Prescription Glasses With Insurance

Prescription glasses are an essential investment for many individuals, offering a clear vision and a chance to embrace unique personal styles. When it comes to purchasing prescription glasses, one of the key considerations is whether to use insurance coverage. Navigating the world of vision insurance and understanding its benefits can be a complex task, but it's an important one to ensure you make the most of your coverage and find the perfect pair of glasses that meet both your visual and fashion needs.

Understanding Vision Insurance Coverage for Prescription Glasses

Vision insurance plans often provide comprehensive coverage for eye exams and a certain level of assistance for purchasing prescription glasses or contact lenses. These plans can be incredibly beneficial, especially for those who require regular vision correction. Understanding the specifics of your vision insurance plan is crucial to maximizing its advantages.

Common Vision Insurance Plans and Their Benefits

There are various types of vision insurance plans, each with its own set of benefits and limitations. Some common plans include:

- Vision Service Plan (VSP): VSP is one of the most popular vision insurance providers, offering coverage for eye exams, prescription glasses, and sometimes even laser eye surgery. VSP typically covers a portion of the cost of prescription glasses, with a set allowance for frames and lenses.

- EyeMed Vision Care: EyeMed provides comprehensive vision benefits, including coverage for eye exams, prescription glasses, and contact lenses. The plan offers a wide range of frame and lens options, ensuring you can find a style that suits your preferences.

- Davis Vision: Davis Vision is another prominent vision insurance provider, offering coverage for eye exams, glasses, and contact lenses. The plan often includes a network of preferred providers, ensuring you have access to quality eye care professionals.

- Spectera Vision Plan: Spectera offers a range of vision benefits, including coverage for eye exams, prescription glasses, and discounts on laser eye surgery. The plan emphasizes flexibility, allowing you to choose from a wide variety of frame and lens options.

These plans often come with a yearly allowance for prescription glasses, which can be used to cover the cost of frames and lenses. The allowance amount can vary based on the plan and the level of coverage you've chosen.

Using Insurance for Prescription Glasses: A Step-by-Step Guide

Using your vision insurance for prescription glasses can be a straightforward process, but it’s important to follow the right steps to ensure a smooth and successful experience.

- Check Your Insurance Coverage: Start by reviewing your vision insurance plan. Understand the specifics of your coverage, including the allowance for prescription glasses, the network of providers, and any limitations or exclusions.

- Locate In-Network Providers: Most vision insurance plans have a network of preferred providers. It's beneficial to choose an eye doctor or optician within this network to ensure you receive the full benefits of your insurance plan.

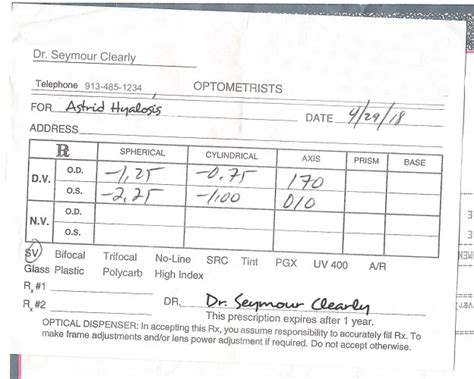

- Schedule an Eye Exam: Book an appointment with an in-network eye doctor for a comprehensive eye exam. This exam will determine your prescription and assess your overall eye health.

- Discuss Your Prescription Glasses Needs: During your eye exam, discuss your specific needs and preferences for prescription glasses. Share any concerns or requirements you may have, such as the need for progressive lenses or specialized coatings.

- Review Insurance Benefits and Allowance: Before selecting your glasses, ensure you understand your insurance benefits and the allowance for prescription glasses. This will help you choose frames and lenses that align with your coverage.

- Choose Your Frames and Lenses: Explore the range of frames and lenses offered by your chosen provider. Consider factors like style, comfort, and any additional features you may need, such as anti-reflective coatings or photochromic lenses.

- Submit Your Insurance Claim: After selecting your prescription glasses, work with your provider to submit an insurance claim. This typically involves providing your insurance information and any necessary documentation to process the claim.

- Receive Reimbursement or Discount: Depending on your insurance plan, you may receive a reimbursement for the cost of your prescription glasses or a discount applied directly at the point of purchase. Ensure you understand the process and any timelines involved.

Maximizing Your Vision Insurance Benefits

To make the most of your vision insurance coverage, consider the following tips:

- Review your insurance plan regularly to stay informed about any changes or updates.

- Take advantage of any additional benefits, such as discounts on lens upgrades or access to exclusive frame collections.

- Consider purchasing glasses online through authorized retailers that accept vision insurance. This can often provide a wider selection and potentially better prices.

- Explore the option of purchasing extended warranty plans for your glasses, which can provide additional protection and peace of mind.

- Stay informed about new technologies and trends in the eyewear industry to ensure you’re making the best choices for your vision and style needs.

The Impact of Vision Insurance on Accessibility and Cost

Vision insurance plays a crucial role in making prescription glasses more accessible and affordable for individuals. By providing coverage for eye exams and prescription glasses, vision insurance plans ensure that individuals can access the vision correction they need without incurring excessive costs.

Improving Accessibility Through Insurance Coverage

Vision insurance plans aim to make eye care and prescription glasses accessible to a wider population. By covering a portion of the costs, these plans reduce the financial burden on individuals, especially those with limited financial means.

For individuals with pre-existing eye conditions or those who require regular vision correction, vision insurance can be a lifeline. It ensures they can access the necessary eye care and prescription glasses without facing financial hardship.

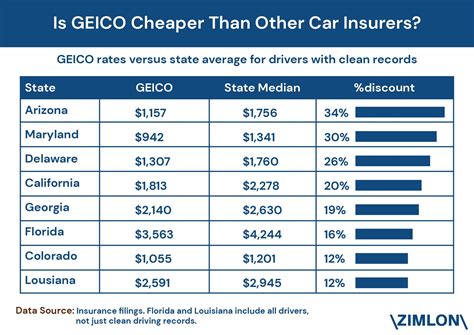

Cost-Effectiveness of Using Vision Insurance

Using vision insurance for prescription glasses can be a cost-effective strategy. By taking advantage of the coverage provided by your insurance plan, you can save a significant amount on the cost of glasses.

The yearly allowance provided by vision insurance plans can cover a substantial portion of the cost of prescription glasses. This means you only need to pay the difference, which can be significantly less than the full retail price.

Additionally, vision insurance plans often provide access to exclusive discounts and promotions, further reducing the cost of prescription glasses. These discounts can be applied to a wide range of frames and lenses, ensuring you have options that fit your budget and style preferences.

| Vision Insurance Provider | Average Annual Allowance |

|---|---|

| VSP | $150 - $200 |

| EyeMed Vision Care | $150 - $250 |

| Davis Vision | $150 - $200 |

| Spectera Vision Plan | $100 - $200 |

The Future of Vision Insurance and Prescription Glasses

The landscape of vision insurance and prescription glasses is continually evolving, driven by advancements in technology and changing consumer preferences.

Technological Advancements and Their Impact

Technological advancements have significantly influenced the eyewear industry, and this impact is expected to continue in the future. Here are some key trends to watch:

- Digital Eye Exams: The rise of digital eye exams and remote vision testing is likely to continue, offering convenience and accessibility to individuals in remote areas or with busy schedules.

- Customized Lenses and Frames: With advancements in 3D printing and customization technologies, the future may see a rise in customized prescription glasses tailored to individual needs and preferences.

- Smart Glasses and Augmented Reality: The integration of smart technologies and augmented reality into prescription glasses is an exciting development. These innovations can enhance visual experiences and provide additional functionality.

Consumer Preferences and Industry Adaptations

Consumer preferences are also shaping the future of vision insurance and prescription glasses. Here’s a look at some key trends:

- Sustainable and Eco-Friendly Options: With growing environmental consciousness, there’s an increasing demand for sustainable and eco-friendly prescription glasses. Vision insurance plans may start incorporating these options into their offerings.

- Fashion and Style: Prescription glasses are no longer just a medical necessity; they’re a fashion statement. Vision insurance plans may begin to offer a wider range of stylish frame options to cater to diverse fashion preferences.

- Convenience and Online Shopping: The rise of online shopping has made it more convenient than ever to purchase prescription glasses. Vision insurance plans may adapt to this trend by partnering with online retailers or offering digital platforms for purchasing glasses.

Potential Challenges and Solutions

While the future of vision insurance and prescription glasses looks promising, there are potential challenges that the industry may face. These include:

- Cost of New Technologies: The integration of new technologies into prescription glasses may come with a higher price tag. Vision insurance plans will need to find ways to make these innovative options more accessible and affordable.

- Accessibility in Rural Areas: Ensuring access to eye care and prescription glasses in rural or underserved areas remains a challenge. Vision insurance plans may need to explore partnerships or initiatives to bridge this gap.

- Keeping Up with Consumer Demands: With rapidly changing consumer preferences, vision insurance plans will need to stay agile and adapt their offerings to meet the diverse needs and expectations of their customers.

How often can I use my vision insurance for prescription glasses?

+Most vision insurance plans provide coverage for prescription glasses on an annual basis. This means you can typically use your insurance allowance once a year to purchase new glasses. However, some plans may offer more frequent coverage, so it’s important to review your specific plan details.

Can I use my vision insurance for prescription sunglasses?

+Yes, many vision insurance plans offer coverage for prescription sunglasses. These plans typically include a separate allowance for prescription sunglasses, which can be used in addition to your regular prescription glasses allowance. However, it’s important to check your specific plan details to confirm the coverage for prescription sunglasses.

What happens if my prescription changes before my insurance coverage renews?

+If your prescription changes before your insurance coverage renews, you may need to pay out of pocket for new prescription glasses. However, some vision insurance plans offer additional benefits or discounts for individuals with changing prescriptions. It’s best to review your plan details or contact your insurance provider to understand your options.

Can I use my vision insurance to purchase contact lenses instead of glasses?

+Yes, many vision insurance plans offer coverage for contact lenses as well as prescription glasses. These plans typically include a separate allowance for contact lenses, which can be used to purchase a supply of lenses. However, it’s important to check your specific plan details to confirm the coverage for contact lenses.

Are there any limitations or exclusions on the types of frames or lenses I can choose with my insurance coverage?

+Yes, there may be limitations or exclusions on the types of frames or lenses you can choose with your insurance coverage. Some plans may have restrictions on the brands or styles of frames, or they may limit the types of lenses you can select. It’s important to review your plan details carefully to understand any limitations or exclusions.