Pet Medical Insurance

Pet medical insurance has become an increasingly popular topic of discussion among pet owners and animal enthusiasts worldwide. With the rising costs of veterinary care and the desire to provide the best possible healthcare for our furry friends, understanding pet insurance and its potential benefits is crucial. In this comprehensive guide, we will delve into the world of pet medical insurance, exploring its intricacies, advantages, and considerations to help you make informed decisions regarding your pet's healthcare coverage.

Unraveling the Concept of Pet Medical Insurance

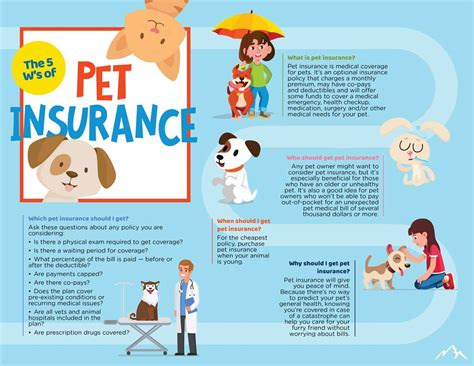

Pet medical insurance is a specialized type of insurance policy designed to cover the medical expenses incurred by pet owners for their beloved companions. Similar to human health insurance, it aims to provide financial protection and peace of mind by mitigating the unexpected costs associated with veterinary care. From routine check-ups and vaccinations to emergency treatments and surgeries, pet insurance can offer a safety net for various healthcare needs.

Key Features and Benefits of Pet Medical Insurance

Pet medical insurance policies typically offer a range of features and benefits tailored to the specific needs of pet owners. Here are some key aspects to consider:

- Coverage Options: Policies often provide coverage for a wide array of medical conditions, including accidents, illnesses, chronic diseases, and even routine care. Some insurers also offer additional benefits such as wellness plans, prescription medication coverage, and alternative therapy options.

- Reimbursement Process: When your pet requires medical attention, you will typically pay the veterinary clinic upfront. Afterward, you can submit a claim to your insurance provider, providing relevant documentation and receipts. The insurer will then reimburse you based on the terms and conditions outlined in your policy.

- Deductibles and Co-pays: Similar to human insurance, pet insurance policies may have deductibles and co-pays. A deductible is the amount you must pay out of pocket before the insurance coverage kicks in, while a co-pay is a fixed amount you contribute for each claim. These factors can influence the overall cost of your policy.

- Breed-Specific Considerations: Certain breeds are predisposed to specific health conditions. Pet insurance providers may offer breed-specific coverage options, ensuring that common ailments associated with your pet’s breed are covered. This personalized approach can provide comprehensive protection.

- Wellness Plans: Many pet insurance companies now offer wellness plans as an add-on or as part of their standard policies. These plans cover routine care such as vaccinations, check-ups, and preventative treatments, helping you stay on top of your pet’s overall health and well-being.

Understanding Policy Types and Coverage Levels

Pet medical insurance policies come in various forms, each offering different levels of coverage and benefits. Here’s a breakdown of the common types:

- Accident-Only Policies: As the name suggests, these policies provide coverage solely for accidents, such as injuries sustained during play or from an external source. They typically have lower premiums but offer limited protection compared to comprehensive plans.

- Accident and Illness Policies: These policies are more comprehensive and cover both accidental injuries and illnesses. They are ideal for pet owners seeking broader coverage for their furry companions.

- Lifetime Policies: Lifetime policies offer continuous coverage throughout your pet’s life, regardless of any pre-existing conditions that may develop. They provide the highest level of protection but often come with higher premiums.

- Time-Limited Policies: Time-limited policies cover specific conditions for a defined period, usually 12 months. After this period, you may need to renew the policy or switch to a different plan. These policies can be cost-effective for short-term coverage needs.

- Wellness-Only Plans: Wellness-only plans focus solely on routine care and preventative treatments. They are suitable for pet owners who want coverage for regular check-ups, vaccinations, and parasite control.

Choosing the Right Pet Medical Insurance Provider

When selecting a pet medical insurance provider, it’s essential to consider various factors to ensure you find the right fit for your needs and those of your pet. Here are some key considerations:

- Reputation and Financial Stability: Opt for reputable insurance companies with a solid track record in the industry. Check their financial stability and customer satisfaction ratings to ensure they can honor their commitments.

- Coverage Options: Evaluate the coverage options offered by different providers. Compare policies based on their scope, including accident and illness coverage, wellness plans, and any additional benefits such as prescription medication coverage.

- Claim Process and Customer Service: Research the claim process and customer service reputation of the insurance provider. Look for companies with efficient claim handling, transparent communication, and a helpful customer support team.

- Premium Costs and Deductibles: Consider your budget and assess the premium costs and deductibles associated with different policies. Remember that the cheapest option may not always provide the best value, especially if it comes with limited coverage or high deductibles.

- Breed-Specific Coverage: If your pet belongs to a breed prone to specific health issues, prioritize insurance providers that offer breed-specific coverage. This ensures that your pet’s unique health needs are adequately addressed.

| Provider | Coverage Highlights |

|---|---|

| PetPlan | Comprehensive accident and illness coverage, breed-specific plans, and excellent customer support. |

| Healthy Paws | Lifetime coverage, high reimbursement rates, and flexible deductibles. |

| ASPCA Pet Health Insurance | Customizable plans, wellness coverage options, and a mobile app for easy claim submissions. |

| Embrace Pet Insurance | Wellness plans, routine care coverage, and a unique "Preventive Care Clinic" for preventative treatments. |

| Trupanion | Unlimited lifetime coverage, quick claim processing, and innovative digital tools for pet owners. |

Real-Life Examples and Success Stories

To illustrate the impact of pet medical insurance, let’s explore some real-life scenarios where pet owners benefited from having insurance coverage for their beloved companions.

Story 1: Jake’s Journey to Recovery

Jake, a 7-year-old Labrador Retriever, was diagnosed with a severe case of pancreatitis. His owner, Sarah, had invested in a comprehensive pet insurance policy that covered both accidents and illnesses. The policy included a wellness plan, ensuring Jake’s routine care was also taken care of.

When Jake fell ill, Sarah was relieved to have insurance coverage. The policy reimbursed her for the emergency treatment, hospitalization, and ongoing medications. With the financial burden lifted, Sarah could focus on Jake’s recovery, providing him with the best possible care without worrying about the costs.

Story 2: Fluffy’s Preventative Care Journey

Fluffy, a 3-year-old Persian cat, had a history of dental issues. Her owner, Mark, opted for a pet insurance policy that included a wellness plan. The plan covered routine dental check-ups, cleanings, and preventative treatments.

Thanks to the insurance coverage, Mark could ensure Fluffy received regular dental care without straining his finances. The policy also provided peace of mind, knowing that if any dental issues arose, they would be promptly addressed without compromising Fluffy’s overall health.

Story 3: Bella’s Unexpected Emergency

Bella, a 5-year-old Golden Retriever, sustained a severe injury during a playdate. Her owner, Emma, had an accident-only pet insurance policy in place. Although the policy did not cover illnesses, it provided excellent coverage for accidents.

When Bella required emergency surgery, Emma was grateful for the insurance coverage. The policy reimbursed her for the surgical costs, allowing her to focus on Bella’s recovery and ensuring she received the best veterinary care available.

The Future of Pet Medical Insurance

The pet medical insurance industry is evolving rapidly, driven by advancements in veterinary medicine and changing consumer needs. Here are some key trends and future implications to consider:

- Telemedicine Integration: With the rise of telemedicine, pet insurance providers are exploring ways to incorporate virtual veterinary care into their policies. This could offer convenient and cost-effective options for certain conditions, expanding the reach of pet healthcare.

- Digital Innovation: Insurance companies are leveraging technology to enhance the customer experience. From mobile apps for easy claim submissions to digital portals for policy management, the industry is embracing digital transformation to improve efficiency and customer satisfaction.

- Wellness-Focused Approach: The focus on preventative care and wellness is gaining traction in the pet insurance industry. Providers are recognizing the importance of routine care and are offering more comprehensive wellness plans to promote the overall health and longevity of pets.

- Breed-Specific Innovations: As breeders and pet owners become more aware of breed-specific health concerns, insurance providers are developing innovative solutions. This includes specialized coverage plans for specific breeds, ensuring that common ailments are adequately addressed.

- Collaboration with Veterinary Clinics: Some insurance providers are forging partnerships with veterinary clinics to offer exclusive benefits and discounted rates for policyholders. This collaboration can enhance the overall healthcare experience for pets and their owners.

FAQs

How much does pet medical insurance cost?

+

The cost of pet medical insurance can vary based on factors such as your pet’s age, breed, location, and the coverage level you choose. On average, premiums range from 20 to 100 per month. However, it’s important to note that the specific cost will depend on the policy and provider you select.

What happens if my pet has a pre-existing condition?

+

Pre-existing conditions are typically not covered by pet insurance policies. However, some providers offer lifetime policies that may provide coverage for certain pre-existing conditions after a waiting period. It’s essential to review the policy’s terms and conditions carefully to understand the coverage for pre-existing conditions.

Can I use any veterinary clinic with pet insurance?

+

Yes, most pet insurance policies allow you to choose any licensed veterinary clinic or specialist. However, it’s always a good idea to check with your insurance provider to ensure the clinic is covered under your policy. Some providers may have a network of preferred clinics, offering additional benefits or discounted rates.

How long does it take to receive reimbursement for claims?

+

The time it takes to receive reimbursement for claims can vary depending on the insurance provider and the complexity of the claim. Typically, it can take anywhere from a few days to a couple of weeks. Some providers offer expedited claim processing for urgent cases.

Are there any age restrictions for pet insurance policies?

+

Yes, most pet insurance providers have age restrictions for enrolling in a policy. Some may accept pets as young as 6 weeks old, while others may have a maximum age limit for enrollment. It’s crucial to review the provider’s eligibility criteria and consider enrolling your pet early to maximize coverage options.

In conclusion, pet medical insurance is an invaluable tool for pet owners seeking to provide the best healthcare for their beloved companions. By understanding the various policy types, coverage options, and considerations, you can make an informed decision to protect your pet’s health and your financial well-being. Remember, the right pet insurance policy can offer peace of mind, ensuring your pet receives the care they deserve without breaking the bank.