans, and features to help you make an informed decision.

The market for pet insurance is diverse and dynamic, offering a range of policies tailored to meet the unique needs of pets and their owners. From comprehensive coverage for unexpected accidents and illnesses to more specialized plans for specific breeds or conditions, the options are vast. As an informed consumer, it's essential to understand the nuances of each plan and the benefits they offer to make the best choice for your furry friend.

In this article, we'll take an expert-led journey through the pet insurance landscape, analyzing key factors such as coverage limits, deductibles, co-pays, and exclusions. We'll also explore the unique features and perks offered by different providers, such as alternative therapy coverage, routine care benefits, and even pet wellness plans. By the end of this guide, you'll have a comprehensive understanding of the pet insurance market and the tools to choose the policy that best suits your pet's health needs and your financial considerations.

Understanding the Basics: Key Concepts in Pet Insurance

Before diving into the intricacies of pet insurance plans, let's establish a foundational understanding of the key concepts that underpin this industry. Gaining a solid grasp of these terms will empower you to navigate the complexities of pet insurance with confidence and make more informed decisions.

Coverage Limits and Deductibles: Unraveling the Fine Print

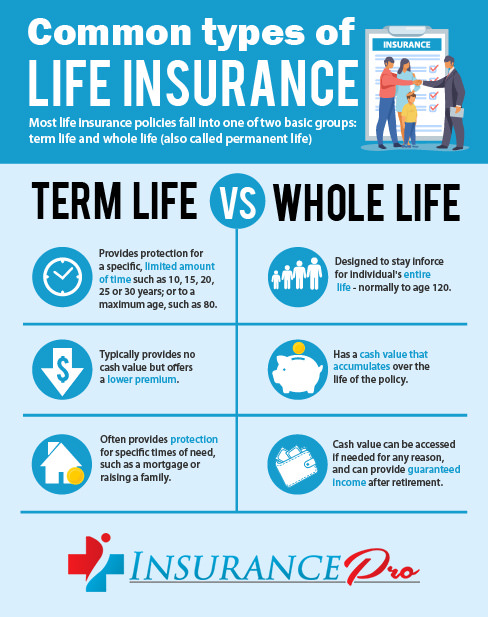

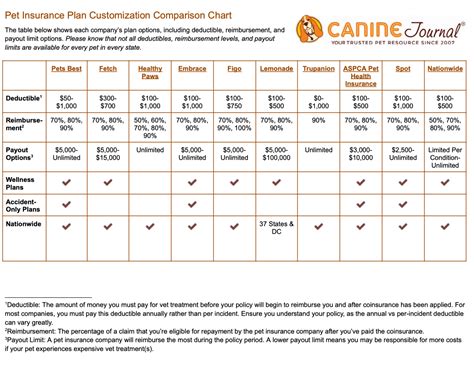

Coverage limits and deductibles are two crucial aspects of any pet insurance policy that can significantly impact your out-of-pocket expenses. A coverage limit refers to the maximum amount your insurance provider will pay out for a specific condition or over a defined period. This limit can vary widely depending on the policy and the insurer, and it's essential to understand these limits to ensure your pet's potential healthcare needs are adequately covered.

A deductible, on the other hand, is the amount you must pay out of pocket before your insurance coverage kicks in. Deductibles can be annual, per condition, or per incident, and they too can vary greatly between policies. Understanding how deductibles work and the potential financial impact they can have is crucial for effective financial planning and ensuring you're not caught off guard by unexpected costs.

Co-Pays and Reimbursement Rates: Navigating Cost-Sharing

In addition to coverage limits and deductibles, pet insurance policies often involve co-pays and reimbursement rates, which further impact your financial responsibility for veterinary care. A co-pay is a fixed amount you pay for each visit or treatment, similar to how co-pays work in human health insurance. Reimbursement rates, on the other hand, determine how much of the remaining veterinary costs the insurance provider will cover after you've paid the deductible and any co-pays.

Reimbursement rates are typically expressed as a percentage, such as 80% or 90%. This means the insurance company will reimburse you for a certain percentage of the eligible costs you've incurred. Understanding these rates is crucial for predicting your potential out-of-pocket expenses and ensuring you choose a plan that aligns with your financial capabilities and expectations.

Exclusions and Pre-Existing Conditions: Knowing the Fine Print

No pet insurance policy is all-encompassing, and it's crucial to understand what's excluded from coverage. Common exclusions include pre-existing conditions, breed-specific issues, and certain elective procedures. A pre-existing condition is an illness, injury, or condition that your pet had or showed symptoms of before you purchased the insurance policy. These conditions are typically not covered by pet insurance, as they are considered existing risks rather than new developments.

Understanding exclusions is essential for ensuring you're not left with unexpected costs for treatments related to conditions that are not covered by your policy. It's also important to note that some insurers may have waiting periods before certain conditions are covered, further emphasizing the need to carefully review the fine print of any policy you're considering.

Comparing Pet Insurance Providers: A Deep Dive into Key Players

Now that we've established a solid foundation of understanding regarding the key concepts in pet insurance, let's shift our focus to the actual providers and the plans they offer. The pet insurance market is home to numerous reputable companies, each with its unique features, coverage options, and pricing structures. By carefully comparing these providers, you can make an informed decision that best suits your pet's needs and your financial situation.

Leading Pet Insurance Providers: A Comparative Analysis

To begin our comparative analysis, let's examine some of the leading pet insurance providers in the market today. These companies have established themselves as trusted names in the industry, offering comprehensive coverage and innovative features to pet owners across the globe. Here's a glimpse into what each provider brings to the table:

Provider A: Comprehensive Coverage with a Focus on Value

Provider A is renowned for its extensive coverage options, which include a wide range of illnesses, injuries, and even certain pre-existing conditions. Their policies are designed to offer maximum peace of mind to pet owners, with high coverage limits and flexible deductibles to cater to various financial situations. One of their standout features is their wellness plans, which cover routine care such as vaccinations, flea and tick treatments, and spaying/neutering, ensuring your pet's overall health is protected.

Additionally, Provider A offers unique add-ons such as coverage for alternative therapies like acupuncture and chiropractic care, providing a holistic approach to pet healthcare. Their plans also include access to a 24/7 pet helpline, providing immediate support and advice for pet-related emergencies or concerns.

Provider B: Innovation Meets Affordability

Provider B has carved a niche for itself by offering innovative, tech-driven solutions to pet insurance. Their plans are designed to be highly customizable, allowing pet owners to choose the level of coverage that suits their needs and budget. One of their unique features is their online claim submission process, which streamlines the reimbursement process and provides transparency throughout.

In addition to their tech-forward approach, Provider B offers competitive pricing and a range of discounts for multi-pet households and early enrollment. Their plans also include access to a vast network of veterinary professionals, ensuring your pet receives the best possible care, regardless of location.

Provider C: Tailored Coverage for Specific Breeds and Conditions

Provider C stands out in the market with its specialized approach to pet insurance. They offer tailored coverage plans for specific breeds, taking into account the unique health concerns and predispositions of each breed. This targeted approach ensures that pet owners can access coverage that addresses their pet's specific needs, providing peace of mind and potentially reducing out-of-pocket expenses.

In addition to breed-specific coverage, Provider C offers innovative features such as genetic testing coverage, which can help identify potential health risks early on, and personalized wellness plans that cater to the unique needs of senior pets.

Comparative Analysis: Key Considerations

When comparing these leading pet insurance providers, several key considerations emerge. Firstly, it's crucial to evaluate the coverage limits and deductibles offered by each provider. While some providers offer high coverage limits with flexible deductibles, others may have more restrictive limits or higher deductibles. Understanding these factors is essential for ensuring your pet's potential healthcare needs are adequately covered without straining your finances.

Secondly, the range of covered conditions and the exclusions in each policy should be carefully scrutinized. While some providers offer comprehensive coverage for a wide range of illnesses and injuries, others may have more limited coverage or specific exclusions. It's crucial to review these aspects thoroughly to ensure your pet's potential health concerns are addressed.

Lastly, the additional features and perks offered by each provider can significantly enhance the value of their policies. These features may include access to 24/7 pet helplines, alternative therapy coverage, routine care benefits, and specialized plans for specific breeds or conditions. By comparing these features, you can identify the provider that best aligns with your pet's unique needs and your personal preferences.

Real-World Insights: Pet Insurance Stories from Pet Owners

As we continue our exploration of the pet insurance landscape, it's essential to gain real-world insights from pet owners who have firsthand experience with these policies. By hearing their stories and learning from their experiences, we can gain a deeper understanding of the practical implications and benefits of pet insurance. Let's delve into some compelling narratives from pet owners who have utilized pet insurance to safeguard their furry companions.

Story 1: A Lifeline for a Rescue Dog's Unexpected Illness

Meet Bella, a loving Labrador Retriever mix who was rescued from a shelter by her devoted owners, Sarah and John. Bella quickly became an integral part of their family, bringing joy and companionship to their lives. However, shortly after her adoption, Bella began showing signs of gastrointestinal distress, leading to a series of costly veterinary visits and diagnostic tests.

With the help of their pet insurance policy, Sarah and John were able to navigate these unexpected expenses with peace of mind. Their insurance provider covered a significant portion of the costs associated with Bella's diagnosis and treatment, including specialized medications and ongoing care. This support allowed them to focus on Bella's recovery without the added financial strain, and they are forever grateful for the security their pet insurance policy provided during this challenging time.

Story 2: Navigating Chronic Care with Pet Insurance Support

Max, a beloved Golden Retriever, was diagnosed with a chronic condition that required ongoing veterinary care and specialized medications. His owners, Emily and David, were faced with the daunting prospect of managing Max's condition and the associated costs. However, their pet insurance policy proved to be a lifesaver, providing coverage for Max's regular veterinary visits, diagnostic tests, and the majority of his medication expenses.

With the financial support of their pet insurance, Emily and David were able to ensure Max received the best possible care without compromising their financial stability. The policy's coverage for chronic conditions gave them the reassurance they needed to focus on Max's well-being, knowing that his healthcare needs were taken care of. Max's story highlights the importance of pet insurance in providing long-term support for pets with chronic illnesses.

Story 3: A Tailored Approach to Breed-Specific Concerns

Meet Charlie, a French Bulldog owned by Amy, who was well aware of the unique health concerns associated with this breed. French Bulldogs are prone to certain respiratory and orthopedic issues, and Amy wanted to ensure Charlie had the best possible care without financial strain. She opted for a pet insurance policy that offered specialized coverage for French Bulldogs, taking into account their breed-specific predispositions.

Charlie's policy provided comprehensive coverage for the respiratory and orthopedic conditions he was most likely to encounter. When Charlie developed a respiratory infection, his insurance policy covered the majority of the costs associated with his diagnosis and treatment, including specialized veterinary care and medications. Amy's proactive approach to securing tailored coverage for Charlie's breed-specific concerns proved to be a wise decision, providing her with peace of mind and ensuring Charlie received the best possible care.

The Future of Pet Insurance: Trends and Innovations

As we conclude our comprehensive exploration of the pet insurance landscape, it's essential to look ahead and examine the trends and innovations shaping the future of this industry. The pet insurance market is dynamic and ever-evolving, with providers constantly innovating to meet the changing needs of pet owners and their furry companions. By staying abreast of these developments, we can gain valuable insights into the direction the industry is headed and the potential benefits that may arise.

Emerging Trends in Pet Insurance

Several exciting trends are emerging in the pet insurance space, driven by technological advancements, changing consumer preferences, and a deeper understanding of pet healthcare needs. Here are some of the key trends that are shaping the future of pet insurance:

- Telemedicine and Remote Care: The rise of telemedicine and remote veterinary care is revolutionizing the way pet owners access healthcare services for their pets. Pet insurance providers are increasingly incorporating telemedicine into their offerings, providing policyholders with access to virtual consultations, remote diagnostics, and even prescription medications, all from the comfort of their homes.

- Wearable Technology and Data-Driven Insights: Wearable devices and advanced tracking technologies are being leveraged to provide pet owners with valuable insights into their pet's health and well-being. These technologies can monitor activity levels, detect early signs of illness, and even provide real-time health data to veterinary professionals, enabling more proactive and personalized care.

- Wellness and Preventative Care Focus: There is a growing recognition among pet insurance providers of the importance of preventative care and wellness programs. Many providers are now offering coverage for routine care, such as vaccinations, dental cleanings, and parasite prevention, as well as specialized wellness plans that promote overall pet health and longevity.

Innovations on the Horizon

In addition to these emerging trends, several innovative concepts are on the horizon, poised to further revolutionize the pet insurance industry. Here's a glimpse into some of the exciting developments that may shape the future of pet insurance:

- Genomics and Personalized Medicine: Advances in genomics and genetic testing are paving the way for more personalized approaches to pet healthcare. Insurance providers may soon offer coverage for genetic testing, enabling pet owners to identify potential health risks and develop targeted preventative care plans based on their pet's unique genetic profile.

- Artificial Intelligence and Predictive Analytics: The integration of artificial intelligence and predictive analytics into pet insurance is expected to enhance risk assessment and claims processing. These technologies can analyze vast amounts of data to identify patterns and predict potential health issues, allowing insurers to offer more tailored coverage and improve overall policy efficiency.

- Blockchain and Smart Contracts: The adoption of blockchain technology and smart contracts could revolutionize the way pet insurance policies are administered and claims are processed. Blockchain's immutable and transparent nature can enhance policy transparency, streamline claims processing, and potentially reduce administrative costs, benefiting both pet owners and insurance providers.

The Impact on Pet Owners and Their Furry Companions

As these trends and innovations continue to shape the pet insurance landscape, the benefits for pet owners and their furry companions are undeniable. From enhanced access to veterinary care through telemedicine and remote services to more personalized and preventative approaches to pet healthcare, the future of pet insurance promises improved well-being and peace of mind for pets and their devoted owners.

By staying informed about these developments and choosing insurance providers that embrace these innovations, pet owners can ensure they are providing the best possible care for their beloved companions. As the pet insurance industry evolves, so too will the opportunities to safeguard the health and happiness of our furry friends, making their lives and ours more fulfilling and stress-free.

How do I choose the right pet insurance provider for my pet’s needs?

+

When selecting a pet insurance provider, consider your pet’s unique health needs, your financial situation, and the level of coverage you require. Compare coverage limits, deductibles, and exclusions to find a policy that aligns with your expectations. Also, assess the additional features and perks offered by each provider to determine which best suits your preferences.

Are there any age restrictions for pet insurance policies?

+

Yes, most pet insurance providers have age restrictions. Typically, pets must be enrolled before they reach a certain age, often between 6 and 14 years old. However, some providers offer specialized plans for older pets, so it’s essential to research and understand the age limits and options available.

What is the process for filing a claim with pet insurance?

+

The claims process can vary between providers, but generally, you’ll need to submit a claim form along with relevant veterinary records and receipts. Some providers offer online claim submission for convenience. Be sure to review your policy’s claim process and requirements to ensure a smooth reimbursement experience.

Can pet insurance cover pre-existing conditions?

+

Pre-existing conditions are typically excluded from pet insurance coverage. These are illnesses or injuries that your pet had or showed symptoms of before you purchased the insurance policy. However, some providers offer waiting periods or limited