Ppo Dental Insurance

PPO dental insurance, or Preferred Provider Organization, is a popular type of dental coverage plan that offers policyholders a wide range of benefits and flexibility when it comes to choosing dental care providers. In this comprehensive guide, we will delve into the intricacies of PPO dental insurance, exploring its key features, advantages, and how it can help individuals and families maintain optimal oral health while managing costs effectively.

Understanding PPO Dental Insurance

PPO dental insurance plans are designed to provide policyholders with access to a network of preferred dental providers, who have negotiated lower rates with the insurance company. This arrangement benefits both the insured and the dentists, as it encourages a steady flow of patients while keeping dental care costs manageable.

One of the standout features of PPO plans is the freedom they offer in choosing dentists. Policyholders are not limited to a specific dentist or group of dentists; instead, they can visit any dentist within the PPO network without needing a referral. This flexibility is particularly beneficial for individuals who have established relationships with their dentists or those who require specialized dental care.

Key Advantages of PPO Dental Insurance

PPO dental insurance plans offer several advantages that make them a preferred choice for many individuals and families.

Wide Network of Dentists

PPO plans typically have extensive networks, which means policyholders have a vast array of dental care providers to choose from. This is especially advantageous for individuals who frequently move or travel, as they can easily locate an in-network dentist in their new location.

| Network Size | Benefits |

|---|---|

| National Networks | Offer the widest range of options, making it ideal for frequent travelers. |

| Regional Networks | Provide a good balance between coverage and localized options. |

| Local Networks | Best suited for individuals with established dentists in their area. |

No Referrals Required

Unlike some other insurance plans, PPOs do not mandate referrals for specialty dental services. This means that if you need to see an orthodontist, periodontist, or any other dental specialist, you can do so directly without the need for a general dentist’s referral.

Flexible Treatment Options

PPO plans generally cover a comprehensive range of dental procedures, from preventive care to restorative and cosmetic treatments. This flexibility allows policyholders to make informed decisions about their oral health based on their unique needs and preferences.

Cost Savings

One of the primary benefits of PPO dental insurance is the potential for significant cost savings. By negotiating lower rates with preferred providers, insurance companies can offer more affordable premiums and out-of-pocket costs for policyholders. Additionally, staying within the PPO network often results in lower copays and deductibles.

How PPO Dental Insurance Works

PPO dental insurance operates on a simple premise: policyholders pay a monthly premium to the insurance company, which then covers a portion of their dental expenses. The specific coverage and cost-sharing arrangements depend on the plan’s design and the policyholder’s utilization of dental services.

Premium Payments

Policyholders are responsible for paying a monthly premium, which is typically a fixed amount regardless of whether they utilize dental services or not. This premium is the cost of maintaining the insurance coverage and accessing the PPO network.

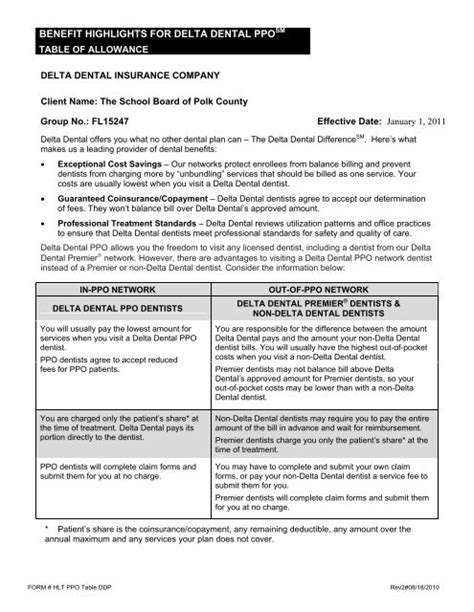

In-Network vs. Out-of-Network

As mentioned earlier, PPO plans offer the advantage of choosing from a network of preferred providers. When visiting an in-network dentist, policyholders typically pay a lower copay or coinsurance, and the insurance company covers the remaining balance. However, if a policyholder chooses to visit an out-of-network dentist, they may incur higher out-of-pocket costs.

Copays and Coinsurance

Copays are fixed amounts that policyholders pay for specific dental services. For example, a routine cleaning might have a 20 copay, meaning the policyholder pays 20 directly to the dentist at the time of service. Coinsurance, on the other hand, is a percentage of the total cost that the policyholder pays. For instance, if the insurance company covers 80% of a procedure, the policyholder pays the remaining 20% as coinsurance.

Annual Maximums and Deductibles

PPO plans often have annual maximums, which represent the highest amount the insurance company will pay for covered services in a given year. Once the policyholder’s expenses exceed this maximum, they are responsible for the remaining costs. Additionally, some plans may have deductibles, which are amounts the policyholder must pay out of pocket before the insurance coverage kicks in.

Maximizing the Benefits of PPO Dental Insurance

To make the most of your PPO dental insurance plan, consider the following strategies:

- Review your plan's coverage and benefits to understand what procedures are covered and at what levels.

- Locate and choose an in-network dentist who aligns with your needs and preferences.

- Schedule regular preventive care appointments to maintain optimal oral health and catch potential issues early.

- Discuss treatment plans and costs with your dentist to ensure you understand the financial implications of recommended procedures.

- Explore optional add-on coverage for specialized treatments or enhanced benefits.

The Future of PPO Dental Insurance

As the healthcare industry evolves, so too does dental insurance. PPO plans are expected to continue offering flexibility and cost-effectiveness, but with a growing focus on preventive care and overall oral health. Insurance companies are increasingly recognizing the long-term benefits of preventive dentistry, which may lead to more comprehensive coverage for preventive services in the future.

Additionally, with advancements in technology, we can expect to see more digital integration in dental insurance. This could include streamlined claims processes, easier access to policy information, and even virtual dental consultations for minor issues.

What is the average cost of a PPO dental insurance plan?

+

The cost of a PPO dental insurance plan can vary significantly based on factors such as location, age, and the specific plan’s coverage. On average, individuals can expect to pay between 30 to 50 per month for a basic PPO plan, while family plans may range from 80 to 150 monthly. It’s important to note that these costs are for the insurance premium and do not include out-of-pocket expenses for dental services.

Do PPO plans cover emergency dental treatments?

+

Yes, PPO dental insurance plans typically cover emergency dental treatments. However, the specific coverage and out-of-pocket costs may vary. It’s always advisable to review your plan’s benefits and contact your insurance provider to understand the coverage for emergency situations.

Can I change my dentist if I’m already enrolled in a PPO plan?

+

Absolutely! One of the advantages of PPO plans is the freedom to choose your dentist. If you’re not satisfied with your current dentist or need to find one closer to your new home, you can switch to another in-network dentist at any time. Simply locate a dentist who accepts your PPO insurance and schedule an appointment.