Ppo Dental Insurance California

Welcome to our comprehensive guide on PPO dental insurance in California. As an informed consumer, you deserve to understand the intricacies of dental insurance plans to make the best choices for your oral health and financial well-being. This article will delve deep into the world of PPO dental coverage, exploring its benefits, how it works, and its advantages for residents of the Golden State.

Understanding PPO Dental Insurance

PPO stands for Preferred Provider Organization, and it is a type of health insurance plan, specifically designed to offer flexibility and a wide range of options for dental care. Unlike other insurance plans, PPO dental insurance provides you with the freedom to choose your own dental care providers, both in-network and out-of-network, without any need for referrals.

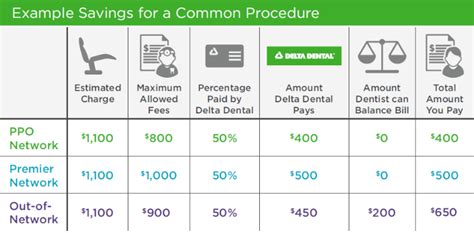

The key benefit of a PPO plan is its extensive network of dental providers. This means you can visit any dentist or specialist within the network and still receive coverage, giving you greater control over your oral health decisions. However, it's important to understand that the level of coverage and costs may vary depending on whether you choose an in-network or out-of-network provider.

How PPO Dental Insurance Works

PPO dental insurance operates on a cost-sharing model. This means you, as the policyholder, share the cost of your dental care with the insurance provider. The specific cost-sharing arrangement is outlined in your insurance plan’s benefits summary, which details your annual maximums, deductibles, co-pays, and co-insurance percentages.

When you visit a dental provider, you'll typically pay a small portion of the cost upfront, known as a co-pay, while the insurance company covers the rest of the bill, up to a certain limit. This limit, or annual maximum, is the most your insurance company will pay towards your dental care in a given year. Any expenses beyond this maximum will be your responsibility.

| Cost-Sharing Components | Description |

|---|---|

| Annual Maximum | The highest amount your insurance company will pay in a year. |

| Deductible | The amount you must pay out-of-pocket before your insurance coverage kicks in. |

| Co-pay | A fixed amount you pay for a covered service, typically at the time of service. |

| Co-insurance | Your share of the costs of a covered health service, calculated as a percentage of the allowed amount for the service. |

Benefits of PPO Dental Insurance in California

California residents have unique considerations when it comes to dental insurance due to the state’s diverse population and its specific healthcare regulations. Here’s how PPO dental insurance can be particularly beneficial for Californians.

1. Flexibility in Provider Choice

California is home to a diverse range of dental practices, from small, family-run clinics to large, specialized dental centers. With a PPO plan, you’re not limited to a narrow network of providers. You can choose any dentist or specialist who accepts your insurance, giving you access to the best care that suits your specific needs.

2. Coverage for a Wide Range of Services

PPO plans typically offer coverage for a broad spectrum of dental services, including preventive care, basic restorative procedures, and even major dental work like implants or root canals. This comprehensive coverage ensures that you can maintain optimal oral health without worrying about financial constraints.

3. No Referrals Required

Unlike some other insurance plans, PPOs do not require referrals to see a specialist. This means you can directly schedule an appointment with an orthodontist, periodontist, or any other specialist without the hassle of obtaining a referral from your primary dentist. This streamlined process saves time and simplifies your dental care journey.

4. Cost Savings

While PPO plans may have higher premiums compared to other insurance types, they often result in significant cost savings over time. With a PPO, you can take advantage of negotiated rates that providers offer to insurance companies, which are typically lower than the full retail price. Additionally, the cost-sharing structure of PPOs ensures that you’re not burdened with unexpected or excessive out-of-pocket expenses.

Finding the Right PPO Dental Insurance in California

When selecting a PPO dental insurance plan in California, it’s essential to consider your specific needs and circumstances. Here are some key factors to keep in mind:

- Review the plan's benefits summary to understand the coverage limits, deductibles, and cost-sharing arrangements.

- Check the provider network to ensure your preferred dentists and specialists are included.

- Consider the plan's waiting periods, especially for major services like orthodontics.

- Look for plans that offer additional benefits like orthodontic coverage or discounts on cosmetic procedures.

- Compare premiums, deductibles, and out-of-pocket maximums to find the most cost-effective option for your needs.

Example: A Real-Life PPO Plan in California

Let’s take a look at a hypothetical PPO dental insurance plan available in California, to better understand how these plans work in practice.

| Plan Name | Golden Smiles PPO |

|---|---|

| Annual Maximum | $2,000 per person |

| Deductible | $50 per person |

| Co-pay for Preventive Care | $20 |

| Co-insurance for Basic Services | 20% (after deductible) |

| Co-insurance for Major Services | 50% (after deductible) |

| Waiting Periods | No waiting for preventive and basic services; 6 months for major services |

| Network Size | Over 10,000 providers in California |

In this example, the Golden Smiles PPO plan offers a comprehensive set of benefits with a reasonable annual maximum and low deductibles. The co-pays and co-insurance percentages are competitive, and the plan has a large network of providers, ensuring Californians have plenty of choices when it comes to their dental care.

Conclusion: Empowering Your Oral Health Journey

Understanding the intricacies of PPO dental insurance is the first step towards making informed decisions about your oral health. By choosing a PPO plan, California residents can enjoy the flexibility of provider choice, comprehensive coverage, and cost savings. Remember to review the plan’s benefits, consider your specific needs, and compare options to find the best PPO dental insurance that aligns with your oral health goals.

Can I change my dentist under a PPO plan if I’m not satisfied with their services?

+Absolutely! One of the key advantages of PPO plans is the freedom to choose your dental providers. If you’re not satisfied with your current dentist, you can easily switch to another in-network provider without any additional costs or hassles.

Are there any limitations on the number of visits or treatments I can receive in a year with a PPO plan?

+PPO plans typically have an annual maximum, which is the most your insurance company will pay towards your dental care in a year. However, there are usually no restrictions on the number of visits or treatments you can receive. As long as your dentist recommends a treatment and it’s considered medically necessary, you should be covered.

What happens if I need emergency dental care while traveling outside of California?

+PPO plans often have a network of providers nationwide, so if you need emergency dental care while traveling, you can locate an in-network provider in your area and receive coverage. However, it’s always a good idea to check with your insurance provider beforehand to understand the specific coverage details for out-of-state emergencies.