Trael Insurance

Travel insurance is an essential aspect of any journey, offering travelers peace of mind and financial protection against unexpected events that may occur during their adventures. With the world opening up again post-pandemic, the travel industry is witnessing a surge in demand, and so is the need for comprehensive travel insurance coverage. In this article, we delve into the world of travel insurance, exploring its various facets, benefits, and considerations to help travelers make informed decisions.

Understanding Travel Insurance: The Basics

Travel insurance is a specialized type of insurance policy designed to cover unexpected expenses and provide assistance during trips. It acts as a safety net, protecting travelers from financial losses and providing them with the necessary support in case of unforeseen circumstances.

What Does Travel Insurance Cover?

The scope of coverage can vary widely depending on the policy and the provider. Here are some common aspects typically covered by travel insurance policies:

- Trip Cancellation and Interruption: Reimbursement for prepaid and non-refundable trip expenses if the journey needs to be canceled or interrupted due to covered reasons, such as illness, injury, or natural disasters.

- Medical and Dental Emergencies: Coverage for emergency medical and dental treatment, including transportation to the nearest medical facility and repatriation if necessary.

- Emergency Evacuation: Assistance and coverage for emergency evacuation due to medical emergencies or natural disasters.

- Baggage and Personal Effects: Compensation for lost, stolen, or damaged luggage and personal items.

- Travel Delay: Reimbursement for additional expenses incurred due to delays in transportation, such as meals, accommodation, and alternative transportation costs.

- Trip Curtailment: Compensation if a trip needs to be cut short due to a covered reason.

- Personal Liability: Protection against legal liability claims arising from accidents or injuries caused to others during the trip.

- Missed Connections: Coverage for additional expenses incurred due to missing a connecting flight or transportation due to delays beyond the traveler’s control.

Key Considerations Before Purchasing Travel Insurance

When selecting a travel insurance policy, several factors should be taken into account to ensure adequate coverage for your specific needs:

- Destination and Activities: Consider the nature of your trip and the activities you plan to engage in. Some destinations and activities may carry higher risks, and hence, require more comprehensive coverage.

- Pre-existing Medical Conditions: If you have any pre-existing medical conditions, ensure that the policy covers treatment for these conditions during your trip. Some policies may exclude coverage for pre-existing conditions, so it’s crucial to read the fine print.

- Duration of Travel: The length of your trip can impact the cost and coverage of your travel insurance. Longer trips may require more extensive coverage.

- Comparison Shopping: Compare different travel insurance providers and policies to find the best fit for your needs. Look for reputable companies with a strong track record of claims handling and customer satisfaction.

- Exclusions and Limitations: Carefully review the policy’s exclusions and limitations to understand what is not covered. Common exclusions include hazardous activities like skydiving or pre-existing conditions not disclosed during the application process.

The Benefits of Travel Insurance: Real-Life Examples

Travel insurance can provide invaluable assistance in a variety of situations. Here are some real-life examples highlighting the benefits of having travel insurance coverage:

Medical Emergency During a Family Vacation

Imagine a family traveling to a remote destination when one of the children suddenly falls ill and requires immediate medical attention. Without travel insurance, the family would have to navigate a foreign healthcare system and incur substantial medical expenses. However, with travel insurance, the policy can cover the cost of emergency treatment, transportation to a nearby medical facility, and even repatriation if necessary, ensuring the child receives the best possible care while providing financial protection to the family.

Trip Cancellation Due to Natural Disaster

A traveler plans a dream vacation to a tropical island, only to have their plans disrupted by a sudden hurricane. The trip has to be canceled, and the traveler risks losing a significant amount of money invested in non-refundable flight tickets and hotel bookings. With travel insurance that includes trip cancellation coverage, the traveler can receive reimbursement for these expenses, mitigating the financial impact of the unexpected natural disaster.

Baggage Loss and Personal Effects Protection

While traveling abroad, a business traveler’s luggage is lost during transit. The traveler urgently needs the items inside, including essential work documents and a laptop. With travel insurance coverage for baggage and personal effects, the policy can provide compensation for the lost items, helping the traveler replace them and continue their journey without significant financial strain.

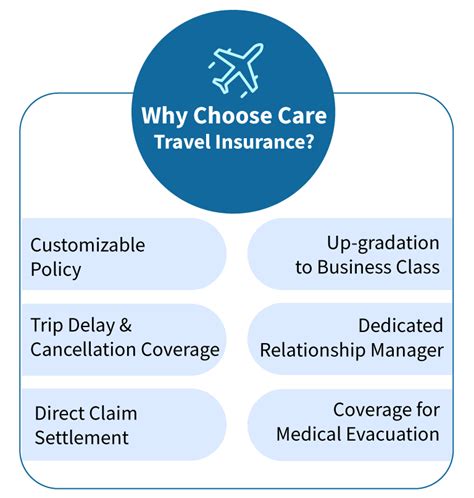

Choosing the Right Travel Insurance Policy

Selecting the appropriate travel insurance policy involves careful consideration of your specific needs and the destination you’re visiting. Here are some factors to keep in mind when choosing a policy:

Assess Your Risk Profile

Evaluate your personal risk profile based on factors such as age, health conditions, destination, and planned activities. This will help you determine the level of coverage you require. For example, older travelers or those with pre-existing medical conditions may benefit from more comprehensive medical coverage.

Review Policy Details

Pay close attention to the policy’s coverage limits, deductibles, and any exclusions. Ensure that the policy provides adequate coverage for your trip’s duration and activities. Look for policies that offer higher limits for medical expenses and emergency evacuation, as these can be costly if needed.

Compare Prices and Providers

Travel insurance policies can vary significantly in price, so it’s essential to shop around and compare different providers. Consider using online comparison tools to evaluate policies based on price, coverage, and customer reviews. Remember, the cheapest policy may not always provide the best value or the coverage you need.

Check for Provider Reputation

Research the reputation and financial stability of the insurance provider. Look for companies with a strong track record of claims handling and customer satisfaction. You can refer to consumer reviews and industry ratings to assess the provider’s reliability.

Read the Fine Print

Always read the policy’s terms and conditions thoroughly. Understand the exclusions, limitations, and any specific requirements for making a claim. This ensures that you are aware of what is and isn’t covered by the policy and can make informed decisions.

Travel Insurance and COVID-19 Considerations

The COVID-19 pandemic has brought about unique challenges and considerations when it comes to travel insurance. Here’s what you need to know:

COVID-19 Coverage

Many travel insurance providers have adapted their policies to include coverage for COVID-19-related expenses. This can include medical treatment for COVID-19, trip cancellation or interruption due to positive test results or exposure, and quarantine-related expenses. However, the level of coverage can vary widely between policies, so it’s crucial to review the policy’s terms and conditions carefully.

Travel Advisories and Restrictions

Travel advisories and restrictions can impact your trip and your travel insurance coverage. Before purchasing a policy, check the latest travel advisories for your destination and understand the implications for your insurance coverage. Some policies may exclude coverage if travel to a specific destination is advised against due to health or safety concerns.

Flexible Policies and Cancellation Coverage

Consider choosing a travel insurance policy with flexible cancellation coverage. Some policies now offer more generous cancellation terms, allowing travelers to cancel their trip for any reason and receive a partial refund. This can provide additional peace of mind during uncertain times.

Frequently Asked Questions

How much does travel insurance typically cost?

+The cost of travel insurance can vary widely depending on several factors, including the duration of your trip, your age, the destination, and the level of coverage you require. On average, a basic travel insurance policy for a week-long trip can range from 20 to 50, while more comprehensive policies for longer trips or high-risk destinations may cost several hundred dollars.

Can I purchase travel insurance after my trip has started?

+In most cases, it is recommended to purchase travel insurance before your trip begins. Many policies require that you purchase coverage within a certain time frame of making your initial trip payment or before departing on your journey. However, there are some specialized policies that offer coverage for existing trips, but they may have more limited coverage and higher premiums.

What happens if I need to make a claim while traveling?

+If you need to make a claim while traveling, the first step is to contact your travel insurance provider’s 24⁄7 emergency assistance hotline. They will guide you through the claims process and provide assistance specific to your situation. It’s important to keep all relevant documentation, such as receipts, medical reports, and any correspondence related to the incident.

Are there any activities that travel insurance typically excludes coverage for?

+Yes, most travel insurance policies exclude coverage for high-risk activities such as extreme sports (e.g., bungee jumping, skydiving), adventure sports (e.g., rock climbing, whitewater rafting), and motor sports (e.g., motorcycle riding, racing). These activities are considered inherently risky and may require additional coverage or specialized policies. Always review the policy’s exclusions carefully to understand what is not covered.

Travel insurance is an essential tool for travelers, providing financial protection and peace of mind during their journeys. By understanding the different aspects of travel insurance and selecting a policy that aligns with your needs, you can travel with confidence, knowing that you’re prepared for the unexpected. So, whether you’re embarking on a solo adventure or a family vacation, ensure you’re protected with the right travel insurance coverage.