Premium For Insurance

In the realm of financial services, insurance plays a pivotal role in safeguarding individuals and businesses against unforeseen risks and potential losses. One of the fundamental concepts in insurance is the premium, which forms the backbone of this industry. Understanding the dynamics of insurance premiums is crucial for anyone seeking to protect their assets and future.

This comprehensive guide delves into the intricate world of insurance premiums, shedding light on what they are, how they are calculated, and their significance in the broader context of risk management and financial planning. By exploring real-world examples and industry insights, we aim to empower readers with the knowledge to make informed decisions about their insurance coverage.

Unraveling the Concept of Insurance Premiums

At its core, an insurance premium is the cost or payment an individual or entity makes to an insurance company in exchange for the coverage and protection provided by an insurance policy. It represents the financial commitment one makes to transfer the risk of potential losses to the insurer.

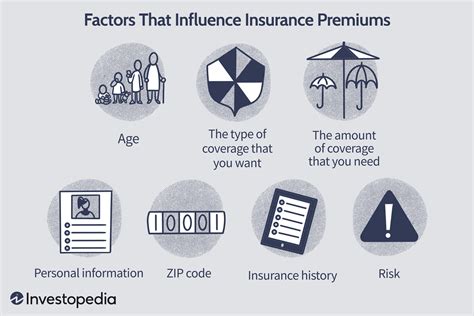

Insurance premiums are not arbitrary figures; they are carefully calculated based on a range of factors that assess the likelihood and potential impact of specific risks. These factors, known as risk assessment metrics, are unique to each insurance type and can include variables such as age, location, occupation, health status, and the value of assets being insured.

For instance, in the case of life insurance, premiums are influenced by the insured's age, health, and lifestyle choices. Younger individuals generally pay lower premiums compared to older individuals due to their longer life expectancy and lower risk of health complications. Similarly, individuals with healthier lifestyles and no pre-existing medical conditions may qualify for lower premiums.

In the context of property insurance, premiums can vary based on the location and type of property. Properties in areas prone to natural disasters like hurricanes or earthquakes may attract higher premiums due to the increased risk of damage. The value and age of the property also play a role in determining the premium, with newer, higher-value properties often commanding higher insurance costs.

The calculation of insurance premiums involves a delicate balance between covering the expected costs of claims and ensuring the insurer remains financially viable. It is a dynamic process, and premiums can fluctuate over time as risk factors change or as the insurance company adjusts its assessment models.

The Mechanics of Premium Calculation: A Deep Dive

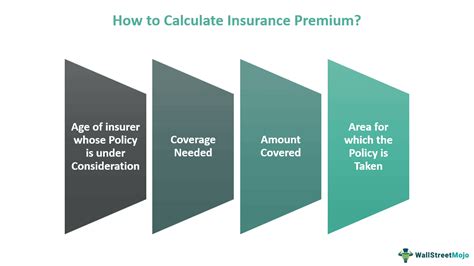

The process of determining insurance premiums is a complex mathematical and actuarial endeavor. Actuaries, professionals skilled in assessing and managing risk, play a pivotal role in this process. They employ sophisticated models and historical data to estimate the probability and cost of future claims.

Here's a simplified breakdown of the key steps involved in premium calculation:

Step 1: Data Collection and Analysis

Insurance companies gather extensive data on their policyholders and the risks they face. This data includes historical claim records, demographic information, and external factors like weather patterns and economic trends. By analyzing this data, actuaries can identify patterns and trends that influence risk levels.

Step 2: Risk Assessment

Actuaries use the collected data to assess the likelihood of specific risks occurring. They calculate the probability of loss for each risk factor and assign weights to these factors based on their impact on potential claims. This step is crucial in understanding the overall risk profile of the insured population.

Step 3: Loss Cost Estimation

Once the risks are assessed, actuaries estimate the cost of potential losses. This involves factoring in the frequency and severity of claims, as well as the cost of settling them. By multiplying the probability of loss by the estimated cost, actuaries arrive at the expected loss cost for a particular risk.

Step 4: Loading and Profit Considerations

To ensure profitability and cover administrative costs, insurance companies add a loading factor to the expected loss cost. This factor accounts for expenses such as salaries, marketing, and general overhead costs. Additionally, insurance companies include a profit margin to ensure long-term financial viability.

Step 5: Premium Rate Determination

The final step involves determining the premium rate for each policy. This rate is calculated by dividing the total expected loss cost, including loading and profit, by the number of policyholders or the sum insured. The resulting premium rate is then used to calculate the premium for each individual policy, taking into account the specific risk factors associated with that policy.

It's important to note that insurance companies continually review and update their premium calculation models to reflect changing market conditions and risk profiles. This ensures that premiums remain fair and accurately reflect the level of risk being insured.

The Impact of Premiums on Policyholders

Insurance premiums have a direct and significant impact on policyholders, influencing their financial planning and decision-making. Here’s how premiums can affect individuals and businesses:

Financial Planning and Budgeting

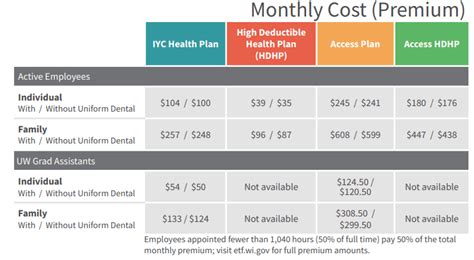

Premiums are a recurring expense that policyholders must budget for. The cost of insurance can vary significantly depending on the coverage and risk factors involved. For instance, a young professional with a high-risk occupation may pay a substantial premium for life insurance, impacting their overall financial plan.

Coverage Options and Limits

The premium directly affects the coverage limits and options available to policyholders. Higher premiums may provide access to more comprehensive coverage, while lower premiums may restrict the scope of protection. Understanding the trade-off between premium and coverage is essential for making informed decisions.

Risk Mitigation and Prevention

Premiums can act as a motivator for policyholders to adopt risk mitigation measures. As mentioned earlier, certain actions can lead to premium discounts. For example, a homeowner who installs a fire alarm system may see a reduction in their property insurance premium, incentivizing risk-reducing behaviors.

Long-Term Financial Health

Premiums play a critical role in the long-term financial health of policyholders. By paying premiums regularly, individuals and businesses can transfer the risk of significant financial losses to the insurer, providing peace of mind and financial security. This is particularly crucial for businesses, as unexpected losses can have severe consequences on their operations and survival.

Premium Variations and Special Considerations

Insurance premiums are not a one-size-fits-all proposition. They can vary significantly based on a multitude of factors. Here are some key considerations that can influence premium rates:

Type of Insurance

Different types of insurance, such as life, health, property, or liability insurance, have distinct risk profiles and premium structures. For example, health insurance premiums may be influenced by the insured’s medical history and the prevalence of certain health conditions in their demographic.

Policy Coverage and Deductibles

The level of coverage and the deductible chosen by the policyholder can significantly impact premiums. Higher coverage limits and lower deductibles generally result in higher premiums, as the insurer assumes a greater portion of the risk.

Location and Geographical Factors

Premiums can vary based on geographical location. Areas prone to natural disasters or with a higher crime rate may have higher insurance premiums due to the increased risk of claims. For instance, homeowners in hurricane-prone regions may face higher property insurance premiums.

Age and Health Status

In certain types of insurance, such as life and health insurance, age and health status are critical factors. Younger and healthier individuals typically pay lower premiums due to their lower risk profile. As individuals age or develop health issues, premiums may increase to reflect the higher likelihood of claims.

Occupational and Lifestyle Factors

An individual’s occupation and lifestyle can also influence premiums. High-risk occupations, such as those involving heavy machinery or extreme sports, may result in higher life or health insurance premiums. Similarly, lifestyle choices like smoking or engaging in extreme sports can impact premium rates.

Policyholder’s Claims History

Insurance companies often take into account an individual’s or business’s claims history when determining premiums. Those with a history of frequent claims may be seen as higher risk and charged higher premiums to offset the increased likelihood of future claims.

| Insurance Type | Premium Influencing Factors |

|---|---|

| Life Insurance | Age, Health, Occupation, Lifestyle |

| Health Insurance | Health Status, Pre-existing Conditions, Location |

| Property Insurance | Location, Type of Property, Age of Property |

| Liability Insurance | Nature of Business, Industry Risks |

Future Trends and Innovations in Premium Calculation

The insurance industry is continuously evolving, and so are the methods used to calculate premiums. Here are some trends and innovations that are shaping the future of premium calculation:

Advanced Data Analytics and AI

Insurance companies are leveraging advanced data analytics and artificial intelligence (AI) to enhance their risk assessment capabilities. By analyzing vast amounts of data, including social media activity, sensor data, and real-time weather information, insurers can make more accurate predictions about potential risks and adjust premiums accordingly.

Pay-as-You-Go and Usage-Based Insurance

Traditional insurance models are giving way to more flexible and personalized options. Pay-as-you-go insurance, where premiums are based on actual usage, is gaining traction. For example, usage-based auto insurance premiums can be calculated based on miles driven, driving behavior, and even the time of day the vehicle is used.

Insurtech and Digital Transformation

The rise of insurtech startups and digital transformation within established insurance companies is driving innovation in premium calculation. Online platforms and apps offer policyholders real-time premium quotes, allowing them to compare options and make informed decisions quickly.

Risk Assessment Through Telematics

In the automotive insurance sector, telematics devices installed in vehicles are being used to monitor driving behavior and assess risk. This data can be used to offer personalized premiums to drivers based on their actual driving habits, encouraging safer driving practices.

Parametric Insurance

Parametric insurance is an innovative approach that provides coverage based on the occurrence of specific events rather than actual losses. For instance, farmers may purchase parametric insurance that pays out based on the severity of a natural disaster, such as a hurricane, regardless of the actual damage to their crops.

Blockchain and Smart Contracts

Blockchain technology and smart contracts are being explored to automate and streamline the insurance claims process. This can lead to more efficient and transparent premium calculation, as well as faster settlement of claims.

Conclusion: Navigating the Complex World of Insurance Premiums

Understanding insurance premiums is essential for anyone seeking to protect their assets and future. The process of premium calculation is intricate, involving a range of factors that assess the likelihood and impact of potential risks. Policyholders must consider these premiums as a critical component of their financial planning, as they directly impact coverage options, risk mitigation strategies, and long-term financial health.

As the insurance industry continues to evolve, the methods used to calculate premiums are also undergoing significant transformations. Advanced data analytics, AI, and digital technologies are revolutionizing the way premiums are determined, offering more personalized and flexible options. By staying informed about these trends and innovations, policyholders can make more strategic decisions about their insurance coverage and navigate the complex world of insurance premiums with confidence.

How often do insurance premiums change?

+Insurance premiums can change annually or even more frequently, depending on the insurance company and the type of policy. Factors such as changes in risk assessment models, market conditions, and claims experience can trigger premium adjustments.

Can I negotiate insurance premiums?

+While insurance premiums are primarily based on actuarial calculations, there may be room for negotiation in certain cases. For instance, if you have multiple policies with the same insurer or if you belong to a specific professional group or association that has negotiated group rates, you might be able to secure a better deal.

What happens if I can’t afford my insurance premiums?

+If you’re facing financial difficulties and cannot afford your insurance premiums, it’s important to reach out to your insurer. They may be able to offer temporary relief, such as a payment plan or a premium reduction, based on your circumstances. Alternatively, you could consider reducing your coverage or switching to a more affordable provider.

Are there any tax benefits associated with insurance premiums?

+The tax implications of insurance premiums vary depending on the type of insurance and your jurisdiction. For example, in many countries, life insurance premiums paid for policies that meet certain criteria are tax-deductible. It’s advisable to consult a tax professional to understand the specific tax benefits applicable to your situation.